Pump-and-Dump

15 December 2022

Hi, The Investor’s Podcast Network Community!

Well, that didn’t take long 😐

After an encouraging CPI print and a smaller rate hike, recession fears are back. The Dow fell about 700 points, and tech stocks were hit even harder.

If it feels like big swings have become common this year, you’re right.

Today marked the Nasdaq’s 84th move of 2% or more in either direction. That’s now more than in 2008 and on pace for the most such moves since 2002.

After years of easy money and stimulus, volatility has gripped markets.

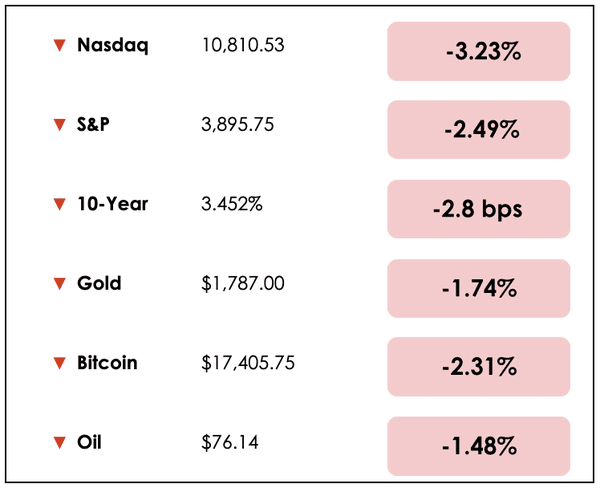

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: Why the risk of Chinese stocks being delisted has fallen, and the influencers caught up in a pump-and-dump scheme, plus our main story on the crises in “crypto.”

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

⛔ DOJ, SEC Charges Social Media Influencers (WSJ)

Explained:

- Prosecutors from the Department of Justices (DOJ) and the Securities and Exchange Commission (SEC) charged eight social media influencers over an alleged stock manipulation scheme. The influencers used their sizable Twitter followings to alter stock prices in a pump-and-dump scheme to earn more than $100 million combined.

- The scheme has occurred since at least January 2020. The influencers encouraged their audiences to buy certain stocks, mostly over-the-counter securities, without sharing their intent to dump them after share prices climbed.

- Each influencer had more than 100,000 followers on Twitter. One had more than 340,000 followers, and another influencer — who made several million on one pump-and-done alone — had nearly 550,000 followers.

Why it matters:

- The influencers mainly built their large audiences during the pandemic, when retail investors swarmed into trading volatile stocks for big gains. But Joseph Sansone, chief of the SEC enforcement division’s market abuse unit, noted that the defendants took advantage of their large followings to earn big paydays.

- The complaint read: “To their legions of followers on social media, the eight defendants have, for years, promoted themselves as trustworthy stock-picking gurus. In reality, they are seasoned stock manipulators.”

- The charges Wednesday followed the SEC’s actions against celebrities touting cryptocurrency: In October, Kim Kardashian agreed to settle charges from the SEC for promoting a cryptocurrency to investors without disclosing the money she was paid for the publicity.

✍️ Threat Of Delisting Chinese Stocks Eases (Bloomberg)

Explained:

- Nearly 200 companies based in China and Hong Kong no longer face imminent threats of being kicked off American stock exchanges.

- This comes after the U.S. Public Company Accounting Oversight Board revealed that its inspectors have been able to complete the necessary audits for these firms, including the likes of Alibaba (BABA) and JD.com.

- Due to security and confidentiality concerns, officials from China and Hong Kong had previously blocked external reviews of Chinese companies’ financials.

Why it matters:

- The recent announcement marks a major breakthrough in the long-running dispute, which became a political issue in 2020 after a U.S. law suggested these companies could be removed from the New York Stock Exchange (ICE) and Nasdaq (NDAQ).

- SEC Chair Gary Gensler applauded the pivot, saying, “This marks the first time that Chinese authorities allowed access for complete inspections and investigations meeting U.S. standards.” Investors have long been concerned about the quality of financial data for Chinese companies.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

THE MAIN STORY: WHAT THE “CRYPTO” CRASH MEANS FOR ETFS

Overview

From the collapse of the not-so-stable, stablecoin Terra Luna to the fall of Three Arrows Capital, Celsius, BlockFi, and FTX, it’s been a brutal year for the diverse space commonly known as “crypto.”

Add to this a year-to-date decline in Bitcoin of over 60%.

On our minds with this topic is a potential spot Bitcoin exchange-traded fund (ETF).

