Seeing the Light

Hi, The Investor’s Podcast Network Community!

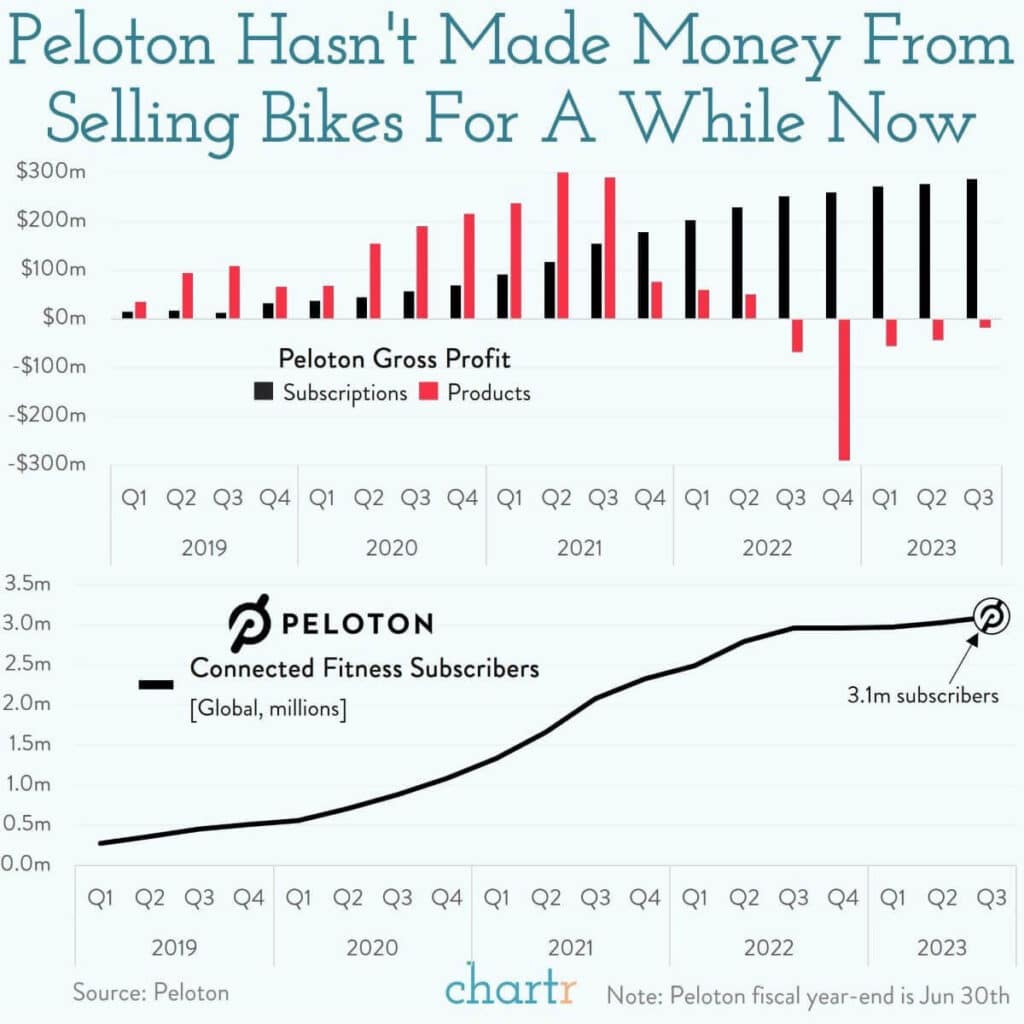

🚴 Remember the pandemic darling Peloton?

As you’ll see in our Chart of the Day below, it’s been a treacherous two years from the stock’s all-time high. The fitness company’s share price has cratered from $162 to $7, a 96% decline.

It’s a good example of why a popular brand doesn’t necessarily translate to a viable investment. Peloton built a large, loyal following, and many users swear by its bikes.

As a user myself, it’s an impressive product with world-class instructors for riding, running, lifting, yoga, and meditation. But the company continues to lose money despite healthy subscriber growth (3.1 million).

-Matthew

Here’s the rundown:

