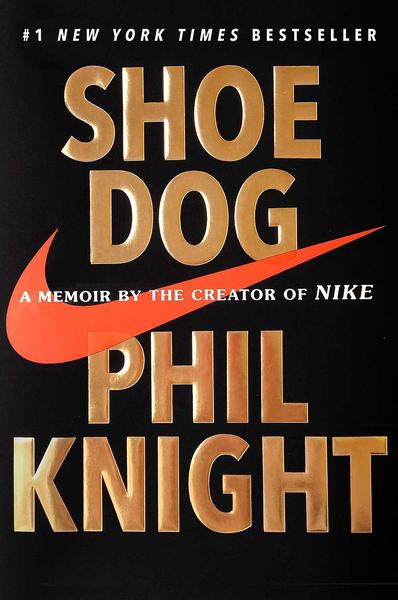

Shoe Dog

Hi, The Investor’s Podcast Network Community!

⛽ Woah, the second quarter kicked off Monday with a bang as oil prices made their biggest jump in nearly a year. It’s likely we’ll start feeling it again at the gas pump.

A Saudi-led group of producers said it would cut more than 1 million barrels of daily output starting next month. We’ll have much more below.

In hoops news, congratulations to the LSU women’s basketball team for winning the national title Sunday night. 🏀

Tonight, San Diego State will square off against Connecticut in the men’s final. The favorite, UConn, has won four championships since 1999.

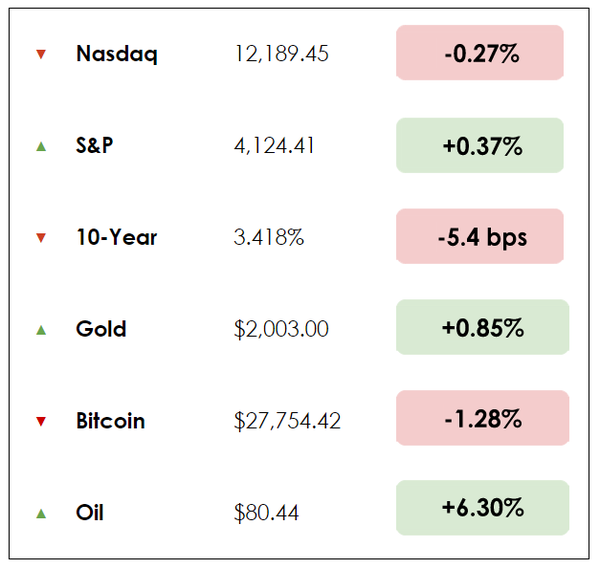

Here’s the year-to-date rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss in the news:

- OPEC+ announces surprise oil production cut

- The latest at Blackstone

- Plus, our main story on lessons from Nike and Phil Knight

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Real estate investing, made simple.

17% historical returns*

Minimums as low as $5k.

Equity Multiple helps investors easily diversify beyond stocks and bonds, and build wealth through streamlined CRE investing.

*Past performance doesn’t guarantee future results. Visit equitymultiple.com for full disclosures

IN THE NEWS

🛢️ OPEC+ Announces Surprise Oil Production Cut (Bloomberg)

Explained

Take a mental snapshot of prices at the gas station because they might soon seem like the good ol’ days:

- Oil prices jumped 8% and are expected to stay elevated following a surprise announcement of production cuts by OPEC+, the alliance of 23 oil-producing countries, including Saudi Arabia, Venezuela, and Russia.

The recent banking crisis has added to fears of an impending global economic recession, which dragged crude oil futures prices to a 15-month low. In response, the oil cartel stated that it’ll withhold over 1 million barrels daily from global markets, aiming to boost revenues by reducing supply and increasing prices.

Interestingly, the move seems like a targeted attack on short sellers who piled into bets against oil prices in light of the banking system turmoil.

- Amrita Sen, the director of research at Energy Aspects Ltd., argues: “The market had become a playing field for these shorts,” and OPEC+ wanted to drive them away. She suggests the oil alliance is saying, “take us on, but at your own peril.”

Why it matters

The decision brings the group of OPEC+ nations in alignment with Russia, which announced production cuts of 500,000 barrels per day in retaliation for sanctions.

- At the same time, higher energy prices doesn’t aid the Fed’s efforts to tame inflation, nor does it help President Joe Biden’s expected re-election campaign launch.

The White House could further tap the nation’s Strategic Petroleum Reserve, though the emergency stockpile has already been drained by around 180 million barrels. That’s a 38% decline from where it started 2022.

The U.S. is the largest oil producer in the world, but unlike other oil-producing countries, it has no nationalized oil company it can directly influence. As a result, pressure on American energy firms broadly will probably ramp up.

Other options include passing the controversial “NOPEC” bill, enabling the U.S. to sue OPEC nations, export curbs, or requirements that mandate oil companies store more fuel domestically to minimize inventory concerns.

🏘️ Blackstone Faces $4.5 Billion in Redemption Requests in Property Fund (FT)

Explained

Blackstone (BX) faced considerable redemption requests in March from investors in its $70 billion real estate trust, known as BREIT. But it only paid out $666 million, as the firm imposes restrictions on withdrawals.

BREIT has become a huge player in the industry, acquiring student housing, apartment buildings, and warehouses, among other property types. However, higher borrowing costs and falling prices have increased defaults, particularly for offices.

