Ponzi Origins

Hi, The Investor’s Podcast Network Community!

🎩 Today is the magician David Blaine’s birthday, famous for, among many other impressive feats, breaking the world record for holding his breath for 17 minutes.

But markets weren’t feeling the magic — the major stock indexes fell after new data for the number of job openings in the U.S. fell in February, dropping below 10 million for the first time in two years, a sign that demand for workers may finally be easing.

A few months ago, the same news might have spurred a rally at the prospect that a less tight job market could cool inflation.

After the recent banking failures, it adds to worries about a more vulnerable economy 💬

Here’s the rundown:

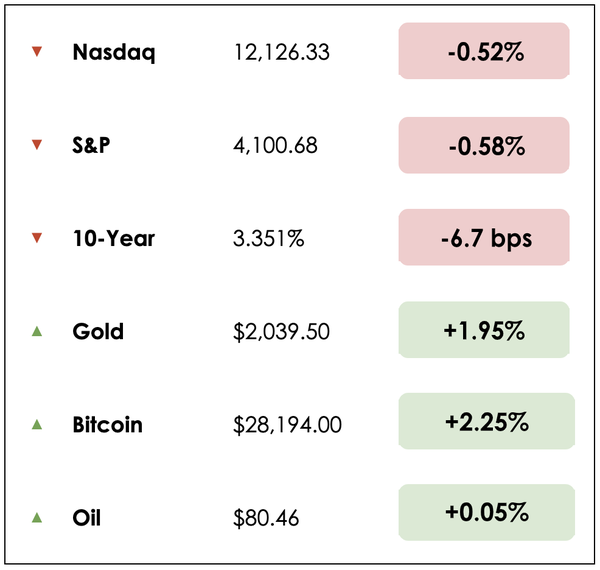

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Jamie Dimon’s recent shareholder letter

- Apartment building sales plummet

- Plus, our main story on the origins of the term “Ponzi scheme”

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Get ahead of the curve with the Stock Spotlight newsletter. Their expert team provides in-depth analysis on interesting companies with strong returns in the medium to long-term.

They don’t promise get-rich-quick schemes. Instead, they focus on proven principles of value investing to help you achieve sustainable growth. Their weekly analysis will you make informed decisions about your portfolio.

Don’t miss out:

IN THE NEWS

✉️ Jamie Dimon’s Shareholder Letter (JPM)

Explained:

In his annual letter to shareholders, JPMorgan chief executive Jamie Dimon said the effects of the banking crisis will be felt “for years to come.”

- “The current crisis is not yet over, and even when it is behind us, there will be repercussions from it for years to come,” Dimon said. “But importantly, recent events are nothing like what occurred during the 2008 global financial crisis,” he added in the letter released Tuesday.

- The recent banking issues in the U.S. began with the collapse of Silicon Valley Bank, which was closed by regulators on March 10 as depositors pulled tens of billions of dollars from the bank.

Why it matters:

JPMorgan and other large banks made $30 billion of deposits at First Republic, another regional lender investors feared could become the next SVB.

- The stress on the regional banks has led investors and analysts to suggest that the “too big to fail” institutions would be a beneficiary of the crisis, but Dimon said JPMorgan wants to strengthen the smaller banks for the benefit of the whole financial system.

“Any crisis that damages Americans’ trust in their banks damages all banks – a fact that was known even before this crisis. While it is true that this bank crisis ‘benefited’ larger banks due to the inflow of deposits they received from smaller institutions, the notion that this meltdown was good for them in any way is absurd,” Dimon wrote.

- Risks are abundant, and managing those risks requires constant and vigilant scrutiny as the world evolves,” Dimon wrote.

Dimon briefly touched on the need for investments in climate tech and resiliency programs amid the rise of artificial intelligence.

