U-Turn

03 October 2022

Hi, The Investor’s Podcast Network Community!

Happy October 🎃 and welcome back to We Study Markets!

It’s the first day of the fourth quarter, and stocks were feeling cheery with an impressive bounce back from last week.

💰 In other news, Kim Kardashian is being fined by the SEC $1.26 million for promoting an obscure cryptocurrency token called EMAX without disclosing that her social media posts were part of a paid deal.

We’re hoping that since the timing of those promotions roughly marked the top in crypto and broader financial markets, perhaps the fallout now for Kim K will mark the bottom.

We’re not holding our breath though…

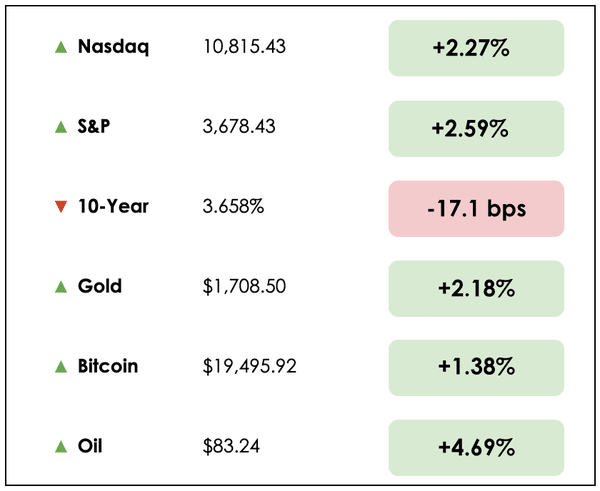

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss Credit Suisse’s financial turmoil, the UK government’s major U-turn, massive potential cuts to global oil production, and an overview of the world’s most misunderstood industry.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

IN THE NEWS

🏦 Major Bank Credit Suisse Falls Deeper Into Turmoil (Bloomberg)

- The struggling bank, plagued by a myriad of scandals and controversies, now faces sentiment from investors that suggests it may be on the verge of collapse.

- Five-year credit default swaps for the bank’s debt are at levels not seen since the Great Financial Crisis, indicating that markets believe the bank’s creditworthiness is declining rapidly. Markets are currently pricing a 23% chance of default within five years.

- Credit Suisse’s (CS) shares fell as much as 12% on Monday in Switzerland and are down about 60% for the year.

What to know:

- As panic began to spread this weekend amongst the bank’s counterparties, investors, and employees, its CEO set out ought to reassure stakeholders in a memo that only fueled alarm further by admitting that the firm faced a “critical moment.”

- The bank is expected to announce a new strategic plan on October 27th, and it’s apparently considering deals to sell its securitized products trading unit along with parts of its Latin American wealth management operations.

🔙 UK Government Pulls A Major U-Turn (Axios)

Explained:

- The British government announced it will abandon part of its plans for controversial tax cuts that sent the country’s currency and bond markets into a crisis.

- The plan was disliked, in part, for removing the 45% top tax rate on high-income earners which was expected to reduce tax revenue for the government while adding to inequality.

- The governing Conservative Party buckled under excruciating external financial pressure to scrap the high-income tax cuts, and polls in the country showed a sharp drop-off in approval ratings that could lead to a huge loss in the next general election.

What to know:

- The proposal sparked an emergency intervention from Britain’s central banks and a stern warning from the IMF which typically reserves such comments for plans that emerge from highly-indebted developing countries.

- Despite his own Conservative Party proposing the fiscal plan, influential former cabinet minister Michael Gove said that “using borrowed money to fund tax cuts” was “not Conservative.”

🛢️ OPEC+ Set To Cut Oil Output In Move To Boost Prices (Reuters)

Explained:

- The OPEC+ group of oil-producing nations has indicated that it will cut 1 million barrels per day of oil production which would mark its largest decline in output since 2020.

- Saudi Arabia, a leading voice in the group, has stated that production cuts are necessary to stabilize oil markets which have fallen sharply over the past few months amongst extreme volatility.

What to know:

- As the U.S. seeks to subdue future oil price increases in a bid to weaken inflation’s bite, a significant production cut would surely come at President Biden’s chagrin.

- Russia, an allied member of OPEC+, has pushed for large output cuts from the cartel, presumably in a bid to boost revenues from higher prices while adding pressure to the energy crisis facing the rest of Europe.

- Stephen Brennock of PVM said, “It must be noted that OPEC+ is already pumping more than 3 million barrels per day below its target, hence any further cut will only exacerbate the existing supply tightness.”

ONE MORE THING

- 📺 Watch: Elon Musk unveils prototype humanoid Optimus robot, from the Verge

- 👂 Listen: The quest for resilient wealth creation, with Matthew McLennan

- 📖 Read: How to make sense of China’s enigmatic rules, by the Economist

DIVE DEEPER: THE WORLD’S MOST MISUNDERSTOOD INDUSTRY

With Ethereum’s recent transition from the proof-of-work mining model still used by the Bitcoin network to a proof-of-stake model, which claims to be 99% more energy efficient, energy usage in cryptocurrency mining has been a hot topic lately.

Bitcoin mining, as a result, continues to be criticized by incomplete mischaracterizations.

So, to add clarity around this deeply misunderstood industry, we turned to blockchain expert Nic Carter’s archive of writings on the topic and found a particularly good breakdown that we wanted to highlight today.

What to know

Firstly, as Carter explains, when many lament about Bitcoin’s energy footprint, they conclude that “someone, somewhere” is being deprived of electricity due to Bitcoin miners’ use of it for solving complex mathematical problems that verify transactions and offer newly “mined” Bitcoin as a reward.

