Twitter’s Ultimatum

18 November 2022

Hi, The Investor’s Podcast Network Community!

Thanksgiving is next week, and we’re ready to stuff our faces with turkey, mashed potatoes, and pumpkin pie 🥧

What’s your favorite dish for the holiday?

Is it a cop-out to say I (Shawn) am excited for all of them?

🚙 Carvana (CVNA) is the latest tech company to ruin the holiday season for its employees after announcing layoffs for 1,500 workers.

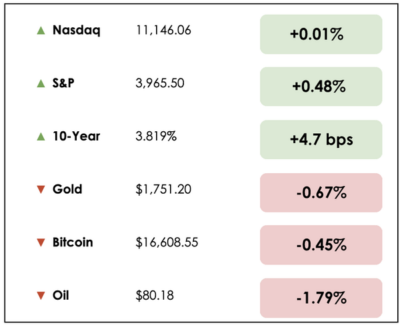

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss Twitter’s employee ultimatum and new data on the housing market, plus our main story on why higher economic growth doesn’t necessarily mean better stock returns.

All this, and more, in just 5 minutes to read.

Do you want to write for this newsletter? Apply here.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🐦 Twitter Employees Exit After Musk’s Ultimatum (Reuters)

Explained:

- Thursday night was the deadline for Twitter (TWTR) employees to fulfill the latest demand from Elon Musk — commit to being “hardcore” or leave the company.

- Musk wrote, “this will mean working long hours at high intensity. Only exceptional performance will constitute a passing grade.”

Why it matters:

- Musk fired nearly half of Twitter’s employees just weeks ago, and now, hundreds more have decided to quit rather than agree to Musk’s demands.

- The exodus of talent has led to worries over the short-term reliability of the platform. Many Twitter employees believe it’s only a matter of time before the service experiences major technical issues.

- As resignations rolled in, Musk tweeted, “How do you make a small fortune in social media? Start out with a large one.”

🏡 U.S. Home Sales Continue Decline (WSJ)

Explained:

- Sales of previously owned U.S. homes fell for a record ninth straight month in October as steeper interest rates continue to batter the housing market.

- According to the National Association of Realtors, contract closings decreased by 5.9%, and sales declined in all four major regions of the U.S.

- Existing home sales have dropped about 32% from their recent peak in January.

Why it matters:

- Mortgage rates have retreated below 7%, but even so, the elevated rates, broader economic uncertainty, and high home prices have made potential buyers more nervous about housing purchases.

- The modest drop in mortgage rates may be a temporary reprieve as Fed officials this week have said they still have a ways to go on their hawkish tightening policies.

- The housing market slowdown is expected to persist because affordability continues to push buyers out of the market. First-time buyers also face rising rents and higher inflation, making it more difficult to save for a down payment.

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

WHAT ELSE WE’RE INTO

📺 WATCH: How to find the holy grail in investing, breaking down Ray Dalio’s investing approach with Shawn O’Malley

👂 LISTEN: The changing composition of money with Alfonso Peccatiello, from the We Study Billionaires podcast

📖 READ: Just how poorly was FTX run? This Twitter thread summarizes 30-pages of its bankruptcy filings

RECOMMENDED READING

Well, we found it: The newsletter that’s giving businesses small and large an edge over the competition.

Stacked Marketer delivers the breaking news, hacks, tips & tricks needed to dominate the entire digital marketing landscape 一 from native ads and SEO to Facebook, Google, Snap, TikTok and everything in between.

What’s more, it is completely free to read. Join over 33K smarter professionals reading Stacked Marketer from Monday to Friday.

Go on sign-up today.

THE MAIN STORY: WHY HIGH ECONOMIC GROWTH DOESN’T EQUAL HIGH RETURNS

Overview

Folks, we have a special guest helping with today’s newsletter.

Rebecca Hotsko, the new host of our Millennial Investing podcast, which aims to help Millennials make better financial decisions, has written our main story today.

This comes as a rebuttal of sorts to our recent writings on investing in India, where we made the case for the country’s stocks based on its broad economic growth prospects.

Let’s jump into Rebecca’s analysis.

What to know

Countries with high gross domestic product (GDP) growth haven’t rewarded investors with greater returns over the long run. In fact, empirical work and historical data show that countries with higher GDP growth have generated lower real equity returns compared to slower-growing, stable economies over time.

This result may seem surprising at first since some may be inclined to think that higher economic growth would be good for corporate profits. However, this hasn’t necessarily been true over the long run for several reasons.

Corporate profits vs. economic growth

- Investors build expectations for faster growth into prices but tend to overpay for this.

- This means that, in general, there’s a tendency for markets to assign a higher P/E and price-to-dividend multiples when economic growth is expected to be high, which lowers realized returns, because the investor is paying a premium now for future earnings growth.

- It also turns out that investors aren’t very good at predicting how fast economies will grow, likely due to overly-optimistic expectations. Over long periods, high-growth economies haven’t produced better stock market returns for investors in both developing and emerging markets.

- A second reason is that fast-growing economies tend to have more new companies forming as competition, in addition to existing companies relying more heavily on equity issuance to grow.

- When companies issue new shares into the market, their earnings and dividends (on a per-share basis) correspondingly grow more slowly than the economy’s total growth.

Illustrating the point

For example, China has exhibited remarkable economic growth for over a decade, but its stock market returns haven’t been as generous.

The reason is that much of the growth in the total stock market occurred via an expansion in the number of listed companies, with hundreds of initial public offerings occurring, as opposed to price increases for existing listed companies.

It’s important to understand that, despite the entire market’s aggregate earnings growing, this doesn’t mean that an investor’s earnings per share (EPS) will benefit.

How a country’s total stock market can rise but not lead to better returns for investors

A stock market’s earnings, referred to as “aggregate earnings,” can grow for three reasons:

1) new companies issue new shares into the market

2) existing companies issue new shares into the market

3) existing companies’ market value grows with no new shares issued.

An investor only benefits from the third, whereas the first two are detrimental to their returns. In contrast, GDP growth may rise when any of the three occurs.

From this, it’s easy to see the disconnect between what drives GDP growth and aggregate stock market earnings compared to what benefits investors’ returns. An investor’s EPS will only keep up with GDP growth if no new shares are issued by either new or existing companies.

More than half of aggregate economic growth comes from the creation of new enterprises, not from the growth of established enterprises.

Interestingly, one study found that EPS tends to follow GDP per capita. If the population grows at around 2% and dilution is around 2%, these two net out.

Why EPS and GDP’s correlation breaks down

Since the primary source of dilution is the net creation of new shares when new companies capitalize their businesses with equity, given the continued importance of innovation and the creation of start-ups, the dilution rate is highly unlikely to subside unless the innovation rate slows.

This means that the assumed dilution of 2% per year may be an understatement.

That said, economic growth rates aren’t irrelevant. In the short term, GDP and stock markets can have a stronger correlation, particularly in recessionary periods.

What does this mean for your portfolio?

Allocating more capital in high-growth economies may not pay off as expected if you over-pay for that growth. It also may not pay off if the relationship between earnings per share and GDP/capita breaks down due to slower population growth or higher-than-expected equity dilution.

Investors, then, should not mistake a country’s strong economic growth as an indicator of high stock returns.

Over time, fast-growing countries in both developing and emerging markets have tended to produce lower returns than more stable economies.

The picture is complicated, but with Rebecca’s help, we can provide more context on investing in rapidly developing economies like India.

Wrapping up

If you enjoyed hearing from Rebecca here, you’d love her podcasts on Millennial Investing.

Check out her catalog of interviews to learn more!

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.