Market Cycles

08 February 2023

Hi, The Investor’s Podcast Network Community!

Congratulations to LeBron James, who became the NBA’s all-time leading scorer on Tuesday night 🎉

In markets, all eyes were on Disney’s Bob Iger today, who spoke during the company’s earnings call after it beat on both the top and bottom lines. Iger announced a $5.5 billion cost-cutting initiative, and the stock rose sharply after hours.

Shares in Disney are up about 30% this year, though it will take some more magic to get the iconic brand back to its winning ways.

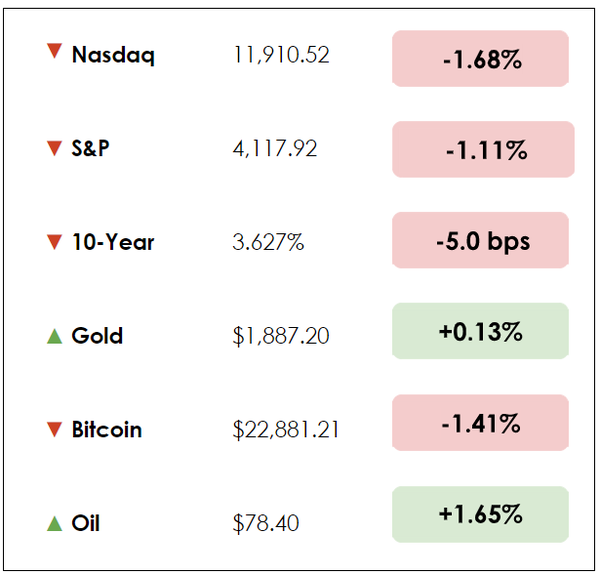

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Turkey halts trading for the first time in 24 years

- Bing’s AI reboot shakes up the search business

- Plus, our main story on what market cycles tell us

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Get the data and visuals you need to understand today’s world and take your office small talk to the next level.

Join 300,000+ data-driven professionals who love the #1 visual newsletter from our friends at Chartr, filled with snackable charts on business, tech, entertainment, and society.

IN THE NEWS

🆘 Turkey Halts Stock Trading After $35 Billion Wipeout (Bloomberg)

Explained:

- In the wake of two devastating earthquakes, Turkey’s stock exchange suspended trading for the first time in 24 years. The pause will last five days, and the exchange will cancel all trades on Wednesday after a selloff erased $35 billion of value.

- One representative, citing low trading volumes, said: “Our stock exchange has decided to halt trading in equities, futures, and options markets.” The decision came after markets hit their max limit down several times, triggering automated circuit-breakers. An Istanbul-based fund manager remarked, “There’s a liquidity crunch, so if the market remained open, it would have continued to plummet.”

- The earthquakes impacted ten Turkish cities, with death tolls topping 11,000. Turkey’s President promised to rebuild the earthquake disaster zone after announcing a three-month state of emergency.

Why it matters:

- The last time Turkish stock trading was suspended in 1999 also came after an earthquake that caused investors to panic. This time, the alarm was spurred, in part, by over 380,000 retail traders based in quake-hit cities, representing about 10% of all equity accounts investing in the Turkish stock market.

- The mayhem marked the worst weekly performance since the 2008 financial crisis, as multiple companies sought to contain the damage with emergency share repurchase plans. The country’s stocks are the worst performers globally this year, down 20% from their January high. With inflation surging to nearly 86% last year, many locals invest in equities to hedge against currency devaluation.

🤖 Bing’s AI Reboot Shakes Up the Search Business (Axios)

Explained:

- About half of all online searches can be answered sufficiently well with short responses and web links, but Microsoft is betting big on AI-powered responses for the other half, right on the heels of the buzz generated by ChatGPT.

- Yusuf Mehdi, a Microsoft executive, argued: “Half of the 10 billion queries are going unanswered today, or at least without very good answers.” To fix this, Microsoft plans to use a more powerful version of the engine that powers ChatGPT to boost its Bing and Edge web browsers.

- As one example of the upgrade, Microsoft will offer citations for its longer-form answers, unlike ChatGPT, allowing users to have higher conviction in responses by fact-checking them.

