The Fed wants less jobs?

8 July 2022

Happy Friday, The Investor’s Podcast Network Community!

Welcome back to We Study Markets, hope you enjoyed the short week 😅

Stocks have kept the 4th of July party going, with the S&P closing up for the 4th trading day in a row yesterday 🙌

Before you log off for the weekend, let’s discuss the bond market mayhem in Japan, the principles of BRRRR real estate investing strategies, the June jobs report, and much more, in just 4.5 minutes to read.

Let’s do it!

In The News

💼 Job growth stays hot in June despite downturn speculations (WP)

Explained:

- This morning, the much anticipated June jobs report from the Department of Labor showed that efforts to tame inflation with higher interest rates have not affected employment — yet. Employers in the U.S created 372,000 new jobs last month, as the unemployment rate stayed at a low 3.6%, which is truly remarkable considering that just two years ago 20 million Americans lost their jobs due to disruptions from Covid-19.

What to know:

- This news comes as little comfort to the Federal Reserve, who is trying to use blunt force monetary policy tools (raising interest rates throughout the entire economy) to thread the needle in producing a soft landing, that is, a cooldown in inflation that doesn’t cause a recession. However, the Fed’s available tools primarily influence demand in the economy, not supply. Rather than stimulating supply chain production and balancing out the shortages throughout the economy, that are, in part, adding to higher prices and inflation, the Fed is hoping to curb consumer spending (demand for goods/services). With a persistent labor shortage and continued jobs growth though, it’s quite difficult to curtail consumer spending. If Americans have the money to spend, then history has shown they’re going to spend it. This jobs report shows that the Fed may have to be even more aggressive in raising interest rates, which doesn’t bode well for their hopes of a soft landing.

🏛️ Mortgage rates see largest decline since 2008 (CNN)

Explained:

- Mortgage rates dropped two weeks in a row posting the largest decline since December 2008. While 30-year mortgage rates this time last year were significantly lower at 2.9%, there is a glimmer of optimism for homebuyers, as rates have fallen over half a percent over the last two weeks from a high of 5.81% to recent lows of 5.3%. Affording a home remains a challenge for many new home buyers as home prices have increased 8.5% year-over-year for 24 consecutive months. In addition, mortgage rates are at their highest levels since the late 2000s.

What to know:

- There are further bright spots on the real estate horizon as active listings are increasing according to Realtor.com data. More supply means sellers are increasingly needing to compete on prices. However, mortgage applications for both purchases and refinancing remain depressed as both higher rates and inflation consume a larger chunk of income. Keep an eye on the 10-year US Treasury bond rate. Mortgage rates tend to track the 10-year and yields on it have dropped below 2.8% after spending most of June over 3%. With the Federal Reserve indicating further rate hikes are coming, now may be a good time to lock-in financing if you’re in the market for a new home.

📈 Small-cap stocks stage a comeback (WSJ)

Explained:

- Small-cap stocks, referring to publicly traded companies with a relatively small market capitalization ranging from a few hundred million to $2 billion in size, are more prone to market sell-offs than their larger peers. This is partially because these companies tend to have less entrenched business models, meaning their continued success during uncertain conditions is less guaranteed, and also because they’re less liquid, which means it takes less selling volume to drive the price down than for more actively traded stocks like Apple.

What to know:

- With the S&P down 21% this year, small-cap stocks have fallen even further at 24%, as measured by the Russell 2000 index. So far this month though, small-cap indices have been outperforming the broader market, powered by gains from names like Urban Outfitters (URBN), Winnebago Industries (WGO), Jack in the Box Inc. (JACK), and Tupperware Brands Corp. (TUP). If this trend persists, it may highlight that much of the extreme pessimistic sentiment has already been priced into the most exposed parts of the market. For the optimists among us, this is a potential leading indicator that excessive fear may be slowly fading which is a good thing for equity prices broadly. We like to use TIP’s momentum indicator tool to track these sort of trend changes 😉.

Sponsored By

How do you make sure that you are investing with a “good” operator?

Dan Handford and his wife are currently invested in 54 different passive real estate syndications with 16 different operators in 10,000+ doors.

They use this exact list when deciding whether or not to invest with a particular group. Get access to the “7 Red Flags for Passive Real Estate Investing” to be confident in your next investment!

