Water the Flowers

Hi, The Investor’s Podcast Network Community!

🚀 Strong year-to-date performance from tech giants such as Apple and Microsoft has driven the S&P 500 higher in 2023 (about 8% thus far).

So too have AI-related tech stocks. If not for the “AI trade,” the benchmark index would be down 2% this year, rather than up 8%, per SocGen research.

By the way, we switched up our newsletter design a bit, leave us your feedback here or hit reply to this email.

—Matthew

Here’s the rundown:

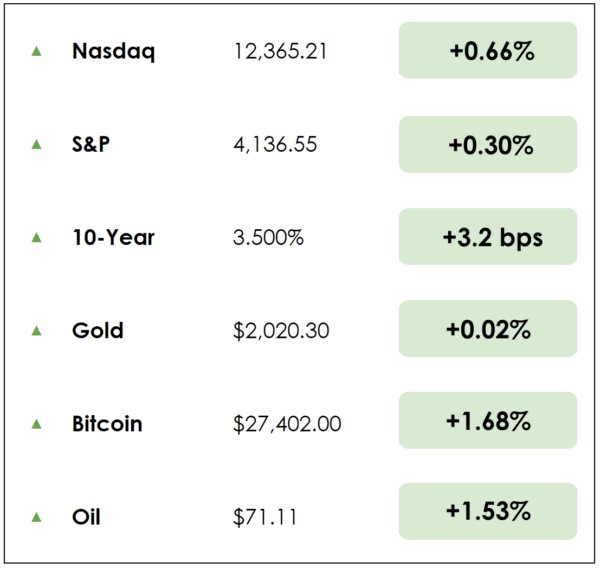

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

-

Woes at venture capital giant Tiger Global

-

Europe takes global lead in the race to regulate AI

-

Plus, our main story on three lessons from investor Mohnish Pabrai

All this, and more, in just 5 minutes to read.

POP QUIZ

Last year, Warren Buffett held his 21st and final charity lunch. How much did the winner bid to eat with him? (Scroll to the end to see)

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

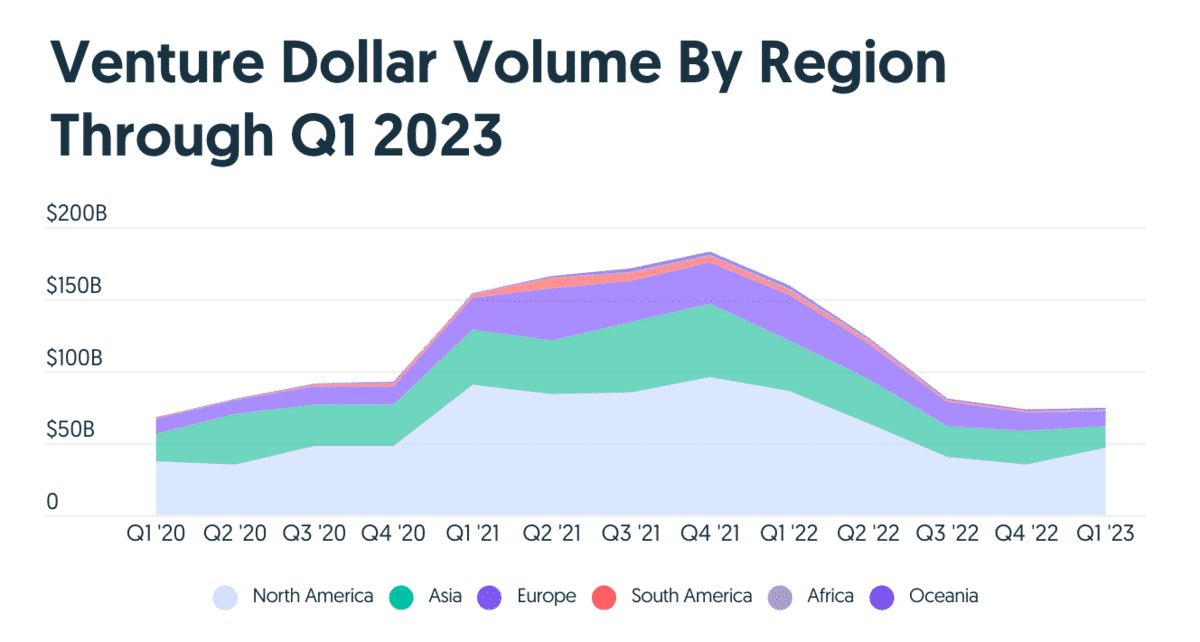

✌️ Venture Capital Giant Wants to Offload Investments after Losses (Bloomberg)

The industry-leading venture capital titan, Tiger Global Management, hopes to offload hundreds of millions of dollars worth of ownership stakes in private companies after marking down its venture capital portfolio some 33% last year.

The firm managed $51 billion to start 2023, with most of its assets invested in startups.

- These early-stage companies aren’t publicly traded, meaning their shares aren’t listed on, say, the New York Stock Exchange, so finding buyers for these ownership stakes can be time-consuming.

Tiger Global has previously invested in businesses like BytdeDance (TikTok’s parent firm), the social platform Discord, and the mobile banking services company Discord.

Why it matters:

Tiger Global, like many of its peers, is struggling to navigate a downturn in the venture capital space after pouring money into flashy startups in 2020 and 2021.

- Its investments are now estimated to have declined around $23 billion in value from their peaks, partly thanks to the surge in interest rates last year that dried up funding for the space.

Funds raised globally in initial public offerings (IPOs) in the first quarter fell 61% year over year — with fewer companies going public, when firms like Tiger Global “cash out” on their investments, venture capital investors are looking for alternatives in the secondary market.

