The Attention Economy

01 February 2023

Hi, The Investor’s Podcast Network Community!

The market just keeps calling the Fed’s bluff. Stocks promptly reversed course today, moving dramatically higher after the Fed confirmed it would hike rates by only 0.25%, hoping its commitment to slowing the economy would soon reverse.

One person probably not bluffing is Tom Brady, who announced his retirement “for good” after playing 23 years in the NFL 🐐

And Meta’s (META) stock popped almost 20% in after-hours trading following its earnings report showing better-than-expected revenue.

Here’s the rundown:

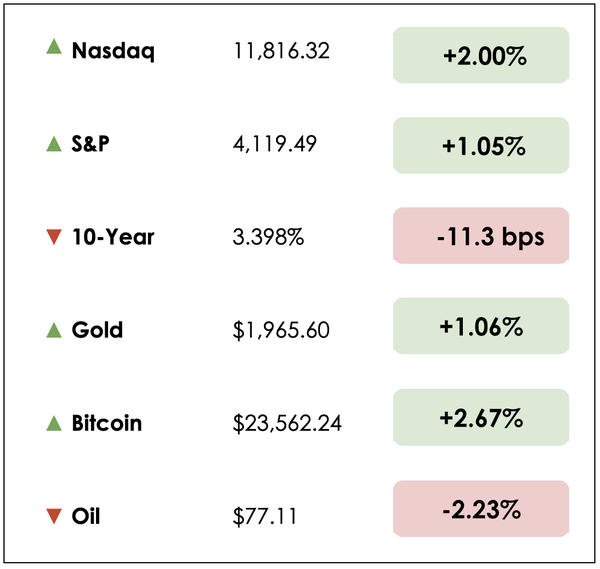

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: resilient climate change startups, and why JPMorgan is snapping up hundreds of millions of dollars worth of timberland, plus our main story on the “attention economy.”

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

- Amid this tech downturn, tech workers and investors are flocking to start-ups that aim to combat climate change, one of the chief issues of our time.

- While tech companies cut perks and jobs, many workers have come to question whether they’re positively impacting the world. The result: more tech workers are flocking to climate start-ups, just as investors pour money into the field.

- Last year, climate start-ups in the U.S. raised nearly $20 billion, topping 2021’s high of $18 billion and nearly tripling 2020’s $7 billion, according to Crunchbase. At least 83 climate-focused companies around the world are worth more than $1 billion, according to HolonIQ, a research firm.

- In the climate space, forget recession worries. Enthusiasm about start-ups is undimmed, and the future looks bright. Larry Fink, the CEO of BlackRock (BLK), recently suggested 1,000 more climate unicorns were on the way (companies with a $1 billion valuation). To some, climate investing represents an opportunity like that of the internet.

- “There’s no line of business that will not be impacted by climate,” said Chris Sacca, one of the founders of Lowercarbon Capital, a climate-focused venture capital firm. “That’s also the opportunity.”

- The excitement is different from the cleantech boom of the mid-2000s. Twenty years ago, investors poured money into clean energy companies that were reliant on government subsidies. Many of those start-ups went under. But with renewable energy prices falling, climate-related spending rising, and public awareness growing, corporations are finally acknowledging the opportunity.

- JPMorgan Asset Management’s timber-investing arm has acquired about 250,000 acres in the Southern pine belt for more than $500 million. It’s Wall Street’s latest big woodlands purchase made with an eye toward carbon markets.

- The wealth manager, which invests on behalf of pension funds, foundations, and other institutional investors, will manage the commercial forests in Mississippi, Oklahoma, and Arkansas for wood production and carbon capture.

- Companies are looking to make up for their emissions by paying timberland owners to leave trees standing so they can absorb carbon from the atmosphere as they grow. These deals generate tradable instruments called carbon offsets.

- The pricing of carbon and mounting corporate pledges to reduce greenhouse gas emissions have prompted investors to rethink the value of timberlands and place long-term bets on woodlands that “are based on more than just what the logs might fetch at a sawmill,” the WSJ said.

- In November, Oak Hill Advisors LP, a major player in credit markets, made one of the largest U.S. timberland purchases in years, paying $1.8 billion for hardwood forests in 17 states with a plan to reduce logging and accumulate carbon.

- Forest carbon deals usually happen in New England and the Great Lake states, where mills have closed, and log prices have fallen sharply. But Southern timber is also sought because there are log buyers around, and the trees there grow fast, making them more valuable whether they’re sold as carbon stores or to mills.

BROUGHT TO YOU BY: SHORT SQUEEZ

Everyone wants to break into the promised land of private equity that pays 24-year-olds over $300k…where you can work less and get paid more than investment banking.

