Moment of Lift

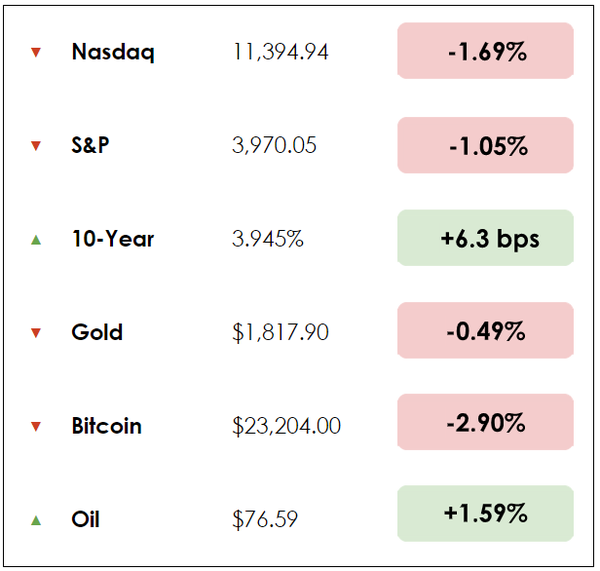

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

Simple setup for new Bitcoiners ✅

Advanced features for Bitcoin veterans ✅

The Bitcoin wallet for your every need ✅

Blockstream Jade is the only hardware wallet designed for your whole Bitcoin journey. Visit store.blockstream.com and use coupon code: ‘Fundamentals’ to get 10% off your Blockstream Jade.

IN THE NEWS

🔫 Defense Stocks Soar on Continued Western Backing for Ukraine (FT)

Explained:

- On the first anniversary of Russia’s invasion of Ukraine, it’s clear that defense companies have benefited from the massive uptick in global military spending. America and its allies are sending unprecedented amounts of weapons to Ukraine, boosting spending in total as countries refill their inventories and expand their overall capacities in anticipation of a broader conflict.

- As a result, defense stocks have outperformed: The Invesco U.S. Aerospace and Defense ETF is up 10% in the past year, while the S&P 500 is down almost 8%. Using an MSCI global benchmark, the defense sector is up almost 30% since mid-October, with Europe’s Stoxx Aerospace and Defense Index rising a third over the same period.

- The gains reflect growing doubt among investors that the war is likely to end anytime soon. One analyst commented, “We reckon that 2022 was the best year (for) defense stocks over the last 40 years.”

Why it matters:

- After President Biden’s surprise visit to Ukraine reaffirmed support for the country, saying to Volodymyr Zelenskyy, “Americans stand with you, and the world stands with you.” To match the talk, the U.S. committed another $2 billion today to bolster Ukraine with drones and more ammunition.

- For investors focused on environmental, social, and governance issues (ESG), what to make of defense stocks has become a hot topic. Connections to weapons and the military had previously lowered companies’ ESG scores, potentially reducing the amount of investor capital flowing to them. Yet, now, many see these companies as serving a noble purpose, raising questions about the difficulty of setting objective ESG guidelines.

- For those considering whether they should jump into defense stocks, the next 12 months are likely to be a “tougher slog for the defense sector” given that “much of the ‘good news’ is already baked into (these) stocks.”

🙅 “Base Effects” Distort Our Understanding of the Economy (WSJ)

Explained:

- In the months ahead, we face a challenge in interpreting economic data. Following the price distortions created by Russia’s invasion of Ukraine and a post-pandemic surge in inflation, particularly in food and energy, year-over-year inflation metrics are misleading.

- For example, last year, the average price for a gallon of gas surged from $3.50 in February (before the invasion) to over $5 by June. Gas prices have since fallen to around $3.40, but if prices climbed back to $4.50 by June, despite being the second-highest June price on record, “base effects” would corrupt year-over-year calculations and show a 10% decline.

- The dramatic price jump after the beginning of the war in Ukraine cooled considerably in the back half of 2022, making annual inflation metrics deceptive by understating the current rate of price changes given the extreme comparison.

