Saving The Treasury Market

19 August 2022

Hey, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

You’ll find that things are a bit shorter today — we’re working on trimming the newsletter’s length down to be more digestible.

Oh, and by the way, we’re moving times. Look for We Study Markets to be delivered to your inbox, after U.S. markets close, in the evenings around 6pm EST 😎

Meme mania added a new chapter to its epic saga, and the movement’s patron saint, Ryan Cohen, Gamestop chairman and founder of Chewy, has taken a tragic turn.

After becoming the face of hope in fighting back against “evil hedge funds”, Cohen seemingly inspired thousands of traders to go all in on Bed Bath & Beyond stock after he revealed a sizable stake in the troubled retailer.

This helped push its price into a feverish 400% rise since its low in July, only to see the beloved Cohen pull out the rug from underneath the movement by selling out of his position at the peak.

So much for sticking it to Wall Street, many retail traders are left feeling the pain of their speculative bets — The stock fell more than 40% yesterday (including after-hours trading) after his sale became public.

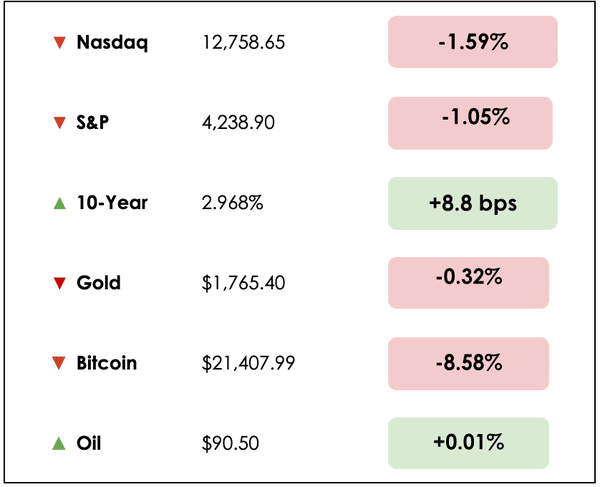

Here’s the market rundown for today:

*All prices as of this morning

Today, we’ll discuss a plan to save the Treasury market, new housing data, the Chinese stock not afraid of delisting risks in the U.S., and Walmart and Home Depot earnings.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

IN THE NEWS

🏪 Home Depot and Walmart Estimates Provide Hope (Fool)

Explained:

- Both Walmart (WMT) and Home Depot (HD) posted better-than-expected results, further fueling investor confidence in a continued market recovery.

- Walmart is the world’s largest private employer and generates roughly $500 billion in annual spending in the U.S. Its earnings results serve as a key indicator of the health of the U.S. economy. When the company cut its guidance three weeks ago, it sent the S&P 500 down more than 1%, as investors saw it as a sign that the U.S. economy was inching toward a recession.

- The retail giant posted better-than-expected results as comparable sales and operating margins came in higher than was anticipated. WMT is still expecting a decline, though, in adjusted earnings per share of between 9% and 11%.

What to know:

- Home Depot’s earnings another indicator worth watching. The largest home improvement retailer in the U.S. generated roughly $130 billion in revenue, representing a significant percentage of discretionary consumer spending. Comparable sales rose 5.8%, driving revenue up 6.5% to $43.8 billion.

- Both retailers appear to be in solid shape for the second half of the year, and the strong comparable sales growth at both companies indicates consumers are as well.

🏡 Home Sales Continue to Fall (Reuters)

Explained:

- U.S. existing home sales fell to a two-year low, providing further evidence that the Fed’s bumps in interest rates have been dampening demand. We’ve now had six straight months of declining home sales as higher mortgage rates and a shortage of homes for sale are cooling down the market.

- Lawrence Yen, the chief economist for the National Association of Realtors, said, “We are in a housing recession.” Sales of previously owned homes dropped 5.9% in July from the previous month, while housing starts fell 9.6%. Almost 16% of home-purchase agreements fell through last month.

What to know:

- As the Fed attempts to bring inflation back to its stated goal of 2%, its policy rate has risen by 225 basis points (2.25%). A 30-year fixed rate mortgage is hovering at around 5.2%, up from 3.22% at the start of the year.

- Home builder confidence fell for the eighth straight month to the lowest levels since May 2020. One-fifth of builders have reduced prices in the past month.

- The median sales price of a home fell to $403,800 in July from a record of $413,800 in June, which was the first decline since January.

🇨🇳 China’s GigaCloud Goes Public in the U.S. (WSJ)

Explained:

- Chinese e-commerce company, GigaCloud Technology (GCT), bucked recent trends and debuted on the Nasdaq stock exchange yesterday. The Hong Kong-based online marketplace provider surged 28% on its opening day.

