Talking Chips

Hi, The Investor’s Podcast Network Community!

19. That’s the number of stocks in the S&P 500 offering a dividend yield above one-year U.S. Treasury notes (5.055%).

That number was 284 last year when one-year notes had 1.065% yields before the Fed started its rate-hiking campaign 💭

Boy, do things change quickly.

🐻 To be a bit of a bear, I (Shawn) would guess that stocks will have trouble sustaining their rally through the rest of 2023, given that investors can lock in guaranteed 5% annual returns in the bond market with considerably less risk — With rates so high, the case for owning stocks becomes comparatively much weaker.

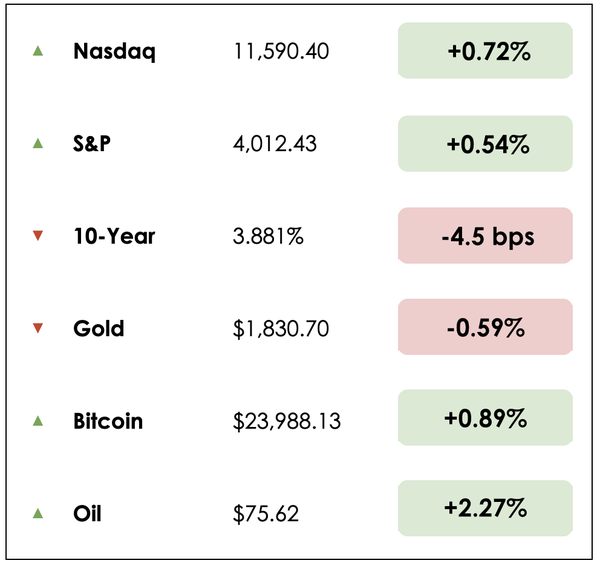

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Nvidia’s forecast for an AI boom

- Arizona competes for a slice of the lucrative chip industry

- Plus, our main story on a delicious yet disturbing conspiracy in the world of frozen desserts

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

History of positive returns ✔️

Inflation-hedging potential ✔️

Resistance to market volatility ✔️

Land has helped investors preserve wealth for generations, and AcreTrader makes it easy to diversify with farm and timberland assets online — Find out how.

IN THE NEWS

💼 Nvidia Forecasts AI Boom (WSJ)

Explained:

- Artificial intelligence is all over the news, and the use cases are real. Nvidia (NVDA) reported a sharp fall in quarterly profit, but the company said artificial intelligence language-generation tools could be a boon for its business.

- The AI technology that has become a hot topic in Silicon Valley (and beyond) is at “an inflection point,” Nvidia CEO Jensen Huang said Wednesday in the earnings call. He said AI could supercharge the value of the market for its chips, which helped send its shares soaring. The stock is up more than 60% in 2023 and nearly 300% in the last five years despite a rough 2022.

- Nvidia said it’s poised to profit from the excitement about so-called generative AI tools that promise to deliver compelling text with limited prompting, giving it relief from a post-pandemic drop in demand for computers that its chips feature in.

Why it matters:

- Microsoft has begun using AI tools in its search engine, and other tech companies are also underway. Some analysts say advanced Nvidia chips are the only viable products that can be used to create these AI systems, estimating that ChatGPT uses about 10,000 Nvidia graphics chips.

- Also driving the bullish outlook on Wall Street is a comment from CFO Corlette Kress, who said Nvidia was working with all the major cloud-computing providers, including Amazon, Microsoft, and Google.

- Said Kress: “The opportunity is significant and driving strong growth in the data center that will accelerate through the year.”

🌵 Arizona Poised For $52 Billion Chips Industry (NYT)

Explained:

- Speaking of chips, Arizona has become a hub for chip makers like Intel and TSMC, as the government prepares to release big money for the industry. Arizona has led the industry in microchip investments since 2020.

- The CHIPS Act, a funding package designed to expand domestic production of semiconductors, was passed in August. It’s a key piece of President Biden’s industrial policy and a push to ensure America’s economic and technology leadership over China.

- Arizona is looking to position itself for a chunk of that once-in-a-generation gusher of federal funding. The Commerce Department is expected to begin taking applications within days.

Why it matters:

- Experts have called this a “race” among states to raise funding for the chips industry. Said one expert: “Every governor, every state legislature, every president of public universities in every state ought to be putting their plan of attack together. This is going to be a competitive process.”

- Tax breaks in Arizona for big business have disgruntled some, however, who say the moves have hurt public spending for schools. The state ranks 47th in per-student funding, which illustrates the balancing act governments must weigh in distributing funds effectively.

- “We need to bring business to our state, but we need to look at balance,” said Beth Lewis, the executive director of Save Our Schools in Arizona. “Corporations are choosing not to settle in Arizona because of our devastated public education system.”

- Though some businesses have strayed away for this reason, Sandra Watson, president of the Arizona Commerce Authority, says there’s still “a robust pipeline” in a state that doubles as one of the more desirable places Americans are moving to after the pandemic.

