Trouble Beneath the Surface

26 January 2023

Hi, The Investor’s Podcast Network Community!

Have you shared this newsletter with your friends and family?

Maybe your buddy who still thinks he can outsmart markets with his options-based day-trading strategies?

Find just five people who would love (or benefit from) this newsletter, get them to sign up, and we’ll send you an Amazon gift card plus a premium membership to our signature TIP Finance stock-picking tool.

Find your unique referral code at the end of this email — refer away 😎

BuzzFeed’s (BZFD) stock more than doubled today after reports that the media company plans to use artificial intelligence to enhance its articles and personality quizzes while also partnering with Meta to generate content for Facebook and Instagram.

Elsewhere, it looks like Bed Bath & Beyond (BBBY) has officially defaulted.

🚀 And Bitcoin continued to tread water at $23,000, a near 40% rise year-to-date.

Here’s the rundown:

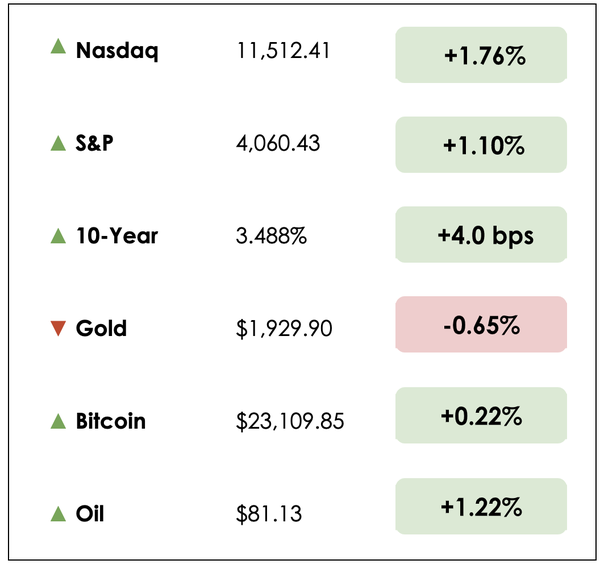

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: the U.S. economy shows signs of growth but trouble beneath the surface, and how climate change may foster trade wars, plus our main story, a masterclass on price multiples in stock valuation.

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

📈 U.S. Economy Posts Solid Growth (NYT)

- Economic activity at the end of 2022 showed the resilience of American consumers and businesses despite rising inflation and interest rates. The U.S. economy grew at an annual rate of 2.9% in the fourth quarter, the Commerce Department said Thursday.

- Adjusted for inflation, U.S. gross domestic product was down slightly from a 3.2% growth rate in the third quarter. Consumer spending grew at 2.1%. Economic output contracted in the first half of 2022, prompting talk of a recession, then rebounded. Over the year, GDP grew 1%, down sharply from 5.7% in 2021.

- However, demand growth slowed, which is good news for the inflation outlook. But it could mean weaker overall growth lies ahead in 2023. It’s also worth nothing that GDP growth is a lagging indicator.

- “The economy continued to motor on,” said Michael Gapen, chief U.S. economist for Bank of America. “There’s more momentum in the economy at year-end than we thought, and a lot of that is from households.”

- But the housing sector continues to tumble, and business investment grew only at a 0.7% annual pace, off from 6.2% in the prior quarter. Plus, consumer demand is softening.

- The question now is whether the resilience can continue in 2023 as inflation globally remains elevated. Construction activity and home sales have slowed, tech companies have announced thousands of layoffs, and manufacturing output has fallen, while Americans are turning to credit cards as pandemic savings dry up.

🌍 Climate Change May Foster Trade Wars (NYT)

- Climate change mitigation efforts are prompting countries to embrace dramatically different policies toward industry and trade, driving governments into conflict.

- The new clashes over climate policy may intensify as climate issues worsen. For example, the current system funnels millions of shipping containers with couches, clothing, and car parts from foreign factories to the U.S. for low prices. But the prices consumers pay for the goods don’t account for the environmental harm generated by the factories or container ships that carry them across the ocean.

- U.S. officials believe they must lessen a dangerous dependence on goods from China, arguing that more must be done to discourage trade in products with greater pollution and carbon costs.

- “The climate crisis requires economic transformation at a scale and speed humanity has never attempted in our 5,000 years of written history,” said Todd N. Tucker, the director of the industrial policy and trade at the Roosevelt Institute. “A task of this magnitude will require a new policy tool kit.”

- The Biden administration is putting in place subsidies to encourage the production of clean energy technology in the U.S., such as tax credits for consumers who buy American-made clean cars.

- But that might come at its own cost, as the subsidies could hurt Japan, South Korea, and allies in Europe. Said Anne Krueger, a former official at the International Monetary Fund and World Bank: “When you discriminate in favor of American companies and against the rest of the world, you’re hurting yourself and hurting others at the same time.”

The Green Coffee Company (GCC), a Legacy Group portfolio company and Colombia’s #1 largest coffee producer, has launched its $100 million Series C funding round.

Earn an 11x multiple on investment projected through a 2026 sale or U.S. IPO:

As a follow-up to her past piece on mean reversion, Rebecca Hotsko, the host of our Millennial Investing podcast, joins us again today to discuss why multiple expansion/contraction is a critical component of your investment return.

She writes the following.

