Woodstock for Capitalists

Hi, The Investor’s Podcast Network Community!

Happy Saturday!

🏢 Today’s the big day! It’s the annual Berkshire Hathaway Shareholder meeting in Omaha, Nebraska.

Don’t worry — we’re there, ready to take notes, and we’ll share all the juicy details with you next week 🕵️

Meanwhile, let’s get into the vibe by breaking down what some call the “Woodstock of Capitalism” and how it has changed over the years.

All this, and more, in just four minutes to read.

— Weronika

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Omaha, Nebraska

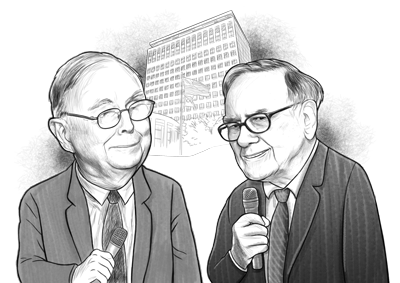

For decades, Warren Buffett and Charlie Munger have hosted Berkshire Hathaway’s annual shareholder meeting. To value investors, it’s an annual Mecca honoring two of the greatest investors to ever live, also nicknamed “Woodstock for Capitalists.”

Each year tens of thousands of shareholders from around the globe fill up the convention center to hear pearls of wisdom from these legends who have kept the show going well into their 90s.

Folks also come to network, celebrate being a part of the community, and make new friends.

The prestige of the event is impressive. You breathe the same air as the biggest names who gathered to pay their respect to Buffett and Munger, including Bill Gates from Microsoft, Tim Cook from Apple, Jamie Dimon from JP Morgan Chase, or even A-list celebrities like Charlie Rose.

What’s compelling after all these years, though, is that both Buffett and Munger still seem genuinely down-to-earth, humble, and almost surprised by the crowd’s excitement while not being afraid to show their wit or crack a few jokes.

How it started

The beginnings were modest. The first Berkshire shareholder meeting was held in 1973 in the employee cafeteria of one of Berkshire Hathaway’s subsidiaries, making it a more low-key meet-up.

In fact, for years, it was basically a non-event. Just 12 people attended in 1981.

As the company and shareholder base expanded, the meeting moved to larger venues. Since the number of participants in 2022 surpassed 40,000, the gathering has occurred in downtown Omaha’s Health Center Arena.

It boasts a massive exhibition hall to accommodate vendors, shareholders, employees of Berkshire and its subsidiaries, press representatives, and their families.

It’s become much more than just an annual meeting for a publicly-traded conglomerate.

Berkshire Bazaar of Bargains

Over time, the event has transformed from a bland affair into a vibrant carnival where you can stuff your pockets with all sorts of delightful goodies.

Starting Friday, you can join the “Berkshire Bazaar of Bargains.” This space is a shareholder shopping event, gathering dozens of the best-known businesses owned by Berkshire, including See’s Candies, Fruit of the Loom, and Justin boots.

Actually, See’s Candies are sold by the Pound.

At the 1994 meeting, Berkshire sold nearly 800 pounds of candy. A decade later, it sold nearly 17 times that amount, 13,440 pounds. Buffett once claimed that See’s had record-breaking sales after the event as shareholders bought boxes of assorted chocolates and Mother’s Day gifts.

But they aren’t the only things being hustled. During a nine-hour period at the annual meeting in 2014, over 1,385 pairs of Justin boots were sold (one pair every 23 seconds), as were 7,276 pairs of Wells Lamont gloves and 10,000 bottles of Heinz ketchup.

To keep up the vibrant spirit, the exhibit hall features quirky attractions, including a Margaritaville-inspired pontoon boat, a towering 12-foot gecko, and various cardboard cutouts of Buffett welcoming fans around every corner.

The Stars of the show

On Saturday, the event commences punctually at 8:30 am, featuring a 30-minute video showcasing TV commercials from Berkshire’s subsidiaries and major public holdings, including American Express, Apple, and Berkshire Energy.

The video also contains a series of humorous clips with Buffett and Munger making appearances in well-known TV shows like The Office, Breaking Bad, and All My Children.

As a long-time tradition, Buffett, who enjoys a good laugh, has been incorporating these videos into the shareholder meeting for years, though they’re seldom made public.

On top of that, attendees, including shareholders and press members, are prohibited from capturing photos, videos, or audio recordings within the meeting. Instead, each year, Berkshire designates a single media company to live-stream the Q&A segment of the event.

Last year, CNBC anchor Becky Quick was responsible for posing questions on behalf of shareholders, and occasionally, Buffett and Munger responded to inquiries from the audience.

Buffett, Munger, Greg Abel, who runs Berkshire’s day-to-day operations, and Ajit Jain, who runs the company’s massive insurance businesses, field questions from shareholders.

Participants ask about anything from Buffett and Munger’s market timing, view on politics, or company selection process, to dealing with challenging macroeconomic conditions.

Whatever the topic, Buffett answers methodically, blending timeless wisdom, amusing anecdotes, and personal viewpoints, while Munger is known for his curt and humorous comments.

On top of that, throughout the years, numerous traditions have arisen, like a Newspaper Tossing Contest that takes place Saturday morning.

Shareholders can compete with Warren Buffett to see who can get closest to the Clayton Home porch, which is located 35 feet away from the throwing line. If anyone beats him, they’ll win a Dilly Bar, one of Dairy Queen’s most iconic products, which has been a Berkshire company since 1997.

Still, despite being distinguished hosts of one of the year’s most prominent financial events, Buffett and Munger try to lay low and continue their long-time tradition — Buffett sips his cherry Coke while Munger enjoys See’s Candies.

Dive Deeper

To explore last year’s Berkshire Hathaway annual meeting, go ahead and listen to Stig Brodersen and Trey Lockerbie’s summary podcast.

WHAT ELSE WE’RE INTO

📺 WATCH: HBO’s Warren Buffett Documentary

👂LISTEN: How to improve a 100% stock portfolio using Return Stacking with Corey Hoffstein

📖READ: King Charles’ coming coronation stirs memories of queen 70 years ago

SEE YOU NEXT TIME!

Enjoy reading this newsletter? Forward it to a friend.