Deep Dive: Yield Curve Control in Japan

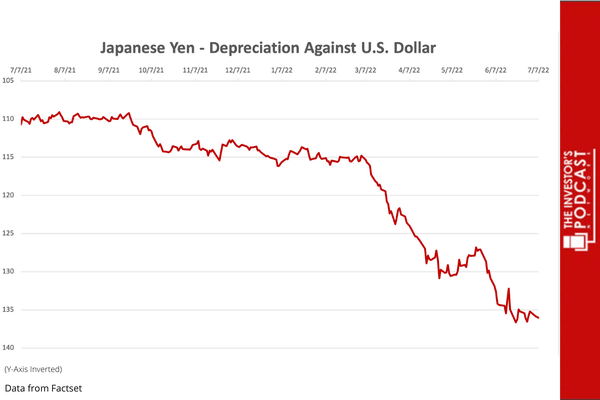

Despite being a major currency, the Japanese Yen is in free fall this year. This is highly abnormal to say the least. Some might say there’s really nothing normal about the Japanese economy though.

Let’s discuss.

In 1989, Japan’s Nikkei stock market index hit a record high at almost 39,000 in light of a truly magnificent financial asset bubble in the country. At one point during the hysteria, real estate sold for as much as $139,000 per square foot, which made the land beneath the country’s imperial palace in Tokyo worth more than all of the real estate in California combined.

Like all bubbles, the excesses are at least partially attributable to loose monetary policy, but the party came to a stop eventually, and so ensued Japan’s ‘lost decade’ of extended declines in GDP. Still today, Japan’s economy is infamous for its stagnant growth, and its stock market has never again come close to those 1989 levels – closing yesterday at 26,490.

This 30+ year period of negative equity price returns is truly remarkable, and it has undoubtedly impacted Japanese citizens’ mindset in how they allocate their wealth, though the fallout from this epic bubble is not confined to just the stock market. In the past decade, nominal GDP growth averaged an extremely lackluster 1.2%.

The country’s central bank, the Bank of Japan (BOJ), is notorious for its increasingly extreme efforts to artificially stimulate the economy with little success, as it fights against a unique set of challenges. This includes a large aging population, and an entrenched deflationary mindset following the lost decade, meaning people have come to expect prices to decrease over time and tend to be quite pessimistic about the country’s economic future. Japanese consumers then are incredibly sensitive to price increases.

With relatively flat prices in aggregate, there’s less justification for demanding and negotiating higher wages, which creates a feedback loop that paralyzes real economic growth. The paradox is that the economy cannot expand meaningfully without rising consumer spending, but consumer spending has proven unwilling to rise without higher wages, and companies are unlikely to uniformly increase wages in an economy that’s not growing.

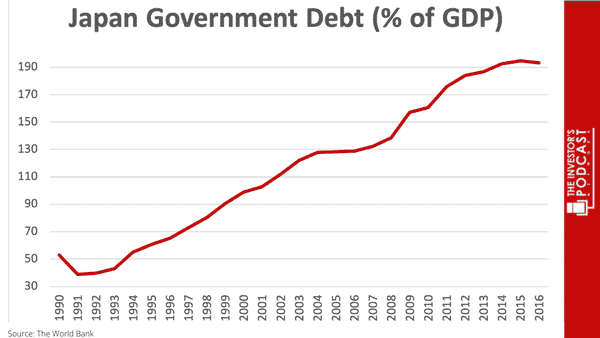

To break this cycle, the BOJ has pioneered a number of quantitative easing programs, negative real interest rates, and even purchases of equities alongside tremendous government spending initiatives that have made the country by far the most indebted in the developed world in terms of debt-to-GDP.

So what’s the issue?

True to form, the BOJ has continued to uphold its commitment to using monetary policy to boost the country’s economy, with a recent reaffirmation of so-called ‘yield curve control.’ This means that the bank has specific targets for certain parts of the yield curve, and will buy as many government bonds as necessary to ensure that yields stay pegged at these levels.

A willingness to functionally purchase an unlimited number of Japanese government bonds in the open market is not a particularly sustainable practice for a country, though if anyone could succeed in dragging out this makeshift solution to the country’s chronic challenges, it would surely be the BOJ.

Artificially low interest rates across the yield curve, enforced by the central bank, are not as uncommon globally as it used to be in recent years. With the Federal Reserve now leading the charge towards raising rates though, in response to record bouts of inflation, Japan’s commitment to loose monetary conditions stands out starkly in contrast to its Western allies.

Traders are now keen to bet that the BOJ will be forced to abandon its yield curve control policy as the spread between yields on Japanese government bonds and U.S. treasuries continues to grow.

The takeaway?

