The Joys of Compounding

Hi, The Investor’s Podcast Network Community!

👰 More wives now out-earn their husbands. The upshot? Their marriages tend to last longer, too.

The share of women out-earning their husbands has tripled over the last 50 years, from 5% to 16% of all opposite-sex marriages, according to data from Pew Research Center.

While there remains a gender pay gap — women earned an average of 82% of what men earned, as of 2022 — growth in women’s educational and career trajectories is driving the trend.

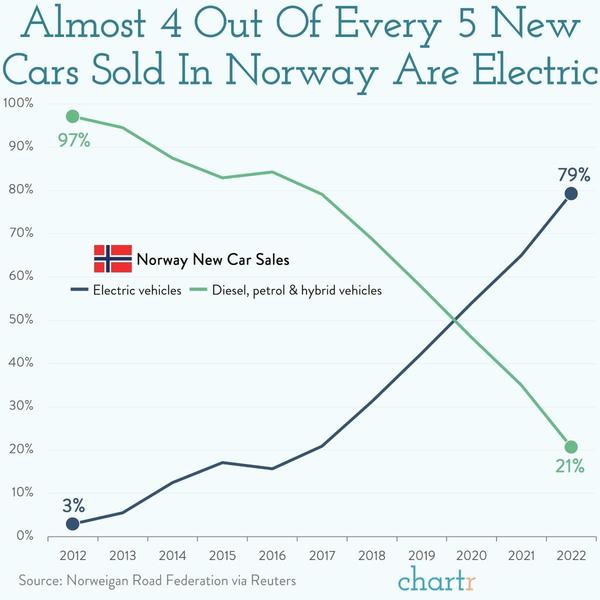

Elsewhere, check out today’s Chart of the Day below, which shows how one country has been quick to adopt the electric-vehicle revolution 🚗

—Matthew

Here’s the rundown:

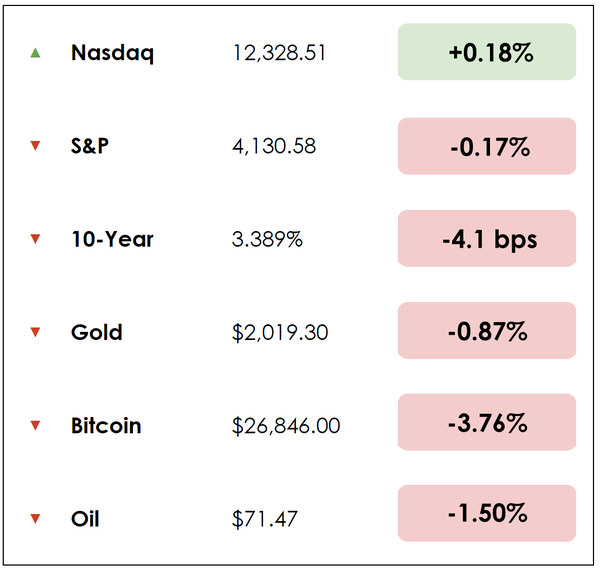

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Why Tucker Carlson’s transition to Twitter has wiped $235 million from Rumble

- More evidence of how worried investors are about a U.S. default

- Plus, our main story on the Joys of Compounding

All this, and more, in just 5 minutes to read.

Today’s trivia: Over a 30+ year period, what percentage of stocks in the Russell 3000 index produce negative returns across their lifetime?

(Scroll to the end to find out).

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

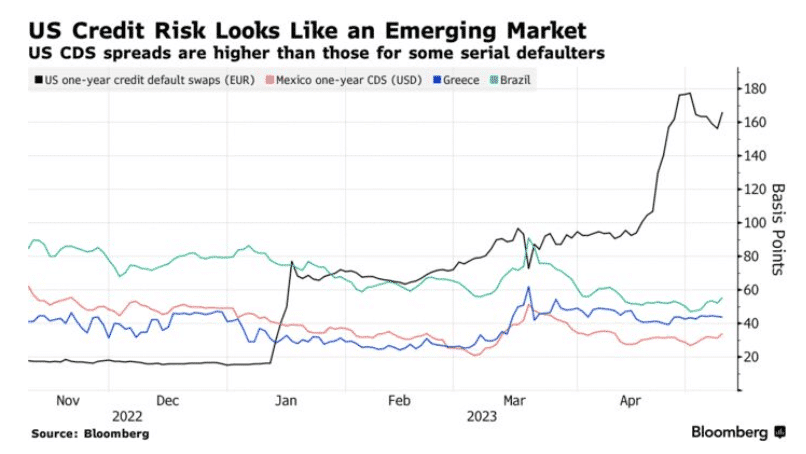

💬 U.S. Default Swaps Now More Expensive Than Mexico, Brazil (Bloomberg)