- The stress on a well-established firm like Blackstone in its real estate fund indicates the growing angst about the sector, and so long as the Fed keeps pushing rates higher to fight inflation, those worries are unlikely to ease soon.

Rising interest rates have forced some investors to raise cash to meet margin calls, and unease spawned by three major bank failures in the U.S. has heightened worries about commercial real estate developers.

Why it matters

BREIT typically offers to repurchase a limited number of shares each month. However, it’s not obligated to honor redemption requests for its clients since that would require it to hastily sell holdings, presumably at depressed prices.

- This is an inherent risk in all private, illiquid funds — the strategies involved, such as purchasing real estate and renting out properties, require longer-term investments.

- Still, the publicity is undesirable for Blackstone and other managers of private funds. And the optics are enough to make investors in peer funds uneasy.

Despite the withdrawal pressure, BREIT’s returns have held up, delivering a 0.7% return in February for its lowest-fee share class. That follows a 5.7% return over the previous 12 months and an 8.4% gain in 2022, as rising rents offset declining property valuations.

Introduction

On Wednesday, “Air” opens in theaters before making its way to streaming on Amazon’s Prime Video. It’s a story based on true events about the origin of Michael Jordan, and how shoe salesman Sonny Vaccaro led Nike in its pursuit of one of the greatest athletes ever.

The new film from the heavy-hitting tandem of Matt Damon and Ben Affleck chronicles Nike’s rise to sneaker dominance.

What better time to revisit Nike co-founder Phil Knight’s memoir, Shoe Dog, which he published in 2016.

It isn’t merely a book about shoes; it’s about his journey of entrepreneurship, friendship, and self-discovery. It’s one of the better entrepreneurial stories we’ve read.

Here’s some of what resonated with us.

Make it count

The iconic Nike sporting goods company started over 50 years ago as a “crazy idea” in Knight’s mind when he was a young runner in Oregon. He sold shoes out of his car after developing the idea for Nike in a school project.

Knight thought Japanese-style shoes could become more popular than European shoes in America, just as Japanese cameras had overtaken German ones.

But for Nike, everything starts with Knight’s drive. Early, you get the sense Knight has something to prove. He wants to make a difference rather than settle for a stable job. He wants to inspire and be inspired. He writes:

“I had an aching sense that our time is short, shorter than we ever know, short as a morning run, and I wanted mine to be meaningful. And purposeful. And creative. And important. Above all…different. I wanted to leave a mark on the world.”

This is why, when giving advice, Knight urges young people to “think about the next 40 years and how you want to spend your time. Don’t settle for a job or even a career, look for a calling.”

Travel & inspiration

In 1962, Knight traveled the world, admiring classic European cities and Asian cultures. He stopped in Greece to admire the Temple of Athena Nike, the goddess of victory. In Japan, he met with a shoe company called Onitsuka. When they asked him the name of his shoe company, he hesitated. He didn’t have one.

Knight thought about the ribbons he had won in races as a young runner. “Blue Ribbon Sports,” he said on the spot. In two hours, he had persuaded them to be his distributor, one of many of the memoir’s examples of Knight’s ingenuity.

Knight also wrote that Japanese Zen Buddhism left a mark. The ideas of simplicity, minimalism, and being fully present drove him as he created Nike. Simplistic design and organizational structure defined his company.

Sales isn’t really sales

Knight riffs about how he surprised himself with his ability to sell. He struggled to sell encyclopedias and mutual funds. But selling shoes? He thrived because it didn’t feel like sales.

“I believe in running,” he writes. “I believed that if people got out and ran a few miles every day, the world would be a better place and I believed these shoes were better to run.”

Raising money

At one point, Nike faced a considerable cash-flow problem. They had no option other than going public, though Knight wasn’t comfortable with a public offering. He didn’t want to lose control over the company by bringing in outside people.

The answer involved offering classes of stock: A and B. Class A shares are reserved for the founders and team, while class B is for the public, enabling Knight to raise lots of money to turbocharge Nike’s growth without losing a lot of control.

Iconic branding

Nike’s rise offers many case studies in brilliant marketing and branding, but its defining symbol is also its simplest. The Nike Swoosh was designed by Portland State University student Carolyn Davidson in 1971. Her invoice total for one of the world’s most recognizable logos? $35.

Knight, an accounting professor at the university, had overheard her complaining that she didn’t have enough money to afford oil painting supplies. He asked her to design a shoe stripe logo that “had something to do with movement.” At first, he didn’t love the swoosh, but it grew on him.

Combine the swoosh and the slogan, “Just do it,” and Nike had orchestrated a masterclass in simple yet effective marketing.

Three final business lessons:

Knight hired ex-runners and fanatics with passion who were paid on commission. They worked hard and long because they believed in the vision.

The Japanese shoe manufacturer, Onitsuka, attempted a hostile takeover in 1971. Knight found an alternative manufacturer in Mexico. The first shoes out of this factory were soccer cleats disguised as football cleats.

For years, Knight didn’t believe in advertising. He thought a great product would speak for itself.

Dive deeper

You may read Knight’s wonderful memoir here. And here’s our podcast episode on Knight and the book; it’s worth a listen.

WHAT ELSE WE’RE INTO

📺 WATCH: Warren Buffett on what won’t change in 50 years

👂 LISTEN: Wealth, wisdom & happiness with Tom Gayner

📖 READ: Mental liquidity by Morgan Housel

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.

Newsletter@theinvestorspodcast.com