Structural Vulnerabilities

Hi, The Investor’s Podcast Network Community!

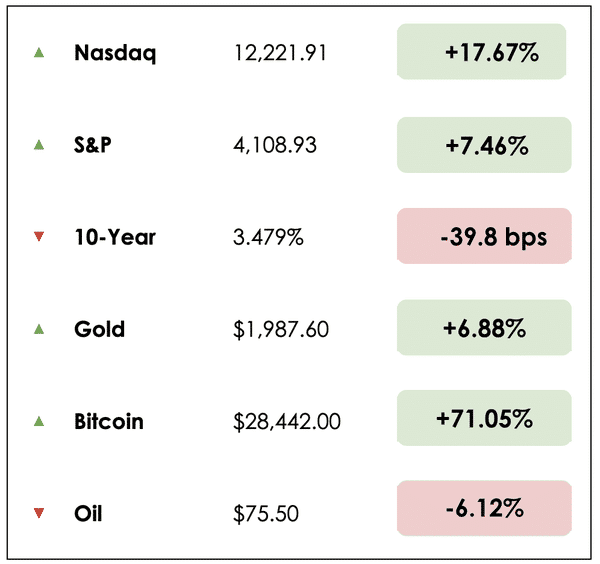

Welcome to the weekend and the end of the first quarter. Would you believe that the Nasdaq is up 17% and Bitcoin is up over 70% this year?

We make these price charts daily, and those numbers still caught us by surprise 😅

2023 has seen bank failures, persistent inflation, and a whole lot of volatility, but risk assets are hanging in there and, evidently, doing pretty well.

We’ll keep you updated on how things unfold, and thank you for giving us a few minutes of your time each day.

Here’s the year-to-date rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss in the news:

- Texas’ business boom

- A flight to money market funds

- Plus, our main story continuing our spotlight series, showcasing a day in the life of our podcast hosts

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

In addition to being a good friend, Compounding Quality is one of the fastest-growing accounts on Substack and FinTwit.

He works professionally as an Equity Fund Manager and teaches people about investing for free with his wonderful newsletter.

Learn about Quality Investing from someone who manages roughly $200 million.

IN THE NEWS

🏦 More Banking Strain Ahead? (FT)

Explained:

A flood of cash into U.S. money market funds could exacerbate banking strains, as Treasury secretary Janet Yellen warned of “structural vulnerabilities” in the sector.

What’s happening: Money market funds allow investors to place their assets in relatively safer places, such as short-term government debt. Their returns have soared far above the interest rates banks pay depositors as the Federal Reserve rapidly raised borrowing costs over the past 12 months.

What’s new: This week, Yellen said the recent flows have drawn the U.S. Treasury’s attention. “If there’s any place where the vulnerabilities of the system to runs and fire sales have been clear-cut, it’s money market funds. The financial stability risks posed by money market and open-end funds haven’t been sufficiently addressed.”

- There are rumblings that the shift further threatens the stability of banks, notably smaller regional lenders that can least afford to increase the interest rates they offer to account holders.

Why it matters:

Further worry: Some analysts worry about the potential downside of further flows into money market funds. While the shift out of banks and into such funds is typical during every cycle of Fed interest rate rises, analysts suggest the move could persist even once the central bank ends its monetary tightening and begins to lower borrowing costs again.

- A tale of two shifts: The first shift happened as savers worried about the stability of banks, which drove assets in government money market funds to a record high of $4.3 trillion this month. The second shift might not begin until savers awaken to the disparity between regular savings accounts and money market funds.

- In other words, even if banks raise the interest rates they pay depositors to compete with funds, savers may want to avoid dealing with the perceived risk in the banking system.

🤠 Texas’ Latest Boom (Economist)

Explained:

Texas keeps getting bigger. The Lone Star state has the second largest population in the U.S. and is on track to pass California in the 2040s, the Economist reports.

What’s happening: Texas’ rise accelerated during the pandemic as tech companies and Americans of all ages have flocked to the state for its relatively lower cost of living. There are thousands of open jobs and mild winters. Texas doesn’t have a state income tax, either.

- Texas’ population grew by almost 20% from 2010 to 2021. Its economy grew by 39%, 1.5 times faster than the national economy.

- Governor Greg Abbott has repeatedly made headlines for his controversial views on immigration and for sending busloads of migrants to Democratic states. But that hasn’t deterred companies from setting up shop in Texas, particularly Austin and Dallas, whose popularity has surged.

Oil bust no more: Texas was hit hard by the oil bust of the 1980s, though it has reinvented itself into a hub for technology companies. Tesla, HP, Oracle, and other big-name brands have made the move, and others are leaving higher-tax states like California for Texas.

- The state has diversified its economy. Austin is a tech hotspot, Houston is still an oil and gas hub, and Dallas is growing its footprint in the finance industry.

