Masterminds

23 November 2022

Hi, The Investor’s Podcast Network Community!

💤 It was a rather uneventful day in markets with Thanksgiving looming tomorrow, though minutes from the latest Fed meeting confirmed investors’ expectations that the central bank will begin scaling back on the size of rate hikes.

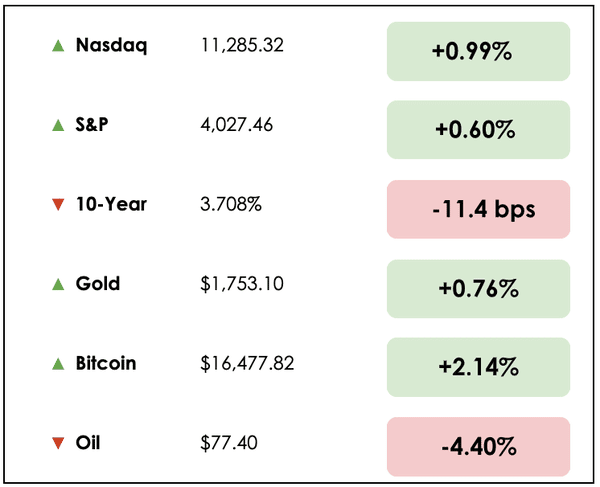

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: A major venture capital firm apologizes to its investors, and a “too big to fail” bank tries to avert collapse, plus our main story on stock picks for the fourth quarter.

All this, and more, in just 5 minutes to read.

Do you want to write for this newsletter? Apply here.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🤨 Sequoia Capital Apologizes For Backing FTX (Bloomberg)

Explained:

- In a conference call yesterday, top partners at the wildly successful venture capital (VC) firm, Sequoia Capital, apologized to investors for backing FTX, which is now being called one of the biggest frauds of the century.

- The industry-leading firm acknowledged that it had investments totaling $214 million in FTX across two funds. Now, it has written down those investments to zero, marking a rare loss for Sequoia.

- Despite striking a conciliatory tone, the partners defended their due diligence efforts. They claimed to have reviewed the troubled crypto exchange’s financial statements multiple times, though they were unaudited.

Why it matters:

- This is important for two reasons. Firstly, it’s evidence that losses in “crypto” aren’t just confined to those trading cryptocurrencies themselves because institutions and investors worldwide have stakes in Sequoia’s funds.

- Secondly, even though the VC firm would like to dismiss its failure to detect the massive fraud orchestrated by FTX that seemingly funneled customer deposits into a speculative hedge fund known as Alameda, the debacle calls into question the exuberance across the industry that willingly dismissed red flags.

- On the bright side, Sequoia suggested that going forward, it would push the startups it invests in to be audited by one of the major Big Four accounting firms.

✅ Credit Suisse Shareholders Approve $4.2 Billion Capital Raise (CNBC)

Explained:

- The struggling Swiss bank, Credit Suisse (CS), will grant shares to new investors like the Saudi National Bank, which will hold a 9.9% stake in the firm.

- In light of its fundraising efforts, Credit Suisse projected a $1.6 billion loss for the fourth quarter while it aims to restructure its business by simplifying its focus to wealth management and the Swiss domestic market.

- Its investment bank will also be downsized and spun off into a new group rebranded as CS First Boston.

Why it matters:

- Unlike in 2008, this banking implosion (so far) hasn’t turned into a systemic crisis. Still, Credit Suisse investors, including several major Swiss pension funds, will now see the value of their shares diluted with new share issuances and a bail-out from the Saudi National Bank.

- Others are concerned that with Saudi backing, Credit Suisse is unlikely to pivot from its role as one of the largest lenders to the fossil fuel industry.

- While the bank gets its finances in order and plots a new course, its customers have lost faith in it, with withdraws reaching around $88 billion in the past five weeks.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

WHAT ELSE WE’RE INTO

📺 WATCH: The history behind the Presidential Thanksgiving turkey pardon, by PBS.

👂 LISTEN: It’s Bitcoin (not crypto), with Cory Klippsten on Bitcoin Fundamentals.

