The Big Picture

Hi, The Investor’s Podcast Network Community!

As the calendar’s about to flip to March, the S&P 500 is up about 4% so far in 2023 📈

That’s down from a 6% rally in January, though, mainly because of a sharp jump in Treasury yields, which surged as investors weighed a possible tighter-for-longer monetary policy.

The yield on the benchmark 10-year Treasury note just touched a high of 3.983%, its highest level since Nov. 10. So, for at least a bit longer, all eyes remain on the Fed’s next moves.

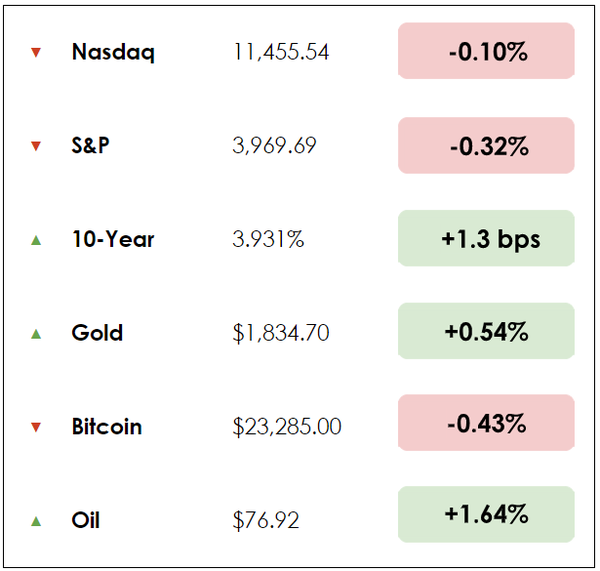

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Payment giants hit the brakes on crypto

- How roughly $1.5 billion in digital bonds has been issued

- Plus, our main story on Warren Buffett’s latest annual letter

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Simple setup for new Bitcoiners ![]()

Advanced features for Bitcoin veterans ![]()

The Bitcoin wallet for your every need ![]()

Blockstream Jade is the only hardware wallet designed for your whole Bitcoin journey. Visit store.blockstream.com and use coupon code: ‘Fundamentals’ to get 10% off your Blockstream Jade.

IN THE NEWS

💳 Visa and Mastercard Pause Crypto Push (Reuters)

Explained:

- The payment giants, Visa (V) and Mastercard (MA), are hitting the brakes on partnering with crypto firms following several scandals that shook faith in the space.

- Following the high-profile failure of firms like FTX and Blockfi, both companies are pausing crypto product launches until market conditions normalize and the regulatory environment improves, according to one unnamed corporate insider.

- These companies pocket a small percentage of each credit card transaction as a fee, so they’ve sought to understand how blockchain tech may disrupt their businesses while entrenching themselves in the industry. Mastercard teamed up with the crypto lender Nexo in April to launch the “world’s first crypto-backed payment card,” and American Express has previously said it would consider using crypto as an option in redeeming reward points.

Why it matters:

- One Visa spokesperson remarked, “failures in the crypto sector are an important reminder that we have a long way to go before crypto becomes a part of mainstream payments and financial services.” However, they added that this “doesn’t change the company’s crypto strategy and focus.”

- Thomas Hayes of Great Hill Capital commented, “(card companies) cannot and should not move ahead until there’s a clear regulatory framework.”

- The ball continues to sit in regulators’ court as an entire industry awaits guidance on how to move forward from the euphoria in 2020/2021 that gripped the world. Early indications suggest that the U.S. government may be taking a blunt-force approach to crypto now, warning banks about building relationships with fintech companies in the digital asset space.

🏁 The Next Frontier for Bonds (WSJ)

Explained:

- It’s not all bad news for digital assets — blockchain tech is increasingly merging with a multi-trillion-dollar industry: Bonds. Per S&P Global Ratings, roughly $1.5 billion worth of digital bonds have been issued over the past year, “up from almost nothing a year earlier.”

- Digital bonds are the same as regular bonds, just hosted on blockchains. And issuers are relying more and more on digital exchanges for listing their bonds and settling related transactions.

- For example, in November, UBS launched a 375 million Swiss franc bond that’s traded and settled on both blockchain-based and traditional exchanges.

Why it matters:

- Why go digital? Well, like many analog-to-digital conversions, it’s about efficiency gains. Bond issuance and trading has historically been a clunky process, but according to S&P Global, blockchains can improve that. Given that bonds are used as a vehicle for financing much of the modern world around us, even small efficiency gains shouldn’t be overlooked.

- One benefit is greater fractionalization. That is, chopping up large bonds into smaller pieces that are easier to trade, boosting liquidity. Another benefit is the possibility of smaller issuance sizes.

- Typically, tapping the public markets for capital requires working with investment banks, lawyers, and rating agencies, which all accrue considerable fees. That makes it harder for smaller firms to raise money publicly, relying more on direct banking relationships and private investors. Blockchains’ streamlined processes and costs may enable smaller bond issuances, helping more businesses raise debt financing.