Why it matters:

Renewables: Texas, with plenty of open lands, now has an interesting juxtaposition in its landscape: Oil fields on the same grounds that wind turbines and solar panels now populate. Texas has become more influential in the country’s politics and tech scene, and its transition to renewable energy comes at a time when the world hopes to move away from fossil fuels.

The lessons: States looking to boost their economy and population might take a page from Texas’ playbook of lean government and business incentives.

- Stereotypes of cowboys and super patriotism are still abundant. But its dynamic business growth, combined with a vibrant food, music, and arts scene, has Americans moving to Texas in masses.

MORE HEADLINES

😬 Bond rally at risk with bank fears easing

📱China’s Huawei says it’s “out of crisis mode” after investing billions in its own capabilities, bypassing sanctions

❌ “It’s not zero” — Wall Street prices in a small but devastating (and growing) risk of U.S. default

SPOTLIGHT SERIES: REBECCA HOTSKO

Highlighting our podcast hosts

In today’s edition, we’d like to spotlight Rebecca Hotsko, the co-host of the Millennial Investing podcast and a writer for The Investor’s Podcast’s blog.

Rebecca joined our company in August 2022, and she’s been off to the races ever since.

She’s covered topics like improving your expected returns with factor investing, finding your own investment philosophy, and how to know whether the stock market has bottomed.

Get to know her better

Rebecca’s a passionate investor and a successful entrepreneur who graduated with a BA Honors in Economics from the University of Saskatchewan. On top of that, she also completed two levels of the Chartered Financial Analyst (CFA) program — each level requires roughly 300 hours of studying.

Currently, Rebecca lives in the vibrant city of Calgary, where she moved from peaceful Kelowna, BC, Canada.

In her spare time, Rebecca is passionate about:

- Creating and producing music (she’s been playing piano and singing since five years old!)

- Fitness activities and competitions

- Creating new recipes for her cooking blog.

Rebecca is active on Twitter and TikTok, where you can dive deeper into her hobbies, and investing insights.

We asked her a few questions:

How did you become interested in investing?

I was interested in investing at quite an early age, and I bought my first stock when I was 18. At this time, I didn’t know much about investing or finance as I was studying economics, so I joined my university’s investment club and fell in love with stock investing from there.

After school, I landed my first job at the Bank of Canada but realized that I wanted to pursue a career in finance, so I pursued my CFA at the same time as working, which was the first formal education I had in investing and finance, and it has helped me tremendously as an investor.

So it was around this time I was also getting into investing more seriously and decided to start my own investment blog in 2020 to share my investing experience and things I’ve learned along the way that made me a better investor.

How did you start your journey with The Investor’s Podcast Network (TIP)?

I was a fan of the show and a listener for years. I heard about the opportunity to become a writer for the newsletter in a podcast episode.

I applied, went through the process and eventually was asked if I would like to be a host instead of a writer. I gladly accepted despite originally applying to be a writer, and I have been hosting the Millennial Investing Show since last August!

Now, I have also begun writing for TIP’s blog, where you can find me deep dive into specific investment topics.

What’s one common misconception about investing you come across?

To increase your returns, you need to increase your exposure to beta (take on more risk), which is false.

Taking on more market beta may not necessarily give you the better results you’re expecting. There are certain characteristics called “factors” that, when you tilt your portfolio towards these, are expected to improve your returns above the market.

I think that one common mistake new investors make is they think they need to pick stocks and do complicated things to get good returns. But really, to be a better investor, you have two options: be better at forecasts or use those forecasts on a wider range of stocks.

How do you come up with podcast topics and choose experts to invite?

Generally, I think about topics I am curious about or want to learn more about to help inform who I bring on. I like to try to bring on a range of different investors who I know have different investment philosophies than me to always try to learn something new and challenge my own beliefs about markets.

I also love hearing input from my listeners to inform who I bring on.

What investors do you find the most inspiring?

I find Cliff Asness to be very inspiring and a brilliant investor who I have learned a tremendous amount from. He owns one of the largest quant funds in the world. A lot of my investing strategy is based on his research and his contributions to finance.

On a completely different spectrum, I also really like learning from investors who spot investments before anyone else, and because of that, Peter Thiel is someone I admire tremendously and love learning about.

What are your favorite books you’d recommend?

Some of my top favorite books are:

- 100 baggers: How to Find Stocks That Return 100-to-1

- Or anything by Larry Swedroe, but some of my favorites are The Complete Guide to Factor Investing, and The Only Guide to a Winning Investment Strategy You’ll Ever Need.

What’s on your bucket list?

Travel to 30 countries by the time I’m 30.

What have been your favorite episodes you’ve released on the Millenial Investing Podcast?

My favorite episodes have been with Aswath Damodaran, Larry Swedroe, Tobias Carlisle, and Lance Roberts!

Where do you see yourself in 20 years?

In 20 years, I see myself continuing to spend my time doing the things I love most, traveling the world, living in different places, and working on projects I love.

Dive deeper

Make sure to follow Rebecca’s episodes on Millennial Investing on whatever app you use for podcasts!

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.