Meta’s Gambit

Hi, The Investor’s Podcast Network Community!

One way to resolve business conflict? Team up 🤝

That’s precisely what Peloton and Lululemon did last week, ending their feud with a partnership. Peloton, which tried to sell its own apparel, will now sell co-branded Lululemon apparel. And Lululemon will discontinue its Studio Mirror home fitness device.

💭 Time will tell whether the partnership can jolt Peloton from a lengthy sales slump. As for Lululemon? As you’ll see below, they’re doing just fine.

— Matthew, Shawn, and Weronika

Here’s today’s rundown:

POP QUIZ

What’s the biggest corporate loss for a single year in history? (Read to the end to find out!)

Today, we’ll discuss the three biggest stories in markets:

- Russia’s dark fleet of sanctions-avoiding oil tankers

- Inside Rivian’s quest to build an elite truck

- Meta plans to add a paid, ad-free tier for European users

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

QUICK POLL

Which would you rather invest $10,000 in right now?

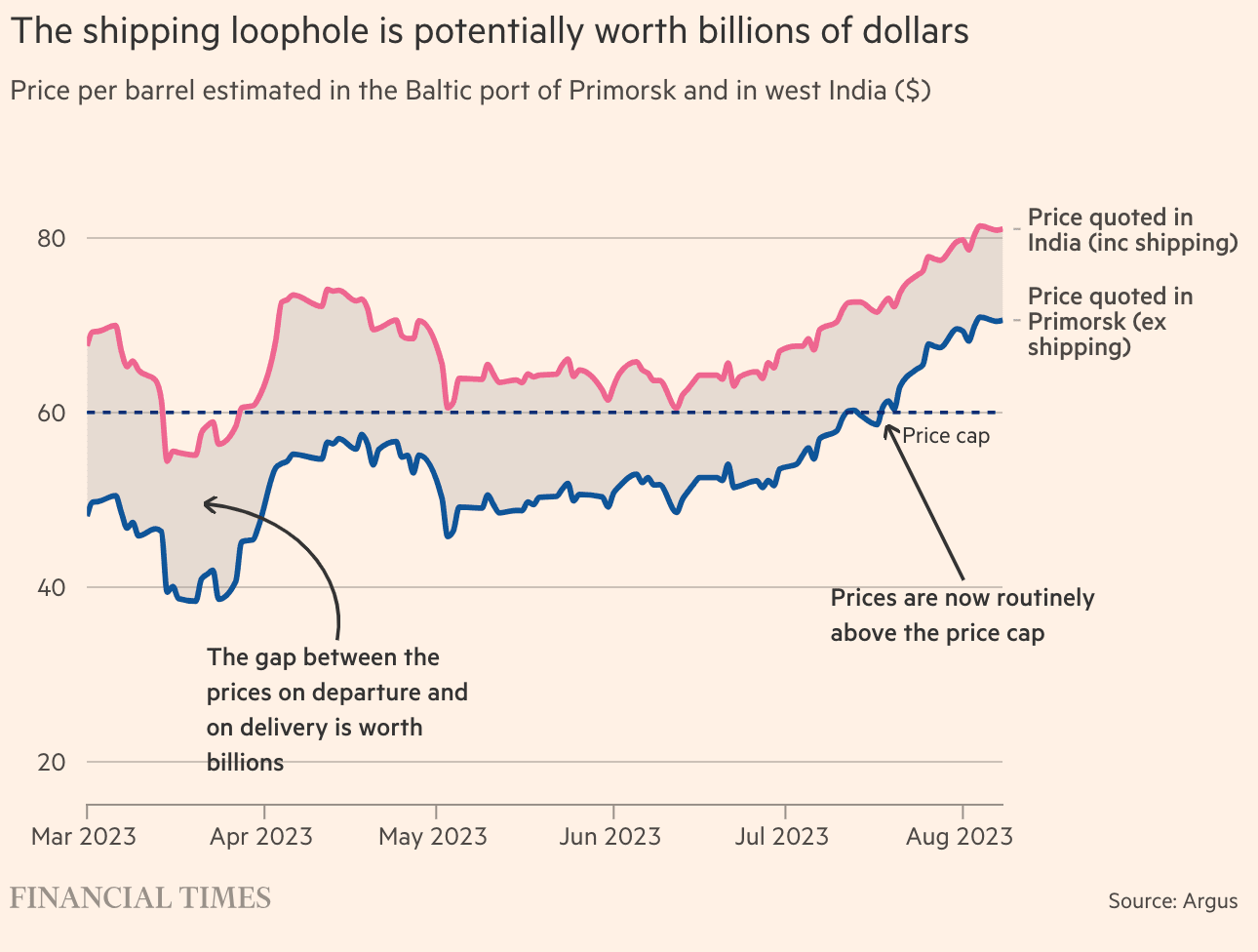

| The U.S. and its allies have faced a conundrum: The world needs Russian oil to keep flowing; otherwise, the supply dropoff could spawn a shortage that pushes energy prices dramatically higher (offsetting efforts to control inflation.) |

