Tenets

26 October 2022

Hi, The Investor’s Podcast Network Community!

👀 Tomorrow will give us the first glimpse into how the U.S. economy did in the third quarter, as the initial numbers on GDP are released.

🏡 In other news, the 30-year mortgage rate just crossed the 7% line, its highest level since 2001, according to the Mortgage Bankers Association.

🇨🇦 And investors are trying to discern the Fed’s next steps after the Bank of Canada announced a smaller-than-expected rate hike.

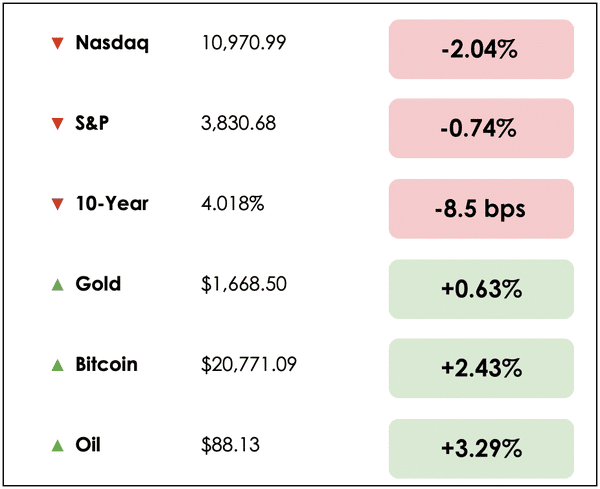

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: The rising cost of a Chipotle burrito and Spotify’s mixed earnings report, plus our main story on Warren Buffett’s investment tenets.

All this, and more, in just 5 minutes.

Let’s go! ⬇️

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🌯 Higher Burrito Prices Pad Chipotle’s Earnings (CNBC)

Explained:

- In August, Chipotle (CMG) raised menu prices for the third time in fifteen months, and this helped the company beat analyst estimates for its quarterly earnings.

- The company’s CEO suggested that there was “minimal resistance” to higher menu prices, though, total transactions declined by 1%.

- At the same time, Chipotle’s board recently approved using an additional $200 million to buy back its shares.

What to know:

- While lower-income consumers appear to be eating out less frequently, higher-income diners paying higher prices for each meal have more than offset the overall reduction in burrito purchases.

- From this time last year, prices at the popular restaurant chain have risen 13%, as companies broadly test out how much they can raise prices before it becomes destructive to profits.

🎶 Streaming Music May Cost More After Rough Outlook For Spotify (Bloomberg)

Explained:

- Spotify (SPOT) fell as much as 10% after the company indicated that profit margins would weaken this quarter. This prompted its CEO to indicate that prices for its music-streaming subscriptions in the U.S. may need to rise.

- The firm’s chief rival, Apple Music, announced a 10% price hike this week, adding pressure from investors for Spotify to do the same. And while ad revenue grew by 19% in the third quarter, this rate was slower than expected due to a “challenging macro environment.”

- On a brighter note, Spotify reported a better-than-expected monthly average users figure of 456 million while also topping predictions for its number of paying subscribers. Third-quarter revenue was $3.03 billion, which slightly beat Wall Street’s expectations.

What to know:

- Although there was some good news, the stock’s selloff is largely attributable to concerns that rising costs will hinder the company’s profitability going forward, especially if it doesn’t respond with higher prices.

- Spotify’s mixed results come in light of disappointing earnings results from tech giants like Alphabet (GOOGL) and Microsoft (MSFT), which reported rapidly slowing sales growth despite having business models seemingly well insulated from economic downturns.

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

WHAT ELSE WE’RE INTO

📺 WATCH: A gambler’s guide to investing with William Green, Richer, Wiser, Happier with Annie Duke.

👂 LISTEN: Katie Gatti’s interview with our Trey Lockerbie, on The Money with Katie Show (P.S. she’s got a great newsletter too — check it out).

📖 READ: $130,000 will get you a 10-year visa to Bali.