- The company sources large items such as furniture, appliances, and fitness equipment and sells them to U.S., European, and Japanese retailers. The company counts the U.S. as its largest market, providing 50% of its revenue.

What to know:

- Chinese companies have been hesitant to tap the U.S. market to sell shares, as regulators in Washington threaten the need for financial audits, increasing the risk of delisting for Chinese companies.

- A ten-year battle between Washington and Beijing over audits is heating up, and it may boot Chinese companies who don’t comply with financial reporting requirements from U.S. stock exchanges. U.S. accounting regulators cannot inspect Chinese companies’ audit working papers, and failing to do so for three consecutive years will result in delisting from U.S. exchanges.

- GigaCloud said it is willing to change auditors, though, if needed to comply with U.S. financial regulations.

FEATURED SPONSOR

Are you worried about inflation? There are few better ways to beat inflation than real estate, but even real estate isn’t all sunshine and rainbows. Learn about the red flags from PassiveInvesting.com.

DIVE DEEPER: A PLAN FOR TREASURY MARKET STABILITY

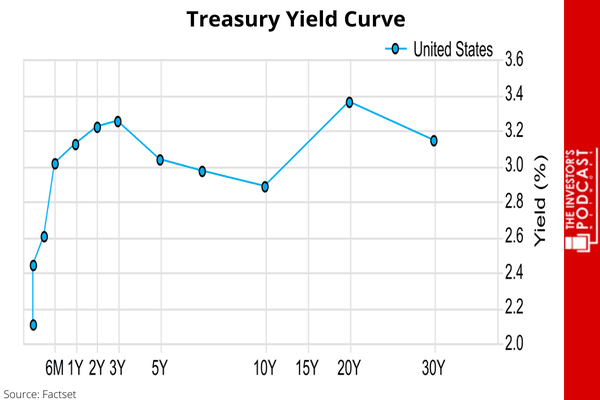

As the Fed has begun quantitative tightening (the opposite of quantitative easing) which drains liquidity from the financial system, this has created a strain on the most important financial market in the world, the U.S. Treasury market.

Breaking it down

To understand this issue better, and learn about possible solutions, we turned to none other than central banking expert, “Fed Guy”, Joseph Wang.

In response to market disruptions from quantitative tightening, as the Fed seeks to raise interest rates across the yield curve and suppress inflation, Wang proposes that the Treasury Department could mitigate bond market volatility through bond buybacks.

In times of fiscal surplus, this means using the surplus to buyback Treasury bonds in the secondary market from private investors to reduce the national burden of interest on public debt.

Of course, we’re nowhere near running a fiscal surplus though (more tax revenue than government spending), but the Treasury could instead issue short-term bills to fund buybacks of older Treasury bonds.

This would serve to create a bid for off-the-run Treasuries similar to the way quantitative easing (Federal Reserve purchases of long-dated bonds) has backstopped bond prices for the past few years.

What’s the issue?

Buybacks by the Treasury Department last occurred in the year 2000, though the idea has been resurrected recently in response to choppiness in Treasury markets.

Market liquidity here has fallen to historically low levels that Wang calls “anemic.” The hope, then, is that such a buyback program would add enough liquidity to stabilize prices and reduce future issuance costs for the federal government.

The concern

Should inflation prove persistent, rates are likely to continue trending higher, which coupled with low liquidity, is a recipe for pain for bond market investors.

This comes just at a time when the government’s spending and debt issuance needs remain quite high.

This is, in part, due to top-down efforts to subsidize industries important to competition with China and for funding the U.S. military and its allies as geopolitical tensions rise.

The Treasury market’s health underpins much of the broader financial system, as measured by liquidity and price stability, so if these measures continue to deteriorate, rallies in other markets are likely to be unsustainable.

What to know

Wang argues that new issuances of shorter-term bills, as part of a Treasury buyback program, would be easily soaked up by money market funds.

At the same time, the program would buy up lower coupon bonds issued during the pandemic that investors don’t want anymore as interest rates rise.

This would also free the Federal Reserve to focus more on its monetary policy aims, rather than being held up by complications in the Treasury market.

Wang says that the Treasury Department can effectively re-shuffle its debt profile by up to $1 trillion, though “Treasury issuance is expected to grow by over $1 trillion+ a year forever. No amount of buybacks can support an asset whose supply is virtually infinite. That’s a job for someone else (the Federal Reserve).”

Wrap up

Let us know what you think — Is there anything we’re missing in this assessment?

For Wang’s full commentary, you can find it here. And don’t miss Clay Finck’s interview with him on Millennial Investing episode 190.

Please also take a moment to fill out our reader survey — we’d love to get to know you better!

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later and enjoy the weekend!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12 pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.