Make Something Wonderful

Hi, The Investor’s Podcast Network Community!

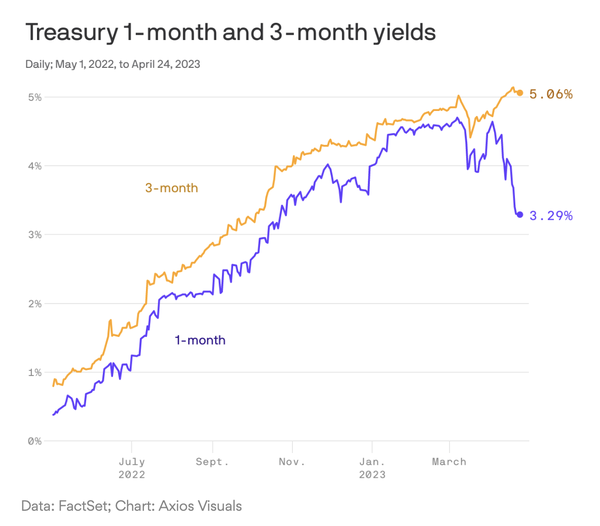

😟 Well, 3-month Treasury bills are yielding 1.77 percentage points more than their one-month equivalents. That’s the largest gap of all time, with the time in between (around June) likely when we’ll see debt issues come to a head.

In other words, there’s a flight to safety into Treasury bills expiring before default issues are expected, and a premium on bills that might be caught up in the budget mess. Scroll down to see this visualized in our chart of the day.

In earnings, Microsoft beat Wall Street expectations as the company’s cloud services revenue jumped 27% year-over-year.

Meanwhile, Alphabet reported revenue and EPS beats while authorizing a massive $70 billion stock buyback. Software is showing resilience amid a tough macro backdrop❗

—Shawn & Matthew

Here’s the rundown:

MARKETS

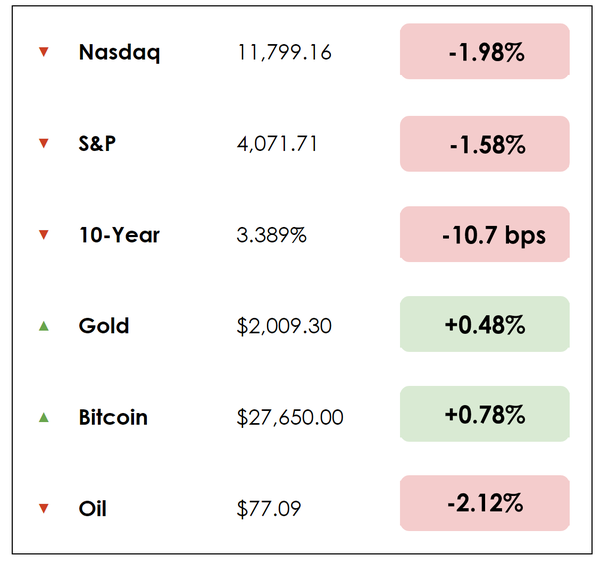

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Big brands flex their pricing power amid earnings season

- Why Italy risks credit downgrade to junk status

- Plus, our main story on the genius of Steve Jobs

All this, and more, in just 5 minutes to read.

Today’s trivia: Why is the company Apple called Apple?

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Simple setup for new Bitcoiners ✅

Advanced features for Bitcoin veterans ✅

The Bitcoin wallet for your every need ✅

Blockstream Jade is the only hardware wallet designed for your whole Bitcoin journey. Visit store.blockstream.com and use coupon code: ‘Fundamentals’ to get 10% off your Blockstream Jade.

IN THE NEWS

💪 Big Brands Flex Pricing Power (WSJ)

In its quarterly earnings Tuesday, McDonald’s said diners shrugged off higher prices, with same-store sales jumping 12% from last year. And PepsiCo raised its forecast for revenue growth after demand stayed strong despite hiking prices 13% last quarter.

- Kimberly-Clark, the marker of Huggies diapers and Kleenex tissues, beat analysts’ sales expectations after raising its prices 10% for the second straight quarter.

- This comes after Procter & Gamble, maker of Tide detergent, Bounty paper towels, Gillette razors, and Crest toothpaste (and many other household brands) beat earnings estimates after raising prices by double-digit percentages for the second consecutive quarter, too.

For the most part, shoppers have willingly absorbed the sting of higher prices.

Why it matters:

There are many factors we can point our finger at for spurring inflation, from rolling Covid lockdowns disrupting supply chains, worker shortages, unprecedented fiscal and central bank stimulus programs, war in Europe, and “de-globalization,” to people just wanting to spend after being stuck at home, and everything in between.

- But companies, particularly the biggest brands with the most pricing power, have also contributed to price spikes, opportunistically using real economic turbulence to boost prices by more than costs increased.

However, executives are cautioning that appetites for further price bumps may be reaching their limits, which is good news for consumers and the effort to tame inflation.

- Constellations Brands, the producer of Corona beers, and Conagra Brands, which produces Hunt’s ketchup and Slim Jims, have both suggested they were done raising prices with sales volumes starting to weaken.

- Similarly, Coca-Cola said on Monday it’d slow its rate of price hikes as consumers begin changing their shopping habits due to inflation.

🇮🇹 Italy Risks Credit Downgrade to Junk Status (Bloomberg)

The credit rating agency Moody’s identified Italy as the only nation it covers at risk of losing its investment-grade rating, according to a recent report.

- These ratings are like credit scores but for governments — a worse rating would make debt issuance for the country more difficult and expensive, making funding the government itself trickier.

