Mother Of All Evil

20 October 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

❌ The much-discussed saga in the U.K. continues with another shocking turn: Prime Minister Liz Truss is out, and this marks the fastest resignation in the country’s history.

Currency strategist Geoffrey Yu said, “Markets are calling the shots right now,” and it certainly seems that way. We’ll find out soon whether this high-stakes political move restores order to financial markets in the U.K.

💰 By the way, in case you missed it yesterday, we are hosting a stock pitch competition, and you could win $1,000 plus a bunch of other cool stuff.

Sounds fun, right?

Congratulations, because you’ve already completed the first part of the challenge (being signed up for this newsletter), now show us your investing skills.

Click here to learn how to compete and claim your prize money, or you can just tell a friend who may be interested.

Good luck!

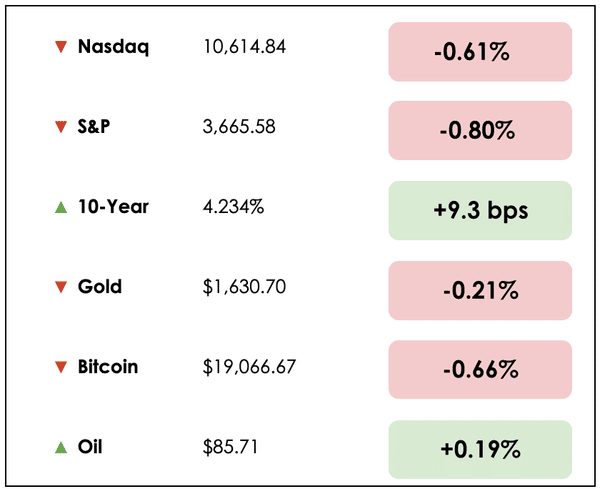

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss more signs of trouble in the housing market, the country that’s still lowering interest rates despite record inflation, and the reasons why you can still lose money even when you’re right in investing.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🏠 Existing Home Sales in the U.S. Extend Decline (WSJ)

Explained:

- Sales of previously owned U.S. homes fell for an eighth straight month in September, underscoring how soaring mortgage rates are hampering the housing market.

- The stretch of monthly declines is the longest since 2007 when a housing market collapse pushed the economy into the “Great Recession.”

What to know:

- Existing home sales have dropped 27% from their peak in January, as the Fed’s increases in interest rates have priced many home buyers out of the market.

- Mortgage rates now stand at a twenty-year high. According to the housing finance agency Freddie Mac, the average 30-year fixed-rate mortgage was 6.94% this week, up from 3.09% a year earlier.

- Applications to purchase or refinance a home have crumbled to levels last seen in 1997.

🇹🇷 Turkey Slashes Interest Rates Despite Rampant Inflation (CNBC)

Explained:

- Turkey’s central bank cut its benchmark interest rate 150 basis points, from 12% to 10.5%, as President Recep Erdogan pushed ahead with a plan to bring down borrowing costs even as the country battles an inflation rate of 83%.

- Erdogan espouses the unorthodox belief that raising interest rates raises inflation rather than the other way around. He has gone as far as saying hiking interest rates is “the mother of all evil.”

- Needless to say, his policies provoke bafflement and criticism from economists and plays a major role in the substantial weakening of the lira against the dollar. The Turkish currency has lost 28% of its value year-to-date and 50% against the greenback in the last full year. The victims of his policies, then, are the Turkish people.

What to know:

- Erdogan says he is determined to get interest rates in Turkey down to single digits by the end of the year in the pursuit of growth and export competition. Another interest rate reduction is expected in November.

- Timothy Ash, a senior emerging markets strategist at BlueRay Asset Management, says Erdogan’s policies are simply an attempt to win the next Turkish general election in November 2023.

- He wrote, “The pro-growth policies might well win Erdogan the election, but they will boost import demand, undermine competitiveness, and surely massively boost the current account deficit.”

WHAT ELSE WE’RE INTO

📺 Watch: Stock Market 101 (Investing for beginners explained), by Weronika Pycek.

👂Listen: How to build wealth like the 1% with Jerry Fetta, hosted by Rebecca Hotsko on Millennial Investing.

📖 Read: Welcome to “Britaly”, from the Economist.

BROUGHT TO YOU BY

Why do you follow superinvestors like Buffett, Pabrai, Munger, and Greenblatt?

Because they have a proven track record for finding great management teams. Get access to the 7 Red Flags for Passive Real Estate Investing to learn what to look out for in a deal’s management team.

DIVE DEEPER: WHY YOU CAN STILL LOSE IN INVESTING EVEN THOUGH YOU’RE RIGHT

Whether you’re a fundamental value investor sifting through research reports and financial data, or a day trader using automated algorithms and watching price charts, participants in financial markets broadly have the same goal: to profit from price distortions.

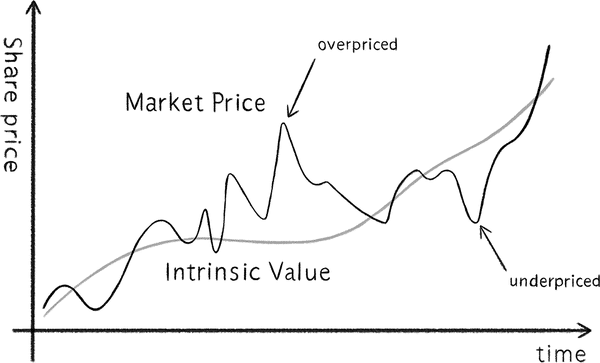

For the value investor, price distortions may occur when a stock drifts above or below its intrinsic value

For the technical trader, finding price distortions can come from identifying trends and making strategic bets on them.

