Zombie Invasion

13 October 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

🔥 Today’s Consumer Price Index (CPI) print came in hotter than expected but likely didn’t surprise those who’ve been feeling lighter pockets from rising prices for everything from gas and electricity to food and rent.

Here are the price increases over the last year from today’s CPI report:

Fuel oil: +58.1%

Gas utilities: +33.1

Gasoline: +18.2%

Electricity: +15.5%

Transportation: +14.6%

Food at home: +13.0%

New cars: 9.4%

Used cars: 7.2%

Shelter: 6.6%

Medical care: 6.5%

🚀 U.S. stocks rocketed higher today (with no clear reason why) after initially tumbling in early trading due to the latest concerning inflation report.

There was some speculation that the yearlong sell-off in stocks had potentially reached a bottom. We shall see…

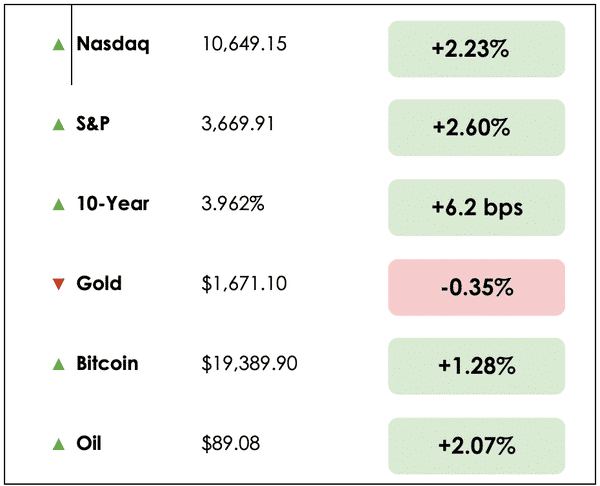

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss the recent surge in mortgage rates, pickleball investments, what today’s CPI report means for investors, and the default risks of zombie companies.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

⤴️ Mortgage Rates Surge (CNBC)

Explained:

- It’s a double whammy for would-be home buyers as interest rates continue to soar while it’s becoming increasingly harder to qualify for a loan.

- According to Mortgage News Daily, the average rate for the popular 30-year fixed mortgage climbed to over 7%. Meanwhile, mortgage credit availability is now at the lowest levels since March 2013, when housing was trying to recover from the Great Financial Crisis of 2008.

What to know:

- Two years ago, the average 30-year rate was 2.87%, and the cost of the average new home in the U.S. was $395,000.

- Today, the average home costs $522,000. The increases in home prices and mortgage rates represent a jump of 110% for the average house payment.

- The Fed’s efforts to curb inflation are having a profound impact on the mortgage market. With today’s CPI report higher than expected, it is more than likely the central bank will continue to aggressively raise interest rates, pushing home ownership out of reach for many would-be buyers.

🎾 Hedge Fund Bets on Pickleball with Tom Brady (Bloomberg)

Explained:

- It’s an unusual investment, but a hedge fund with $9 billion of assets under management just added a professional pickleball team to their portfolio. The ownership group includes NFL superstar Tom Brady and former No. 1 ranked tennis player Kim Clijsters.

- The hedge fund Knighthead Capital Management, co-founded by Tom Wagner, specializes in event-driven distressed credit opportunities.

- Wagner said, “this isn’t a deployment of capital because we happen to like the sport — it’s because we see a significant opportunity.”

What to know:

- Pickleball, one of the world’s fastest-growing sports, combines ping pong, tennis, and badminton elements and is accessible to both young and old athletes.

- Brady is not the only one getting involved in the popular game. NBA stars LeBron James, Draymond Green, Kevin Love, and Super Bowl champion Drew Brees all have stakes in professional pickleball teams.

- Let us know if you are a fan of the game. We hear it’s addictive.

📈 Core Inflation Hits New High (WSJ)

Explained:

- Investors hoping for a slowdown in core inflation (the metric most watched by the Fed) had their hopes dashed this morning as September’s CPI showed another month of high and broad-based inflation.

- U.S. consumer inflation, excluding energy and food, pushed to a four-decade high last month as prices increased 6.6% from a year earlier, up from 6.3% in August. That marked the biggest increase since August 1982.

