The Recession Begins!

28 July 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

And welcome to the official start of the 2022 recession, as the Commerce Department confirmed today that real GDP shrank for the past two consecutive quarters.

Equity markets though loved that the Fed had no special surprises in their interest rate hike yesterday, delivering an expected 75 basis point increase while recognizing that some inflationary indicators may actually be softening.

Even better for stocks, the Fed has not set explicit expectations for the next rate increase, so this pragmatic wait-and-see approach helps ease fears regarding more aggressive hiking scenarios.

The party extended across the board from stocks to bonds to Bitcoin and gold 📈

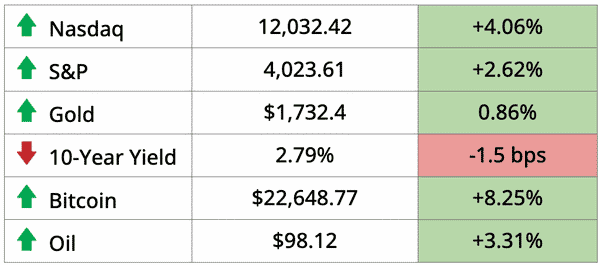

*As of 4pm EST on prior day’s close

Today, we’ll discuss Facebook’s downturn warning, today’s GDP figures, lessons from history’s wealthiest man, and the relationship between interest rates and inflation. All this, and more, in just 5 minutes to read.

Let’s do it!

IN THE NEWS

⚠️ U.S. economy shrinks at a 0.9% annualized rate (WSJ)

Explained:

- With inflation hitting a four-decade high last month, in the midst of an urgent rate hiking campaign by the Fed’s Jerome Powell, American consumers have been hit with a double whammy. Prices for everyday goods and services are significantly more expensive than just a year ago, while higher rates make everything from credit card loans to mortgages more costly.

- Jeffries chief economist Aneta Markowska says, “We’re in a sentiment recession. I don’t think we’re in an actual recession.” The definition of a real recession has become a contentious political point, as a strong labor market seems at odds with a downturn in the business cycle.

What to know:

- As the media increasingly discusses poor economic outlooks, many Americans are left believing that things are in quite dire straits. We’re not here to say they aren’t, but Markowska’s point is that simply the perception of a recession is enough to change consumer behavior in such a way that one technically occurs, before businesses have started widely laying off workers.

- We’ve written about before, but the economy is just weird right now, and you could be forgiven if you find things hard to read. Large inventory build-ups earlier this year hurt profits for companies like Target, yet supply markdowns in these stores haven’t fed through to lower inflation. And people generally still have their jobs, yet we are technically in a recession, which one would normally associate with broad increases in the unemployment rate.

↘️ Zuckerberg Says Economic Downturn is Here (CNBC)

Explained:

- Meta posted its first decline in revenue and announced a dimmer outlook as the company faces growing competition from rival TikTok and adjusts to headwinds caused by macroeconomic forces. Zuckerberg said, “we seem to have entered an economic downturn that will have a broad impact on the digital advertising business.”

- Quarterly revenue of $28.8 billion dropped 1% from a year earlier and was slightly below the $28.9 billion analysts were expecting. Meta’s stock has fallen slightly over 5% in after-hours trading since the announcement.

What to know:

- The digital advertising market is struggling with soaring inflation and others like Google and Twitter have seen slow rates of growth in ad spending. A strong dollar is weighing on the top line according to the company’s CFO.

- Meta posted a net profit of $6.7 billion for the second quarter which is the third quarter in a row the company’s bottom line has fallen. Zuckerberg also said, “This is a period that demands more intensity…and I expect us to get more done with fewer resources.”

📈 Fed Making History With Rate Hike (CNN)

Explained:

- You’ve probably heard. The Fed raised rates 75 basis points yesterday, and this increase made history. It was the first time the Fed had raised rates by 0.75% twice in a row. The unprecedented action indicates how far the Fed is willing to go to temper sky-high inflation.

- More tightening is expected to combat 40-year-high inflation. Jerome Powell rejected claims that the U.S. is currently in a recession and noted robust job growth and continued low unemployment.

What to know:

- The S&P rose 2.6% while NASDAQ had its biggest one-day gain in more than two years as it climbed 4.1%. Given the Fed’s insistence on taming inflation by causing slower growth and bringing recession risks into play, it is somewhat surprising many asset classes reacted so positively (see chart above).

