Silver-Tongued Demagogues

Hi, The Investor’s Podcast Network Community!

☔ Thought you had a big rainy day fund saved up? Warren Buffett’s Berkshire Hathaway is sitting on almost $130 billion of cash.

Berkshire did use some of its funds to buy back 1.2% of outstanding shares last year, though.

And Buffett was quick to hit back at the critics, saying, “When you’re told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you’re listening to either an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive)” 👀

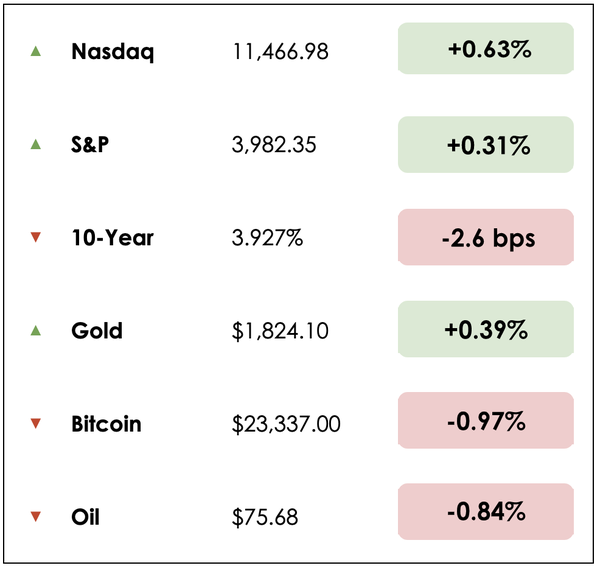

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- What’s going on with apartment rents

- Some perspective on the labor market

- Plus, our main story diving deeper into tech layoffs

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Simple setup for new Bitcoiners ✅

Advanced features for Bitcoin veterans ✅

The Bitcoin wallet for your every need ✅

Blockstream Jade is the only hardware wallet designed for your whole Bitcoin journey. Visit store.blockstream.com and use coupon code: ‘Fundamentals’ to get 10% off your Blockstream Jade.

IN THE NEWS

🏢 Apartment Rents Falling? (WSJ)

Explained:

- It might not feel this way, but apartment rents in every major U.S. city are falling as new supply hits the market. In Seattle, new-lease rents have tumbled 8% since August.

- Renters with new leases in January paid a median rent 3.5% lower than they would have paid last August, according to estimates from the listing website, Apartment List. It’s the first time in five years that rent fell every month over a six-month period.

- The biggest delivery of new apartments in nearly four decades is slated for this year. Nearly half a million new apartments are coming online this year as developers seek to cash in on the high rents tenants have been paying.

Why it matters:

- The softening rental market follows quite the run for the apartment and home-rental industry. Pent-up demand for housing exploded in the months after the introduction of Covid-19 vaccines in late 2020. A surge in people searching for apartments lifted rents 25% over two years.

- More recently, many renters can’t afford to buy a home because of higher mortgage rates and steep prices, so rentals have been in high demand.

- But recent declines show tenants have maxed out on how much of their income they can devote to rent. Layoffs have created new concerns for some, while other would-be renters live with family or friends to save money.

- The impact of rent declines tends to lag what’s expressed in the CPI. Many renters are in the middle of leases signed before recent price drops. That’s one reason why the rising cost of rent reflected in the CPI shows annual price growth that is still higher than market measures, which track new leases.

💼 What Layoffs? (NYT)

Explained:

- As the Federal Reserve hikes interest rates to tame inflation, there are signs the red-hot labor market is cooling off. But layoffs in the economy remain rare outside of high-profile companies, mostly in the tech sector, which is a topic we cover more in our main story below. This dynamic underscores why it’s important not to judge a trend based on a few headlines.

- There were fewer layoffs in December than in any month during the two decades before the pandemic, government data show. Filings for unemployment insurance have barely increased. The unemployment rate, at 3.4 percent, is the lowest since 1969.

- You might still see plenty of “Now Hiring” signs throughout cities and towns, and many white-collar and blue-collar jobs still struggle to find workers.

Why it matters:

- For Federal Reserve policymakers, the job market’s surprising strength is a source of both optimism and concern. Low unemployment suggests a recession isn’t imminent, but also that the Fed hasn’t yet achieved its goal in slowing down the economy.

- Economists say some companies might be holding off on layoffs simply because of how difficult and costly it can be to recruit and train employees. Some might be worried that they will become short-handed.

- Said one CEO: “Finding talented labor that wants to stay and wants to be committed to the long-term success of the company — that’s been very challenging.”