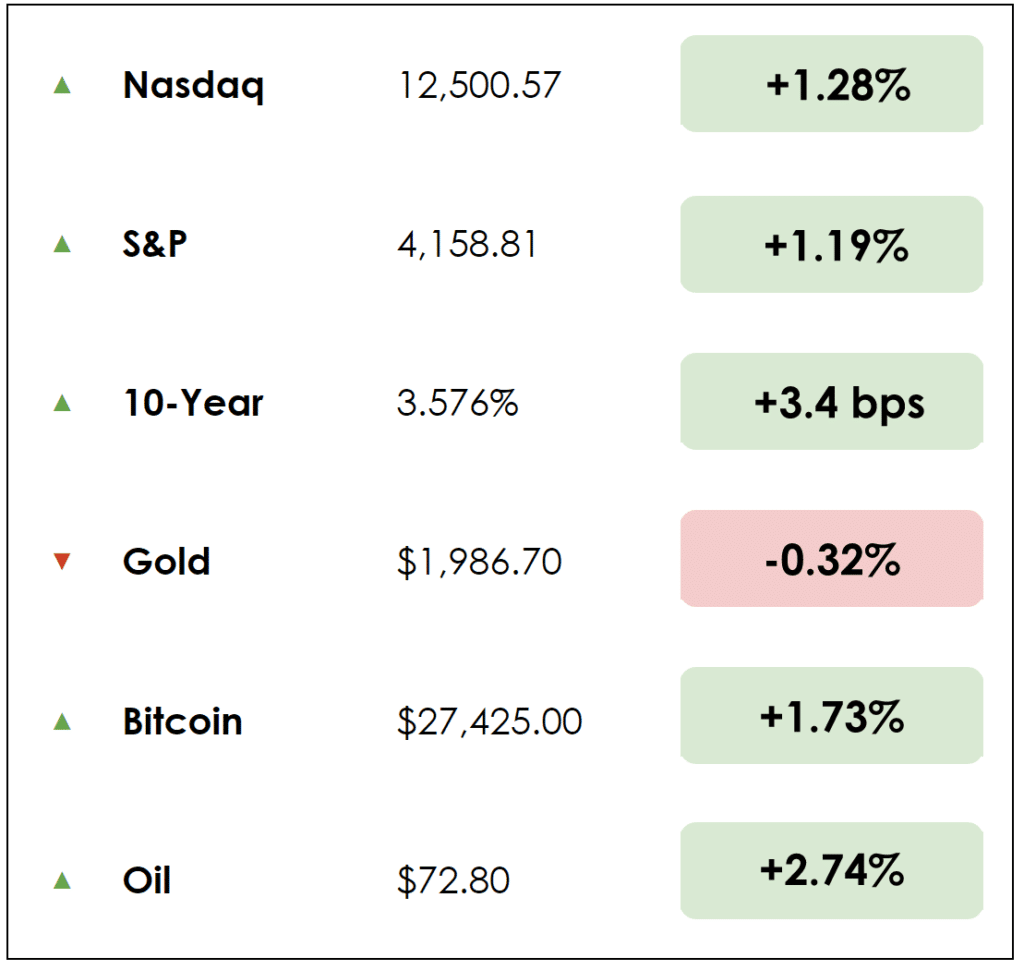

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Shell dives into deep sea oil exploration with AI

- A big stock index reshuffling

- Plus, our main story on the legend of Ben Graham

All this, and more, in just 5 minutes to read.

POP QUIZ

Which accomplished finance author is slated to release a book on the rise and fall of Sam Bankman-Fried and FTX this October?

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🪸 Shell Dives into Deep Sea Oil Exploration with Cutting-Edge AI Tech (Reuters)

Shell (SHEL) is set to partner with big-data analytics firm SparkCognition, employing AI-driven technology in deep sea exploration and production to enhance offshore oil yields.

Shell, the leading oil producer in the U.S. Gulf of Mexico, will utilize SparkCognition’s AI algorithms to process and scrutinize vast quantities of seismic data in search of undiscovered oil reservoirs.

- “We are committed to finding new and innovative ways to reinvent our exploration ways of working,” said Shell’s VP of Innovation and Performance.

Why it matters:

The objective is to improve operational efficiency, speed, success in exploration, and increase production. The new method could trim exploration times from nine months to under nine days.

The technology is designed to produce subsurface images using fewer seismic data scans than typically required, promoting deep sea preservation.

- Seismic technology employs sound waves to examine subsurface areas.

Reducing seismic surveys expedites the exploration workflow and cuts costs related to high-performance computing.

- “Generative AI for seismic imaging can revolutionize the exploration process with extensive implications,” stated Bruce Porter, Chief Science Officer for SparkCognition.

🥊 Meta, Alphabet Poised to Get Knocked Out of Value Index (WSJ)

Next month, the stock market will endure a sizable reshuffling: The index provider, FTSE Russell, will rebalance its stock benchmarks.

Given that many mutual funds and ETFs track these indexes, a change in the underlying benchmark forces these funds to adjust their holdings to ensure tracking accuracy, sending ripples through markets that can influence trillions of dollars worth of investments.

Meta (Facebook’s parent company) and Alphabet (Google’s parent company) will likely be removed from the Russell 1000 Value index, per Goldman Sachs estimates.

- This would be a considerable change since Meta is the fourth-largest holding in the iShares Russell 1000 Value ETF.

- Ironically, Meta has also been in the Russell 1000 Growth index, and Goldman expects its weighting there to increase to 3% from 0.6%.