- The overall CPI increased 8.2% from the same month a year ago, down from 8.3% in August.

What to know:

- Housing makes up the largest share of the overall and core inflation indexes, and it has risen the most since the early 1980’s due to a strong labor market which continues to push up rental rates.

- The Social Security Administration separately announced today that they would be increasing benefits by 8.7% in 2023.

- The latest CPI print has raised chatter of a 100 basis point hike in November, and it has likely cemented in place a 75-point increase.

DIVE DEEPER: ZOMBIE INVASION?

Have you ever heard of zombie companies? 🧟♂️

Yes, the invocation of the living dead is intentional.

Explained

The expression intends to reference companies whose entire existence was made possible, or sustained primarily by, the ultra-low interest rates that followed the Great Financial Crisis.

In other words, these businesses’ survival may have been propped up artificially by cheap borrowing costs that made up for lack of profits.

There’s been a lot of concerns that once interest rates rose, as they have this year, a tsunami of defaults and financial woes would threaten the financial system’s stability due to an excess of these companies beginning to fail.

Why it matters

Creative destruction, as it’s called, is a vital process in capitalism where new competition is driven to profitable industries and business models that force existing players to either improve or die.

It’s Darwinian in nature, and it’s safe to think about it as survival of the fittest but for companies.

If corporate evolution and the natural cycle of creative destruction have been distorted, that’s a big deal.

So, to investigate this matter, we turned to research out of Goldman Sachs.

Let’s discuss.

What to know

Some may define zombie companies as “firms that haven’t produced enough profit to service their debts (also known as an interest coverage ratio below one) for three straight years.”

Based on that definition, around 13% of U.S. companies could be classified as zombies.

Goldman Sachs researchers Micahel Puempel and Ben Shumway push back on this definition and suggest that it captures tech firms that are growing their revenues fast and reinvesting rapidly, which may conceal the underlying profitability of their operations.

The researchers adjusted for these high-growth stocks by setting a filter that only captures stocks that have underperformed the S&P 500 index by at least 5% in each of the last two years to identify truly weak firms, and they found that this lowers the zombie universe to less than 4% of American companies.

Puempel argues, “There are not nearly as many zombies as some of the headline data might suggest.”

Beneath the surface

One shortcoming of this research is that it focuses primarily on public companies.

While these firms aren’t immune to creative destruction (quite the opposite), they still tend to be among the largest and most financially stable businesses.

For a conclusive assessment, we would need to investigate private loan markets, for which data is much more difficult to come by.

Despite this, Goldman Sachs believes that unprecedented monetary policies in recent years, such as quantitative easing, haven’t created a glut of funding in credit markets that artificially sustained zombie firms.

An October 2020 research report from Goldman concluded that primary markets (where companies go to raise funds directly from investors) and secondary markets (where investors trade debt securities back and forth) had proven to be not entirely welcoming to zombie borrowers. This was at a time when much of the economy was awash in fiscal and monetary stimulus.

Puempel states, “public markets are actually pretty good at efficiently allocating capital away from the zombies.”

Opposing arguments

We’re skeptical of this research, and aren’t convinced that zombie default risks have been totally overblown. At the moment, it’s too soon to say.

Ethan Wu of the Financial Times wrote about this topic with more concern.

He poses that we are in the first phase of a market that’s repricing financial assets due to rising interest rates and elevated inflation. He claims there’ll be increasing fear as overly indebted companies find it difficult to refinance their obligations in the next phase that will unfold in the coming months.

Wu explains that it takes time for higher rates to sting borrowers, since many of these debts will still have fixed rates that don’t mature for several months or years, and were locked in during the pandemic at extremely low rates.

As these debts continue to come due, we’ll have a better feel for whether most companies have been able to find the credit they need.

Wrapping up

It’s not entirely crazy to think that a tidal wave of financial risk brought on by zombie companies may have been an exaggerated narrative borne out by free market purists during a time of low rates, as Goldman Sachs contends. Still, it’s also far too soon to know this fully.

Credit risks will bear pain as economic growth slows and interest rates increase.

This creates a double whammy for companies in the form of declining revenues and more costs. We’ll continue monitoring defaults for evidence of spreading systematic risk.

Tell us, readers — Which side of the debate do you fall on?

Are zombie company risks over or understated?

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.