- This is the fourth consecutive rate hike by the Fed and we can expect more. Powell said, “these rate hikes have been large, and they’ve come quickly…It’s likely that their full effect has not been felt by the economy, so there’s probably some significant additional tightening in the pipeline.” Ouch! 🤕

Tweet about this:

FEATURED SPONSOR

How do you make sure that you are investing with a “good” operator?

Dan Handford and his wife are currently invested in 54 different passive real estate syndications with 16 different operators in 10,000+ doors.

They use this exact list when deciding whether or not to invest with a particular group. Get access to the “7 Red Flags for Passive Real Estate Investing” to be confident in your next investment!

DIVE DEEPER: DOES HIGH INFLATION HAVE TO MEAN HIGHER INTEREST RATES?

With the Fed raising interest rates by 0.75%, we asked ourselves, “Does higher inflation cause interest rates to rise naturally, or do central banks simply raise interest rates in response to inflation?”

The distinction may seem small, but this nuance actually carries important ramifications. Our question was inspired by Harley Bassman, managing partner at Simplify Asset Management, who discussed this dynamic in an interview last week.

Bassman is what’s known as a monetarist, meaning that he belongs to the school of economic thinking associated with Milton Friedman, where it’s believed that changes in the broad money supply are the primary determinants of demand in the economy. Increases and decreases in the money supply then are expected to fundamentally alter economic activity and lead to price inflation or deflation.

So he places himself firmly in the non-transitory inflation camp, believing that current bouts of inflation are caused primarily by increases in the broad money supply, rather than stemming mostly from temporary supply chain disruptions related to covid-19 and Russia’s invasion of Ukraine.

The truth is likely a blend of these various macroeconomic factors, but for investors and savers alike, the question remains, how should we expect long-term interest rates to behave in response to inflation?

While it’s commonly accepted that central banks can very directly influence short-term and overnight interest rates through their policies, their ability to influence long-term U.S. Treasury rates (ten to thirty years), is much less clear.

The Fed has rapidly raised its policy rate this year, but the yields on long-term bonds have been much less responsive, which has created some of the yield curve inversions we’ve previously discussed.

Conventional wisdom suggests that long-term yields are derived principally from expected economic growth and inflation rates.

So why, then, have long-term yields held flat the past few weeks, despite record-breaking levels of inflation?

If you’re going to lock up your money for 30 years, for example, by lending to the government and buying its bonds, you should demand a return that, at a bare minimum, matches the rate of inflation, otherwise you’re just agreeing to lose the real purchasing power of your investment over time.

With that logic in mind, one might find it quite curious then that 30-year Treasury bonds have clung to approximately 3% and have declined since June’s blistering CPI report showed prices rising at 9.1% annually.

There’s a profound cognitive dissonance here that Bassman emphasizes, as investors see unprecedented accelerations in inflation before their own eyes in daily life, yet yield curves indicate that such inflation is unsustainable and will soon return to the average levels of the past few decades. Otherwise, their investments in long-dated bonds at current prices would be seemingly irrational.

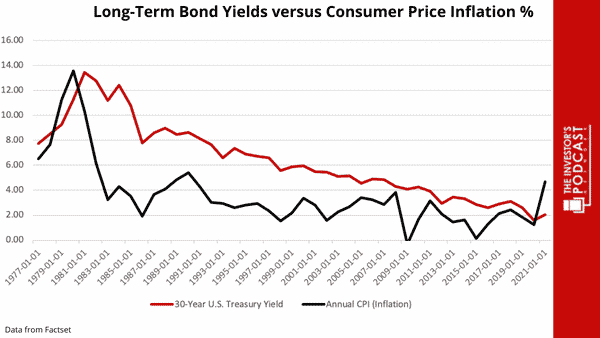

As you’ll see in the chart below, thirty-year Treasury yields have had a strong correlation with inflation since the 1970s, and for the majority of that time, have traded with a reasonable return above realized inflation, until you look at the very far right of the graph.

Here, during the period since the start of 2021, inflation has rocketed higher, while yields have been left in the dust.

Bassman argues that one explanation for why long-term rates have stayed so low, is because pension funds, who have liabilities dated decades in the future, are eager to lock in profits from two great years in equity markets.