So long as the BOJ refuses to allow interest rates to rise, the Yen is likely to continue depreciating because of what’s known as the carry trade, where investors borrow Japanese Yen, and then sell them in exchange for a currency like the dollar that they can earn higher interest rates in.

What’s clear is that something has to break – either the currency or the country’s sovereign bond prices. Will the BOJ standby while the Yen continues to implode in order to ensure the value of Japanese government bonds, or will they abandon their bond market commitments to save the Yen?

If you have any guesses as to how this plays out, reply to this email to let us know.

To hear more on this saga, listen to Bitcoin Fundamentals episode 84 with James Lavish.

Quote of the Day

“As in most markets, there are areas of overvaluation and of undervaluation, with the bulk of shares appearing to hover in the area of fair value relative to their prospects.”

— Bill Miller

Meaning

While the commonly taught Efficient Markets Hypothesis (EMH) argues that stocks tend to reflect all available information, meaning that market prices reflect a given equity’s fair value, we tend to believe that human emotion (among other factors) contributes toward deviations away from this fair value.

That said, to the EMH’s credit, accurate and efficient pricing does tend to be generally true for the majority of stocks, particularly in deeply liquid markets like the United States, where no shortage of investors are able to convey their opinion about a stock’s value.

That said, as Bill Miller highlights here, the reason legendary investors like him can consistently beat the market averages is because markets are likely not perfectly efficient, at least not with every available stock at all times.

Momentum, and collective euphoria or despair, can lead to persistent distortions in financial asset pricing (the ‘dot com’ bubble of the early 2000s is an excellent example of this) that savvy investors can capitalize on.

To track the portfolios of legend investors and figure out which stocks may be undervalued, we love to use our investing tool TIP Finance – try it out for free 🙂

For more Bill Miller, listen to our interview with him on Richer, Wiser, Happier episode 7.

The BRRRR Approach to Real Estate

“Real estate has the most dumb, rich people of any industry,” Sam Parr said in a recent interview. While this is debatable, he did not intend it as a knock on real estate investors, but simply as an acknowledgment that only an average IQ is needed in order to succeed.

What is it?

The BRRRR strategy stands for Buy, Rehab, Rent, Refinance, and Repeat. There are many profitable strategies to pursue in real estate, but the BRRRR strategy is popular because of its ability to produce passive income while building a solid real estate portfolio over time.

Let’s dig a little deeper and explore how it works:

1. Buy – Your goal here is to buy a distressed property to which you can add value. Many first-time investors use private loans from family or friends, or seek out hard money loans (a loan secured by real property, usually funded by private investors or companies, and typically at a higher rate), to finance both the purchase and rehab. Lack of money can always be overcome, so don’t let that deter you. Know your market and do proper due diligence to find great deals as buying right will increase your odds of success.

2. Rehab – Make any structural or aesthetic improvements that will enhance the value of the property, and make it attractive to renters. Keep the rehab simple and focus on kitchens, bathrooms, curb appeal, and perhaps additions that increase functional space. Know your cost of the rehab, manage it well, and stay within budget.

3. Rent – Ideally, during the rehab process you are seeking out high-quality tenants that will take care of the property and have a history of paying rent on time. Your rent should, at minimum, cover your loan costs and ideally have enough of a buffer to create some positive cash flow. Consider doing property management and maintenance yourself to decrease expenses.

4. Refinance – All banks have different requirements, but after a seasoning period of steady rental income, you can have the property appraised in hopes of doing a cash-out refinance to pay off the original loan and get your capital back. Most banks will loan up to 70-80% LTV (Loan to Value) on the value of the property.

5. Repeat – With the proceeds of the cash-out refinance, you will begin the process again this time having greater experience to increase efficiencies and profitability. Rinse and repeat as desired.

As with any investment, there are risks associated with the BRRRR strategy, which include cost overruns, delayed completion dates, bad tenants, low appraisals at the time of the refinance, and not being able to refinance.

However, properly executed and with enough patience and determination, the BRRRR strategy can be one of the most effective real estate strategies there is.

If active investing strategies like the BRRRR method isn’t for you, be sure to check out our sponsor, Passiveinvesting.com. If active investing, or the BRRRR method, does seems right for you, you can learn more about the BRRRR method and managing rehabs here.

See You Next Time!

That’s it for today on We Study Markets!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12 pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.

We’ll see you back here again Monday!

P.S The Investor’s Podcast Network is excited to launch a subreddit devoted to our fans in discussing financial markets, stock picks, questions for our hosts, and much more! Join our subreddit r/TheInvestorsPodcast today!