Why it matters:

- Most people notice only headline figures, and even professional investors can be guilty of ascribing too much significance to these reports, raising the prospect that base effects will be misinterpreted as a “premature declaration of victory over inflation.”

- Base effects appear in many percentage-change statistics, notably in early reporting of Covid-19 hospitalization rates from a low base in 2020. If weekly pediatric hospitalizations rose from 0.4 to 0.7, that’s a terrifying 70% increase. Lacking the proper context, parents may be inclined to panic, without realizing that the figure is 0.7 out of 100,000.

- Narrower comparison periods, then, are more relevant. Changes in consumer prices from last month tell us far more about the economy’s current health than year-over-year comparisons. But as Yale economist Robert Shiller notes, “Humans everywhere tend to assume the year interval is somehow THE interval.” Meaning, despite the flaws, we’ll continue to be flooded by reports of annual changes in inflation that are, over the next few months, particularly distorted by base effects.

WHAT ELSE WE’RE INTO

📺 WATCH: Paid subscription for Facebook and Instagram: Are you going to be affected?

👂 LISTEN: The epic collapse of GE with William Cohan

📖 READ: How to invest like Warren Buffett

One day on a trip to India, Melinda Gates recalls a mother of two asking her to take her children back with her to the U.S.

Gates, the mother reasoned, could provide her children with a safer life without the stress of poverty.

The interaction stayed with Gates long after her trip. It also frustrated her.

It’s one of many interactions she’s had around the globe where she was struck by the wealth gap, poverty, and inequality.

“I have rage,” she told The New York Times about the injustices she has seen. “It’s up to me to metabolize that and use it to fuel my work.”

Empowering women to improve economies

Gates, 58, is one of the wealthiest and most powerful women in the world, with a net worth of about $6.6 billion, according to Forbes.

Through the charitable foundation that bears their name, she aims to increase global health and reduce poverty while tackling climate change.

Her book, “The Moment of Lift,” centers on broadening women’s rights. It also offers lessons for people who study markets and economics, especially those interested in development, problem solving, and policy.

Gates believes investing in women might be one of the best financial decisions for the global economy. She believes that women’s rights mean families flourish and, thus, societies thrive.

She points out that when you include a group that has been excluded, you benefit others.

“Because sometimes all that’s needed to lift women up is to stop pulling them down,” she writes.

To uplift humanity, empower women.

Out of poverty

Gates’ book or philanthropy isn’t superficial fluff. She illustrates how communities that empower women can spawn greater economic growth, business development, and better healthcare.

She argues that no country has escaped poverty without giving women access to contraceptives. She also highlights how vaccines and basic investments in medical care can save thousands of lives.

Through their work with vaccinations, she learned that when women were in charge of their reproductive health, it allowed them to space pregnancies and control the number of children they had, resulting in healthier children and families.

“It took us years to learn that contraceptives are the greatest life-saving, poverty-ending, women-empowering innovation ever created,” she writes.

Extreme poverty and isolation devastate women and make it almost impossible for them to provide for and protect their children. As a result, the cycle of abuse and poverty continues.

Who writes the code

Her argument for including women goes beyond the workplace.

She says women need to have more access to VC money, and women need to be a part of research and development for important advancements like AI to avoid bias being programmed into the technologies.

As she puts it, “It matters who writes the code.”

“The goal is for everyone to be connected. The goal is for everyone to belong. The goal is for everyone to be loved.”

Gates adds that young girls who attend school feel more confident and powerful.

These women then work for the betterment of all lives in their communities, creating a tide of positive change that ripples throughout.

The final word

Philanthropy is a large space and a critical piece of global progress. It’s an art and a science.

As we wrote about in our piece on MacKenzie Scott, effective philanthropy isn’t easy. How do you know where to allocate money, and how do you know it’s being put to good use to help those in need?

Figuring out what interventions will make the biggest difference, scaling solutions that work, measuring progress and adjusting strategies – it’s hard to do.

Gates provides a roadmap worth studying.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.