ETFs and trusts

Current Bitcoin-related ETFs are tied to futures contracts, which carry implicit costs that hinder their ability to accurately track Bitcoin’s price, possibly by as much as 10-12% or more per year.

Instead, investors hoping to purchase assets like Bitcoin more directly without custodying it themselves have relied on the Grayscale Bitcoin Trust (GBTC).

Unlike an ETF, though, this trust structure is less efficient. As a result, shares in this trust that hold Bitcoin on investors’ behalf can trade at wild discounts while enabling the trust’s managers to charge excessive fees (2% yearly) due to a lack of competition.

GBTC trades at a nearly 50% discount to its net asset value (NAV).

Spot ETF

James Seyffart of Bloomberg Intelligence argues that had a spot Bitcoin ETF been approved sooner, with Grayscale actually leading the charge in applying for one with the Securities and Exchange Commission (SEC), much of this devastation could’ve been avoided.

Because an easily accessible, well-regulated, and efficient investment product didn’t exist, as it would with a spot Bitcoin ETF, speculators ventured onto platforms like the crypto exchange FTX and digital asset lenders such as BlockFi and Celsius.

These platforms often promised yield on token deposits similar to interest payments in your bank account. An ETF, though, wouldn’t be able to speculatively use client funds to try and generate yield for customers.

Platform risks

As we’ve learned since, much of this yield was subsidized, coincidentally, by risky arbitrage bets on the Grayscale Bitcoin Trust’s discount to NAV closing.

Unlike your deposits at an FDIC-insured bank, at firms like BlockFi, your money isn’t. And the return of customer deposits now depends on how its bankruptcy hearings unfold.

It’s hard to think that an approved Bitcoin ETF wouldn’t have protected thousands, if not millions, of people from losing money on these less-regulated platforms.

Looking forward

Eric Balchunas, a senior ETF analyst at Bloomberg, believes that the outlook for approving a Bitcoin spot ETF could move in two directions.

He explains that FTX’s collapse vindicates concerns that SEC head Gary Gensler raised about trading in Bitcoin markets, which was used in part as a rationale for delaying a Bitcoin ETF.

However, the president or Congress may spur agencies like the SEC to address the issue with more regulation.

With this in mind, Seyffart still believes that a Bitcoin spot ETF is on the table for 2023.

The question, then, is whether there’ll be much investor appetite for it. Although the euphoria of 2021 has been swept away, the thesis for digital assets, particularly Bitcoin, remains unchanged.

For those who would like to invest in Bitcoin in retirement accounts and/or are uncomfortable trying to hold it directly themselves, such an ETF would be attractive.

On that second point, the same goes for institutions. Seyffart goes so far as to say that asset managers overseeing collectively trillions of dollars would almost certainly want some exposure.

More on GBTC

Jumping back to GBTC, while Grayscale hopes to convert the trust into a spot Bitcoin ETF, as Seyffart explains, there are now concerns over Grayscale’s parent company Digital Currency Group’s solvency.

Digital Currency Group (DCG) reportedly seeks to raise over $1 billion in emergency financing, sparking concerns over GBTC’s future. This has certainly contributed to the discount on GBTC’s shares.

It’s possible that DCG is forced to sell its “crown jewel” in Grayscale to another firm, perhaps one more embedded in traditional finance (Fidelity, Charles Schwab, etc.).

A worst-case scenario is that Grayscale is forced to liquidate GBTC.

Rather than distributing Bitcoin to all trust holders, more than 640,000 Bitcoin would be sold in the open market with cash proceeds returned.

This onslaught of selling would spawn an unprecedented wave of price pressure that would drive Bitcoin down and reduce the proceeds to GBTC holders.

Fortunately, that bleak dynamic seems unlikely. However, questions remain over how this will all unfold.

Takeaways

Should GBTC’s future be resolved, and especially if it’s allowed to convert to an ETF from a trust, its price would jump to match its net asset value.

In other words, there’s an opportunity for speculators to double their money should GBTC’s discount return to zero from nearly 50%.

For long-term holders, we’d encourage you to custody your Bitcoin yourself and not keep it in GBTC or on any exchange. We’ve found Unchained Capital to be very helpful in this regard.

Dive deeper

You can listen to the full podcast where James Seyffart shares his outlook here.

And to better understand the many crises in crypto this year, check out Preston Pysh’s interview with Dylan LeClair on Bitcoin Fundamentals.

RECOMMENDED READING

Web3 Daily is a (free) newsletter where you can find the most important and interesting Web3 and crypto news, written in a way that everyone can understand.

Get it straight to your inbox, Monday to Friday.

[ Sign Up Now ]

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.