Saving Goldman Sachs

Hi, The Investor’s Podcast Network Community!

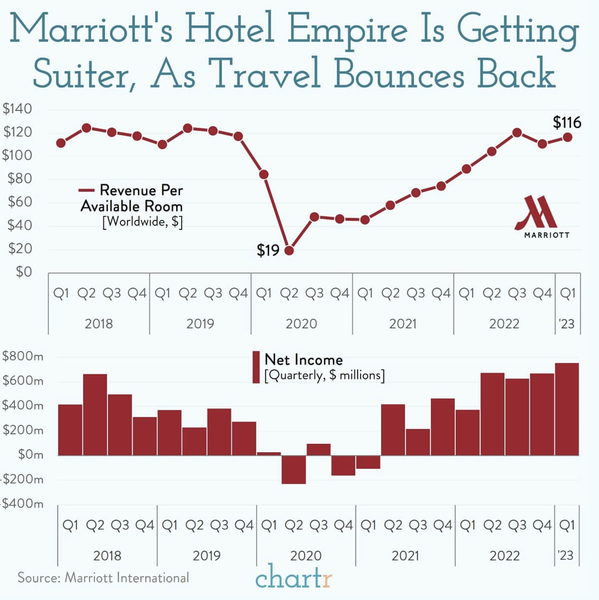

🏨 What recession? The hotel empire Marriott International says it isn’t seeing signs of one.

Earlier this week, the company reported a 34% annual increase in revenue to $5.6 billion. Boasting some 30 hotel brands, Marriott controls over 5,800 properties with more than 1.5 million rooms. It’s an inspiring pandemic recovery story (see our Chart of the Day for a depiction).

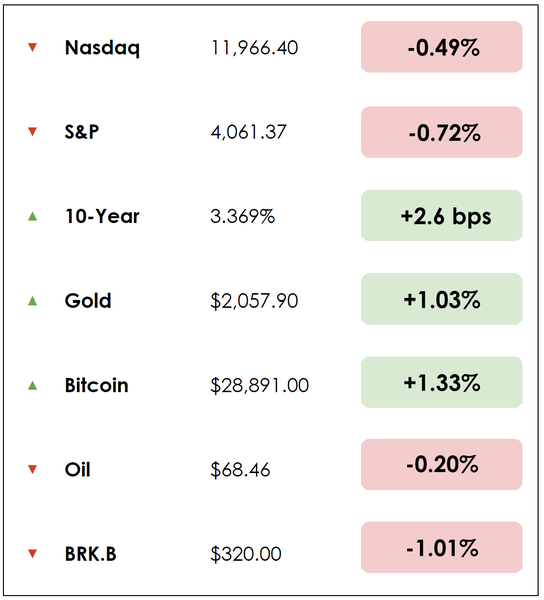

Broadly, stocks fell again Thursday, continuing a slide to start the month of May. On a positive note, Apple beat soft expectations for sales and revenue, driven by stronger-than-anticipated iPhone sales.

The tech giant also increased their dividend for the 11th consecutive year and announced an additional $90 billion stock buyback plan 📱

—Shawn & Matthew

Here’s the rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Why Warren Buffett & Berkshire are piling into energy

- The Fed’s latest move and what it means

- Plus, it’s day four of Berkshire week, featuring our main story on how Warren Buffett once saved Goldman Sachs

All this, and more, in just 5 minutes to read.

Today’s trivia: How many banks failed during the Great Financial Crisis?

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Real estate investing, made simple.

17% historical returns*

Minimums as low as $5k.

EquityMultiple helps investors easily diversify beyond stocks and bonds, and build wealth through streamlined CRE investing.

*Past performance doesn’t guarantee future results. Visit equitymultiple.com for full disclosures

IN THE NEWS

⛽ Why Berkshire Is Piling Into Energy (WSJ)

This weekend, we might learn precise answers as to why Berkshire Hathaway has gobbled up billions of dollars of stock in big oil companies. Why?

- Buffett admitted years ago that he was “dead wrong” on his ConocoPhillips investment in 2008. In 2015, after another oil loss on Exxon, Buffett said: “We will not be buying, very often, oil and gas stocks.”