Getting started

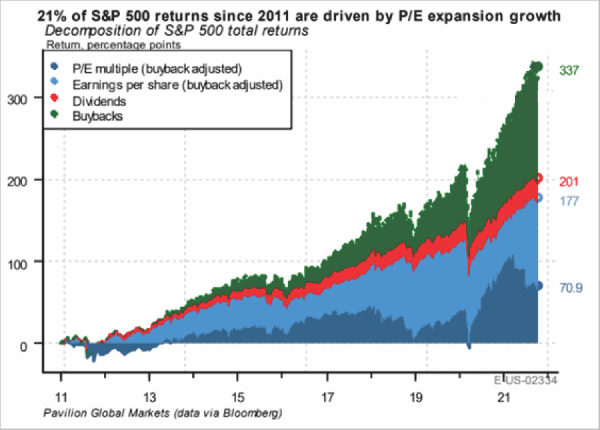

Price multiples are often thrown around, but people usually fail to interpret them within the proper context. Interestingly, Pavilion Global Markets found that price-to-earnings multiple (P/E) expansions drove 21% of the S&P 500’s returns since 2011.

In other words, investors paying more for the same amount of earnings was a huge contributor to investment returns.

Predicting where a company’s price multiple will be in the future is no easy task, though. Several factors cause multiples to change over time, some of which are impossible to predict.

Factors that cause multiples to change over time:

- The level and growth rate in earnings per share

- The perceived riskiness of the stock or risk of receiving these future cash flows (which shows up in the discount rate)

- The expectations of inflation, interest rates, equity risk-premium, and specific company risks (which also show up in the discount rate)

Volatile multiples

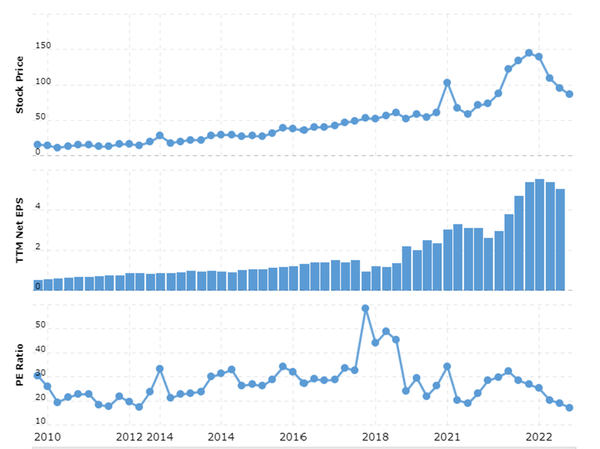

Let’s look at Alphabet (GOOGL) as an example — and I’ll just refer to them as Google to keep things simple.

The company has grown earnings per share (EPS) by an average of 27.5% over five years. Yet, over this same period, its multiple has fluctuated substantially, falling from 58x earnings in 2017 to 17x in 2022.

Source: Macrotrends

What’s happening with Google?

Despite Google’s solid growth in EPS since 2018, its multiple is much less today than in prior years, when it earned far less.

The market is forward-looking, so it may believe that Google’s growth prospects have changed, likely slowing. Therefore, it doesn’t warrant as high of a multiple anymore.

This aligns with declines in analysts’ estimates for Google’s EPS growth for the next five years of 9%, much lower than its previous five-year EPS growth of 27.5%.

Google is not a recession-proof business. Some of the multiple contraction recently could reflect recessionary risks facing the company as the market grows concerned about receiving those expected future cash flows, which would justify a lower price paid today.

External factors

The tricky thing is that not only is a company’s multiple based on its future growth prospects, but also several external factors that are impossible to predict, including interest rates, inflation, and recessions.

For example, low-interest rates kept multiples artificially high for years by reducing the risk-free rate used to value equities, aka the discount rate.

Similarly, low inflationary periods have also historically led to lower discount rates, which means a higher multiple than higher inflationary periods.

Elevated inflation injects uncertainty into every layer of the economy, and this uncertainty causes investors to demand higher future return compensation, resulting in higher discount rates and lower price multiples.

What to know

A company’s earnings growth is just one piece of the puzzle in determining where the multiple will be.

Additionally, external factors can override positive earnings growth and suppress multiples. As a result, a company’s multiple will fluctuate considerably over time. Still, it’s crucial to remember that historical multiples are not necessarily a good predictor of where it will be in the future.

So what is the right multiple to use?

Empirical evidence from Jing Liu, Doron Nissim, and Jacob Thomas found that forward-looking multiples are more accurate value predictors.

They compared the performance of historical and forward industry multiples for a subset of companies trading on various U.S. exchanges and found that forward-looking multiples had greater accuracy. Moonchul Kim and Jay Ritter found similar results when they compared the pricing power of historical and forecast earnings for 142 initial public offerings.

Downside of forward multiples

That said, using forward estimates has downsides. Because they’re based on Wall Street’s consensus earnings estimates, they’re subject to significant room for error. Predicting the future is no easy task. It’s always worth double-checking the implied growth estimates embedded in these forward estimates. Looking at Google, its current P/E is approximately 17.6x earnings, and its forward P/E is 17.0x, which means that this assumes Google will grow earnings next year by 5-10%. So, while forward estimates are empirically supported as a better and more reasonable estimate of where next year’s multiple will be, it still requires your own due diligence.

What about in the long term?

As mentioned in my discussion of mean reversion, a more conservative estimate to use long term is to assume that the multiple will move toward the industry average over time, which is about 19.7x earnings currently.

Google trades for a multiple less than this, and on top of that, it’s trading at a multiple within the lowest range of its history.

This suggests that the risk of further multiple contraction is reduced, leaving room to potentially benefit from future multiple expansion.

Wrapping up

It’s worth mentioning that although I am showing the P/E multiple for simplicity, this is often not the best multiple to use for all companies, especially high-growth companies with volatile earnings.

It’s often best to take a combined approach and look at a range of multiples that are most suitable for the business and industry.

Dive deeper

If you didn’t read Rebecca’s write-up on mean reversion, you can check it out here.

And make sure you subscribe to the Millennial Investing feed on your favorite podcasting app to hear more of Rebecca!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.