Delicious Drama

Stop into any supermarket’s frozen section, and you’ll find an intriguing mystery.

You’ll see the big brands like Breyers, Turkey Hill, and Edy’s, and specialty brands making gelato or vegan ice creams.

And then, you’ll see the higher-end “fancy pints” from Ben & Jerry’s or Häagen-Dazs. Where Häagen-Dazs offers smooth flavors like vanilla, Chocolate, and pistachio, Ben & Jerry’s focuses on chunkier ones such as Cherry Garcia and Chunky Monkey.

Is this difference in flavor and texture just a coincidence borne out of natural competition and specialization?

Christopher Sullivan of the University of Wisconsin-Madison suspects something more sinister. He argues that the two companies may be engaging in “tacit collusion.”

In other words, the competitors may have an implicit agreement to stick to each other’s own turf.

Let’s get to the creamy core of this chilling conspiracy.

Choosing not to compete

Instead of evaluating a brand’s set of products and services for what they are on the surface, we can invert the problem and look for insights into the less obvious yet still intentional decisions not to compete in certain areas.

Don’t be fooled, knowing where not to compete is an essential part of corporate strategy. McDonald’s sells hamburgers, not tacos.

Same for shoes, Nike chooses not to make dress shoes because that would distract from their efforts to be the world’s leading athletic clothing and shoe brand.

Flavor scandal

One day, Sullivan popped open his freezer to see his favorite ice cream brand, Ben & Jerry’s, and he started to reflect on their various flavors and, more interestingly, what they don’t offer.

He noticed that their grocery store products excluded basic flavors like chocolate, strawberry, butter pecan, and coffee, among other best-sellers.

Yet, they sell Coffee Toffee Bar Crunch. Presumably, at some point in the production process, there’s a big vat of only coffee ice cream without all the chunks.

Evidently, they choose not to sell it this way, at least not in supermarkets, even though they could.

As any patron of their stores will know, Ben & Jerry’s sells smooth ice cream flavors to visitors, making their choice to sell only chunky ice cream in grocery aisles all the more bizarre.

Carving out flavors

Sullivan suspects collusion in carving up the chunky and smooth ice cream markets.

Under this deal, consumers lose as products stagnate and prices are pushed up.

This is “market division,” and it’s typically seen in a geographical context where brands choose not to compete in certain areas of a city, state, country, etc.

He proposes that instead of dividing city maps, the two ice cream brands have split up the flavor space.

Brazen betrayal

Heading into the 1990s, they found a stalemate equilibrium, commanding a combined 90% share of the ultra-premium ice cream market.

That is, until 1992, when ultra-premium sales started dropping, and Häagen-Dazs ventured across the flavor spectrum to offset that. Shots fired (figuratively speaking).

Häagen-Dazs began selling chunky flavors in supermarket aisles, prompting Ben & Jerry’s to respond by selling smooth flavors for the first time.

After years of occupying different turf, the two companies faced a high-stakes struggle. The result was more options for consumers and discounted prices, as the two sought to undercut each other.

Ben & Jerry’s retaliatory measures were seemingly intentional. Ben, of Ben & Jerry’s, was even quoted as saying, “When the smooth get chunky, the chunky get smooth.”

The politics of ice cream

It’s a storyline reminiscent of an old gangster film. The two ice cream crime families enjoyed years of peace before an eye-for-an-eye battle over shelf space threatened their profits.

Two distinct pathways emerged: They could compete over the same flavor turf and destroy their profit margins or cooperate by retreating to the previous flavor divisions.

Game theory

It’s a great case study on game theory. Companies must not only consider the best options before them but also the options before their competition and how they should respond to each other’s choices.

The two are collectively better off by collaborating. However, each one is continuously tempted to veer into the other’s turf to earn greater profits, at the risk of forging a new, more competitive equilibrium where both are less profitable.

Sullivan says, “When we’re colluding, there are these short-run incentives to deviate and for me to massively undercut you, steal all your customers, and earn more money.”

It took a few years, but by 2013, both sides had waved the white flag, ending the cold war.

Are they actually colluding, though?

After reviewing thousands of ice cream sales data points, Sullivan concludes that ultra-premium ice cream is around 20-50% more expensive than it would be in a fully competitive market. This means the two brands are most likely colluding to sell ice cream within their flavor niches at generally higher prices.

Is any of this illegal?

Explicit arrangements between firms are illegal, but tacit collusion in this way is more of a gray area.

Once you open your eyes to tacit collusion, you may notice it everywhere. From beer to rental car companies, implicit competitive arrangements are everywhere.

Don’t be fooled, ice cream is no sweet business, and the market players are desperate to protect their profits. For now, there’s peace between the two ice cream titans, but how long will it last?

To learn more about this “ice cream conspiracy,” listen to NPR’s full podcast episode on the topic.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.