|

| The solution? Major global economies implemented a “price cap” on Russian oil, limiting how much Russia can earn from fuel sales without cutting off oil supplies entirely. |

|

| Bockman adds, “More Russian oil than ever before is being transported on sanctions-circumventing tankers that exploit loopholes in international maritime regulations.” |

|

| Why it matters: |

|

Russian crude oil is currently priced, on average, about 30% higher than the cap set by the U.S. and its allies. |

| Subtle workaround: Russian oil may technically trade at the price cap, but shipping costs have been “inflated” to bring the total purchase costs of Russian oil in line with market prices, particularly for ships sailing to India from Russian ports. |

| This workaround is estimated to have generated extra revenue worth billions of dollars for Russia. |

|

| Read more |

Investing is the most important skill to master if you want to make your money work while you sleep.

That’s why Thomas Chua of Steady Compounding created an email course that features lessons from super investors such as Warren Buffett, Nick Sleep, and Mohnish Pabrai.

With these 15 timeless investing lessons, you can identify and analyze great businesses that will compound your wealth over time.

As an added bonus, you’ll have access to exclusive investing tools and resources.

🕒 You can sign up for this course for FREE for the next five days only.

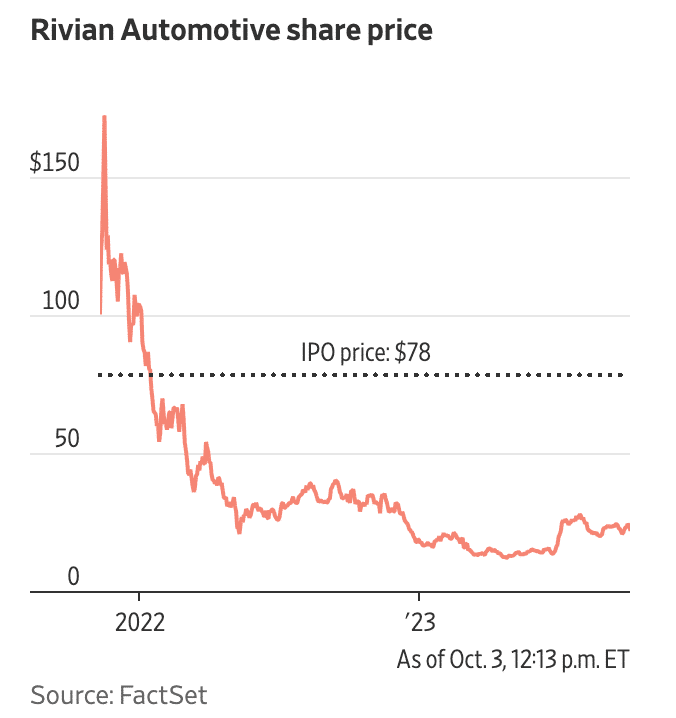

| Tesla aside, Rivian is the hottest name in the EV space. But its attempt to build the top electric truck costs billions of dollars, even as its trucks dazzle drivers with dozens of features and an ability to go from zero to 60 in three seconds. |

|

| Even today, Rivian loses money on every sale. It pays too much for parts, and it’s only sold 65,000 total vehicles, a tiny fraction of what bigger car companies make in a single factory in a year. |

| To fix the problems, Rivian’s founder and CEO is trying to cut expenses and trim operations. He wants to pay suppliers less for parts, simplify the truck’s design, and boost production volumes to inch closer to profitability. Still, it’s burning $1 billion of cash per quarter. |

| Will it pay off? Executives say Rivian will make a profit on its vehicles in a year and that burning all that cash has been necessary to grow. |

|

| Why it matters: |

| Rivian’s dilemma is an age-old question of how much to invest in growth before you’re profitable. It’s a tough needle to thread, and it can be the difference between long-term success and falling into irrelevance. |

|

| As one auto industry analyst put it, “You should be able to start to make money after three to six months. By the time you’re ramped up and running at rate, you’re making pretty good money.” |

|

| Read more |

MORE HEADLINES

🏈 Taylor Swift propels NFL to record ratings

☕️ Starbucks scientists are developing a “climate-proof” coffee

🪧 Americans support strikes until they affect their daily lives

💪 The job market stayed strong through August, with more than 9.6 million job openings

⛹️ Mr. Beast’s snack company to be the Charlotte Hornet’s official jersey patch sponsor

🤑 Meta Plans To Charge $14 A Month For Ad-Free Instagram Or Facebook

How about another subscription service?