Regardless of the approach you use, though, you may find that you’re “right” only to still lose money. How can this be?

Let’s discuss.

What to know

The academic term is known as the “limits to arbitrage.”

Even skilled investors may find that periodically, despite correctly identifying a price distortion from fair value, it’s quite difficult to actually profit from this knowledge.

For example, consider all of the overpriced stocks in the 1999 tech bubble, or more recently, the astronomical valuations that Tesla (TSLA) and Gamestop (GME) reached last year.

Many rational investors have observed these moments and correctly recognized price distortions, but acting on this information effectively is a different question altogether.

This leads into considering why financial markets seemingly fail to be efficient.

Alpha and arbitrage

The implicit aim of all active investors is to generate what’s known as “alpha.”

This ideally refers to a repeatable process one can utilize to outperform a benchmark with respect to the level of risks being taken.

You want to maximize your returns for the level of risk you incur and do so consistently.

So-called alpha can come from having access to better information than everyone else or from being able to better interpret and assemble well-known information.

Another way to earn alpha can stem from the limits to arbitrage that we mentioned above. Take, for example, instances where news and other publicly available information may not always be immediately reflected in financial asset prices.

This is evidenced by a well-documented phenomenon known as “post-earnings announcement drift.”

If a stock announces earnings that beat expectations, rather than moving up all at once, its stock may jump initially and then continue to trend higher over several weeks as more and more investors digest the positive report.

So, this is a limit to arbitrage and a reason for how you can be “right” and still not make money.

Breaking it down

To explain further, if a company releases its quarterly earnings, and you’re able to analyze quickly that the stock’s new intrinsic value is $100, instead of its current price of $90.

As markets process the positive information, the stock may jump to, say, $93, and then drift up to $96 over the next three weeks.

As you wait for this price distortion between the market price and your assessment of intrinsic value to converge, you’re exposed to random news events during that time lag.

Perhaps, in that period, the company gets sued for something that happens to a customer while using its products, and this sends the stock careening down to $85.

Even if you were correct in calculating the stock’s intrinsic value after the earnings report, the delay with which markets fully process new information made you vulnerable to new events that could materially change the stock’s value. And now, you’re stuck with a loss on the position.

Momentum

Another reality is that participants in markets, such as hedge funds, may choose to rationally avoid closing a mispricing.

Even though they may know that Tesla is overvalued (just an example), their strategy is built on riding momentum, so they just stick with what’s hot.

It can quickly become a positive feedback loop where a stock finds a positive trend, and a bunch of momentum traders pile in, which attracts more momentum traders and others with a fear of missing out.

Even if you had all available information at your fingertips and could perfectly assess the correct value for Tesla’s stock price, if it’s trapped in a momentum/FOMO feedback loop, well, who knows how long it will drift further from its intrinsic value.

It could be days, or it could take years. That’s a long time for a person to be continuously losing money on their bets without losing conviction in their thesis.

Liquidity

On top of this, there’s also liquidity risk. This refers to, generally speaking, how easy it is to buy or sell a stock, and it’s a particularly relevant challenge for small market capitalization companies.

If there are very few people in the market selling a stock, even if you know it’s undervalued, you may not be able to profit because there’s no one available to sell shares to you.

For the regular investor, this is, of course, a negligible concern. But for large investors like hedge funds and mutual funds who typically drive price swings, liquidity can be a thorny obstacle.

And if there’s a price distortion for a small stock, but not enough liquidity for a large investor to buy/sell without driving the price beyond their target, they may choose to do nothing at all.

Career risk

On top of all this, there’s career risk for professional investors. Those who run investment funds are beholden to their fund’s investors (the people giving them money to manage).

So, they may find an opportunity in markets where a stock is mispriced, but if it takes too long for the stock to return to its intrinsic value, investors may lose faith in the investment fund and pull their money out.

There’s tremendous pressure, then, to play it safe. Or at least, bail on a bet that they may know is right if it becomes clear that the bet would take too long to prove true without imposing costs on their career (i.e. losing clients).

Takeaway

The point here is that markets aren’t perfectly efficient due, in part, to the limits to arbitrage we’ve discussed. And this can cut both ways for us regular investors.

It may mean that we’re “right” about an investment, but we still end up losing on it.

Either because circumstances change, as we wait for the price distortion to close, or because it’s psychologically too painful to hold a position for long enough to be proven right. It also means, though, that there are indeed opportunities in markets for us to uncover and profit off of.

Understanding why it’s structurally possible for profitable opportunities to exist in markets is important and related to why you can lose money when your analysis is correct.

Both are due to limits to arbitrage, and skilled investors will become familiar with the nuances of these dynamics in their quest to earn investment alpha.

Wrapping up

Do you agree with our thinking here?

Let Patrick and I (Shawn) know if you have any questions or comments.

And to find investment opportunities, we always use TIP Finance, our signature stock-picking and market research tool.

You can use it for free.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.