Yield Giving

22 December 2022

Hi, The Investor’s Podcast Network Community!

We come bearing good, or possibly, very bad news — it remains to be determined.

☀️ On the bright side, since 1928, the S&P 500 Index has only fallen for two straight years on four occasions: The Great Depression, World War II, the 1970s oil crisis, and the bursting of the dot-com bubble.

Meaning, next year will likely be a better one for stocks if history is any guide.

🌧️ On the downside, when such outliers have occurred with two or more consecutive down years, the second year has always been worse than the first, with an average decline of 24%.

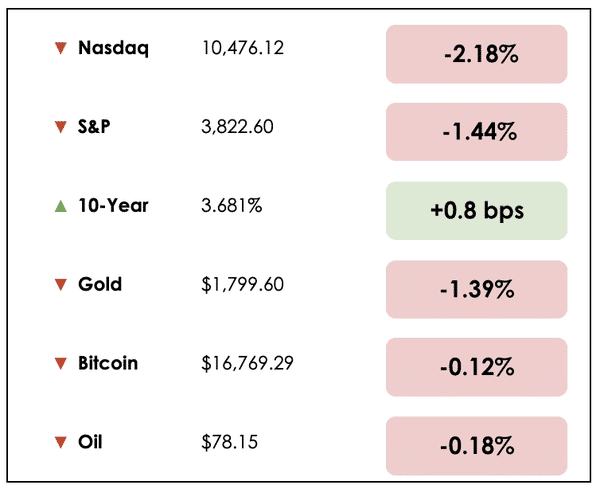

Here’s the rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: The historic rush for the exits in commodities markets, and the hedge fund having a hugely profitable year, plus our main story on one charitable mega donor.

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate.

Learn more at PassiveInvesting.com.

IN THE NEWS

⛏️ Traders’ $129 Billion Commodities Exodus Marks Historic Shift (Bloomberg)

Explained:

- Investors’ exuberance for commodities earlier this year has transformed into a spectacular retreat, as $129 billion has fled these markets globally, according to JPMorgan (JPM).

- Disruptions from the war in Ukraine and China’s sudden pivot away from strict Covid policies have made the volatility intolerable. That, combined with tighter financial conditions broadly, has considerably raised futures trading and hedging costs.

- With bigger price moves, clearing houses are raising collateral requirements to guard against defaults while also increasing borrowing costs for traders. This has tamped down speculation but pushed capital outwards towards more stable assets, further driving volatility in commodities trading and threatening a liquidity crunch.

Why it matters:

- Higher collateral costs and interest rates also make it more expensive for companies to hedge their exposures to commodity prices. In Europe, extreme spikes in energy costs have pressured Germany, France, and the U.K. to nationalize struggling utility companies.

- The number of active contracts in U.S. crude futures is, for example, near its lowest since 2014, and open interest in the primary European natural gas market is at its lowest in four years. Among the largest shale oil producers, only 16% of their output for next year is insured due to greater hedging costs, compared with 39% in 2021 and 81% in 2017.

- Banks and other firms’ models for anticipating market moves are becoming less accurate amid incredible volatility, leading one strategist to conclude, “investors aren’t really comfortable getting into this market.” Another said simply, “volatility begets volatility.”

💰 Citadel and Other Hedge Funds Return Profits After Blowout Year (WSJ)

Explained:

- While hedge funds tilted toward investing in growth stocks have faced a tough year, short-term trading-oriented hedge funds like Citadel, believed to be the second-most profitable hedge fund ever behind Ray Dalio’s Bridgewater, are having a great year and benefit from the volatility.

- Citadel expects to return $7 billion in profits to its clients, with its flagship fund up 32% through November. Although it’s not unusual to return cash in good years, some clients have mixed feelings since they must now determine how to reinvest the large distributions.

Why it matters:

- While clients in these funds might prefer Citadel to continue reinvesting the profits directly, academic data has shown that smaller funds tend to produce better returns, which is likely why Citadel is eager to return some capital.

- If assets under management grow too big, generating returns at scale with the same strategies might become difficult.

- Other hedge funds that had strong years, like the macro firm Brevan Howard, are also returning investors’ money. They’re accepting reinvestment of this capital, but only in shares classes in funds that are less favorable to investors (i.e., higher fees for the hedge fund).

A MESSAGE FROM PERSONAL CAPITAL

Personal Capital helps users take control of their finances by blending world-class technology with human advice.

