Lucky Duck

Hi, The Investor’s Podcast Network Community!

☘️ Happy St. Patrick’s Day to those who celebrate.

If you were looking for green today, it didn’t come from the stock market.

St. Patrick’s Day is historically one of the greenest days for stocks: It’s the best day, on average, in the first nine months of the year and the fourth-best day overall. Not this year, as First Republic’s slide rattled Wall Street.

You’re right if it feels like we’ve been rangebound for a while. The S&P 500 is at about 3,900, almost exactly where it was in September 2022. Investors are weighing Federal Reserve decisions and more recent chaos in the banking industry.

While the S&P 500 rose this week, oil prices and bond yields fell, which shows investors are worried about the economy. Where are we headed next?

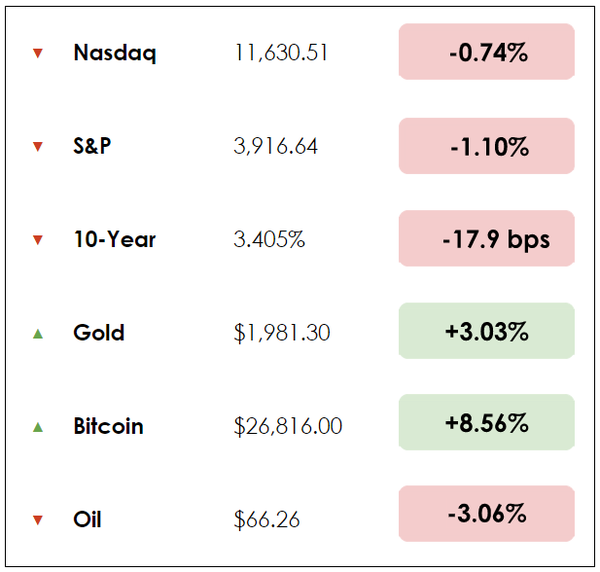

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Silicon Valley Bank’s tech ties run deep

- What’s next if rates stay high

- Plus, our main story on luck’s role in investing

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Simple setup for new Bitcoiners ✅

Advanced features for Bitcoin veterans ✅

The Bitcoin wallet for your every need ✅

Blockstream Jade is the only hardware wallet designed for your whole Bitcoin journey. Visit store.blockstream.com and use coupon code: ‘Fundamentals’ to get 10% off your Blockstream Jade.

IN THE NEWS

🏧 Silicon Valley Bank’s Deep Tech Ties (NYT)

Explained:

- More than many other banks, SVB catered to how risky tech start-ups and their backers don’t adhere to normal business practices.

- Before SVB failed last week and set off global financial panic, it was known as a regional, low-profile bank. That wasn’t the case within tech, where the bank had molded itself to the quirks and idiosyncrasies of the industry, becoming deeply interwoven into the lives of investors, entrepreneurs, and executives.

- For 40 years, SVB prioritized companies centered on breakneck growth and those that celebrate routine failure as a learning opportunity. They’re often worth billions before ever turning a profit, and they can go from simple idea to behemoth at a rapid pace. Most important, they rely on a tight network of money, workers, founders, and service providers to function. That all requires a specialized bank like SVB.

Why it matters:

- The tight network makes the tech industry tick. When a start-up wants a loan, the bank talked to its backers. Said one former SVB employee: “There were constant touch points with the investors. Everyone knows each other.”

- SVB also branched out to industries adjacent to tech, such as the wineries of Napa and Sonoma Valleys, where many tech founders and execs spend their weekends. Last year, SVB lent $1.2 billion to wine producers alone.

- Further, SVB’s home loans were much better than those from traditional banks. The loans were $2.5 million to $6 million, with interest rates under 2.6%, while other banks turned down the same applicants or offered higher interest rates.

🏦 Low Rates Were Meant to Last (NYT)

Explained:

- Economists expected inflation and rates to stay low for years. But in the last 12 months, the Federal Reserve has hiked interest rates sharply. Now, with SVB’s implosion, Wall Street is reckoning with how wrong that prediction has proven to be.

- A number defining the 2010s: 2%. Inflation, annual economic growth, and interests all hovered around that level, driving most to believe the era of low-everything would last well in to the 2020s.

- It started with high inflation following the pandemic, and now higher interest rates is making it more costly for businesses, investors, and households to borrow. SVB is one of the most prominent examples of an entity being caught so off-guard.

Why it matters:

- Even if the Fed succeeds at neutralizing the threat of bank runs tied to rising rates, other vulnerabilities likely grew during decades of relatively low interest rates. “That could trigger more problems at a time when borrowing costs are substantially higher.”

- “There’s an old saying: Whenever the Fed hits the brakes, someone goes through the windshield,” said Michael Feroli, chief economist at J.P. Morgan. “You just never know who it’s going to be.”

