The Apple of Appliances

Hi, The Investor’s Podcast Network Community!

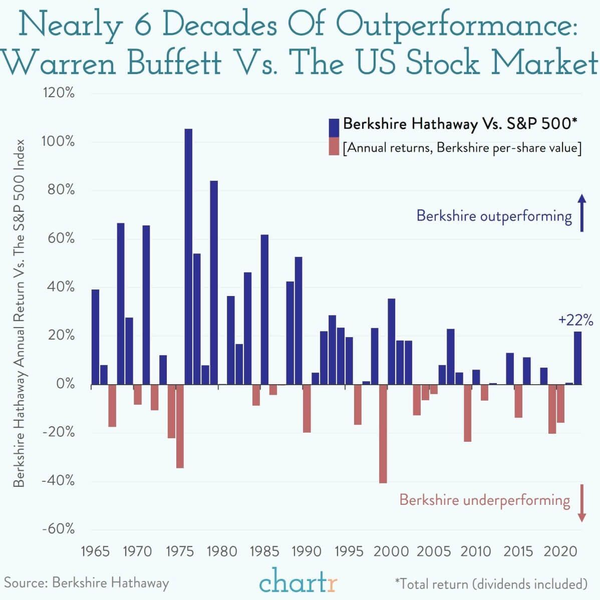

On this day in 1894, Benjamin Grossbaum was born in London. His family later changed its surname to Graham, and he became the founder of securities analysis and value investing.

His book, “The Intelligent Investor,” changed the fortunes of many, particularly Warren Buffett, one of Graham’s students at Columbia University.

See our Chart of the Day for a visualization of just how well Graham’s principles have helped Buffett invest.

Wrote Buffett many years ago: “Walter Lippmann spoke of men who plant trees that other men will sit under. Ben Graham was such a man.”

—Matthew

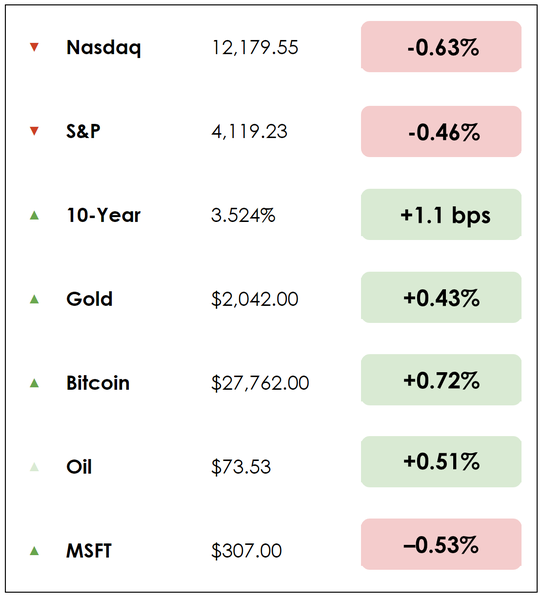

Here’s the rundown, featuring Microsoft, +214% over the last five years:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Goldman to pay $215 million to settle lawsuit

- Why investors keep bidding up junk bond prices

- Plus, our main story on the remarkable story of Dyson vacuum

All this, and more, in just 5 minutes to read.

Today’s trivia: At Microsoft, how much cash did Bill Gates insist on always having in the bank to keep the company alive if revenue fell to zero?

(Scroll to the end to find out).

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Trade economic and financial events on Kalshi, the first regulated exchange to trade what inflation or fed rates will be, whether the debt ceiling will be raised, or if TikTok will be banned.

With hundreds of event contracts and traditional assets like S&P and FX, you can hedge your portfolio against specific risks or profit from accurate predictions on global trends.

IN THE NEWS

🏦 Goldman to Pay $215 Million to Settle Gender Discrimination Lawsuit (Bloomberg)

Goldman Sachs has agreed to a $215 million settlement to resolve an ongoing class-action lawsuit that charged the firm with extensive gender discrimination regarding pay and promotions, as revealed in a joint statement from the bank and the plaintiffs.

The plaintiffs, all previous employees of the Wall Street behemoth, claimed that Goldman Sachs consistently paid women less than men and gave them subpar performance evaluations, obstructing their career progression.

- This lawsuit ranks among the most high-profile cases addressing Wall Street’s reportedly unequal treatment of women, as part of a lengthy history of litigation against numerous banks spanning decades.

- The settlement surpasses the amount Smith Barney paid years ago—over $100 million—to conclude the infamous Boom-Boom Room suit, which alleged harassment and discrimination within the firm.

Why it matters

According to the statement, the settlement encompasses approximately 2,800 female associates and vice presidents who worked in Goldman Sachs’ investment banking, investment management, and securities divisions.

- Kelly Dermody, co-counsel for the plaintiffs, said they believed the settlement provided “substantial, certain recoveries for all class members and advances gender equity at Goldman.”

Moreover, Goldman Sachs will employ an independent expert to examine its performance evaluation and promotion processes for three years.

The impending trial, set for next month in New York, would’ve offered a unique public platform for discussing inequality within the financial sector. Men have led all but one of the six largest U.S. banks.