These views are misleading at best, though.

This is because energy globally is not perfectly exchangeable or transportable, for electricity decays as it ventures further from its point of production.

Carter highlights that 8% of global electricity is lost via transporting it from where it’s generated to where it’s used by end consumers.

These transmission costs are why we have an energy grid that enables electricity to be produced nearly everywhere, not just in one single spot and then transported from there.

Using clean energy

The beauty, then, that Bitcoin mining offers, is the ability to better utilize and monetize stranded energy sources that have been built but struggle to be economically viable due to their distance from population centers.

Since Bitcoin miners can essentially plug-in anywhere, they provide a uniquely robust source of demand for isolated energy resources

China, for instance, was famous for over-building hydroelectric dams over many years that had huge capacities to generate electricity, yet they were massively underutilized due to poor planning (too far from population centers).

Until Bitcoin mining was banned in China in 2021, Bitcoin miners were able to set up shop with their mobile “mining” rigs (specialized computers) near these hydroelectric power dams and make use of effectively zero-cost and zero-emission energy sources that were otherwise going to waste.

Why it matters

In the time since Bitcoin mining concentration was pushed out of China by the Communist Party, miners have spread out around the globe and continued to find the lowest-cost energy sources to monetize which are often stranded renewable assets.

These miners are driven to the lowest-cost energy sources, because they operate in a highly competitive industry with razor-thin margins.

And to differentiate themselves and ensure profitability, they need energy sources that are extremely cheap which often means working with renewable energy projects that are positioned far away from sources of demand (cities).

Making the most of fossil fuels

On top of this, Bitcoin mining has also been known to more efficiently utilize energy waste from fossil fuel sources.

Natural gas flaring is a process where gas gets burned off at the point of extraction in oil drilling. The World Bank has called this practice a “monumental waste,” but it continues to this day.

Transporting natural gas requires extensive pipelines, so when drillers focused on oil stumble across gas formations, it’s easiest for them to just burn it away than try to discern how to make use of it.

While this gas flare-off would normally be totally disregarded, Bitcoin miners are working increasingly to use the energy waste for their own operations.

Shipping containers can be filled with Bitcoin miners and placed on oil wells, and then the excess gas can be diverted to generators that convert it into electricity and power the Bitcoin mining rigs.

In some sense, Bitcoin, then, enables the export of energy through its monetary network from the most remote corners of the world to anywhere someone wishes to use the digital currency.

Carter provides a helpful hypothetical.

He says, “Imagine a topographic map of the world, but with local electricity costs as the variable determining peaks and troughs. Adding Bitcoin to the mix is like pouring a glass of water over the 3D map — it settles in the troughs, smoothing them out.”

He continues by stating, “Bitcoin thrives on the margins, where energy is lost or curtailed.”

Mischaracterizations

A common mistake from critics is to try and extrapolate Bitcoin’s total energy consumption to an equivalent measure of carbon dioxide emissions.

For example, the World Economic Forum is famous for saying that Bitcoin mining would consume all of the world’s energy by 2020.

Beyond the fact that this is evidently wrong, the energy mix used by Bitcoin mining is important here as well.

These projections fail to account for the green energy sources often used to power Bitcoin mining, at least according to Carter.

Another benefit is their flexibility, since Bitcoin mining rigs can be easily unplugged at times when there are large industrial or population demands for energy and then turned back on during times when capacity is not being fully utilized (night time for example).

In other words, they help to make energy demand more constant.

Takeaways

Of course, Bitcoin miners do use electricity, and some do create CO2 emissions.

The question that Carter raises in response is whether critics believe private digital currencies like Bitcoin have any valid claims to society’s resources.

This, in part, depends on your view of Bitcoin.

If you see it as a way to store your wealth and transact outside of the state’s surveillance, a way to bring financial technology to the world’s poor, or a way to hedge against currency debasement by central banks, then energy expenditures on Bitcoin mining that secure the network will seem quite justified.

If you believe it’s a Ponzi scheme, outlet for money laundering, flawed technology, or otherwise deemed to fail or detract from society, then surely you will see any energy usage in its name as a waste.

Carter highlights, though, that Bitcoin mining is one of the few energy uses that we subject to such moral examinations.

While we seldom question the broad use of energy to illuminate Christmas lights each year or the massive data centers that enable us to mind-numbingly stream Netflix content for hours, skeptics are quick to label any energy usage in Bitcoin’s name as wasteful.

Wrapping up

Let us know readers — Do you like Bitcoin-related topics like this?

To hear more about Bitcoin mining and from Nic Carter, check out Preston Pysh’s interview with him from earlier this year.

One more thing

In the spirit of continuous learning, we wanted to also take a moment here to hand off to another newsletter that we think adds a ton of value for its readers.

James Lavish is a friend of The Investor’s Podcast Network and a brilliant financial commentator, educator, and investor.

His newsletter, 🧠 The Informationist, comes out once a week, and we read it as soon as it arrives in our inboxes.

In the newsletter, he distills complex financial topics ranging from how to interpret credit default swaps, how the Fed really works, why repo markets matter, and the consequences of yield curve control, in a way that’s approachable and easily understandable.

He does an excellent job explaining these important subjects, and we’d encourage you to add it to your reading list — Sign up here to receive his free analysis.

To listen to James Lavish and learn more about Bitcoin, don’t miss our most recent Bitcoin Fundamentals podcast interview with him.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.