- Added Carl White, a senior vice president at the Federal Reserve Bank of St. Louis: “The industry’s lack of recent experience with rising and more volatile interest rates, coupled with material levels of market uncertainty, presents challenges for all banks.”

- Remember, when borrowing costs are very low (2010s), people and businesses need to take on risk to earn money on their cash. That dynamic has since changed entirely, causing shock, panic, and uncertainty.

WHAT ELSE WE’RE INTO

📺 WATCH: Steve Jobs on the power of saying no

👂 LISTEN: Insights from the world’s top money managers

📖 READ: Worried about a recession? You’re not alone

“No one actually thinks luck doesn’t play a role in financial success.

But since it’s hard to quantify luck and rude to suggest people’s success is owed to it, the default stance is often to implicitly ignore luck as a factor of success.”

Green shamrocks everywhere

Every March 17th, the United States becomes an emerald country for a day. Americans drink green beer and wear green clothes.

Restaurant menus come up with lucky green cocktails and bagels, while Chicago dyes its river green.

People across the country celebrate everything Irish by cheering bagpipers and marching bands parading on the streets. Covered in shamrocks, and eating corned beef and cabbage, they honor Irish ancestry and celebrate good fortune.

These familiar annual traditions don’t derive from Ireland, though. They were made in the US.

The luck of the Irish

In contrast to today’s merrymaking, March 17th has been more holy day than holiday in Ireland. And green wasn’t even traditionally associated with St. Patrick — the color was blue.

Since 1631, St. Patrick’s Day has been a religious feast day to memorialize the anniversary of the fifth-century death of the missionary who brought Christianity to Ireland.

According to Edward T. O’Donnell, a Professor of Irish American History, during the gold and silver rush in the 19th century, a number of the most famous and successful miners were of Irish and Irish-American birth.

Over time this association of the Irish with mining fortunes led to the expression ‘luck of the Irish’, where everybody wanted a piece of it for themselves.

Wish you good luck

Even though it’s hard to quantify luck, most of us feel a boost of confidence by hearing someone wishing us “Good Luck!”

Morgan Housel, an expert in behavioral finance, says every outcome in life is guided by forces other than individual effort, including luck.

In other words, if you’re successful, it doesn’t matter how well-educated, hard-working, or outstanding you are. Luck likely played a role in your success to some extent.

Unfortunately, calling someone’s success lucky is insulting because it undermines that person’s efforts.

Yet our expert says that there’s nothing wrong with luck, and we should never underestimate its power over our financial outcomes.

Investing goes hand in hand with luck

It’s possible to statistically measure whether some financial decisions are wise, but in the real world, you can’t be sure what the outcome will be.

If you buy stock, and ten years later, it’s gone nowhere, it might have been a bad decision to buy it in the first place.

It’s also possible that you made a good decision with an 80% chance of making money, and you just ended up on the side of the unfortunate 20%.

Morgan Housel states that everything worth pursuing has less than 100% odds of succeeding, and risk is just what happens when you end up on the unfortunate side of that equation.

Benjamin Graham, the father of value investing and an early mentor to Warren Buffett, wrote about his Geico investment success “One lucky break, or one supremely shrewd decision – can we tell them apart?”

The majority of his investing success was based on owning an enormous chunk of Geico stock, which broke many diversification rules that Graham himself taught in his famous texts.

Genius or lucky?

Bill Gates once said, “I was lucky to be in the right place at the right time.” He went to one of the only high schools in the world that had a computer.

One in a million high-school-age students attended the high school that had the combination of money and foresight to buy a computer. Bill Gates happened to be one of them.

Charlie Munger says you can be very deserving, intelligent, and disciplined, but luck is also a factor. “The people who get extraordinary outcomes have a hell of a lot of luck,” he says.

Mark Zuckerberg shared that, “Success like mine only happens with luck, and that’s a huge problem we need to fix.”

Not only did he start Facebook, but he also turned down Yahoo’s $1 billion offer to buy it. He made a choice that turned out to be the right financial decision. Was he lucky?

On the other hand, Yahoo was criticised for turning down a big buyout offer from Microsoft. It’s easy to say that they should have cashed out while they could. Bad luck.

Nothing is black or white, or crystal clear. When we look at various cases individually, we can mark that they can be a mix of components. Our effort, genius, skills, or luck. Or lack of them.

Nevertheless, it’s probably better to have a bit of good luck from time to time — Happy St. Patrick’s Day!

Dive Deeper

If you’re interested in behavioral finance and why most people make their financial decisions at a dinner table rather than a spreadsheet, we recommend you read The Psychology of Money by Morgan Housel.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.