Pursuit of Happiness

Hi, The Investor’s Podcast Network Community!

“How low can stocks go?”

That was the ominous headline on the front page of The Wall Street Journal 14 years ago this week, in early March 2009, at (or near) peak pessimism.

You know what happened from there.

At the time, few people not named Warren Buffett were bullish on U.S. equities. Yet it turned out to be the market bottom of the Great Financial Crisis and a generational buying opportunity.

Loving this newsletter? Why not forward it to a friend. They can sign up here.

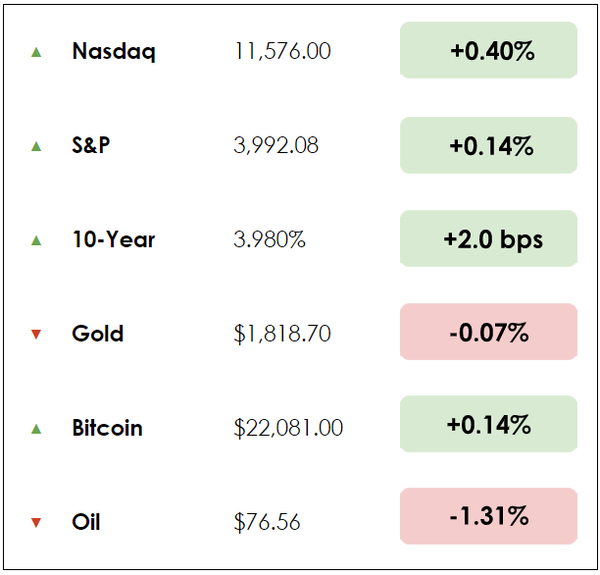

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- International stocks back in vogue?

- Maybe, money really does lead to happiness

- Plus, our main story on podcast host Clay Finck

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

🌍 International Stocks Lure Bargain-Seeking Investors (WSJ)

Explained:

- U.S. stock indexes are enjoying a nice start to 2023, but investors are looking overseas for bargains. They’ve added over $14 billion to mutual funds and ETFs that buy international stocks while pulling $34 billion from domestic stock funds.

- This has boosted stocks worldwide, with the MSCI All Country World ex USA index climbing 5.1% this year on a U.S. dollar basis, beating the S&P 500’s 3.8% gain. Regional indexes have done even better, though: The Stoxx Europe 600 is up 7.2%, the Shanghai Composite is up 6.2%, the UK’s FTSE 100 has climbed 4.5%, and Japan’s Nikkei 225 is up 4.4%.

- U.S. stocks outperformed their international peers for more than a decade following the 2008 financial crisis, but that run ended last year. And 2023 is set to continue this new trend in favor of global equities, partly, because of the relative discounts offered abroad.

- Companies in the S&P 500 trade at roughly 18 times projected earnings over the next 12 months, while this multiple is 13 in Europe and 10 in Hong Kong on a local currency basis.

Why it matters:

- The outflows from U.S.-focused funds signal a lack of confidence in this year’s rally, as the Fed remains steadfast in its commitment to boosting rates, slowing the economy, and moderating euphoric outbreaks in the stock market. Investors pulled money from domestic equity funds for nine consecutive weeks, the longest such streak since 2016.

- Outflows from domestic funds alone aren’t necessarily noteworthy at a time when investors can earn a 5.28% guaranteed annualized return simply by owning six-month Treasury bills, which compares to the 1.7% average dividend yield offered by the stocks in the S&P 500.

- But the inflows into international stock funds are a rare bright spot, with dividend stocks and small caps being the only other equity fund categories that have attracted cash on a net basis this year, according to Refinitiv Lipper.

🌈 Maybe Money Does Buy Happiness? (Bloomberg)

Explained:

- We often hear that “money doesn’t buy happiness,” which is true to an extent. Usually, such comments are followed up by an explanation that “after earning $75,000 a year, more money doesn’t make people happier.”

- In other words, once you can afford the basics of a middle-class lifestyle, extra income can’t do much to make you truly happier. The Nobel Prize-winning psychologists who studied this phenomenon called it the “happiness plateau.”

- A new study of 33,000 Americans found, though, that contentedness does increase steadily with incomes and even accelerates as pay exceeds $100,000 a year. The results contradict a famous 2010 paper by the renowned psychologist Daniel Kahneman and economist Angus Deaton, which found that happiness rose with income until flattening between $60,000 and $90,000 per year.

- The new study finds that there’s still a plateau, but only among the unhappiest 20% of people. For this set of troubled people, “the miseries that remain aren’t alleviated by high income.”