THE MAIN STORY: BUFFETT’S INVESTING TENETS

We Study Billionaires’ Clay Finck has been going deep down the Warren Buffett rabbit hole lately, and we’ve enjoyed following along with him.

Clay produced a valuable two-part Buffett series (Part 1 and Part 2) discussing “The Greatest Investor To Ever Live.” We’d encourage you to check them out.

He also recently released an episode exploring The Warren Buffett Way by Robert Hagstrom, focusing on the Oracle of Omaha’s 12 value investing tenets.

We wanted to share six of these key investing principles (we’ll discuss the other six in Friday’s newsletter), so you can use them to review your own portfolio and see if your holdings meet Buffett’s guidelines.

Let’s explore.

Business Tenets

- Is the business simple and understandable?

Buffett wants to play games he can win and will only invest in companies he thoroughly understands that are within his circle of competence.

Understanding a company means knowing how it generates revenue, cost drivers, cash flow, pricing flexibility, and industry competitors.

Buffett is known to avoid technology companies and puts them in the “too difficult to understand” pile. He is very selective in the sectors and industries he focuses on and prefers to go deep rather than wide.

We can boil this idea down to avoiding complexity and choosing simplicity.

- Does the business have a consistent operating history?

Buffett wants to invest in companies producing the same product or service for many years. He focuses on investing in industries that are staples of the economy, including railroads, energy, insurance, and banking.

Solid, stable, consistent, and boring companies trump fast, new, innovative, and untested ones over time. And allowing the power of compounding over time is the key to Buffett’s success.

He ignores hot stock picks and is only concerned with buying great companies that are stable, consistent, successful, and profitable long-term.

- Does the business have favorable long-term prospects?

Buffett looks for three things in a great company: First, it must produce a product or service that society needs and desires. Second, it has no close substitute. And finally, it is not regulated.

All three attributes allow a company to have pricing power and earn above-average returns on capital over time.

Once a company meets all three criteria, Buffett evaluates the long-term competitive advantage and whether it is lasting. Companies with favorable long-term prospects combined with his three criteria have the ability to create a moat around them.

Generally, companies with wide, sustainable moats can generate consistently high returns for investors.

As Buffett said, “the most important thing for me is figuring out how big a moat there is around the business. What I love, of course, is a big castle and a big moat with piranhas and crocodiles.”

Management Tenets

Buffett carefully considers the quality of a company’s management. All of the businesses Berkshire invests in are operated by honest and competent managers that are admirable and trustworthy.

As a Berkshire annual report in 1989 said, “No matter how attractive the prospects of their business, we have never succeeded in making good deals with a bad person.”

- Is management rational?

Buffett emphasizes the importance of management’s rationality and ability to exercise logic in capital allocation. Efficiently allocating capital determines shareholder value, and the lack of rationality is the quality he thinks is often lacking in companies.

Retaining earnings and reinvesting at a rate of return that is lower than the cost of capital is irrational — a practice that’s quite common on Wall Street.

Buffett wants to see that management can consistently produce high rates of return on invested capital. It shows that the business can produce more cash relative to the cash invested into the business.

In his opinion, if management cannot invest at above-average rates, the most logical course of action is to return the excess earnings to shareholders, through dividends or share buybacks.

- Is management candid with its shareholders?

Buffett likes to see honest, transparent, truthful, and genuine management. These qualities must also be applied to shareholders in discussing company challenges and failures.

Too often, he feels, management can be overly optimistic. A good strategy is to read past annual reports to see if management has delivered on its promises. Actions speak louder than words.

- Does management resist the institutional imperative?

Buffett defines institutional imperative as the lemming-like tendency of corporate managers to imitate the behavior of others. Managers that follow the status quo tend to get mediocre results.

The institutional imperative can be likened to herd behavior as management looks to industry peers for guidance. Buffett wants to see managers who are critical and independent thinkers.

Determining the quality of a management team is more difficult than measuring a company’s financial performance because you can’t directly measure things like rationality, candor, and independent thinking.

Dive Deeper

For a deeper understanding of Buffett’s investment tenets, be sure to listen to Clay Finck’s thorough review using Coca-Cola (KO) as a case study.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.