📖 READ: Is the World Cup a giant waste of money? From The Economist.

THE MAIN STORY: THE MASTERMIND GROUP — Q4 2022 MARKET VIEWS

Overview

As we stumble into the final stretch of 2022, some may feel like Rocky in the final rounds of a fight with Mr. T. Many are bloodied and bruised, trying to make sense of what’s going on and what’s next for the markets.

To get our bearings, we turned to Stig Brodersen’s Mastermind discussion with Tobias Carlisle and Hari Ramachandra.

A Distinction

Carlisle kicked off the discussion by distinguishing between the stock market and the underlying economy.

He likes to look at both and considers them independently.

The economy is a tremendously complex system defined by how its many moving parts are currently interacting, while the stock market is a forward-looking mechanism that typically has already factored in what’s unfolding in the underlying economy.

Role of The Federal Reserve

Carlisle then explains that before the Federal Reserve’s creation in 1913, there were more frequent and shorter business cycles, and businesses held more cash reserves to weather these ups and downs.

That’s because there was no central entity around to potentially bail them out.

He argues that today’s Fed micromanages these cycles and prevents their natural ebb and flow. This results in much longer cycles, with asset prices often divorced from their intrinsic value.

The Fed’s dual mandate is maximum employment and price stability. According to Carlisle, though, they’ve failed miserably on both accounts. He says, “why we continue this experiment is sort of beyond me.”

One thing is clear: The Fed is currently between a rock and a hard place.

How long they can continue to ramp up interest rates remains to be seen. Still, Carlisle believes they are nearing the end of their rope and questions how the federal government can afford ongoing higher interest payments in this environment.

What’s Next?

Carlisle believes the Fed will eventually cut rates, and when they do, there’s a strong likelihood the market will spike approximately 15%.

After the initial spike, investors will likely realize prices for most asset classes are still high while the underlying fiscal and monetary problems persist.

At that point, he thinks the market may sell off and become chaotic.

During the downward chaos, many investors will panic and sell out, which he would caution against. This is the time to weather the storm and pick up high-quality businesses at more reasonable prices.

Inverted Yield

Carlisle also explained how an inverted Treasury yield curve has been a remarkably accurate predictor of past recessions, especially when the inversion holds for 90 days. Typically, the yield curve slopes upwards as longer-duration bonds yield more than shorter-dated debt as compensation for lending your money for a longer period.

The curve is currently “inverted” because the yield on three-month Treasury bills exceeds the yield on ten-year Treasury bonds.

If the past is prologue, the current inverted yield curve points to a recession and continued strain on financial assets.

Takeaways

Carlisle expects another 3-9 months of downward pressure on stock prices.

However, he doesn’t anticipate another Lehman Brothers-type credit crisis as banks are better capitalized today and have avoided the absurd loan products that contributed to the Great Recession.

In his view, assets have simply been overvalued, and a slowing business cycle will lead to a moderate drawdown.

Top three picks

We really enjoyed Carlisle’s breakdown of how he views current market conditions. But, the fun part of the discussion was hearing the Mastermind Group give their top stock picks for the quarter.

Ramachandra’s pick was somewhat of a contrarian one in choosing Meta, also known as Facebook (META). As he explained, the stock is beaten down, Zuckerberg is a pariah on Wall Street, and approximately 6 to 7 years of market cap were eliminated as shares trade at levels last seen in 2016.

Yet, the underlying business remains stable and hugely profitable.

Brodersen’s top pick was a Dutch company called Prosus (PRX.AS), a stock Mohnish Pabrai has also favorably discussed.

He lays out a compelling thesis since its shares are trading at a significant discount to net asset value, which includes large holdings in the Chinese tech company Tencent (TCEHY).

Finally, with Carlisle’s top pick, Colgate (CL), he aims to reduce downside risk while having potential for gains as the headwinds the company faces die down.

Mostly, he wants to weather the coming storm with this defensive pick so as to invest elsewhere once bargains are more readily available.

Dive deeper

Although we’ve run out of space to explain their picks thoroughly, we encourage you to check out the full podcast here to learn more.

Let us know what you think of their stock pitches.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.