Would you consider spending about $14 a month for ad-free Instagram? Europeans might.

Meta is exploring ad-free subscriptions for its European Union (EU) users. The company proposes to regulators that European users might have the choice to opt for a paid subscription or consent to personalized advertisements.

- In September, Meta discussed the plan in sessions with privacy regulators in Ireland and digital competition authorities in Brussels.

What gives? Meta has informed regulators about its intention to launch a plan, “SNA” (Subscription No Ads), for European users in the upcoming months.

- The proposal would give users a choice: continue using Instagram and Facebook for free with personalized ads or opt for paid versions of the ad-free platforms.

Charging extra: Meta has proposed to regulators a plan to charge users about $10.50 per month for ad-free desktop access to Facebook or Instagram and around $6 for each additional linked account. Mobile access would cost about $14 per month, reflecting commissions from Apple’s and Google’s app stores on in-app payments.

- Notably, Meta has counted 258 million monthly Facebook users and 257 million Instagram during the first half of this year in the EU.

Why it matters:

CEO Mark Zuckerberg has emphasized that his primary platforms should stay free and ad-supported to remain accessible to individuals across all income brackets.

- “You don’t need thousands of dollars to connect with people who use our services,” Zuckerberg said at a 2018 conference.

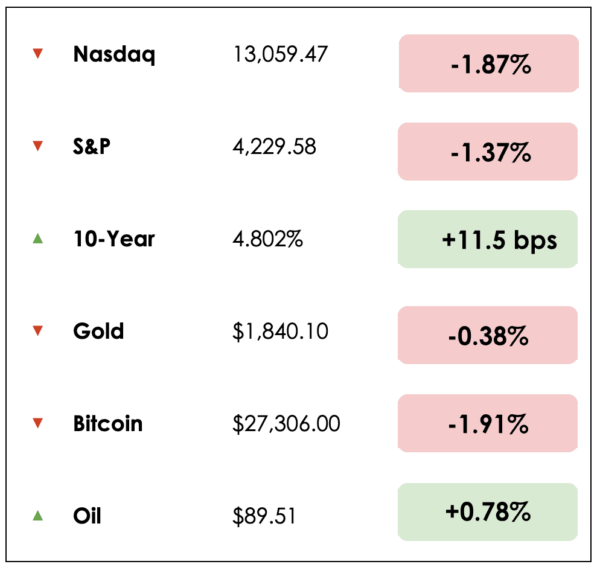

Keeping a close eye: Investors might closely watch the financial outcomes of Meta’s new fee model, especially considering the Meta stock’s sharp drop in 2022 and swift recovery in 2023. Shares are up about 146% year-to-date.

A guinea pig: Currently, the switch seems aimed at European consumers. U.S. users, particularly those mindful of privacy, may not see an option to subscribe to ad-free Instagram or Facebook anytime soon. But this could change if the new fee model proves to be successful.

- Meta has distinctly pitched its proposals to adhere to EU regulators’ demands for obtaining consent before processing user data for precise ad targeting.

Mimicking others: Meta, advocating for its plan, has highlighted how certain companies, like Spotify, offer users an option between a free, ad-supported service and an ad-free subscription service.

- The proposed mobile pricing from Meta aligns with what YouTube charges for its ad-free premium service in Europe.

TRIVIA ANSWER

In 2002, AOL Time Warner reported a net loss for the year of $98.7 billion, which is considered the worst annual loss in modern corporate history. On an inflation-adjusted basis, that’s a loss of almost $170 billion today — yikes. AIG’s $99.3 billion loss in 2008 is the highest nominal loss (but is lower after inflation adjustments.)

See you next time!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.

Was this newsletter forwarded to you? Sign up here.

All the best,

P.S. The Investor’s Podcast Network is excited to launch a subreddit devoted to our fans in discussing financial markets, stock picks, questions for our hosts, and much more!

Join our subreddit r/TheInvestorsPodcast today!