Why it matters:

- This all comes as unwelcome news to Google’s lucrative search empire, possibly the greatest threat to its tech monopoly ever, with insiders calling the unveiling of ChatGPT and its capabilities a “code red.”

- Google isn’t standing idly by, though. On Monday, the company showcased plans to integrate AI-capabilities into its search results in addition to its own ChatGPT rival called Bard. The system will be able to creatively answer open-ended questions while also being able to address current events, something ChatGPT can’t do yet.

- Competition over artificial intelligence is heating up, and it’s sure to revolutionize our lives and business. Like the early days of the internet, it’s hard for us to fully understand the big-picture ramifications. Still, internet searches look to be the first target of disruptive technologies that will eventually impact much of the broader economy.

WHAT ELSE WE’RE INTO

📺 WATCH: Why Warren Buffett doesn’t own Nike.

👂 LISTEN: Warren Buffett’s shareholder letters, with Clay Finck.

📖 READ: Austin’s astonishing transformation into a tech megalopolis.

Introduction

Did you know this quarter is one of the most “bullish” of all 16 quarters in a presidential cycle?

It’s derived from a simple theory: Equity market returns follow a predictable pattern each time a new U.S. president is elected, regardless of the political party.

According to the theory, the October 2022 lows likely marked the start of a new bull market, given that equities tend to bottom around the midterm elections.

Is this a real trend? Let’s dive in.

Midterm weakness

It’s widely known that U.S. stock markets generally perform weakest in the first two years of a president’s term before recovering and moving higher toward the latter half.

In The Stock Trader’s Almanac, 2004, Yale Hirsch notes that, based on his studies, “Presidential elections every four years have a profound impact on the economy and the stock market. Wars, recessions, and bear markets tend to start or occur in the first half of the term and bull markets, in the latter half.”

We saw that in 2022, the second year of U.S. president Joe Biden’s term. It was a midterm year. There was a war in Ukraine, and there was a bear market.

The S&P 500 index’s average annual return in the 12 months before a midterm year is 0.3%, much lower than the historical average of 8.1%. In 2022, the S&P 500 fell 19%.

In 2018, another midterm year, the S&P fell 6.24%, in line with the trend

A different story

The post-midterm election stock market performance is a whole other ballgame.

According to U.S. Bank, the S&P 500 has historically performed well in the 12 months after a midterm election, with an average return of 16.3%.

One- and three-month period returns following midterm elections are especially strong. True to form, since the mid-October lows, stocks have risen substantially.

The recent rally could still be a bear market rally. But the presidential cycle theory would indicate it’s most likely the start of a new bull market. According to Bloomberg data, the stock market has risen after every midterm election since 1950.

The fourth and final year of a president’s term is also quite bullish. If you look out two years after a midterm election, the average return is 33.7%.

Causes

What causes this trend? It likely boils down to political uncertainty. The market likes a degree of certainty.

Without knowing which political party will hold majorities in Congress, it’s unclear which social and economic policies will take priority until after the midterm elections. When there’s less macro uncertainty following the midterms, investor sentiment rises.

Yet the outcome of midterm elections has no noticeable impact on overall equity market performance. The party or parties controlling Congress is historically not an indicator of market performance.

Vanguard research, which goes back to 1860, found that the compounded annual return for a portfolio of 60 percent equities and 40 percent fixed income performed roughly the same whether a Republican or Democrat was elected president.

Many studies have noted that the health of the economy is critical: The last time the S&P 500 posted a negative return in the 12 months after a midterm election was 1939, when the U.S. was still recovering from the effects of the Great Depression, and World War II was underway in Europe.

As many long-time bulls will tell you, there are always reasons to be bearish, at least in the short term. Lately, one could point to war, inflation, interest rates, and geopolitical tensions.

Yet the market tends to move higher over long periods anyway.

Final thoughts

We aren’t encouraging market-timing strategies around the election cycle.

Rather, the case study provides useful insights into understanding market behavior — increased uncertainty (who will win the elections?) drives up discount rates while lowering asset prices.

In contrast, removing uncertainty, such as the resolution of midterm elections, regardless of the political outcome itself, can reduce discount rates and increase asset prices. At least in theory…

Dive deeper

Investopedia has compiled a helpful guide on the presidential election cycle theory.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.