WHAT ELSE WE’RE INTO

📺WATCH: How to invest wisely with Howard Marks.

👂LISTEN: We Study Billionaires’ Q1 investing “masterminds” episode.

📖READ: Berkshire Hathaway’s latest annual letter to shareholders.

Headlines versus reality

For weeks, it felt like every day, we were reading headlines about major layoffs at dozens of tech companies. Yet, aggregate unemployment figures remain extremely low.

What gives?

Anecdotal data, even lots of it, isn’t always reflective of broader trends, and never has that been more true in the economy.

Still, with dominant companies like Meta, Amazon, Google, Microsoft, and many more laying off thousands of workers, it’s worth exploring further, especially when the announcements seemingly contradict broader economic data.

Tech veteran Patrick McKenzie has a few insights.

Setting the scene

For the full context, McKenzie suggests we must go back a few years. He explains that the tech industry had an “uninterrupted series of a bunch of very good years.”

In other words, the pandemic pulled forward the digitalization of the economy as many of us were stuck at home, forced to increasingly rely on Zoom to connect us, streaming to entertain us, social media to distract us, food delivery to feed us, and so on.

That, combined with the massive fiscal stimulus introduced by governments worldwide, which poured money into people’s pockets, created incredibly ripe conditions for many of these businesses to flourish.

Back to Earth

With “more money sloshing around” and “absolutely blockbuster years for tech companies,” McKenzie argues it was difficult not to get caught up by the unprecedented growth rates in new users, advertising revenues, etc.

Others liked to throw around the expression that it felt like “Decades of growth were happening every couple of weeks,” and the big question, says McKenzie, was, “how long does that continue for?”

In hindsight, the digital transition certainly expedited shifts that might have taken several more years to go mainstream. However, many of us happily returned to our former offline lives when the world reopened.

To Mark Zuckerberg’s chagrin, interest in spending our days in the digital “metaverse” is lower than expected, particularly compared to outlooks delivered in 2021.

As we navigated the pandemic, these companies largely embraced the hype, deciding to hire aggressively in response to optimistic views of a hyper-digitalized post-Covid economy. McKenzie explains that things aren’t even all that bad for many tech companies but realized growth trajectories have “bent downwards” more than anticipated.

Breaking down layoffs

Most of the economy can be quite strong as tech companies, which benefited from the pandemic, experience sweeping layoffs. Many now have the same headcount as they did less than two years ago.

In hiring, quality may have been sacrificed for quantity, either intentionally or via a less hands-on hiring process done remotely. Still, companies can clearly measure productivity differences for their latest hiring class relative to past years.

Even at software companies, not everyone is a programmer, of course. So which types of employees are getting laid off?

Customer service teams grow linearly with product use, so if product use drops off, these jobs may be the most at risk. If the company is still growing, just not as fast as hoped, then recruiting jobs might be more at risk, given that these typically grow linearly with the organization’s size, and now that size doesn’t need to expand as quickly.

According to McKenzie, engineers working on the company’s core products, say Google search for Alphabet or Facebook for Meta, are generally safer. Teams devoted to less proven or more narrowly focused projects would be at greater layoff risk.

Layoffs typically come from the top with a focus on cutting the least-necessary areas and, perhaps unfairly, reducing employee performance to a few, or even a single, metric(s).

Land grab mode

He calls tech companies’ general propensity to over-hire “land grab mode,” because there’s so much opportunity to integrate software systems into our lives but also intense competition.

With this view, companies aren’t thinking conservatively about how to accomplish a minimal number of tasks with as few people as possible. Instead, they’re opportunistically looking for the “next big things” to test what may become a defining product or feature.

As a result, Mckenzie doesn’t love the narrative that became popular when Elon Musk took over Twitter and promptly relieved huge chunks of its staff.

On one hand, you could cut maybe 50% of workers at tech companies, and their core systems may operate just fine. On the other hand, these companies exist to innovate and earn an advantage with superior engineering, so their focus in hiring isn’t to run a barebones, maximize-profits-at-all-costs operation.

Rather, they hire workers to drive growth into new areas. The layoffs we’ve seen then are a way for companies to hit the pause button and assess market conditions after rapid growth before deciding where and how to grow next.

Takeaways

Despite the current pullback, which McKenzie calls a “minor wobble,” he still thinks demand for engineers and other jobs at tech companies will be high over the coming years.

For those laid off, so long as their skills aren’t overly specialized, jobs can likely be easily found across the economy, helping companies outside of traditional tech employ software systems effectively.

To hear McKenzie’s full thoughts on tech layoffs, listen to his Bloomberg interview here.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.