Spoiler Alert

04 January 2023

Hi, The Investor’s Podcast Network Community!

After spending more than a month reviewing dozens of submissions for our stock pitch competition, we’re excited to announce the winners today! 🎉

Thank you to all who chose to compete, it was an absolute pleasure to read over the submissions. We have an incredible community of investors.

Here are the finalists 💪

- 1st place: David Bastian — ticker: AMRK

- 2nd place: Tyler Hicks — ticker: CNX

- 3rd place: Tristan Unger — ticker: LEGH

- Honorable mention: Kyle Holmes — ticker: GNRC

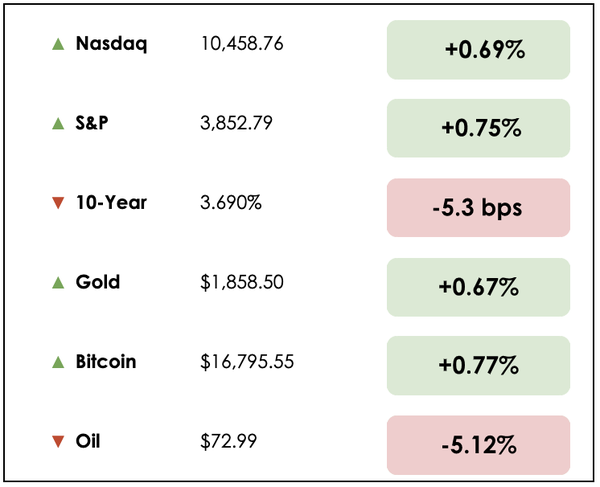

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: Why Meta is getting a big fine and what’s causing natural gas prices to plummet, plus our main story on how mean reversion affects stock prices.

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

💰 Meta Fined More Than $400 Million (WSJ)

- A top European Union privacy regulator ruled that Meta (META) can’t use its contracts with Facebook and Instagram users to justify sending them ads based on their online activity.

- The ruling, announced Wednesday by Ireland’s Data Protection Commission, imposed fines of $411 million, saying the company violated EU privacy laws by suggesting such ads are necessary to execute contracts with users.

- Litigation could take years. Meta, the parent of Instagram and Facebook, said it disagrees with the ruling and plans to appeal. The case will depend on how Meta receives legal permission from users to collect their data for personalized advertising.

- Meta shares have fallen sharply from their September 2021 peak, down over 60% in the past year, and it has laid off thousands of employees.

- If upheld, the ruling could mean that Meta must allow users to opt-out of ads based on how individuals interact with its own apps, which could hurt its core business. It’s the latest headwind facing Meta, which is grappling with a major drop in ad revenue because of a change made by Apple in 2021 that gave iPhone users the choice of whether advertisers could track them.

- The ruling is one of the most significant judgments since the EU, one of Meta’s largest markets, enacted a landmark data-privacy law to restrict Facebook and other companies from collecting information about users without their prior consent. The law took effect in 2018.

☀️ Natural Gas Plummets Amid Warm Weather (WSJ)

- Unseasonably warm temperatures across the Northern Hemisphere have melted down natural-gas pipes, mitigating dire forecasts of energy shortages and sinking Vladimir Putin’s plan to squeeze Europe this winter.

- Natural gas futures ended Tuesday at $3.988 per million British thermal units, down 50% from summer highs and about where they were when Russia’s invasion of Ukraine upended energy markets.

- The plunge is not welcome news for drillers, whose shares were big winners in 2022. But cheaper gas is good news for households and manufacturers, and it could help further tame inflation in the coming months.

- Mild weather is driving gas prices lower in Europe, a reprieve for a region that had feared rolling blackouts and factory shutdowns. Nat gas prices have nearly halved over the past month alone while the war in Ukraine rages on.

- European governments committed billions of dollars to shield consumers and companies from high energy prices after Moscow cut gas supplies to Europe last year. European officials described the move as Russia’s attempt to undermine military and financial support for Ukraine.

- Winter is far from over, but so far Russia’s strategy isn’t working. Warm winter weather is limiting demand, as is an EU effort to curb consumption. Some analysts, however, note that prices in Europe could rise again when the continent tries to refill stores for the 2023-24 winter without much Russian gas.

History of positive returns ✔️

Inflation-hedging potential ✔️

Resistance to market volatility ✔️

Land has helped investors preserve wealth for generations, and AcreTrader makes it easy to diversify with farm and timberland assets online — Find out how.

WHAT ELSE WE’RE INTO

📺 WATCH: Why the dollar isn’t going anywhere, explained by Peter Zeihan

👂 LISTEN: How to pick stocks like Peter Lynch

📖 READ: Oregon becomes first state to legalize “magic mushrooms”

THE MAIN STORY: MEAN REVERSION

Overview

What is mean reversion, and how does it impact an investor’s returns?

Rebecca Hotsko, host of the Millennial Investing podcast, spoke with Tobias Carlisle on this topic in episode MI241.

Today, we welcomed Rebecca back as a guest writer to share her thoughts on the topic.

She writes the following.

Breaking it down

Economic booms and busts, or the peaks and troughs of the stock market, are typical examples of ‘mean reversion.’ However, investors often overlook how mean reversion affects companies’ valuations.

Famed value investor Jeremy Grantham argues that “profit margins are probably the most mean-reverting series in finance, and if profit margins don’t mean revert, then something has gone badly wrong with capitalism. If high profits don’t attract competition, there’s something wrong with the system.”

Buffett agrees, and in 1999, he stated, “you must be wildly optimistic to believe profits can remain high for any sustained period.”

This newsletter received such great feedback, we decided to write an entire article just on mean reversion. Read the full piece here.

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.