The Holy Grail

28 October 2022

Hi, The Investor’s Podcast Network Community!

🧨 Holy smokes! What a week it’s been.

Elon finalized his buyout of Twitter. The FAANG stocks are starting to look like they’re missing a few teeth. Mortgage rates climbed to over 7%, and we have a new billionaire Prime Minister in the U.K. That’s just for starters.

☕ Sit back, pour yourself a nice beverage, and dig into today’s edition.

By the way, we want to thank you for giving us your most precious asset — your time and attention. We hope you gain something of value from us every day.

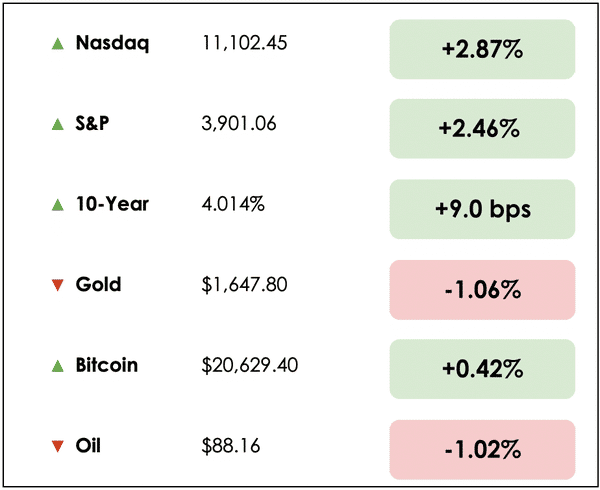

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: Why Intel’s stock is surging despite its gloomy outlook and how housing is getting hammered by the Fed’s war on inflation, plus what Warren Buffett considers the 9 most important words ever written about investing.

All this, and more, in just 5 minutes.

Let’s go! ⬇️

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

⚠️ Intel Stock Surges But Warns “No Good News” For Economy On The Horizon (Bloomberg)

Explained:

- Intel Corp. (INTC) shares surged up today after the chipmaker pledged to cut costs, as it braces for weakening computer demand. The company’s CEO said, “The worsening macro was the story and is the story…there’s no good economic news.”

- The firm reported a decline in quarterly income to $1 billion in its most recent quarter, which is down from $6.8 billion during the same time last year.

Why it matters:

- To cut costs, Intel is expected to undergo major layoffs, perhaps numbering in the thousands of employees. With revenue expected to decline by 20% year-over-year in 2022, reduced spending is seen as the best way to protect profit margins.

- A bright spot did come earlier this week for Intel, though, as its self-driving technology unit, Mobileye Global Inc. (MBLY), successfully IPO’d and surged 38% in its market debut while raising $861 million. Intel still maintains control over the division, and this transaction may serve as a template for how the company can better capitalize on some of its other assets.

🏡 Housing Gets Hammered By The Fed’s War On Inflation (Axios)

Explained:

- Yesterday, we covered the new GDP figures showing positive growth for the U.S. economy. There are some concerning findings, though, such as in residential real estate investments (new housing units, improvements to existing homes, etc.), which declined by an annualized 26.4% rate in Q3.

- This massive contraction marks the U.S. housing sector’s worst contribution to GDP since 2007, as residential investment subtracted 1.37 percentage points from economic growth despite being only about 4% of the total economy.

Why it matters:

- Housing is particularly sensitive to interest rate hikes, and it’s one of the most volatile parts of the economy. This stands out since personal consumption expenditures are still plowing ahead, growing at 1.4% last quarter, despite the Fed’s intentions to crush spending across the economy.

- Monetary policy is an imprecise tool, and if slowdowns in spending were more evenly distributed across the economy, we’d likely see inflation under control sooner. Instead, housing is getting walloped while other parts of the economy prove resistant to higher interest rates (at least so far).

WHAT ELSE WE’RE INTO

📺 WATCH: Brent Johnson on the dollar milkshake theory, a game of musical chairs

👂 LISTEN: 4th quarter macro overview with Luke Gromen, on Bitcoin Fundamentals

📖 READ: YouTube’s richest creator is seeking a $1.5 billion valuation, Mr. Beast in Fortune

THE MAIN STORY: BUFFETT’S INVESTING TENETS

What are the nine most important words ever written about investing, according to Warren Buffett?

Benjamin Graham concluded the Intelligent Investor by saying, “Investing is most intelligent when it is most businesslike.” And the Oracle of Omaha claims understanding this quote is key to his investment success.

When Graham says to be businesslike in investing, he means to thoroughly understand the products and services of a company, working capital, capital reinvestment needs, management, and capital allocation.

Robert Hagstrom wrote about Buffett’s 12 investing tenets, which provided the guiding principles for the investment legend throughout his career, in Chapter 3 of The Warren Buffett Way.

Our colleague and co-host of We Study Billionaires, Clay Finck, reviewed these important guidelines using Coca-Cola (KO) as a case study in his most recent episode. It’s not hyperbole to say these 12 tenets make up the holy grail of value investing.

