Podium Of Errors

17 November 2022

Hi, The Investor’s Podcast Network Community!

As details continue to pour out from the FTX collapse, it just gets uglier. And uglier 😪

With both stocks and bond prices down today, investors seem to be embracing a wait-and-see mentality for more news on how this financial contagion is spreading, while new comments from the Fed only fueled angst.

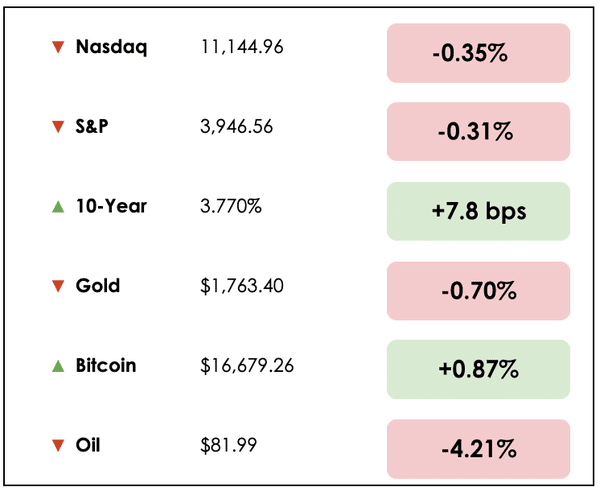

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two things in the news: The surprising resilience of corporate investment and London’s downfall as a global financial center, plus our main story on François Rochon.

All this, and more, in just 5 minutes to read.

(Working at The Investor’s Podcast Network comes with various unique benefits, such as the chance to work for yourself, meet expert investors, and optimize for happiness in your work-life balance. Want to learn more? Click here.)

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🤯 Companies Boost Capital Investment Despite Higher Rates (WSJ)

Explained:

- Even as recession worries and rising interest rates have weighed on corporate earnings this past quarter, capital spending among companies in the S&P 500 topped $200 billion. This represents a 20% increase from last year.

- One portfolio manager said that a company’s “biggest bang for (its) buck is typically investing in its own growth prospects.” While this is true, businesses typically cut expenditures and investments during tumultuous economic periods.

- Energy companies are ramping up spending at the fastest pace of any group in the S&P 500.

Why it matters:

- It may be surprising to see capital spending remain so strong. However, if companies with healthy balance sheets and positive free cash flows can still find prudent projects to undertake, they may be able to grow their market share while their competition is vulnerable.

- Despite ultra-low interest rates for much of the last decade, oil and gas producers minimized investment spending. Now, with energy prices considerably higher, new projects are attractive even if financed with more expensive debt, so these companies are adding meaningfully to the capital spending increases.

🇫🇷 France Challenges The UK For Title Of Europe’s Biggest Equities Market (FT)

Explained:

- The market value of all the companies listed in Paris has ballooned to over $2.83 trillion from just $1.8 trillion in 2016. London stocks have a total value of $2.89 trillion.

- William Wright, founder of the UK think-tank New Financial, said, “It’s the result of the poor performance of UK stocks, the poor pipeline and performance of UK new issues, and the terrible performance of the sterling. It’s clearly not great news for London — and Brexit is a big factor in all three.”

Why it matters:

- While UK policymakers were eager to illustrate the benefits of exiting the European Union trading bloc in 2016, since then, the British pound has fallen by nearly a fifth against the dollar while London’s dominance as a financial center has waned.

- All hope isn’t lost, though. In the last three years, 60 new listings have raised more than $100 million at a total valuation of $26 billion in the UK, as opposed to France’s 19 listings worth $8 billion over the same period.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

THE MAIN STORY: THE BEST OF THE BEST WITH FRANÇOIS ROCHON

Overview

We always look forward to new episodes of Richer, Wiser, Happier and recently sat down to listen to William Green’s interview with François Rochon.

Rochon is the president of Montreal-based Giverny Capital, who’s consistently beaten the market for over 30 years. Rochon Capital is a combination of personal and family accounts that he manages and has generated annual returns of over 14%.

He explains his mission as both an investor and an art collector is simply to buy the best of the best.

What I (Patrick) appreciated most from the interview was Rochon’s rational and clearheaded explanation about how the stock market works and what it takes to generate exceptional returns.

He’s also a broad thinker who reads deeply about philosophy, literature, psychology, and art.

Self Learning

Rochon was an engineer in 1992 and had always thought of the equity markets as a casino dominated by financial sharks.

That all changed when he read Peter Lynch’s One Up On Wall Street and learned it’s possible to buy a stock far below its intrinsic value. He was hooked on the concept of value investing and went on to read Lynch’s other book, Beating the Street, over ten times.

From there, he read The Intelligent Investor and devoured Warren Buffett’s annual letters. As Rochon explains, studying from the great masters of investing was just a logical thing to do.

Rochon’s passion for learning is evident in the interview.

Much like many investment greats, he reads widely from different disciplines because, as he says, “I’m just interested and curious and passionate. The more fields you understand, the better you can understand as a whole, the human race and human nature.”

Rule of Three

Rochon discussed the need for a long-term time horizon and not getting caught up in daily market fluctuations. The Rule of Three is a fundamental reminder he uses to stay humble and rational.

The rule states that a third of the stocks you purchase will likely do poorly. A third of the time, you’re going to underperform the index. And a third of the years, the stock market will fall by 10% or more.

Remembering the Rule of Three keeps himself grounded in recognizing how difficult it is to beat the stock market benchmarks over several decades, and it provides a framework for realistic expectations for his investors.

Current Portfolio

Rochon likes to buy shares in companies that are big enough and old enough to have a strong competitive advantage and wide moat but not so big that their future earnings growth is limited. He typically likes to hold roughly 20 to 25 companies.

To get an idea of the businesses he likes, check out the top holdings of his portfolio below:

Podium of errors

Each year, Rochon’s shareholder letter has a section he calls the “podium of errors.” He reviews his top three mistakes of the year in it and does as Charlie Munger suggests to, “rub your nose in your own mistakes.”

Once again, this practice fosters humility and respect for the market. Rochon discusses both his errors of commission and errors of omission. He reviews the stocks he bought that underperformed and those he should have bought in retrospect.

As he says, “you want to be sure that in the future we don’t make the same mistakes.”

Tribal genes

According to Rochon, for thousands of years, a tribal gene has been passed down from generation to generation. The gene gives us the urge to follow the tribe to ensure our own safety. 10,000 years ago, if a tiger entered a village, it was wise to run away with the herd and seek safety.

Based on his observations, Rochon feels that roughly 5% of individuals are born without the tribal gene. The missing gene allows them to go left when the rest of the tribe is going right.

The greatest investors in the world likely lack the tribal gene, which allows them to do their own independent thinking, stay true to their convictions, and generate returns above the market averages.

What to know

Rochon’s investment philosophy has remained very simple over his thirty-year career. As he wrote, “we own approximately 20 companies with solid balance sheets, conservative accounting, a durable competitive advantage, and a management team dedicated to shareholders.”

Rochon is a legendary investor who has modeled his career on investment giants like Buffett, Graham, and Lynch, and his passion is contagious.

Dive deeper

To learn even more about his strategies and philosophies, check out his fascinating interview with William Green on Richer, Wiser, Happier.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.