Withdrawal Limits

01 December 2022

Hi, The Investor’s Podcast Network Community!

❄️ Welcome to the month of December. Crazy to think that 2023 is just a month away, huh?

The Fed’s preferred inflation metric, which strips out energy and food costs, came in cooler than expected today, rising only 0.2% in October from the previous month as opposed to projections for 0.3%.

For those keeping count, that’s the second-smallest increase this year and lends credibility to the narrative that inflation has peaked 😬

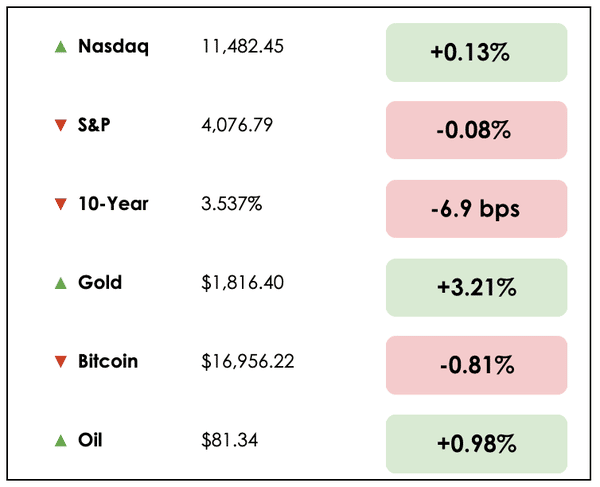

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: Why Blackstone’s stock is selling off and a big announcement from Tesla, plus our main story on when to expect a full recession in the U.S.

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🏨 Blackstone Limits Withdrawals On Property Fund (FT)

Explained:

- Blackstone’s (BX) $125 billion real estate fund for high net-worth individuals said it would limit redemptions after receiving a surge of requests from investors looking to liquidate into cash. The news sent the private equity firm’s stock down as much as 8%.

- The company met only 43% of redemption requests from investors in their Real Estate Income Trust (REIT) in November.

Why it matters:

- Blackstone’s real estate fund became a massive player in the industry, buying up apartments, suburban homes, medical offices, and casinos in the last few years. It grew rapidly in an era of ultra-low interest rates as investors looked for higher yields.

- Now, soaring borrowing costs and a cooling economy are quickly changing the landscape, which caused the Blackstone REIT to caution it would limit or even suspend redemption requests going forward.

- On Thursday, Blackstone announced the sale of its 49.9% share of the MGM Grand Las Vegas and Mandalay Bay Resort casinos, a deal valued at $5 billion, including debt.

🚚 Tesla Semi-Truck Unveiled (Reuters)

Explained:

- Tesla (TSLA) will unveil its long-awaited Semi, an 18-wheeler electric freight hauler, to at least one customer on Thursday night, three years later than originally planned.

- PepsiCo (PEP) reserved 100 Semis shortly after its reveal and will receive its first trucks today.

- The launch is the company’s first venture into the trucking business as President Biden’s administration plans to offer a generous $40,000 tax credit for clean commercial vehicles.

Why it matters:

- Tesla has faced skepticism from industry experts who question whether electric trucks’ batteries can take the strain of hauling heavy loads for hundreds of miles.

- Elon Musk had initially stated the trucks would be in production by 2019, but battery constraints delayed its release. In 2017, Tesla said the Semi’s range was 500 miles, and they expected to price it at $180,000.

- Musk previously stated the vehicle would likely have self-driving capabilities, but as of now, the Semi will not be taking human drivers out of the loop.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

THE MAIN STORY: FIVE INDICATORS OF RECESSION

Overview

We’ve heard analysts calling for a recession for much of this year, yet, economic growth seemingly remains relatively robust.

So what’s the deal? Has a recession already started, is it just around the corner, or are we in the clear?

As we’ve discussed before, the term has ranging subjective definitions, but it’s safe to say that we aren’t “in a recession” until there are more widespread job losses.

At least, that’s what macro investor Alfonso Peccatiello thinks.

He recently put together a five-part framework of leading indicators to gauge where the economy currently stands.

Let’s go through it.