- Many European countries came into 2023 with better financial prospects than in much of 2022, surviving the worst of the economic aftershocks imposed by the war in Ukraine. But, “Italy is currently the only (investment-grade) rated sovereign with a negative outlook,” said two analysts.

The remarks underscore the risk of dysfunction returning to Italy’s bond market. Thanks to a quieter period of domestic politics, aims to be more fiscally prudent, and support from the European Central Bank (ECB), 10-year Italian government bonds’ extra cost over safer German bonds has declined to 1.87%, down from 2.5% in late 2022.

In other words, debt financing has gotten relatively cheaper for Italy as investors’ worries eased in recent months. However, Moody’s negative credit review highlights that, despite improving conditions, financial challenges remain for Italy.

Why it matters

Italy faces “heightened risks” in implementing vital reforms for boosting its growth prospects, including those related to EU Recovery Fund allocations. And a credit downgrade to junk status would hit national pride, leading the country into unchartered financial territory while making its bonds less appealing to investors.

Despite plans to minimize deficit spending, Italy faces an over 140% debt-to-GDP ratio and slowing growth.

- If Italy were to be downgraded, it would join 28 other countries that have become “fallen angels” since 1995, per Moody’s. Only 12 have managed to claw back their investment-grade credit ratings after years of “major transformations.”

MORE HEADLINES

🚚 UPS warns that the U.S. economy is slowing, reports a 22% decline in its operating profits

✅ President Biden officially announces his 2024 re-election campaign

😅 First Republic Bank falls over 40% after reporting earnings, down more than 90% this year

Strong roots

Simplify rather than complicate. Stay hungry, stay foolish. Have the courage to follow your heart and intuition.

Jobs was no saint, but his life offers practical business, investing, and leadership lessons that students will study for decades.

It’s an incredible story: Jobs co-founded Apple in his parents’ garage in 1976, at the age of 21, with Stephen G. Wozniak, five years his senior, in Silicon Valley.

Within five years, Apple had become a billion-dollar company. But he was ousted in 1985, returned to rescue it from near bankruptcy in 1997, and by the time he died, in October 2011, had built it into the world’s most valuable company. It now has a market cap of $2.6 trillion and is Berkshire Hathaway’s top holding.

Along the way, Jobs helped to transform seven industries: personal computing, animated movies, music, phones, tablet computing, retail stores, and digital publishing.

This month, the Steve Jobs Archive released a free book, “Make Something Wonderful,” with a collection of Jobs’ interviews and speeches. Here are some of our favorite lessons.

Intense focus

For years, Jobs took his “top 100” people on a retreat each year. Each time, he stood by a whiteboard and asked, “What are the 10 things we should be doing next?” People would fight to get their suggestions on the list.

Jobs would write them down, but he’d cross off the ones he decreed worthless. After much discussion, the group would devise a list of 10. Then Jobs would cut the bottom seven and say, “We can only do three.”

Don’t always ask; build

When Jobs took his original Macintosh team on its first retreat, one member asked whether they should do market research to see what customers wanted. “No,” Jobs replied, “because customers don’t know what they want until we’ve shown them.” He invoked Henry Ford’s line, “If I’d asked customers what they wanted, they would have told me, ‘A faster horse!’”

Intuition over intellect

Jobs developed his appreciation for intuition—feelings based on accumulated experiential wisdom—while studying Buddhism in India as a college dropout.

“The people in the Indian countryside don’t use their intellect like we do; they use their intuition instead,” he said. “Intuition is a very powerful thing—more powerful than intellect, in my opinion.”

Sometimes, that meant that Jobs used a one-person focus group: himself. He made products that he and his friends wanted.

Always improving

After the iPod became a huge success, Jobs spent little time relishing it. Instead he began to worry about what might endanger it. One possibility was that mobile phone makers would start adding music players to their handsets. So he cannibalized iPod sales by creating the iPhone. “If we don’t cannibalize ourselves, someone else will,” he said.

Other highlights

Some of our favorite passages from the new book:

- “It’s so important to pick very important things to do. It’s very hard to get people motivated to make a breakfast cereal. It takes something that’s worth doing.”

- Be a creative person.

- Invest the extra time to make your work great.

- “I always tried to coach myself on not being afraid to fail.”

- “Find a way to put something back into the pool of human experience.”

- Have fun.

In a 1996 speech at Palo Alto High School graduation, Jobs urged students not to “be a career.”

“The enemy of most dreams and intuitions, and one of the most dangerous and stifling concepts ever invented by humans, is the ‘career.’ A career is a concept for how one is supposed to progress through stages during the training for and practicing of your working life.”

- “Make your avocation your vocation. Make what you love your work.”

- “The journey is the reward. People think you’ve made it when you’ve gotten to the end of the rainbow and got the pot of gold. But they’re wrong. The reward is in crossing the rainbow.”

- “Think of your life as a rainbow arcing across the horizon of this world. You appear, have a chance to blaze in the sky, then you disappear. To know my arc will fall makes me want to blaze while I am in the sky.”

- “A good way to remember these kinds of intuitive feelings is to walk alone near sunset—and spend a lot of time looking at the sky in general.”

Dive deeper

This piece is only scratching the surface on Jobs, a fascinating character. For more, check out the full Steve Jobs archive here. It’s a wonderful collection of essays, speeches, quotes, and lessons.

TRIVIA ANSWER

Jobs came up with the name simply because he liked apples. It also “sounded fun, spirited and not intimidating…plus, it would get us ahead of Atari in the phone book.”