🗑️ Investors Keep Bidding Up Junk Bond Prices (WSJ)

Despite recession fears when more financially vulnerable firms might normally face extra caution from investors, junk bonds—debt issued by companies with comparatively poor credit ratings—have held up well this year.

While the Federal Reserve’s SLOOS, a lending outlook survey released Monday, suggests that the recent banking crisis, in addition to rising interest rates generally, will make it more difficult for businesses to borrow cash.

- Yet, this hasn’t resulted in a sell-off of bonds from less stable companies. The extra yield premium on so-called junk bonds is around 4.8%, which aligns with historical averages.

- That’s not what you’d expect during a widely anticipated economic downturn, where increasing default rates would hurt bondholders broadly.

Why it matters

As one portfolio manager, Hussein Adatia, put it: There’s a “deep technical bid” for junk bonds. In other words, as rates have risen to two-decade highs, debt financing is more expensive, so some companies have pulled back on borrowing.

- Adatia added, “There’s a lot of dark clouds on the horizon, whether geopolitical or the debt ceiling; even just the general slowing in the economy. I’d argue high-yield (junk bond) spreads should be wider.”

But there are large investment funds with mandates to invest a certain amount of their portfolio in these securities.

- When the universe of junk bonds shrinks as issuance slows, these investors are forced to bid up prices (pushing down yields) on a narrower selection of bonds.

MORE HEADLINES

😬 “Everyone is worried” following Chinese national security crackdowns on international businesses

👎 Investors hated PayPal’s 1st quarter, sending its stock down over 11%

✈️ The U.S. government wants airlines to compensate flyers with cash for delays

Thousands of failures

It took James Dyson 15 years and 5,127 attempts to develop the first bagless cyclonic vacuum.

The vacuum that has become ubiquitous in households is one of the best stories of persistence in American corporate history.

Today, Dyson, the founder, is 76 years old and worth nearly $10 billion. Virtually every family owns a vacuum, but putting the Dyson vacuum on the market in the early 1990s took remarkable determination and drive to succeed.

“Failure is just part of the process,” Dyson wrote in 2014. “ And I won’t lie, it was frustrating, aggravating – but it was also invigorating, exciting. What matters about failure is that you learn from it.”

‘Slightly terrified’

In 1974, Dyson bought a vacuum cleaner that lost suction after a brief period of use. He emptied the disposable paper bag to restore the suction, which had no effect. When investigating the bag, he noticed a layer of dust inside, clogging the fine material mesh.

Frustrated with how his existing machine worked, Dyson reused technology that mirrored how a cyclone forcefully sucked the wind from its surroundings, spending 15 years before releasing his first vacuum cleaner in 1993.

He initially licensed the designs to companies in the U.S. and Japan, but eventually decided to build the machines himself.

“When we launched it, we were slightly terrified,” said Dyson, who had mortgaged his home and used his life savings to fund the project.

“I’m not a businessman. I didn’t start a business, I started with an idea.”

Culture of innovation

Dyson encouraged his design engineers to think creatively and embrace problem-solving.

“If it doesn’t work, take a step back, remove something, toggle with something else, and try again,” he once said. “Creativity doesn’t come from instructions, but the guts to look at something in a different way and question it.”

Dyson also loved to hire inexperienced people, often straight out of college.

“Why? Because untried minds bring energy and expertise in places where, let’s be frank, someone with my number of miles on the clock might not have.”

His foundation’s annual competition, the James Dyson Award, invites students to submit a design that solves a problem. Hundreds of students enter each year.

As part of the judging criteria, Dyson requires them to write in detail about the progression from concept to final design and prototype. Every year, the build-test-re-build story wins; they are simply better ideas and better products.

“Developing new technology is a grueling process,” Dyson said. “And plenty of it never sees the light of day. Walk down the aisles of the Dyson prototype archive; there are many ‘failures.’ Take the Dyson Fuel cell – for three years, 10 engineers worked to adapt a Dyson digital motor to sit at the heart of a fuel cell.”

A compact, lightweight, and highly efficient digital motor, the V4HF digital motor, resulted in a 20% increase in power density and improved efficiency. The findings taught them about digital motors, the knowledge they’ve applied to their small, lightweight cordless vacuums.

“So you see, I think the word “failure” should be re-evaluated. It should be a term that is encouraged, accepted, even sought after. Because it’s failure that drives invention forward.”

Still innovating

Dyson is up to about 13,000 employees and doing $7 billion in annual revenue.

But to get there, Dyson always told his employees to focus on the product. Everything else would follow.

“You are just as likely to solve a problem by being unconventional and determined as by being brilliant.”

Dive deeper

Check out the Dyson story on Tim Ferriss’ podcast right here: “Turn the Mundane into Magic.”

Enjoy reading this newsletter? Forward it to a friend.

TRIVIA ANSWER

Gates insisted on always having enough cash in the bank to keep Microsoft alive for 12 months with no revenue coming in. “I always had to be careful that we wouldn’t hire too many people,” he said in 2017.