🏬 Apartment Building Sales Plummet (WSJ)

Explained:

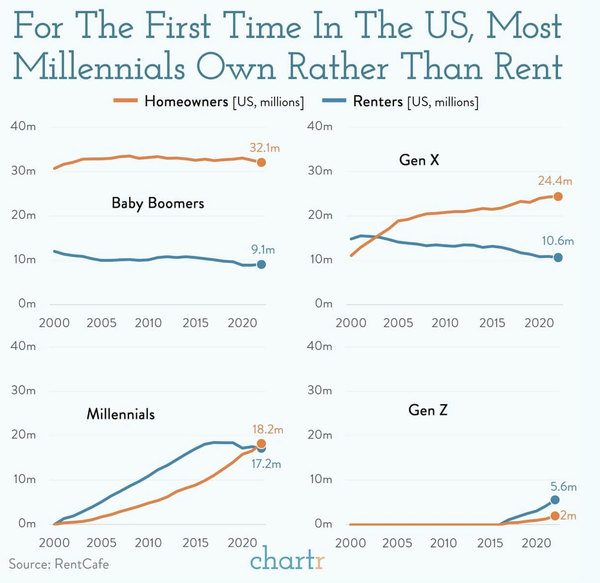

Interest-rate increases and banking upheaval have pushed down demand for multifamily buildings. And now, rents are running flat or declining in some metro areas.

Sales of rental apartment buildings are falling at the fastest rate since the subprime-mortgage crisis. It’s a sign that higher rates, regional banking turmoil, and slowing rent growth are undercutting demand for these buildings.

- Investors purchased $14 billion of apartment buildings in the first quarter of 2023. That’s a 74% decline in sales from the same quarter a year earlier and would be the largest annual sales decline for any quarter going back to a 77% drop in the first quarter of 2009.

Why it matters:

The recent drop in building sales follows a stretch of record-setting transactions that peaked in late 2021, when the multifamily sector was a top performer in commercial real estate.

- Investors top choices were in Sunbelt cities such as Dallas, Phoenix, and Tampa, where rental housing is largely unregulated and rents rose 20% or more annually until last year.

An upheaval in banking is also making it more challenging to buy buildings, investors and analysts said, as more lending institutions pull back or lend only at high rates.

- As a result, most apartment-building values are falling, and many landlords won’t sell at today’s lower prices.

MORE HEADLINES

🏦 World Bank warns of ‘lost decade’ for global economy

🌍 Climate hawks and Big Oil cheer geothermal energy

🎓 Was your degree really worth it? 56% of Americans don’t think so

An enduring legacy

When your name is associated with a household term decades after your death, your ability to transcend time can be either a really good thing or a really bad one.

The Italian-American immigrant Charles Ponzi, the inspiration for the term “Ponzi Scheme,” falls into the latter category.

Would you believe it if I told you that at one point, Ponzi had two-thirds of the Boston police force invested in his “business”?

Ponzi is a complex character, perhaps not as evil as you think. At least, that’s what Mitch Zuckoff found in researching his book Ponzi’s Scheme: The True Story of a Financial Legend, who says, “the deeper I went, the more I felt stirrings of sympathy” for Ponzi.

The real Ponzi

In 1903, Ponzi did what so many other young Italians were doing; he boarded a boat for America. From there, he had a varied resumé, working in a bank, as a translator, mining camp nurse, sign painter, grocery clerk, factory hand, dishwasher, and librarian.

In one instance, he was a hero: After an accident at a mining camp in Appalachia left a woman badly burnt, he offered up 72 square inches of skin off his thighs and another 50 off his back for skin grafts.

He spent months in the hospital recovering from the procedure, but it paid off, and he saved the woman’s life.

Not the sort of move you’d expect from history’s most famous fraudster.

Coupon arbitrage

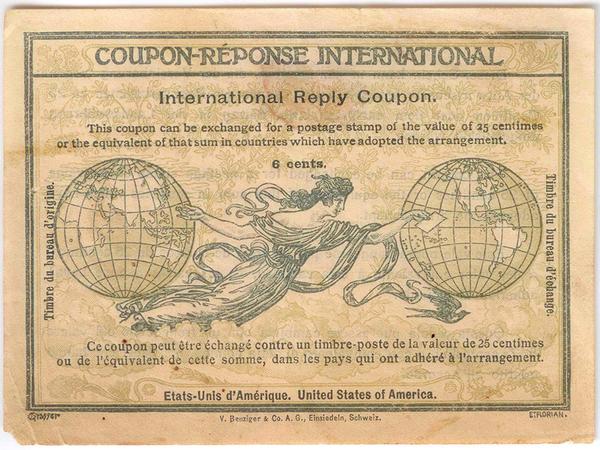

By 1919, Ponzi had spent 15 years trying to make it in the U.S. Now living in Boston, he was married, with an office downtown. One day, he opened his mail and out fell a little piece of paper known as an international reply coupon.

