Spill the Beans

Hi, The Investor’s Podcast Network Community!

Warren Buffett has said, “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

How about 25 years? 🤯

Investment funds run by college students are taking on a challenge: Pick stocks for the next 25 years. The caveat? Never trade them. No one, no matter what, will be able to sell anything. They’ll be frozen.

Which businesses would you choose? Let us know by simply replying to this email.

Here’s the rundown:

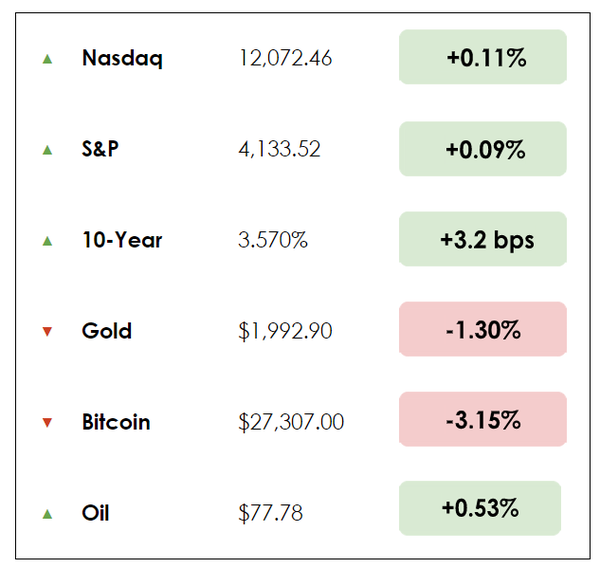

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- U.S. tourists to spend big in the U.K.

- Why President Biden aims to block investments in China

- Plus, our main story on brilliant Starbucks marketing

All this, and more, in just 5 minutes to read.

Trivia question — What is the best-performing S&P 500 stock of the past 25 years?

Read to the end of the newsletter to find the answer.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Let’s face it…Building a resilient portfolio is difficult.

Finding and capitalizing on the best stock market opportunities with no help is next to impossible.

This is why we launched the TIP Mastermind Community!

We’re kicking off the community launch with an exclusive live discussion with Stig Brodersen chatting about his portfolio.

Spots are limited to the first 30 investors.

Upgrade your network today:

IN THE NEWS

👑 U.S. Tourists to Spend More Than Brits for Coronation (Bloomberg)

Explained

Despite ditching the monarchy in 1776, Americans may be more enthusiastic about the king than his British subjects.

According to royal analysts, during King Charles III’s coronation at Westminster Abbey on May 6, American tourists are expected to spend more than British citizens at London’s leading hotels to celebrate the occasion.

Luxury U.K. hotels set a royal precedent, offering coronation-themed experiences like high teas, Michelin-starred dinners, a $25,000 whisky, or The Dorchester’s rooftop lunch with a Red Arrows flypast.

- AI hotel booking platform Allora.ai’s shared research findings showing that 32% of booking revenue in 4- and 5-star U.K. hotels come from U.S. travelers (up from the usual 24%), while domestic travelers make up only 34%.

“The fact that the coronation has really caught the imagination of visitors from the US is a real added bonus for London hoteliers, as they are far more likely to make use of the hotel’s facilities, such as the restaurant or spa,” says Michael De Jongh, the chief commercial officer at Allora.ai.

Why it matters

Americans are key drivers of the U.K.’s tourism recovery after the lifting of pandemic restrictions. They spent $5.2 billion in the U.K. in 2019, with spending up 40% this year, claims VisitBritain CEO Patricia Yates.

- In the meantime, a YouGov survey reveals that the majority of British citizens, especially those aged 18-24, are uninterested in the event.

Interestingly, Expedia search data reveals that numerous Brits aim to leave town during the celebrations, seeking flights to Amsterdam, Paris, and even New York, while Americans reserve London’s top hotels.

🚫 Biden Aims to Block Investments in China (Bloomberg)

Explained:

President Biden intends to sign an executive order in the next few weeks limiting investment by American companies in key parts of China’s economy, reports Bloomberg.

- This would include fields like semiconductors, artificial intelligence, and quantum computing, focusing on investments where U.S. firms play an active role in management.

- From venture capital and private equity to joint ventures, certain investments will be blocked outright. In other instances, businesses will just need to notify the U.S. government in advance.

The administration has debated escalating this escalation for almost two years. Still, the announcement is expected to come at a summit of the Group of Seven (G-7) advanced economies in late May.

China accused the U.S. of politicizing tech issues, with its Foreign Ministry spokesman saying Washington’s “real goal is to deprive China of its development rights. It’s pure economic coercion.” The Treasury Secretary pushed back on a speech Thursday, suggesting the ban would be on national security grounds.

Why it matters:

The move marks a new phase in a multi-year campaign to contain China as a peer rival to the U.S. following efforts like former President Trump’s tariffs on Chinese imports and, more recently, restrictions on exports related to sensitive semiconductor chips. Now, capital flows between the world’s largest economies are being targeted.

- One Bloomberg analyst added, “The U.S. has been working towards this for a while, and U.S. investments in sensitive areas have already been declining. Nonetheless, China tech will become more reliant on domestic capital pools and state support as foreign investment continues to withdraw.”

However, American companies have loved investing in China: cumulative total investments there by U.S. firms hit nearly $120 billion at the end of 2021.

MORE HEADLINES

🏆 Procter & Gamble beats earnings estimates, raises revenue forecast

⛔ The Fed is considering closing a loophole that masked Silicon Valley Bank’s losses

🏢 The commercial real estate market’s latest victim: Blackstone

Introduction

Starbucks sells coffee and other drinks, though it also helps to consider the Seattle-based brand as an unregulated bank. But unlike banks, Starbucks doesn’t need to worry about a bank run or collapse.

