Volatility Vortex

28 September 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

🌀 To our readers in Florida — We hope you stay safe with Hurricane Ian making landfall today.

In other news, the Federal Reserve estimates that Americans have lost as much as $10 trillion in wealth from stock market declines this year.

On the bright side, both bond and equity prices soared today, and the S&P broke a six-day losing streak. Uncertainty and fear is spreading in markets, though, which sets the stage for continued choppiness.

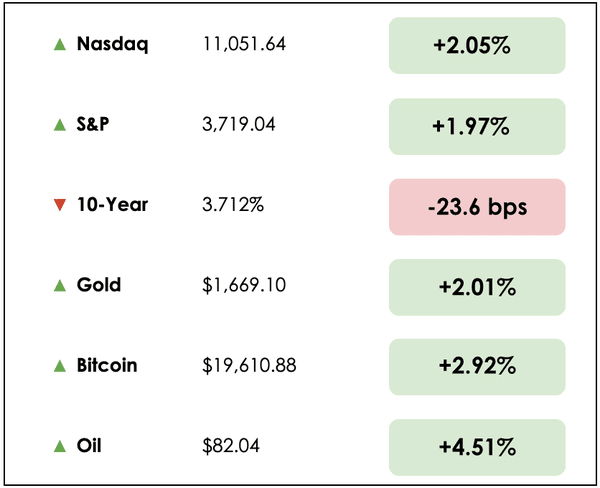

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss the IMF’s urgent message to the British government, a volatility vortex in Treasury markets, an ultra-cheap electric car, and Ray Dalio’s recent musings on inflation.

All this, and more, in just 5 minutes to read 📖

IN THE NEWS

🇬🇧 IMF Issues Scathing Warning To The UK (Bloomberg)

Explained:

- The International Monetary Fund urged the UK government to review its huge unfunded tax cut plans that were announced last week, while ratings agencies like Moody’s suggested that the country’s credit ratings could be at risk due to permanent damages to its public finances.

- Given the record levels of inflation gripping the UK, the IMF emphasized that the country should continue with tightening financial conditions, not unleashing massive fiscal stimulus.

What to know:

- In response to the country’s planned stimulus, which stands at odds with its monetary policy that aims to slow the economy, the British Pound hit an all-time low versus the dollar on Monday, and the government’s 30-year bond yields rose to their highest level since 1998 (yields rise when bond prices fall).

- Famous investor Ray Dalio, who is also the topic of today’s deep dive below, said that the UK’s government is “operating like the government of an emerging country.”

- Raphael Bostic, the President of the Federal Reserve Bank of Atlanta, said this about the UK: “The proposal has really increased the uncertainty and really caused people to question what the trajectory of the economy is going to be.”

🌪️ Volatility Vortex Slams Into The $24 Trillion U.S. Government Bond Market (FT)

Explained:

- The Treasury market has endured recently its most extreme bout of turbulence since the Covid pandemic rocked markets globally in March 2020.

- The Ice BofA Move Index tracks volatility in fixed income markets, and it has just reached its highest point in over two years.

- Gennadiy Goldberg, a strategist at TD Securities, said “you have investors staying away because of the volatility — and investors staying away increases volatility. It’s a volatility vortex.”

What to know:

- From Japan having to step in last week to save the yen from its collapse against the dollar, to the recent free fall in both the Pound and Euro, bond and currency investors are on edge from these cataclysmic disruptions in what are supposed to be among the world’s most stable economies.

- U.S. Treasury bonds have sold off at their fastest clip in years, if not decades, and this intense selling has handicapped demand for new debt issuances intended to fund the American government.

- High inflation, and a Fed that has aggressively hiked rates and voiced its intention to continue doing so, have added further angst and uncertainty into these markets.

⚡ Tata Motors Launches $10,000 Electric Car In India (Reuters)

Explained:

- Tata Motors has just launched India’s lowest-priced electric vehicle (EV), as it looks to attract more consumers to the space.

- The ultra-cheap electric car is, in part, made possible by substantial government subsidies, which have also powered Tata’s EV dominance more broadly alongside high tariffs on imports that reduce demand for alternatives.

What to know:

- The launch comes at a time when its rival, Mahindra & Mahindra, is negotiating to raise $500 million for its EV unit.

- Tata’s Tiago EV, a hatchback starting at $10,370, is rivaled only in affordability in China, where some EV models start for as low as $4,5000.

- Electric vehicle sales in India make up just 1% of total car sales, but some estimates expect this to grow to 30% by the end of the decade.

WHAT ELSE WE’RE INTO

👂 Listen: How to work and live purpose, from our new Millennial Investing podcast host Rebecca Hotsko.

📺 Watch: How people think and work across cultures, a video review of the Culture Map.

📖 Read: An incredible visual breakdown of Ukraine’s successful counteroffensive against Russia, from the Financial Times.