How do you break into Private Equity? For starters, you can take the best recruiting course out there from the Overheard on Wall Street team.

They usually charge $1,500 for it, but they’re in the New Year spirit and want you to check out their Short Squeez Insiders membership.

So if you want to get free access to the course, sign up for a no-commitment, free month of Short Squeez Insiders here.

WHAT ELSE WE’RE INTO

📺 WATCH: Why hosting the Super Bowl isn’t worth it

👂 LISTEN: The bull case for energy, with Lucas White

📖 READ: The world’s most influential school? & the billion-dollar start-up trying to bring back the dodo bird

Young people have always perplexed their elders, yet their shopping habits underpin powerful future economic trends.

For Gen Z, contradictions seemingly abound: they wield thin wallets but have expensive tastes; they treasure convenience but demand a social conscience; they enjoy seamless but personal shopping experiences.

Brands that can master relations with this paradoxical generation can tap a formidable market — Europe boasts nearly 125 million people between the ages of 10 and 34, while America adds another 110 million Gen Zs and Millennials.

What to know

At the oldest part of this spectrum, these consumers came of age in the Global Financial Crisis, whereas their younger generational counterparts were the most impacted by the Covid-19 pandemic.

These two shocks have fostered feelings of nihilism that incentivize spending now over saving.

A study from McKinsey recently indicated that a quarter of Gen Zs doubt that they’ll afford retirement, and less than half expect to ever own a home. At the same time, social media inundates them with impulsive, pleasure-oriented spending requests.

Before you make me out as a washed-up ‘boomer,’ I (Shawn) am actually a ripe member of Gen Z, and I can attest to the pervasiveness of this burgeoning “attention economy.”

Breaking it down

For most of us young shoppers, we’ve never known a world without smartphones, or at least some smart device (my first was Apple’s iPod Touch). More than two-thirds of 18-34-year-old Americans spend four or more hours on their devices daily.

With this comes a huge emphasis on convenience in all aspects of life; from Airbnb to Amazon to Uber, we expect hiccup-free experiences. One study by Salesforce found that Gen-Z is the most likely of all age groups to want their groceries delivered within an hour and also the most likely to use their phones for purchases.

Always ready to shop

In their study, McKinsey calls the generation “always-on purchasers” who prefer subscriptions to outright ownership, evidenced by their demand for streaming services and online-rental sites like Rent the Runway for fashion.

Despite falling out of favor with investors, Netflix remains one of the most popular and trusted brands among young natives of the attention economy.

In this new world, a viral TikTok can inspire everything from beauty to sportswear and propel little-known brands into sudden fame.

Authenticity matters more than ever

Rather than dulling our senses, the attention economy has made us hypersensitive to brands that reek of inauthenticity, at least according to the public-relations firm Edelman, which found that 70% of Gen Zs fact-check claims made in advertisements.

This is a generation of incredibly nimble shoppers who hold little loyalty to companies that fail to meet their ethical checklists, with McKinsey noting that nine in ten Gen Z/Millennial Europeans changed “how they shopped, where they shopped, or the brands they bought in the previous three months.”

While older generations see wellness and luxury as discretionary items, they’re seemingly staples for younger shoppers. The Economist writes that “self-care is all the rage,” while many now make their first luxury purchase at just 15, compared with 19 for their 30-something peers.

Shopping on values

Young consumers claim to be the most values-driven shoppers; perhaps, biasedly, I think this is true. Research from Forrester validates this, showing that across 16 countries, the Gen Z crowd was the most concerned about climate change and man-made natural disasters.

This wasn’t just an abstract concern, though. This generation is the most likely to try (and stick with) plant-based protein alternatives, often paying a 9% premium globally for more environmentally friendly foods.

Of course, the allure of instant gratification and hyper-convenience comes with distinctly ungreen costs, but such is life for us paradoxical Gen Zs.

Takeaways

Feelings aside about this generation, they’ll determine the course of future consumption. Their preferences are already reshaping the global economy.

It’s worth taking the time to get to know them (us) better.

A few generational favorites include the likes of outdoor-clothing brand Patagonia, fast-fashion retailer Shein, Nike, Lululemon, Discord, Snapchat, Spotify, Cash App, Reddit, DoorDash, Roblox, and, of course, Tik Tok and Instagram.

As investors, understanding the power these brands, among others, wield in the attention economy and why they carry such weight will be imperative for earning superior returns in a changing world.

Dive deeper

Check out The Economist’s full write-up on how the young spend their money.

And see here for more context on Gen Z’s favorite brands.

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.