As part of their rewards program, millions of Starbucks customers have preloaded money onto Starbucks cards, effectively loaning the $123 billion coffee behemoth more than $1 billion, interest-free.

It has about $1.6 billion in outstanding gift card balances. That’s like an interest-free loan from its customers, and it’s more money than many small U.S. banks have. Starbucks also gets to keep a large chunk of the capital, as it had $196 million in unused gift card balances in 2022.

Starbucks doesn’t have to abide by regulations around storing customer funds, so it’s free to invest the funds however they want, which allows them to invest in expansion, operations, marketing, and other areas. The bulk of the credit goes to its ubiquitous smartphone app.

Years ago, Barron’s noted: “Starbucks identified the smartphone revolution years before most brick-and-mortar firms.”

Mobile payment empire

It’s like how McDonald’s is in the real estate business with more than $40 billion of assets in property and equipment or how premier universities like Harvard, Yale, Princeton, and Stanford act like hedge funds by chasing annual returns on their endowment funds. Together, they hold well north of $100 billion.

Starbucks, founded in 1971, launched its popular app in 2009. By 2011, you could make in-app payments. In 2014, Starbucks rolled out mobile “pre-order and pay” before it was commonplace. So, Starbucks benefited from a first-mover advantage. Combined with a loyal following, strong brand, and easy-to-use app, Starbucks supercharged its sales growth.

For years, Starbucks had the most mobile payment users in the U.S., until Apple surpassed it. This is an incredible feat, given Apple users can make payments virtually anywhere, while Starbucks users have only one option.

Starbucks’ app uses machine learning to provide customers personalized recommendations for additional products they might want to purchase based on their history.

On earnings calls, the company’s leadership has said that its personalization initiative “is the single biggest driver” of improved spend per customer it has seen. Analysts have said Starbucks might have the most successful mobile ordering app of all time, at least for a brick-and-mortar store.

All told, the world’s largest coffee house chain has over 33,000 stores in 80 countries, 15,000+ of which are in the U.S. Annual revenue was $32.91 billion in 2022.

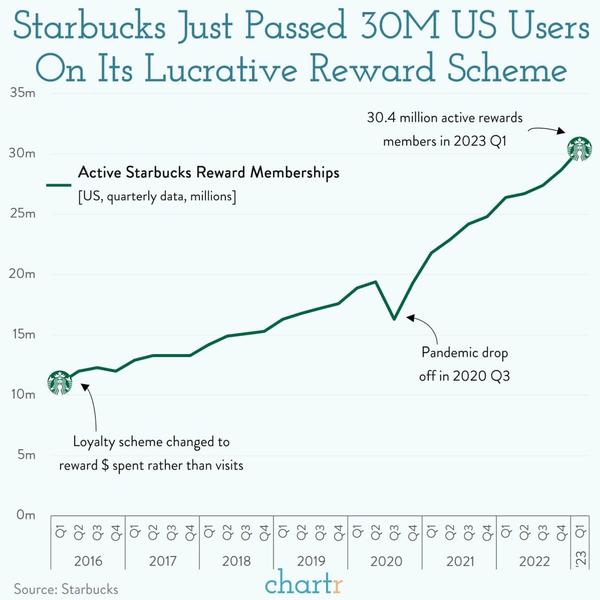

Lessons in loyalty

The loyalty program incentivizes customers to use the app and accumulate points, which leads to discounts and free drinks. The company has said “digitally engaged customers purchase two to three times as many products as those that are not digitally engaged.”

You might be able to attest to the psychological pull to spend more with the mobile app. Once you’ve loaded, say, $50 onto your app, customers are more likely to add a snack or extra shot of espresso.

Nearly half of customers pay for their beverages and snacks by loading money onto their Starbucks card, usually through the app. Because of Starbucks’ size and customer loyalty, customers aren’t afraid to keep some of their money in a Starbucks account. They know they’ll use it someday.

Starbucks gladly accepts up-front cash, and it doesn’t need to keep some cash on hand to give money when customers withdraw money. (In banking, this is called “fractional reserve banking.”) And Starbucks doesn’t need any cash ready for mass withdrawals, which is another advantage.

Don’t ask, experiment

Another aspect of Starbucks’ success worth studying lies in experimentation. Rather than ask what customers want, Starbucks tested out various features. They didn’t ask if customers wanted a loyalty app; they built one. They didn’t ask customers if they wanted to be rewarded with stars after purchases, red cups around the holidays, or Pumpkin Spice Lattes; they just did it, realizing that even customers don’t necessarily know what they want.

Other factors that helped Starbucks build the loyalty program:

- App’s user-friendly design

- Engaging loyalty program

- Mobile pay and order, easy to reload

- Integration with other platforms and services

Taken together, the program helps people build habits around spending time on its app and in its stores. Across the country, Starbucks is people’s “third place” to spend time, after home and work.

I, Matthew, am typing these words at a New York City Starbucks, alongside several other people hunched over their laptops. Soon, I’ll reload the money on my card, caffeinate with another drink, earn rewards, and keep the flywheel going, just as Starbucks wants.

Dive deeper

Here’s “Onward” by ex-Starbucks CEO Howard Schultz and, from 1997, “Pour Your Heart Into It,” about Starbucks’ ascent into a household brand.

TRIVIA ANSWER

Monster Beverage, which has been a monster all right. It has averaged a 37% annual return over the past quarter century. Its cumulative return means that a mere $10 investment made on New Year’s Day 1998 would have been worth $26,888.24 on New Year’s Eve 2022.

SEE YOU NEXT TIME!

Enjoy reading this newsletter? Forward it to a friend.