The Perfect Stock

25 July 2022

Hi, The Investor’s Podcast Network Community!

Hope everyone had a relaxing weekend, and welcome back to We Study Markets!

More earnings reports are coming out this week, including from Alphabet (GOOG), Amazon (AMZN), Apple (AAPL), and Meta (META).

Also, here’s a stunning stat: 616 players were drafted in the 2022 Major League Baseball draft. Guess how many petroleum engineers graduated this year? Just around 400 new petroleum grads-an 83% decline from 2017 due to many students shunning oil industry degrees for an ESG future. Hard to believe there are more newly minted baseball players in the majors than there are new petroleum engineers.

Today, we’ll also discuss the Fed’s mission impossible, figuring out your “X-number,” and thinking about the perfect stock for you. All this and more in just 4.5 minutes to read.

Let’s go!

IN THE NEWS

📊 Weak Earnings Aren’t Fazing Investors (WSJ)

Explained:

- Mediocre earnings from several big companies such as Bank of America, Netflix, and Tesla don’t seem to be fazing investors with the S&P 500 up nearly 5% this month and 2.5% last week.

What to know:

-

- This is an important week for the markets. Some analysts consider it the most important week of the summer due to a slew of earnings reports, economic data announcements, and a Fed rate increase in the cards.

- With inflation at a four-decade high and the Fed aggressively attempting to tame inflation with rate increases, sentiment was quite negative going into earnings season, and the market had already discounted the expected decline in earnings. It’s going to be a fun week to watch unfold!

🏛️ The Fed’s Mission Impossible? (NPR)

Explained:

- Jerome Powell has the unenviable position of attempting to engineer a “softish” landing by curbing demand and bringing inflation under control without tipping the economy into recession. The Fed is expected to raise interest rates later this week for the fourth time in five months. A 75 basis point (0.75%) increase is expected to be announced.

- Severe crosswinds are making the job of reigning in inflation difficult to do. The pandemic, combined with Russia’s invasion of the Ukraine, has caused serious supply disruptions causing prices to rise. Powell has said, “it’s getting more challenging because of these external forces.”

What to know:

- “We’ve had 13 or 14 recessions since World War II, and more than two-thirds of those recessions were caused by the Fed raising interest rates faster than the economy could handle,” according to University of Chicago economist Austan Goolsbee. It seems unlikely the Fed will be able to push rates much higher as the entire world has taken on and gotten accustomed to cheap debt.

- One of the main things the central bank has going for it is a strong job market. Powell has said a modest uptick in unemployment which was 3.6% in June to 4.1% for July, would be considered a successful outcome and a softish landing. We’ll see if he can land this plane gently without an economic stall.

Russia Drops Key Interest Rate by 150 Basis Points (CNN)

Russia Drops Key Interest Rate by 150 Basis Points (CNN)

Explained:

- The Central Bank of Russia (CBR) dropped its key interest rate to 8%. Rates were as high as 20% in late February when the conflict in the Ukraine began. The drop of 150 basis points (1.5%) is the fifth consecutive reduction by the CBR and comes about due to the strength of the ruble, cooling inflation, and possible recession within the country.

What to know:

- Inflation fell from 17.1% in May to 15.9% in June. The CBR anticipates inflation dropping to 12%-15% by the end of the year and expects inflation to range between 5%-7% in 2023. They expect to meet their target inflation rate of 4% by 2024.

- However, the CBR noted that “the external environment for the Russian economy remains challenging and continues to significantly constrain economic activity.”

SPONSORED BY

How do you make sure that you are investing with a “good” operator?

Dan Handford and his wife are currently invested in 54 different passive real estate syndications with 16 different operators in 10,000+ doors.

They use this exact list when deciding whether or not to invest with a particular group. Get access to the “7 Red Flags for Passive Real Estate Investing” to be confident in your next investment!

DIVE DEEPER: The Perfect Stock from One Up On Wall Street

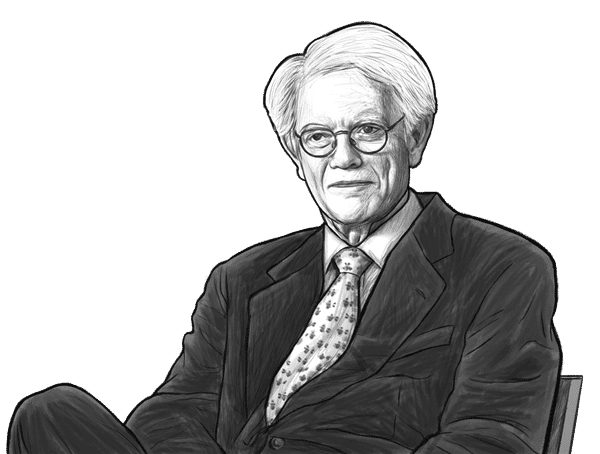

One Up On Wall Street, published by Peter Lynch in 1989, remains one of my favorite investment books of all time. Mohnish Pabrai happened to pick it up in an airport bookstore and was inspired such that he launched a career in investing after reading it. Lynch managed the Magellan Fund and achieved a 29.2% average return while at the helm.

