Money Laundering

07 December 2022

Hi, The Investor’s Podcast Network Community!

For the fifth straight trading day, stocks finished lower.

Stock market losses are the least of one generation’s worries, though.

Soaring rents over the past two years have forced millions of millennials to move back in with their parents, according to a report from Bloomberg. 🏡

One in eight millennials have apparently returned to their parent’s homes.

And for the first time since the Great Depression, per a Pew survey, the majority of Americans aged 18-29 live with their parents. 😨

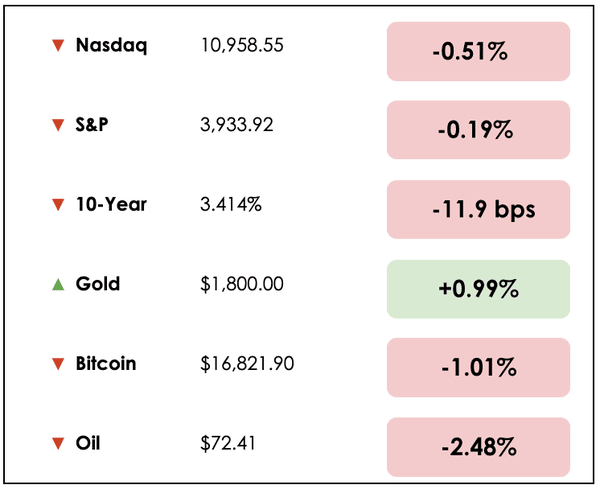

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: China’s pivot away from “Zero Covid,” and Silvergate Capital’s role in the FTX crisis, plus our main story on investing genius Li Lu.

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🇨🇳 China’s Covid Pivot Comes Before A Fed Pivot (Bloomberg)

Explained:

- For the past three years, China has remained in rolling bouts of strict lockdowns, whereas Western vaccines and natural immunity have enabled most other countries to reopen their economies. China’s vaccines have proven less effective, yet it has shunned alternatives.

- After weeks of unprecedented protests against harsh Covid rules, the Communist Party appears to be pivoting, at least moderately. Covid control measures are expected to relax nationwide as the government seeks to prioritize economic growth while arguing that new variants have become much milder.

- Much of China’s population, particularly its considerable elderly demographic, have little natural immunity or vaccination exposure. This has prompted health officials to warn that a full move away from the country’s strict containment measures could cause over one million deaths this winter.

Why it matters:

- Markets have been anxiously waiting to see which would happen first: Would the Fed pivot on its rate hiking plans, or would China’s economy reopen and unleash a tidal wave of pent-up demand on the world?

- A recovery in China’s economy may help countries avoid the worst-case recession scenarios. However, it’s certain to raise pressure on commodity and energy prices as a less locked-down China resumes a more normal business environment for its 1.4 billion residents.

- While we saw huge surges in commodity and energy prices earlier this year (remember almost $5 gas?), things would’ve been much worse had China’s economy not been largely on pause. The question now is whether China’s reopening will ignite a new inflationary impulse or just offset weaker demand across the rest of the globe.

🤐 Digital Asset Bank Silvergate Asked By Senators To Explain Its FTX Ties (Bloomberg)

Explained:

- Silvergate Capital Corp. (SI), a prominent digital asset bank, is knee-deep in controversy following crypto exchange FTX’s collapse and apparent fraud.

- In a letter, three U.S. Senators stated, “Your bank’s involvement in the transfer of FTX customer funds to Alameda (a private trading firm linked to FTX’s founder) reveals what appears to be an egregious failure of your bank’s responsibility to monitor for and report suspicious financial activity.”

- Accusations continue that Silvergate “failed to implement or maintain an effective anti-money laundering program.”

Why it matters:

- The bank’s stock has slid 84% this year as it also navigates a collapse in digital asset prices broadly. Short sellers have pounced to bet against the stock, with short interest as a percentage of free-floating shares jumping to 28%.

- The well-known investment manager, Cathie Wood, bought over 200,000 shares last month in Silvergate. The rest of Wall Street remains hesitant, with Morgan Stanley downgrading the stock, saying, “ongoing stress in the crypto ecosystem drives a wider range of risks for Silvergate.”