- But then, last year, Buffett built a new $39 billion bet on Occidental Petroleum and increased his stake in Chevron. Berkshire has become both Occidental and Chevron’s biggest shareholder, and energy shares made up about 14% of Berkshire’s stock portfolio at the end of 2022—the highest share going back to at least 2000.

Why it matters:

It hasn’t been all smooth sailing thus far. U.S. crude oil prices have fallen to around $69 a barrel after surging above $130 a barrel last year following Russia’s invasion of Ukraine.

- Occidental likely caught Berkshire’s eye because it recently paid down its debt load, paid dividends, and bought back stock, practices that often resonate with Buffett.

It’s also possible that Buffett isn’t counting on rising oil prices from here. He may be wagering that oil prices will stay within a certain range that makes profits possible for oil companies, said Mohnish Pabrai, founder of the Pabrai Investments Funds and a Berkshire shareholder who met Buffett in 2008.

- Occidental, for instance, has said it can turn a profit with oil as low as $40 a barrel.

- Buffett and Munger have built Berkshire for the long haul, Pabrai said. Their oil investment is the same.

Adds Pabrai: “When you think about the railroad—100 years from now, it’ll still be cranking,” he said, referring to Berkshire’s BNSF Railway business. “The utilities—they’re going to be around for a long time,” he said, referring to Berkshire Hathaway Energy. “They’re not going to chase the latest fad,” Pabrai said. “They’re as much as possible looking for no-brainers.”

🎓 Insight on the Fed’s Latest Move (NYT)

The Fed raised rates by a quarter point this week, bringing them above 5% for the first time in more than 15 years.

They also opened the door to pausing rate increases as their policies, combined with bank turmoil, weighed down the economy.

Central bankers lifted rates to a range of 5 to 5.25 percent, a level they had not reached since the summer of 2007. The move capped the fastest series of rate increases since the 1980s.

- Now, they could stop raising interest rates at the next meeting — perhaps as soon as they gather on June 13-14.

Why it matters:

The Fed is trying to ease inflation by cooling the economy without putting it in a deep freeze. Officials don’t want unemployment to soar more than necessary to wrestle price increases under control.

- The challenge is figuring out how much more economic cooling will ensue in summer and fall with no more rate hikes.

- “We have credit conditions tightening not just in the normal way, but perhaps a little bit more,” Fed Chair Jerome Powell said. “We have to factor all of that in.”

Added one analyst: “It’s not like inflation is going to suddenly start cooling,” she said. “But the economy will be cooling and the banking distress will remain front and center, and that will add to the credit tightening the economy has to absorb.”

In addition, Powell was repeatedly asked about the debt limit. If Congress failed to raise the limit, he said, no one should have confidence that the central bank could use its powers to stem the fallout.

- “We shouldn’t even be talking about a world in which the U.S. doesn’t pay its bills.”

MORE HEADLINES

🏦 European Central Bank raises rates by 25 basis points, slowing the pace of hikes

🚫 First Horizon Bank shares tumble 40% after TD bank merger fails

🚗 Volkswagen’s EV sales surge 42% despite slump in China, and Ferrari profit jumps 24%

Capitalizing on crises

Said former U.S. President John F. Kennedy, “The Chinese use two brush strokes to write the word ‘crisis.’ One brush stroke stands for danger; the other for opportunity. In a crisis, be aware of the danger — but recognize the opportunity.”

One man has become particularly famous for internalizing this lesson, waiting patiently for years until crisis brews and capitalizing on opportunities that, under normal circumstances, would be unworkable.

In keeping with this week’s theme, while also on my way to Omaha for Saturday’s annual Berkshire Hathaway shareholder meeting, I (Shawn) would like to highlight Buffett’s most famous and arguably most consequential crisis intervention.

That is, Buffett’s efforts to “bail out” the banking system in 2008, which possibly saved the storied Goldman Sachs — much to his (and Berkshire’s) profit.

How did this play out in 2008?

Flashing back to the darkest hours of the Great Financial Crisis, government officials, namely Treasury Secretary Hank Paulson, raced against the clock to orchestrate deals to save America’s largest financial institutions.