Pair industry-leading financial tools with licensed advisors and full-service planning experts across all 50 states.

Personal capital offers a free Investment Checkup tool to evaluate the health of your portfolio, a free Net Worth Calculator, personal finance guides, and so much more!

THE MAIN STORY: MAVERICK PHILANTHROPIST

Overview

The gifts keep coming, one after the other: one woman has given $14 billion in total donations to more than 1,600 nonprofit groups thus far.

Sometimes, they come as out-of-the-blue grants to small groups struggling to get funding. It’s $20 million here, $40 million there, with no strings attached.

She has given away nearly $2 billion to over 300 organizations in the past seven months alone.

Her name is Mackenzie Scott, and her charitable giving spree has been nothing short of incredible.

Amid giving season, it’s a great time to dissect Scott’s philanthropic efforts. Plus, the novelist, activist, and ex-husband of Jeff Bezos just launched a site to track how she donates her money, and why.

We think Scott’s efforts are exemplary, so let’s dig in.

The art of thoughtful philanthropy

Scott, 52, graduated from Princeton University in 1992, then amassed a fortune that makes her the third-wealthiest woman in the world, thanks to her 4% stake in Amazon. By most estimates, she’s worth just under $30 billion.

Scott has rocketed to global attention as she began giving away her fortune at a pace rarely seen in philanthropy. In her May 2019 letter for the Giving Pledge, Scott promises “to keep at it until the safe is empty.”

Since 2019, Scott and her team have gathered information on nonprofits privately and anonymously, evaluating a group’s finances, leadership, and likelihood of making a “sustained positive impact.”

Scott’s new site, Yield Giving, has revealed how she allocates her contributions. She targets “organizations working to advance the opportunities of people in underserved communities,” the site says, listing 53 focus areas Scott has already contributed toward.

They include: reproductive health, youth development, and literary and performing arts.

Now, Scott is laying out an “open-call process” for nonprofits to apply for funding during targeted online application rounds. Last year, Forbes named Scott the most powerful woman in the world, thanks largely to her generous giving spree.

In an essay posted last week, Scott wrote that the site intends to “break barriers” and “if more information about these gifts can be helpful to anyone, I want to share it.”

Big gifts for underserved communities

Among Scott’s most considerable donations:

- Habitat for Humanity, $436 million

- Boys and Girls Club of America, $281 million

- Planned Parenthood, $275 million

This summer, she gave away two homes in Beverly Hills, valued at a combined $55 million, to the California Community Foundation.

During the pandemic, she gave one college $50 million. That school, Prairie View A&M University, is a historically Black college in Texas.

“This pandemic has been a wrecking ball in the lives of Americans already struggling,” she wrote at the time. “Economic losses and health outcomes alike have been worse for women, for people of color, and for people living in poverty.”

Even more extraordinary: She rarely has a personal connection to the recipients. She doesn’t ask for naming rights, pose for photo shoots, or call for press conferences during gift announcements.

The challenge of thoughtful giving

It’s no secret that writing big checks doesn’t necessarily lead to desirable outcomes. There have been concerns that her large gifts would lead other donors to pull back their support or that small groups wouldn’t be able to handle them.

Bezos, Scott’s ex-husband, had donated less than $2.4 billion to charitable causes as of October, less than 20% of what Scott had given to that point, though Bezos vowed this year to give away the majority of his fortune.

In a CNN interview, he noted that it’s not “easy” to donate money, with many donations proving to be “ineffective.”

While Bezos has a point, Scott’s giving has proved to be constructive, according to the Center for Effective Philanthropy, which found that nearly 90% of recipients said the gift from Scott was the largest unrestricted donation their organization had ever received.

Most groups said they were directing the funds toward improving their programs and hiring staff, and more than 90% said they were using the donation to improve their charity’s financial stability.

How to help

Scott has said that people from all walks of life can chip in to the causes they care about. Gifting to a local charity during this time of year is a way to spread holiday spirit, but she also notes that using your time or voice is an alternative to donating money.

In 2022, one of my (Matthew) goals was volunteering for local nonprofits, particularly in helping fight hunger and climate change.

Scott’s latest giving spree has restored my inspiration to give.

Readers: In what ways have you found donating your time and money to be most impactful? We’d love to hear from you.

Dive Deeper

For more info, check out Scott’s new site, Yield Giving.

Here’s more on The Giving Pledge, a promise the world’s wealthiest people make to dedicate most of their wealth to charity.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.