Lynch had an atypical college background and mostly studied history, psychology, and political science. He encouraged investors to read and study broadly. He also had a rather dim view of business school and academic economics.

This is a great book to read if you’re first getting started in investing, as he doesn’t make stock picking more complicated than it needs to be. It’s also a fun book to re-visit if it has been a while since you last read it.

One of Lynch’s main points in the book is that ordinary people can invest well by sticking to companies they know well and love. In fact, the subtitle of the book is “How to Use What You Already Know to Make Money in the Market.” Likewise, many may have advantages from the profession or industry in which they work. For example, a software engineer can watch first-hand as trends develop in the tech space.

Chapter 8 is one of my favorites because it details what Lynch views as the perfect stock. It is a sort of checklist to review before you make a stock investment. Here’s what he likes to buy:

- It has a boring name

- Its business is dull (like bottle caps) or even disgusting (trash collection, intestines for hot dogs, etc.)

- It’s a spin-off (as large investment firms sell the stock, depressing its price)

- It’s depressing (funeral services, alcohol)

- Its industry is not growing. No one tries to compete there, and the best company can consolidate the market

- It has a niche (reduced competition)

- People have to keep buying its products

- Technology cut its costs

- Insiders are buying

You can see a clear pattern emerge in the stocks Lynch likes. He prefers to avoid trendy stocks or stocks bought up due to hype. He likes to invest in hated and ignored sectors. Some points could be disputed, but it’s hard to ignore a guy with over 29% returns. Read our book summary here.

What do you think of Peter Lynch’s list for the perfect stock? Is there anything you would add or take away from your investing checklist? You do have a checklist, right? Let us know your thoughts by responding to this email!

QUOTE OF THE DAY

“Investing is a wonderful, thoughtful adventure, but it can also be self-centered. We think it is true that, once past X-amount, real meaning comes from reinvesting in society through charitable giving, which can also be a thoughtful, challenging, wonderful adventure, but with the added bonus that it feels like the world working properly.”

-Nick Sleep

Meaning

Last week, we mentioned Nick Sleep, the co-founder of Nomad Investment Partnership. Nomad returned 921.1% over thirteen years versus 116.9% for the MSCI World Index and 149% for the S&P 500. Nick and his partner, Qais Zakaraia (Zak), have since closed the fund, returned cash to their investors, and are now pursuing their own charitable pursuits. We highly recommend reading Nomad’s Investment Partnership letters, where we came across our featured quote.

Nick and Zak used to ponder in their early days of investing over a concept they called “X-Amount” — where X was the amount of money they felt was sufficient to put food on the table, pay for their kids’ education, own their own homes, and have a nice lifestyle. They wanted to avoid the temptation to avoid the human drift toward an indulged life just because you can. Everyone’s number will be different, but it’s a fun mental exercise to determine what your X-number would be.

It’s reminiscent of Charlie Munger’s quote, “If all you succeed in doing in life is getting rich by buying little pieces of paper, it’s a failed life. Life is more than being shrewd in wealth accumulation.” Most of the featured great investors in William Green’s book Richer, Wiser, Happier all have foundations or planned charitable giving to help causes in which they believe. Mohnish Pabrai has set up the Dakshana Foundation and gives away 1% of his wealth each year to provide education for Indian students who otherwise would not be able to attend the prestigious Indian Institute of Technology. Nick Sleep, likewise, has set up The I.G.Y. Foundation to “rationally and quietly reallocate capital to where it can do the most good.” Not surprisingly, both Sleep and Pabrai have set up their foundations using the same rigor that have made them successful fund managers. While it may be hard to think about hitting your X factor when the market is down, but over time due to the magic of compounding, many of our readers will likely have sizable portfolios that may put them in a similar situation as Nick and Zak.

Investing is a fun and exciting endeavor that tests us on many levels. It is an intellectually challenging game that can be incredibly rewarding financially. Many of us are in the phase of building and creating wealth, so it may be hard to even think about a future scenario where you don’t have to work due to your investment acumen. If this describes your situation, be sure to check out tomorrow’s We Study Markets when we discuss some of the investing tenets that allowed Nomad to achieve such outstanding returns and for Sleep to “retire” from the investing world at the ripe age of 45.

How much would you need in your portfolio to devote the excess to more “caring” pursuits? We’d love to hear what your X-number is.

BEFORE YOU GO!

Share with friends, get awesome stuff!

Have friends who’d love our newsletter too? Give them your unique referral link (below) and get an awesome reward when they subscribe.

Rewards include our cartoon sketches, books, t-shirts, and even a MacBook Pro!

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!.

See you tomorrow!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12 pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.

P.S The Investor’s Podcast Network is excited to launch a subreddit devoted to our fans in discussing financial markets, stock picks, questions for our hosts, and much more! Join our subreddit r/TheInvestorsPodcast today!