We discussed the first six points on Wednesday, which reviewed the business and management tenets on which Buffett focuses. Today, we’ll dive deeper into the key financial metrics he uses.

Let’s explore ⬇️

Financial Tenets

Buffett is not overly concerned with quarterly or yearly results when analyzing a company. Instead, he prefers to focus on three to five-year averages to get a better picture.

- What is the Return on Equity?

Wall Street often puts a big emphasis on a company’s earnings per share. Yet, Buffett focuses more on strong and consistent return on equity without the use of excessive leverage or accounting shenanigans.The return on equity (ROE) is a ratio of operating earnings divided by the shareholder’s equity or book value. If a company has net income of $10 per share and the book value is $100 per share, then the return on equity is 10% for that year.Buffett typically wants to see ROE either stay steady or increase over time. Generally, a company with an ROE greater than 10% is ideal and shows it is efficiently reinvesting its earnings back into the business to produce even more earnings over time. - What are the company’s “owner’s earnings”?

Buffett also judges a company’s financial performance using “owner earnings,” defined as net income plus non-cash charges of depreciation and amortization less capital expenditures and any working capital that might be needed.Knowing the owner’s earnings helps Buffett evaluate a company’s ability to generate cash for shareholders. It is similar to the calculation of free cash flow, which also subtracts out dividend payments. - What are the profit margins?

Buffett seeks out companies with wide moats selling goods and services in which there are no close competitors. These companies typically have high-profit margins because of their unique niche. He looks for companies with operating margins and net profit margins above industry norms.The operating margin measures the costs directly associated with producing the goods and services of the business. In contrast, the net margin takes all of the company’s activities into account.High-profit margins show that management can control costs and will likely produce significant free cash flows. - Has the company created at least $1 of market value for every dollar retained?

Buffett has what he calls the “$1 rule,” meaning for every dollar of a company’s retained earnings, he wants to make sure at least one dollar of market value is created.He knows the market will punish companies that use retained earnings unproductively. Buffett feels that companies with good long-term prospects run by shareholder-oriented managers will gain market attention, resulting in a higher market price.

Market Tenets

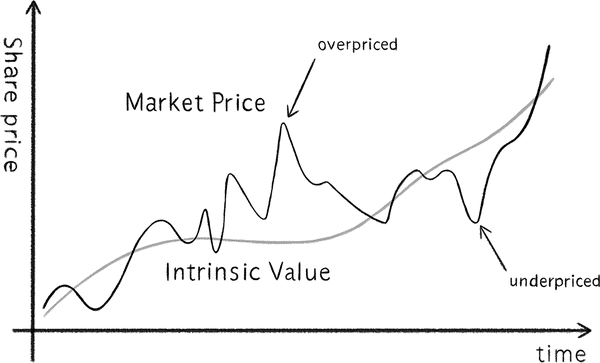

- What is the value of the business?

The market will determine the company’s price, but it is up to the investor to determine the actual or intrinsic value.Even if you have identified a great business, it does not necessarily represent a good investment unless you can purchase it at a reasonable price.To calculate the current value of a stock, we estimate the total earnings across the business’s life, then discount it backward to determine the present value of those future cash flows using an appropriate discount rate.Buffett uses the yield on the U.S. long-term government bond as the risk-free rate since it is fairly certain that the U.S. government will pay its coupon over the next thirty years. This way of valuing a company is known as the Discounted Cash Flow (DCF) method. - Can the business be purchased at a significant discount to its value?

The difference between the price and intrinsic value is the margin of safety — a key principle of value investing.Buffett wrote in a letter to Berkshire shareholders in 2008, “Long ago, Ben Graham taught me that — Price is what you pay; value is what you get. Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”Having a large margin of safety protects investors from downside risk. It also generates more opportunities for outsized returns, as the stock price trends upwards to catch up to the intrinsic value.

The Takeaway

We recognize that applying these 12 tenets can be very difficult. But understanding and implementing them could be considered the holy grail of value investing.

Buffett recommends traditional index investing if you don’t have the time or inclination to follow his precepts. But those who successfully employ these analytical tools can invest like him and watch their portfolios thrive.

Dive Deeper

If you’re willing to put in the effort to screen for stocks as Buffett does, we recommend using TIP Finance, our signature stock-picking and market research tool, to aid in the process.

You can use it for free.

If you want a deeper understanding of how to apply Buffett’s 12 investing tenets, check out Clay Finck’s excellent review of them here.

RECOMMENDED READING

Well, we found it: The newsletter that’s giving businesses small and large an edge over the competition.

Stacked Marketer delivers the breaking news, hacks, tips & tricks needed to dominate the entire digital marketing landscape 一 from native ads and SEO to Facebook, Google, Snap, TikTok and everything in between.

What’s more, it is completely free to read. Join over 33K smarter professionals reading Stacked Marketer from Monday to Friday.

Go on sign-up today.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.