In Warren Buffett’s latest annual letter to Berkshire Hathaway shareholders, the 92-year-old veteran urged investors to do what he’s always done: Focus on the big picture, rather than high inflation, the Federal Reserve, and short-term stock movements.

He also urged Americans not to be shaken by “self-criticism and self-doubt,” saying the country’s dynamism has benefited Berkshire in his 58 years running the company from Omaha, and will do so after he passes the reins.

“We count on the American Tailwind and, though it has been becalmed from time to time, its propelling force has always returned,” Buffett wrote.

“I have yet to see a time when it made sense to make a long-term bet against America. And I doubt very much that any reader of this letter will have a different experience in the future.”

Compounding for decades

Buffett bought his first stock at age 11 and first filed taxes at age 13. Now he’s the fifth-richest person worldwide with a $106 billion net worth, according to Forbes. He has pledged to give away his wealth to charity through the Bill and Melinda Gates Foundation.

He’s been a successful investor for 80 years, largely because of patience.

“Charlie and I are not stock-pickers; we are business-pickers,” he wrote.

Anyone who stuck with Berkshire from 1965 to 2022 saw their shares gain about 3,787,464% in value. The S&P 500 still rose a handsome 24,708%, including dividends over that period, but it pales in comparison.

Since 1965, Buffett has averaged a roughly 20% annual return.

He acknowledged that he’s made plenty of mistakes, but none have been catastrophic. His extraordinary gains over time resulted from only about one dozen “truly good” decisions.

“The lesson for investors: The weeds wither away in significance as the flowers bloom. Over time, it takes just a few winners to work wonders. And, yes, it helps to start early and live into your 90s as well.”

Plenty of cash

The letter was accompanied by Berkshire’s year-end results, including a record $30.8 billion operating profit.

Buffett called 2022 a “good year” for Berkshire, with many of its strongest businesses withstanding pressures from elevated inflation, rising interest rates and supply chain disruptions.

Berkshire also posted a $22.8 billion annual net loss, compared with an $89.8 billion gain in 2021, as the prices of Apple Inc (AAPL) and many other stocks in its vast investment portfolio declined.

Buffett downplays net results because they’re volatile and affected by accounting rules. He expects the company’s gains to be “meaningfully positive in future decades,” adding that the fourth-quarter losses—which are “regularly and mindlessly headlined by media”—serve to “totally misinform investors.”

Berkshire repurchased $7.9 billion of its own stock in 2022, signaling confidence it was undervalued.

Buffett also defended buybacks, a target of politicians in Washington. This month, President Joe Biden urged a quadrupling of a 1% tax on corporate stock buybacks that became law in his Inflation Reduction Act last August.

While Biden hasn’t demanded an end to buybacks, Buffett said those who claim all repurchases “are harmful to shareholders or to the country, or particularly beneficial to CEOs” are “either an economic illiterate or a silver-tongued demagogue.”

He added: “Berkshire will always hold a boatload of cash” and “a wide array of businesses.” He continued to be optimistic about the growth of the U.S. economy and promoted efforts for philanthropy.

Plenty of cash

Buffett called his journey “a bumpy road involving a combination of continuous savings by our owners (that is, by their retaining earnings), the power of compounding, our avoidance of major mistakes and – most important of all – the American tailwind. America would have done fine without Berkshire. The reverse is not true.”

He added a dose of life wisdom: “Find a very smart high-grade partner – preferably slightly older than you – and then listen very carefully to what he says,” Buffett said, in a shout to long-time friend and business partner Charlie Munger.

“‘Efficient’ markets exist only in textbooks,” Buffett added. “In truth, marketable stocks and bonds are baffling, their behavior usually understandable only in retrospect.”

No finish line

Buffett didn’t discuss succession but noted, ‘Our future CEOs will have a significant part of their net worth in Berkshire shares, bought with their own money. And yes, our shareholders will continue to save and prosper by retaining earnings. At Berkshire, there will be no finish line.”

A few final notable quotes from the Oracle, some of which he paraphrased from Munger, his partner:

- Stocks often trade at truly foolish prices, both high and low.

- Early on, write your desired obituary – and then behave accordingly.

- The world is full of foolish gamblers, and they will not do as well as the patient investor.

- Patience can be learned. Having a long attention span and the ability to concentrate on one thing for a long time is a huge advantage.

- You can learn a lot from dead people. Read of the deceased you admire and detest.

- You don’t have to own a lot of things in order to get rich.

- You have to keep learning if you want to become a great investor. When the world changes, you must change.

This book is an excellent compilation of almost all of his letters.

RECOMMENDED READING

Assembling IKEA tables got you feelin’ like the Steph Curry of furniture?

The Average Joe will turn you into the Marie Kondo of investing. Organized, calm, and ready to conquer the markets.

- Their newsletters are the “IKEA instructions for investing” — short, simple, and concise

- It’s filled with market trends and insights that’ll have you asking “where’ve you been all my life?“

But you don’t read IKEA manuals in your spare time and you wouldn’t read financial publications for fun. Until now…

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.