Why it matters:

While most would consider tech giants like Meta, Netflix, and PayPal growth stocks, value indexes typically use financial metrics to determine inclusion for “cheap” stocks. And last year, as valuations plummeted from all-time highs, these companies were moved into the value index due to their low price-to-book ratios.

- At the time of their inclusion in 2022, Meta had declined 53% year-to-date, with Netflix and PayPal falling 70% and 61%, respectively.

- To some, those drops were enough to make these flashy tech companies look like value-investing bargains.

With almost $4 trillion of assets under management benchmarked to Russell indexes, the reconstitution day, when index rebalancing is implemented, “typically concludes as one of the highest trading volume days of the year,” according to FTSE Russell.

MORE HEADLINES

🧑💻 Potential IRS e-filing service threatens the $14 billion tax prep industry

🩺 Senator Bernie Sanders renews Medicare for All campaign to fix “totally broken” healthcare system

😵💫 There were 54 U.S. corporate bankruptcies in April, the highest since 2010

The Intelligent Investor

Warren Buffett was 19 years old and a senior at the University of Nebraska when he read Ben Graham’s class, The Intelligent Investor. The book changed his life, shaped his investment philosophy, and led him to a $100 billion fortune.

He likened the moment to “Paul on the road to Damascus,” as he learned the philosophy of “buying $1 for 40 cents.”

Before reading the book, Buffett said, “I went the whole gamut. I collected charts, and I read all the technical stuff. I listened to tips. And then I picked up Graham’s The Intelligent Investor. That was like seeing the light.”

What was so special about Graham?

Meeting at Columbia

Buffett met his hero in 1950 when he enrolled in graduate school at Columbia University. “Next to my dad, Ben Graham had more impact certainly on my business life than any individual,” he’d say later.

What also intrigued Buffett was that Graham was more interested in the intellectual challenge of investing than in building a fortune. For both, it wasn’t all about getting rich.

After Buffet joined Graham’s firm, he said: “Money won’t make any difference to you and me. We won’t change. Only our wives will live better.”

When Buffett graduated from Columbia in 1951, Graham suggested postponing his investing career until the overheated market took a rest.

But Buffett started investing anyway; he understood from a young age that timing the market wasn’t a game he had any business playing.

“I had about 10 thousand bucks,” Buffett said (in today’s dollars, that’s about $115,000). “If I’d taken the advice, I’d probably still have about 10 thousand bucks.”

Stick to the principles

In writings, speeches, and interviews, Buffett has returned again and again to Graham.

“I consider there to be three basic ideas, ideas that if they are really ground into your intellectual framework, I don’t see how you could help but do reasonably well in stocks. None of them are complicated.”

Buffett continued: “None of them take mathematical talent or anything of the sort. (Graham) said you should look at stocks as small pieces of business. Look at (market) fluctuations as your friend rather than your enemy – profit from folly rather than participate in it.”

“And in (the last chapter of The Intelligent Investor) he said the three most important words of investing are ‘margin of safety.’ I think those ideas, 100 years from now, will still be regarded as the three cornerstones of sound investing.”

And Buffett is not concerned about Graham’s principles going stale:

“If principles can become dated, they’re not principles.”

Follow the leader

Buffett has said he’s “baffled” that many people know his philosophy but don’t follow it. Same with Berkshire Hathaway.

Says Buffett: “We tell our principles freely and write about them extensively in our annual reports. They are easy to learn. They should be easy to follow. But the only thing anyone wants to know is, ‘What are you buying today?’ Like graham, we are widely recognized but least followed.’”

Other lessons

Graham regularly taught at Columbia and the New York Institute of Finance. He never taught a class without current examples and was willing to share what others thought of as secrets.

Said Buffett: “It is sort of the ultimate generosity when you go out and teach someone something that is actually going to be harmful to your own commercial well-being, and I saw Ben do that.”

Graham and Buffett love math, but they warn against investors using charts, graphs, or formulas.

Graham often reminded investors that they own the companies they invest in and to think as owners, not stick pickers, an idea Buffett took to heart. A few other takeaways from Graham:

- Always Invest With a Margin of Safety

- Expect Volatility and Profit From It

- Know What Kind of Investor You Are

I (Matthew) majored in finance in business school, yet can’t recall one reference to Graham.

What gives?

As Buffett says, Graham’s theories are seldom included in college curricula because “it’s not difficult enough. So, instead, something is taught that is difficult but not useful. The business schools reward complex behavior more than simple behavior, but simple behavior is more effective.”

Added Buffett: “He was true north on a lot of people’s compass.”

Dive deeper

Check out The Intelligent Investor right here. Buffett especially recommends chapters 8 and 20.

TRIVIA ANSWER

Michael Lewis. The author of bestsellers like The Big Short and Moneyball has shadowed SBF for nearly a year in the Bahamas and California. “Going Infinite” comes out on Oct. 3.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.