- Silvergate’s future following this episode will depend on how sharply regulators clamp down with new industry-wide regulations, whether customer faith in the bank can be restored, and what investigations into its relationship with FTX further uncover.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

WHAT ELSE WE’RE INTO

📺 WATCH: The lasting impacts of Russian oil price cap, from Peter Zeihan.

👂 LISTEN: The real impact of the IMF & World Bank, with Alex Gladstein and Sam Callahan on Bitcoin Fundamentals.

📖 READ: Apple scales back its self-driving car plans and delays launch until 2026, per Reuters.

THE MAIN STORY: THE ESSENTIAL LI LU

Overview

There’s only one man besides Warren Buffett that Charlie Munger trusts with investing his capital.

That gentleman is Li Lu.

We’ve written about him before here, but Li Lu is such a fascinating character he warrants further study and discussion.

He reportedly has generated approximately a 30% compound annual growth rate since 1998 for his fund, Himalaya Capital Management.

Early Years

Li Lu’s story reads like a true hero’s journey. He started his early life rotating between adoptive families after his mother and father were sent to labor camps during the Chinese Cultural Revolution.

He was a student leader during the Tiananmen Square protests and later fled the country to avoid imprisonment. He arrived in America penniless and spoke little English, but he was welcomed as a hero and was given a scholarship to Columbia University.

He simultaneously earned three degrees in Economics, Law, and an MBA. Check out the fascinating documentary, Moving the Mountain about his early life.

Discovering Buffett

In his second year at Columbia, he attended a guest lecture by Warren Buffett.

After absorbing Buffett’s principles, he invested his student loan money and turned it into over $1 million by the time he graduated.

Lu said, “Mr. Buffett really made a lot of sense during that talk. It was like a punch in my eyes. It was like I had just woken up, and a light had switched on.”

Deciding to Sell

Li Lu agreed to a rare interview published in Graham and Doddsville, a value investing newsletter that the students of Columbia University produce.

The interview is loaded with investment wisdom, but we wanted to discuss one of the thorniest problems investors face — knowing when to sell or not sell a stock position.

Himalaya’s Portfolio

It’s one thing to preach a buy-and-hold investing philosophy and quite another to follow one in practice. Even Li Lu’s investment hero, Warren Buffett, who generally urges a holding period of forever, tinkers with his portfolio each quarter.

Li Lu holds just six American positions in his Himalaya portfolio and makes very few changes quarter-to-quarter. In 2022, he added to his position in Alphabet (GOOG) and sold out of Meta Platforms (META).

That’s it.

His two largest American holdings include Micron Technology (MU), at 33% of the U.S. holdings, and Bank of America (BAC), which makes up 25%. He also has positions in Berkshire Hathaway (BRK.B) and Apple (AAPL).

Since he’s not required to report foreign holdings, little is known about Li Lu’s international positions besides BYD, China’s largest electric car manufacturer.

Three Reasons to Sell

In his conversation with Columbia business students, Li Lu revealed the three things that would cause him to sell a stock:

- Number 1 — “If you make a mistake, sell as fast as you can, even if it’s a correct mistake.

What do I mean by a correct mistake?

Investing is a probability game. Let’s say you go into a situation with 90% confidence that things will work out one way and a 10% chance they work out another way — and that 10% event happens. You sell it.”

- Number 2 — The second time you want to sell is when the valuation swings way too much to the extreme.

He says, “I don’t sell a security because it’s a little overvalued, but if it is way overboard on the other side into euphoria, then I will sell it.”

- Number 3 — The final occasion to sell is when you find a better opportunity. Essentially, a portfolio is opportunity cost.

He says, “Your job as an investor is to constantly improve your basket. You start with a high bar. You want to increase the bar higher and higher. You do that by constantly improving the opportunity costs. You find something better.”

Advice to Beginners

For beginning investors, he suggested that “If you get a chance to meet Mr. Buffett, I’d run to it if I were you. I wouldn’t even take an airplane; I would just run to Omaha. Start by learning from the best — listening, studying, and reading.”

With that in mind, please consider joining us for the 2023 Berkshire Hathaway Annual Shareholder’s meeting in Omaha on May 6th.

Details for this amazing event can be found here.

Dive deeper

To learn more about Li Lu, check out his Graham and Doddsville interview.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.