Insurance protection against the U.S. government defaulting on its debts now exceeds rates for emerging market countries. Despite the U.S.’s considerably better AAA credit rating, the debt ceiling debate raises the odds that the government will run out of funds.

This anomaly is confined to one-year contracts rather than longer-term insurance contracts, reflecting that a U.S. default is seen more as a short-term risk amidst the debt ceiling standoff.

- Still, most investors remain optimistic that a technical default will be avoided at the last minute.

- One-fixed income expert added, “The CDS prices reflect the cost of insurance on a very big credit in a very small insurance market. You can’t translate from the price of the CDS to the likelihood of (default) outcomes.

Why it matters

While the U.S. would be unlikely to stay in default for long, even a brief delay in repayments would disrupt the $24 trillion Treasury bond market, which is the foundation of the global financial system.

While Congressional Republicans wrestle with the President over budget concessions, Treasury Secretary Janet Yellen has warned that the U.S. could be short of money as soon as June 1st.

As a result, investors have piled into credit default swaps (CDS) protecting against default over the next year, sending prices for these contracts beyond their peaks in previous debt-ceiling battles.

- Bloomberg calculates that this trade could have a 2,400% payoff if the U.S. defaults, as traders would reap the difference between the market value of Treasury bonds and their par value (the amount a bond was originally issued for).

🎥 Tucker Carlson’s Transition to Twitter Wipes $235 Million From Rumble (Bloomberg)

Just under three weeks since departing Fox News, Tucker Carlson’s decision to launch a new show on Twitter wiped out $235 million in market value from the video platform Rumble (RUM).

Shares of the Peter Thiel-backed media company dropped by up to 12% before recovering as traders considered how Rumble would compete with Twitter for more conservative media personalities.

- Carlson’s exit from Fox News, where his nightly weekday show routinely garnered well over three million viewers, sent its parent company’s stock plummeting, losing more than $500 million in market capitalization.

The Wall Street Journal, under the control of Fox Corporation Chairman Rupert Murdoch, disclosed last month that Carlson’s Fox News contract was about $20 million annually, and Carlson was expected to receive full payment.

On Tuesday night, Musk clarified that Twitter had not entered into a financial agreement with Carlson.

Why it matters

Ahead of the 2024 Presidential election, Carlson’s choice to revive his popular show on Twitter demonstrates his determination to maintain a prominent presence in both the media and political spheres after hosting one of cable news’ highest-rated shows on Fox.

- “Speech is the fundamental pre-requisite for democracy,” Carlson said. “Amazingly, as of tonight, there are not that many platforms left that allow free speech. The last big one remaining…is Twitter, where we are now.”

Investors had previously purchased Rumble shares and similar stocks amid rumors of Carlson’s potential next career move after leaving Fox.

- Rumble sees itself as a YouTube alternative, aiming to “create technologies that are immune to cancel culture.”

MORE HEADLINES

🤑 Softbank says goodbye to Alibaba, pivots toward AI

✋ PacWest shares halted after falling 30% — the bank recently reported an almost 10% withdrawal of client deposits

🏰 Disney shares fall over streaming subscriber losses

The most powerful force

“Someone’s sitting in the shade today because someone planted a tree a long time ago.” —Warren Buffett

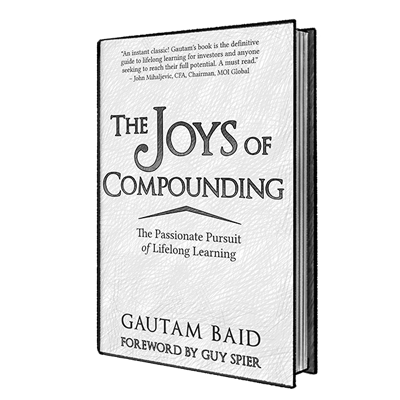

In The Joys of Compounding, Gautam Baid celebrates value investing, long-term thinking, and the power of compounding in both investing and life. It’s one of our favorite books.