While the global monetary system teetered on the brink of collapse, most investors and corporates were scrambling to protect their balance sheets, yet one man stood ready to help re-capitalize the big banks.

In an interview, Buffett remarked, “It was something we hadn’t seen before. The system had stopped. I describe it as an economic Pearl Harbor, except it was the economy that had gotten hit by an unbelievable force.”

Buffett’s Berkshire Hathaway poured $5 billion into Goldman Sachs.

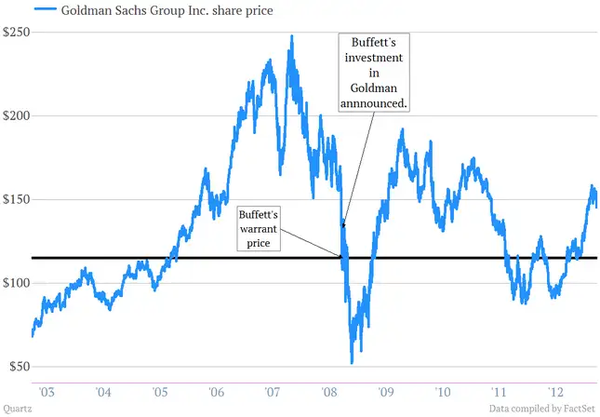

In exchange for the much-needed investment, Goldman gave Berkshire $5 billion worth of preferred stock paying a 10% annual dividend, in addition to warrants that enabled Berkshire to buy up to 43.5 million shares of common stock at a price of $115 in the ensuing five years.

Big payday

It was a brilliant investment: Buffett’s name alone restored confidence in the bank, while the warrants provided a chance for additional upside — if Goldman’s stock could avoid returning to crisis lows and trade above $115 per share, Berkshire could load up on shares at a discount and sell them for a guaranteed profit.

At the 2010 shareholder meeting, Buffett celebrated the deal. “Every day that goes by that Goldman doesn’t call our preferred is money in the bank,” since Goldman had to pay Berkshire a $500 million yearly dividend until it could buy back the preferred shares.

Buffett added, “It’s been pointed out that our preferred is paying us $15 a second. So as we sit here, tick, tick, tick, tick, that’s $15 every tick. I don’t want those ticks to go away. I just love them. They go on at night when I sleep.”

Eventually, the ticks came to an end. Goldman bought back the preferred shares in March 2011, repaying the $5 billion principal with a $500 million additional premium for doing so early, plus $140 million in accrued dividends. Ultimately, Goldman paid Buffet nearly $1.2 billion in dividends alone.

Before accounting for the warrants, Berkshire garnered a roughly 35% return from investing in Goldman’s preferred shares.

In 2013, Goldman renegotiated the warrants before Buffett exercised them, giving Berkshire a smaller stake of 13.1 million shares (about 3% ownership of Goldman) at no cost and a $2 billion cash payout, as opposed to allowing Buffett to buy over 40 million shares at a discount as originally designed.

A great deal (in hindsight)

Let me emphasize that performing well enough under pressure, and capitalizing on opportunities of this scale, requires tremendous foresight and discipline. It necessitates sacking money away when everyone else is getting rich on things like tech stocks, real estate, or, more recently, crypto.

Easier said than done, especially in the moment.

Instead, opting to build up enough savings, at the expense of current returns, to exploit opportunities when the world is seemingly imploding.

If Buffett hadn’t diligently ensured Berkshire had a sufficient cash pile, earned over many decades, such a deal with Goldman would never have been possible.

Put differently, you need the foresight and self-control to forsake chasing profits today, with an almost monk-like devotion to waiting for inevitable crises to emerge.

Again, easier said than done when a crisis could be either six weeks, six months, or six years away. And then, when the moment comes, having the courage and clarity of mind to act decisively.

This is what makes Buffett’s actions in 2008 so remarkable — a testament to principled and disciplined actions over a lifetime that uniquely positioned him to help with the rescue plan in one of America’s worst moments.

Dive deeper

Step back in time to 2008 with this account of the deal from the New York Times, or you can read Goldman’s perspective on the deal here.