These coupons enabled people to buy stamps in other countries. For example, if Ponzi wanted to write to his family in Italy, he couldn’t send them U.S. stamps to use in response, nor could he mail them nickels because they would need Italian Lira to purchase domestic stamps.

So these international reply coupons were like vouchers that could be redeemed at post offices worldwide. Upon uncovering these coupons, Ponzi had a eureka moment shortly thereafter because of an arbitrage opportunity in their value.

Basically, the organization that set rates for these coupons failed to account for differences in inflation, meaning one might be able to buy 20 coupons in the U.S. for $1. In contrast, they could use the same $1 of purchasing power to buy 60 international reply coupons in Italy.

He could travel to Italy, buy the coupons at a relative discount, and then sell them for more in the U.S.

Diving into business

He didn’t have all the details figured out, such as how he would transport coupons at scale or who he would sell them to, but he knew he had a good idea.

He had enough details to convince investors to fund his coupon-arbitrage business, promising folks 50% returns in just three months.

The possible returns weren’t completely unrealistic given the price differences between international reply coupons, so it’s hard to say whether it began as an intentional fraud, naïveté, over-exuberance, or a combination of all three.

Ponzi’s scheme kept getting bigger in the meantime. At its peak in July 1920, he had taken in $6.5 million from 20,000 investors in a single month. With the funds, he bought himself all the trappings of 1920s life, from a Gatsby-esque mansion to a new limo.

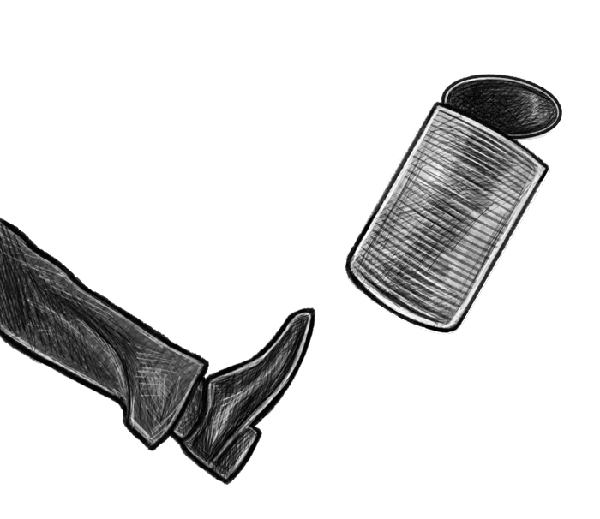

Kicking the can

He knew things couldn’t stay good forever, though, as he paid off new investors with funds raised from older ones.

When a court decided to freeze most of his bank accounts over a lawsuit, a bank run of sorts occurred, with thousands of people panicking and demanding to be paid back at his office.

Incredibly, Ponzi managed to calm them and pay everyone off, enabling himself to kick the can down the road a bit longer. But now he really had the authorities’ attention.

Yet, things were messy because he used investors’ funds to buy stakes in real businesses, even becoming an owner of several banks.

To stall regulators, he proposed a voluntary audit, but he knew he had to find some cash to plug the holes in his balance sheet.

Bank robbery

His not-so-brilliant plan was essentially a bank heist: He would go down to one of the banks he was an owner in, acquire access to the vault, and temporarily steal enough cash to complete the audit, which he would then return shortly after.

He was going to rob his own bank.

Regulators knew something was fishy, and they staked out the bank. Ponzi was declared hopelessly insolvent and overdrawn, and when the auditor finally finished his work, he owed $3 million more than he had.

Ponzi spent much of the next decade in jail, eventually dying in Brazil with $75 to his name.

Final thoughts

The Ponzi story is nothing new — it’s a manifestation of human nature.

Many fraudsters don’t intend to commit fraud when their endeavors begin, but a series of poor decisions wrapped up in human emotion can leave them deeply in trouble, looking for any temporary solution to make things “right” again.

If an investment seems too good to be true, well, it probably is.

Dive deeper

To learn more about Charles Ponzi, read Zuckoff’s book or listen to this podcast from NPR.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.