- That’s to find investors willing to wait for these businesses to (hopefully) go public or be acquired, and take them off Tiger Global’s hands. This enables Tiger to make payouts to clients, invest more in other companies in their portfolio, or fund new investments.

🇪🇺 Europe Takes Lead in Global Race to Regulate AI (CNBC)

Lawmakers in the European Parliament approved a pioneering AI regulation, moving it closer to becoming the first Western AI law.

- This milestone highlights the increasing need to govern rapidly evolving AI technology, especially since China has already drafted rules for managing generative AI products (like ChatGPT).

The regulation adopts a risk-based strategy, assigning obligations based on potential hazards. It outlines requirements for “foundation models” like ChatGPT, addressing concerns about their advancement and potential displacement of skilled labor.

Ultimately, the European Union’s (EU) proposals aim to establish guidelines for organizations utilizing AI technology, which is integrated into more applications than many realize, influencing not only viral videos and images on social media but also science and healthcare solutions.

- The EU’s new guidelines follow Google’s recently announced Bard AI updates, including the advanced language model PaLM 2, which outperforms other top systems and offers real-time internet access.

Why it matters:

The AI Act classifies AI applications into four risk tiers: unacceptable risk, high risk, limited risk, and minimal or no risk. Applications deemed unacceptable risks are prohibited and cannot be implemented within the EU.

- Examples of unacceptable AI uses include social scoring systems, biometric categorization based on sensitive attributes, subliminal or manipulative efforts to distort behavior, and exploiting individuals’ or groups’ vulnerabilities.

- One legal expert noted, “The providers of such AI models would be required to take measures to assess and mitigate risks to fundamental rights, health and safety, and the environment, democracy and rule of law.”

MORE HEADLINES

⚰️ Just two miles apart, Boston neighborhoods have a 23-year gap in life expectancy

🙃 How Wall Street is preparing for a potential U.S. government default

🏓 Pickleball is replacing Bed Bed & Beyond and Old Navy at malls

An expensive meal

In 2007, Mohnish Pabrai and Guy Spier forked over more than $650,000 to have lunch with Warren Buffett. They found a cozy nook at the Manhattan steakhouse Smith and Wollensky. It lasted near three hours, and Pabrai later said it was “worth every penny.”

Buffett gave them an unconventional method to determine their integrity, asking them, “Would you rather be the greatest lover in the world yet be known as the worst, or would you rather be the worst lover and be known as the greatest?”

“And he said, ‘If you know how to answer that correctly, then you have the right internal yardstick,’” Pabrai recalled.

Recently, our Stig Brodersen interviewed Pabrai, famed investor and author of The Dhandho Investor.

Since its inception in 2000, Pabrai has returned 989% to investors in his flagship fund, compared with “only” 401% for the S&P 500.

Here are three highlights from the conversation.

4% hit rate for the best

Pabrai mentions how Buffett recently noted that Berkshire Hathaway has owned a few extraordinary businesses.

Most have been good or mediocre. In 58 years, only about 12 decisions have created most of the company’s great outcomes (Berkshire has averaged a roughly 20% annual return since 1965.)

Aside from these 12 excellent investment decisions, such as Coca-Cola, American Express, and Apple, Buffett has made plenty of average decisions.

“Over 58 years, Warren has bought more than 80 companies,” Pabrai said. “In that period, he’s probably made at least 10 key hires and probably bought at least 210 stocks over that period. So collectively, well over 300 decisions.

“And when he says that 12 stand out, it’s like one in 25. It’s like a 4% hit rate for someone as great as Warren Buffett and Charlie Munger. They’ve said many times that if you took out 15 decisions, ‘Our record would be useless.’ ”

Bullish on Turkey

Pabrai has said Turkey might be “the cheapest market in the world.” He noted that the average holding period there is only a few days, giving investors like him with a longer-term orientation an advantage.

Many companies are trading at cheap price-to-earnings ratios, too.

Ben Graham said: “In the short run, the market is a voting machine, but in the long run, it’s a weighing machine.”

Pabrai commented “no one” is weighing the companies in Turkey; they’re voting, “dancing in and out” of positions. “Buffett has a great quote: He says the stock market is a mechanism to transfer wealth from the active to the inactive.”

“And it could not be more true than a place like Turkey. It’s almost a little bit of a time warp. It’s like going back to the 1960s and 1970s in the U.S. It almost feels like the early 1990s in India, where you had a lot of very high-quality businesses at single-digit multiples.”

Timeless lessons

Pabrai is worth a few hundred million dollars, but he knows he’s made plenty of mistakes. Two constants in the investing business?

You’ll make many mistakes, but it’s a forgiving business.

- “You can be wrong, even 98% of the time, and still come out smelling really nice,” he said. “But that is only going to happen if you buy businesses with great economics at reasonable valuations and then hang on to them forever.”

Pabrai believes in holding your winners, even when they get fully priced

When overpriced, winners shouldn’t necessarily be sold. “It’s only possible when they get completely ridiculously egregiously overpriced that you can consider selling,” he said, which aligns with Buffett’s ideal holding period: forever.

- “I think it’s very hard to beat the market if you don’t have this framework, because you’re going to be cutting the flowers and watering the weeds,” he added.

- “What we need to do is make sure we don’t cut the flowers. And it really doesn’t matter whether you water the weeds or not, but the important thing is you just don’t cut the flowers.”

Pabrai also clarified that the best investors might be wrong more than half of the time. With a portfolio of 10 stocks, more than half might be mistakes. You could lose money on them or not compound them and still do well if one or two turn into big winners.

Dive deeper

Check out the full conversation with Pabrai right here on We Study Billionaires.

TRIVIA ANSWER

An anonymous person bid $19 million to dine with Buffett last year, with all proceeds going to a San Francisco charity.