DIVE DEEPER: IT STARTS WITH INFLATION

In a recent post, legendary investor Ray Dalio, founder of the hugely successful hedge fund Bridgewater, sought to describe how inflation, interest rates, markets, and economic growth relate to each other and what it means for our future.

It’s an ambitious undertaking, to say the least.

But true to form, Dalio takes immensely complex topics and distills them to their essential principles.

Breaking it down

He begins by describing the nature of productivity, as living standards continually improve due to inventions that enable us all to get more value out of a day’s work.

This fundamental truth pushes our modern societies into a favorable uptrend with money and credit cycles instilling ups and downs into the long-term trend.

In simple terms, Dalio says, “when money and credit growth are strong, demand and economic growth are strong, unemployment declines, and all that produces higher inflation. When the opposite is true, the opposite happens.”

The goal is to maximize economic growth and minimize unemployment, so long as these dynamics do not produce painful accelerations in the rate of inflation.

What rate of inflation is undesirable?

As he explains, this is observed when the secondary effects of inflation result in negative distortions to productivity. The economic consensus is that this goldilocks level of inflation is around 2%.

For central banks, their ideal combination of strong economic growth and low unemployment raises inflation, which causes them to choose between a trade-off of inflationary costs, or an economy that they’ve weakened by raising interest rates.

In other words, if inflation exceeds 2%, they sacrifice economic growth and jobs to return to an inflationary equilibrium.

Dalio continues by saying that high inflation concerns today outweigh complications from raising the rate of unemployment, so central banks must continue to raise rates, slow the economy, destroy jobs, and hopefully, reduce inflation rates.

What to know

To define inflation, he thinks of it as being the change in the total amount of money and credit in an economy spent on goods and services divided by the change in the quantities of those goods and services.

Demand is shaped by the total amount of money and credit, in addition to the interest rate levels set by central banks, while quantities of supply are defined by productivity, trade networks, manufacturing output, the impact of disruptions, etc.

Central banks are key here to determining the total amount of money and credit available through the buying and selling of debt assets with money that they print (quantitative easing and quantitative tightening), and therefore, they have a meaningful impact on demand.

As interest rates rise with respect to inflation, prices for financial assets broadly must go down.

Dalio explains that this is because of three reasons:

- Negative income effects for companies and individuals, such as more interest expenses on borrowings that consume a greater percentage of income, thus restricting productive reinvestments while raising credit concerns.

- The “present value effect,” as assets seen to be less safe than government bonds must decline in price so as to offer more competitive future returns

- The reality that higher interest rates reduce the amount of money and credit available to buy financial assets in aggregate.

As the effects of higher rates ripple through financial markets, sending prices lower and destroying peoples’ perceived wealth, the real economy begins to suffer.

This destruction in wealth hinders spending and consumption, thus restricting economic output and yielding slowing or negative economic growth, underpinned in part by an increase in unemployment.

Takeaways for today’s environment

Dalio predicts that, although markets expect inflation to be around 2.6% for the next decade, it will really hover around 4.5 to 5%, and this could go higher should there be worsening economic tensions, wars, or major environmental crises.

He further speculates that real yields must remain quite low for some time to accommodate high debt burdens. In other words, interest rates cannot exceed the rate of inflation by more than 1% per year without creating crippling debt servicing costs.

For this to happen, U.S. government bond yields would need to hit at least 4.5% with a range of up to 6%.

This is a significant increase from where the 10-year Treasury, for example, trades today between 3 and 3.5%.

So what?

Diving deeper, he raises concerns around the demand for government debt going forward.

To fund its deficits, the U.S. government will have to sell bonds worth around 4-5% of its GDP this year, and the Federal Reserve also plans to sell (and/or let roll off) a lot of debt — about 4% of GDP — as they seek to tighten financial conditions in response to inflation.

He poses the question as to who, then, will want to purchase this new supply of debt (8-9% of GDP), when the prospect of earning much after inflation is quite limited?

Should the private sector have to absorb this burden, we can expect lending growth and investment rates to drop off dramatically for America’s businesses.

To put it bluntly, this is not conducive to strong economic growth at all, and this debt responsibility will be a significant headwind as we work to dig ourselves out of this inflationary conundrum for the next few years.

A rise in interest rates to 4.5%, says Dalio, would correlate with an additional 20% decline in equity prices on average, due to present value effects (described above) and declining incomes in a weaker economy.

Should conflicts with Russia and China worsen further, or internal strife run rampant in the U.S., declines could be even greater.

Wrapping it up

Tell us readers — What do you think of Dalio’s call for inflation to stay elevated and for the stock market to decline another 20%?

For more Ray Dalio, you can read our past writings about him, or listen to William Green’s interview with him.

To learn about his investing strategy, you can check out our Millennial Investing mini-episode walking through it.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.