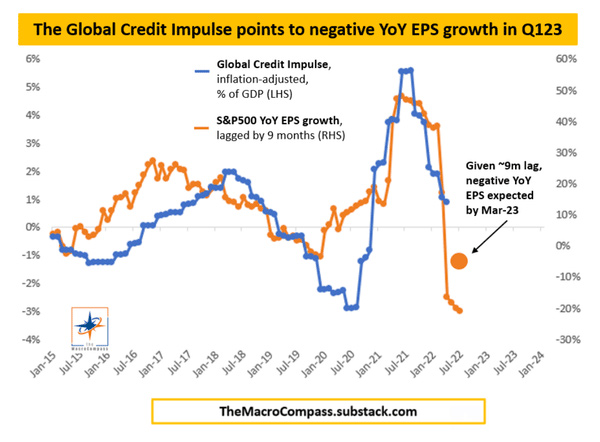

#1 The Global Credit Impulse = Pretty bad

Alf, as he’s commonly known, explains that he uses a proprietary Global Credit Impulse Index to measure the pace of money creation in the real economy.

In recent months, this index moved sharply negative, which correlates with declines in corporate earnings between 10 and 15% over the following nine months.

Weaker earnings from businesses are a consequence of all recessions, and with this credit index’s declines, Alf expects a harsh recession to arrive by March of next year.

#2 Conference Board Index = Concerning

The Conference Board compiles “ten statistically significant forward-leading indicators for the U.S. economy.”

It’s got a strong record.

Over the last fifty years, a recession occurred every time this index prints a value in negative territory on a year-over-year basis in two or more consecutive months.

Alf notes that this trigger point was reached in August, but it still hasn’t bottomed yet. Based on its seven-month lag time, Alf believes this index also predicts a recession by March 2023.

#3 The housing market = Pretty bad

Housing-related jobs and activities account for between 12 and 15% of the American economy, yet this sector is highly sensitive to interest rates.

Alf emphasizes that housing market downturns have historically preceded broader unemployment downturns by about twelve months. He uses the NAHB Housing Index, and by its account, housing market activity has fallen dramatically.

If history is any guide, these declines will roughly correlate with a doubling in the unemployment rate by the middle of next year, says Alf.

#4 Philly Fed new orders = Speculative but concerning

The Philadelphia Fed Survey, which goes out to 125 Chief Executives of relevant companies, is another decent forward indicator.

Alf uses this survey to look at the “Forecast for New Orders” section. This reflects their upcoming expectations for business activity, and any time this index has fallen below a value of 15 for several months, a recession has always followed.

Can you guess what we’re about to say next?

The index dropped below 15 in September and hasn’t recovered above that.

This also sets the stage for a recession in the second or third quarter of next year, and Alf notes that based on how quickly the index has fallen here, it doesn’t look like it’ll be a mild one.

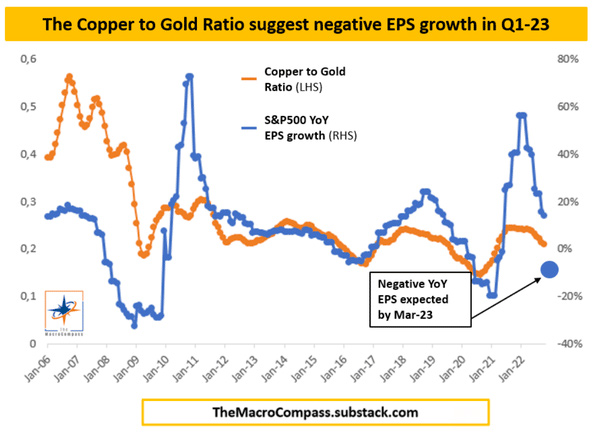

#5 Mr. Market = More speculative but still concerning

What are markets telling us?

Alf uses the copper-to-gold price ratio since copper is widely used across the economy to discern whether economic growth is accelerating or decelerating. A strong economy would be expected to push copper’s price up, especially with respect to a “safe haven” investment like gold.

Dr. Copper, as it’s called for its ability to gauge the economy’s health, has been meaningfully underperforming lately against precious metals.

There could be other factors for this, but when combined with the other four indicators, it adds to an ugly picture.

Putting it all together

Alf believes a broad recession is coming in the next 6-8 months, and markets haven’t priced it in.

While analysts are directionally correct in revising down earnings estimates for the S&P 500, they’ve failed to do so by a large enough margin.

He sees stock falling further as earnings are revised down while offering long-term bonds as a “tactical trade” because they will gain value quickly should the Fed be forced to cut rates in light of a recession.

While some calls for recession have proven slightly premature, it’s fair to say that conditions are increasingly deteriorating, which makes a recession more likely.

By Alf’s assessment, we’ll be in the midst of an ugly drop-off in economic activity by the middle of next year or sooner, and we think this is plausible too.

Go deeper

You can read Alf’s full thoughts on the topic here.

And for more with “Macro Alf,” you can listen to his recent interview with Trey Lockerbie on We Study Billionaires.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.