This means that these funds have been selling equities, and buying distant 30-year Treasuries, which pushes yields down (bond prices and their yields have an inverse relationship), so as to hedge further downside in stock markets while securing capital for future payouts.

So what?

On paper, we should be seeing long-term interest rates that adjust to current changes in inflation and inflation expectations, and it’s fair to say that we’ve seen this over the past year.

It’s possible, though, that global investors are anticipating a severe recession in the next year or two that is so harsh it zaps inflation, in which case, current yields on long-term bonds are much more rational.

While a recession looks increasingly possible, if not likely, one of this inflation-killing magnitude is expected by very few, at least publicly. The Fed certainly doesn’t seem to think we are heading towards economic calamity, which is why the stubbornness of long-term bonds is quite perplexing to them.

Flat long-term bond yields are making their job more difficult. As the Fed tightens the economy by raising short-term rates, its space for operation becomes narrower without corresponding increases in yields on the back end of the curve. In this case, they risk panicking markets with further yield curve inversions.

If record inflation and the Federal Reserve can’t get long-term yields up, we are left wondering what the market, in its collective wisdom, actually knows that we don’t.

Perhaps we are in a new paradigm of inflation that investors just haven’t accepted yet, as reflected by 30-year Treasury yields, and it will take many months more of high inflation to break the status quo, since for decades inflation has been broadly declining.

Or maybe there’s a severe recession on the horizon foreseen by bond markets, but not yet expected by the Fed, equity investors, and most economists.

On the other hand, there could be technical reasons for this, as Bassman suggests, including efforts in the short-term by pension funds to guarantee gains in equity markets, though if so, we’d expect long-term bond yields to begin rising eventually.

If you know the answer to why interest rates haven’t kept pace with inflation, let us know – just hit reply to this email 😉

Tweet about this:

MONEY LESSONS FROM THE WORLD’S WEALTHIEST MAN

If you had to guess who the wealthiest person in history was, many would throw out names like Rockefeller, Musk, or Bezos. Maybe Vanderbilt or Carnegie. Few would throw out the name of Jacob Fugger. While it’s debatable, many historians have called him the wealthiest person to ever live, with a fortune estimated to be $400 billion in today’s dollars.

We’d never heard of Jacob Fugger until a few days ago, so we had to look into the man further to find out more. Fugger was born in 1459 and was the son of a textile merchant. He ultimately built the family firm into a textiles, banking, and mining dynasty. At the time of his death, he had amassed a fortune that amounted to 2% of Europe’s GDP.

Let’s discuss five wealth accumulation tips from Jacob Fugger:

1. Know the facts – Fugger created the world’s first news service and used it to find out about market events before others. He also employed a network of spies across Europe to gain power through knowledge. Monarchs at the time would rely on bankers like Fugger to finance military or political campaigns. Using his spies, Fugger would access a king’s creditworthiness. Luckily today, company information is easily accessible, but the point is smart investors do their research and know an investment in knowledge pays the best interest, to paraphrase Ben Franklin.

2. Find the right asset mix – Fugger divided his wealth into four equal parts: stocks, bonds, real estate, and gold. It was estimated this portfolio earned him 12% for 33 years. After 40, he focused on wealth preservation and took fewer financial risks. Establishing your optimum mix of assets to meet your financial goals and lifestyle needs is key for investors.

3. Know the numbers – Fugger was among the first in Germany to use double-entry book-keeping, having studied it in Venice as a young man. He created the first balance sheet and used auditors to review expenses at his many enterprises. As an investor, having an easy and reliable system to keep track of cash flow, investment returns, and expenses helps us stay on track to reach our financial goals.

4. Stay cool – Fugger kept calm and cool in risky situations that could have ruined him. Even during periods of debt, he maintained public displays of wealth and good cheer until circumstances were back in his favor. Financial markets are a rollercoaster and can wreak havoc on one’s emotions if left unchecked. Successful investors are level-headed and avoid making decisions in a panic which can harm returns.

5. Be generous – In the latter part of his life, Fugger created a charitable trust and built Fuggerei, where needy citizens could be housed. The gated residence has been continuously occupied since it was built in 1516 and is still run by Fugger’s descendants providing low-income housing. Consider your own plan for giving. What kind of impact would you like to make with your wealth?

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you tomorrow!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12 pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.