Why it matters:

- The finding that for most Americans, more money really does mean more happiness, stands at odds with conventional wisdom, at least since the Kahneman and Deaton study was released. For Americans with a baseline happiness in the top 30%, happiness accelerates as incomes rise beyond six figures.

- One interesting conclusion: “An approximately four-fold difference in income is about equal to the effect of a weekend.” The two days off at the end of each week are apparently quite valuable.

- Money isn’t everything, but at least we can now acknowledge honestly that the relationship between money and happiness likely extends further than previously thought by academics.

WHAT ELSE WE’RE INTO

📺 WATCH: Digital minimalism and reducing phone use before bed.

👂 LISTEN: Investing legend Bill Gurley on rules and outliers.

📖 READ: The Psychology of Money blog post that became a book.

Highlighting our podcast hosts

Today, we bring you something new. We’re launching a spotlight series to introduce you to some of the people that make the Investor’s Podcast Network go.

In the first edition, we offer a glimpse into the life of one of our podcast hosts, Clay Finck, who has recorded many fascinating stories on his podcast including: the Jeff Bezos/Amazon origin story, insights from Warren Buffett, and how Airbnb has soared since its founding in 2008.

Clay’s an avid reader and thinker. He graduated from the University of Nebraska-Lincoln with a degree in Actuarial Science and minors in Mathematics, Finance, and Economics.

Before joining The Investor’s Podcast, he became an Associate of the Society of Actuaries and developed a deep interest in value investing on the side.

Clay enjoys educating others about financial literacy, personal finance, stock investing, Bitcoin, and personal development. In his free time, he enjoys going to the gym, playing basketball, listening to podcasts, and spending time with friends and family.

In early May, he’ll make the short drive from his Lincoln, Nebraska home to the 2023 Berkshire Hathaway Annual Meeting, which will be his fourth time at the event. He’d love to meet you at one of our events.

Clay is active on Twitter and Instagram with relevant investing wisdom.

Without further ado, here’s how Clay got involved here and his process as a podcast host.

How did you get involved with The Investor’s Podcast?

“I’ve been a long-time listener and fan of The Investor’s Podcast Network. After working as an Actuary for a few years after college, I got an email from Robert Leonard announcing that The Investor’s Podcast was hiring a new host for the Millennial Investing Podcast.

At first, I hesitated as I never imagined myself being a podcast host, but I didn’t want to pass up the incredible opportunity.

I applied for the job, managed to talk them into hiring me, and the rest is history. I couldn’t be more grateful for the opportunity to work on projects I enjoy and get paid for studying the subject of investing.”

What experiences or people shaped your interest in markets and investing?

“I’ve always been drawn to understanding math and numbers, so investing naturally became a passion of mine. Initially, I learned a lot of the basics from Preston and Stig through the podcasts and BuffettsBooks.com.

They have a way of explaining things in a way that is simple to understand. They also made learning about investing a fun and enjoyable experience. Super investors I’ve studied that also impacted me were Warren Buffett, Ray Dalio, Howard Marks, Nick Sleep, and Terry Smith.”

What’s the best investing-related book(s) you’ve read?

“There are many to choose from, but two of my favorites are The Price of Tomorrow by Jeff Booth and Where The Money Is by Adam Seessel.”

How do you come up with podcast topics? What’s the overall process from start to finish?

“I honestly just follow my curiosity and inspiration. Many times I go into my week not knowing what subject I’m going to research.

This approach has allowed me to naturally find things I wouldn’t have otherwise found. For example, on Twitter, I recently discovered Mark Leonard and Constellation Software, which is based out of Toronto, Canada.

After I did my initial research on the company, I became enamored with the work they were doing, so I decided to record an episode on them.

My typical episode includes me reading a book or researching an investor, taking notes, and recording the episode. Then I send the recording to our audio team for editing. Before the episode is released, I’ll make the final touches to the audio.”

What’s the most overlooked/misunderstood part of investing?

“I often get asked what will happen to the stock market/economy over the coming year. I don’t know, and nobody else does either.

Thankfully, you don’t have to know to be a successful long-term investor. If Warren Buffett and Howard Marks don’t try and time the market, why does anyone else think they can?

I’m confident that continually buying and holding high-quality, profitable companies or low-cost index funds for the long term will continue to be a sound investment strategy.”

What have been your favorite episodes you’ve released on the We Study Billionaires Podcast?

“Episode 526: Quality Investing: Lessons from Terry Smith Episode 492: The Best Investor You’ve Ever Heard Of (Nick Sleep)”

Dive Deeper

If you enjoyed getting a glimpse into the life of a professional podcast host, make sure to follow Clay’s episodes on our We Study Billionaires show on whatever app you use for podcasts!

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.