Baid is the Managing Partner and Fund Manager of Stellar Wealth Partners India Fund, an investment partnership available to accredited investors in the U.S. The fund is modeled after the Buffett Partnership fee structure and invests in listed Indian equities with a long-term, fundamental, and value-oriented approach.

Because compound interest is arguably the most powerful force in the universe, the book urges us to think about compounding in terms of human traits such as positive thoughts, good health, good habits, wealth, knowledge, and goodwill.

The main takeaway: The power of compounding in all areas of life can work wonders when given enough time.

Writes Baid: “It is essential to understand the opportunity cost of this one hour. On one hand, you can indulge in getting dopamine-laced rushes from emails and social media feeds while multitasking.

On the other hand, you can dedicate the time to deep work and self-improvement.

An hour’s time spent acquiring in-depth knowledge about an important principle pays off in the long run. This current investment is minuscule compared with the significant net present value that results over a lifetime. It is akin to buying a dollar for less than one cent.

This is why good books are the most undervalued asset class: the right ideas can be worth millions, if not billions, of dollars over time.”

Your internal north star

Elite investors like Warren Buffett believe the key to investing success isn’t complicated formulas. He’s repeatedly said that basic arithmetic is all you need. He always knew that discipline, mental models, and managing emotions were far more important than anything else.

In the book, Baid illustrates how Buffett and Charlie Munger understood that the ultimate goal of investing was financial independence. They also knew that constantly raising one’s lifestyle expectations could turn that pursuit into a prison.

Baid argues that simplicity is usually the best strategy and that one should focus on compounding capital over time with minimum risk.

Baid also explains how putting in more time and effort doesn’t necessarily guarantee better results in investing. Doing less and making fewer but better decisions is often more beneficial.

Buffett said he has made only about 12 wonderful investment decisions in the past 80 years.

Life is short, and time is fleeting, Baid notes; thus, pursuing one’s passions is central to a meaningful life. Baid believes in pursuing your internal North Star and compounding positive thoughts, good health, good habits, knowledge, and goodwill, which could all lead to compounding wealth as a side effect.

Compounding goodwill

Being generous with your time and insights might not lead to a direct benefit. But over a long lifetime, you have a much greater chance of good things happening to you through “luck” that had less to do with luck than with good karma built up by being a quality human focused on investing in people and skills.

It reminds us of Dale Carnegie’s insight in his book, “How to Win Friends and Influence People” about how small gestures can have a sizable impact:

– Remembering Names

– Sincerely caring about the other person’s problems

– Expressing gratitude-Writing thank-you notes and cards

– Listening with intent

Some of our favorite quotes

Some of our favorite quotes from the book:

“Compounding is the alchemy that turns knowledge into wisdom and savings into wealth.”

“Time is the most valuable ingredient in the recipe for wealth creation.”

“In investing, as in life, the easiest thing to do is often not the right thing to do.”

“The true secret to successful investing lies not in discovering hidden gems but in avoiding common pitfalls.”

“Investing is not a game of perfect; it is a game of probabilities.”

“The greatest risk in investing is not market volatility but our own behavior.”

“The price we pay for anything is not just the money we give up but also the opportunities we forgo.”

“The true value of money lies not in its purchasing power but in the freedom and security it provides.”

Dive deeper

The book is full of gems, so here’s our handy Twitter thread on the book, and here are Clay Finck’s in-depth podcast episodes with a whole lot more.

Enjoy reading this newsletter? Forward it to a friend.

TRIVIA ANSWER

A JP Morgan study found that 40% of stocks in the Russell 3000 index in the U.S. since 1980 produced negative returns across their entire lifetimes.

A few wonderful companies do most of the heavy lifting to push indexes higher over time.

SEE YOU NEXT TIME!

Enjoy reading this newsletter? Forward it to a friend.