Less is More

23 January 2023

Hi, The Investor’s Podcast Network Community!

Tech layoffs continue as Spotify is shedding about 600 employees, or 6% of its workforce.

It’s a big week on Wall Street for earnings, with Microsoft (MSFT), Tesla (TSLA), Blackstone (BX), and American Express (AXP) all reporting.

In markets, 10 of the S&P 500’s 11 sectors closed in the green on Monday, and the tech-heavy Nasdaq registered a second consecutive 2% gain for the first time since October 😎

Investors continue to bet that inflation will fall.

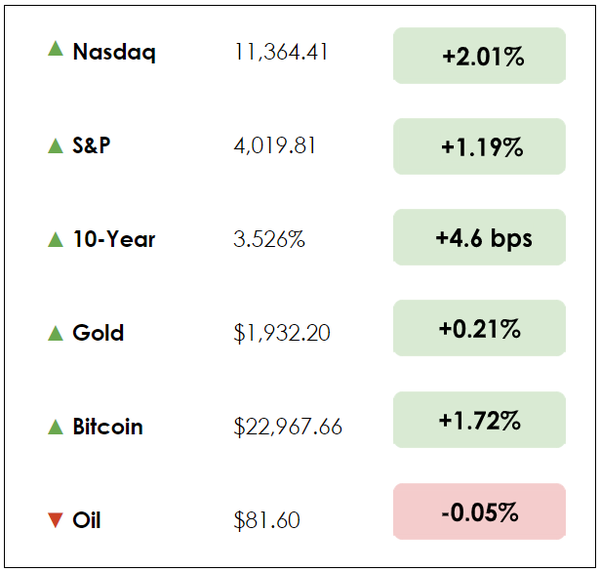

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: Why crypto banks are tapping home-loan banks and Brazil and Argentina’s plan for a common currency, plus our main story on how simplicity can be an investing advantage.

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

🏦 Crypto Banks Tap Home-Loan Banks to Plug Shortfalls (WSJ)

- Two of the biggest banks to cryptocurrency companies are responding to a flood of customer withdrawal requests by borrowing billions from Federal Home Loan Banks, a system originally designed to support mortgage lending in the 1930s.

- The two banks began hemorrhaging deposits after FTX filed for bankruptcy, which sent the industry into a spiral. Signature Bank (SBNY) tapped its local home-loan bank for nearly $10 billion last quarter, while its rival Silvergate Capital (SI) received at least $3.6 billion. Capitalizing recently on the digital asset craze, Signature is a commercial bank previously known best for its multifamily real estate loans.

- The $1.1 trillion home-loan bank system provides low-cost funding to its 6,500+ members. For the 11 government chartered cooperatives known as Federal Home Loan Banks (FHLBs), their job is to help shore up the banking system, yet critics don’t believe this should include cleaning up the crypto industry’s fallout.

- However, FHLB loans are superior to all other debt in a bankruptcy, even ahead of the Federal Deposit Insurance Corporation, and FHLBs have yet to book a credit loss in their 90-year history. To receive funding, banks must provide generous amounts of mortgage-backed securities as collateral.

- Senator Elizabeth Warren argued, “This is why I’ve been warning of the dangers of allowing crypto to become intertwined with the banking system. Under no circumstance should taxpayers be left holding the bag for collapses…(in) a market brimming with fraud, money laundering, and illicit finance.”

- Silvergate has remained firm in its commitment to the space, with its chief executive saying, “This industry has experienced a significant crisis of confidence across the ecosystem because of all of the overleverage in the system and some of the bad actors and bankruptcies. What we’re trying to communicate is that…we’re here for the long haul.”

- According to the president of the Council of Federal Home Loan Banks, FHLBs “have been a financial first responder” during this crisis, helping contain contagion risks.

- Brazil and Argentina will announce their plans for a common currency this week, which could form the world’s second-largest currency bloc behind the eurozone. The two countries will discuss the plan at a Buenos Aires summit this week and invite other neighbors to join.

- Argentina’s economic minister, Sergio Massa, stated: “There’ll be…a decision to start studying the parameters needed for a common currency, which includes everything from fiscal issues to the size of the economy and the role of central banks. It would be a study of mechanisms for trade integration.” The hope is that a common currency would boost regional trade and reduce reliance on the U.S. dollar.

- The project is unlikely to come to fruition soon, with Massa emphasizing that it took Europe 35 years to construct the euro.

- The move to a new currency is most attractive for Argentina, a country plagued by inflation rates of nearly 100% annually. For Brazil and other prospective currency union members, Argentina’s perennial economic volatility, including several sovereign defaults, raises concerns about tying the region’s economic future together.

- A broader Latin American currency union would potentially cover around 5% of global GDP while enabling the region’s historically unstable economies to unify under a more integrated model based around a shared currency.

- Consideration of the plan alone underscores how the paradigm is changing globally, as regional powers increasingly try to carve out spheres of influence and minimize their dependence on the U.S. dollar-based financial order.

WHAT ELSE WE’RE INTO

📺 WATCH: Fight burnout (in investing and life) with work cycles

👂 LISTEN: Mohnish Pabrai’s Dhandho Investment Framework, as review by Clay Finck on We Study Billionaires

📖 READ: What is the dollar milkshake theory? Our Shawn O’Malley explains

Warren Buffett’s “20 slot” rule might be extreme for some, but it’s a striking reminder of the power of simplicity, both in investing and life.

Buffett has said, “I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches, representing all the investments that you got to make in a lifetime.”

“And once you punched through the card, you couldn’t make any more investments at all.”

Buffett continued: “Under those rules, you’d really think carefully about what you did and you’d be forced to load up on what you’d really thought about. So you’d do so much better.”

But this kind of selective focus isn’t conventional wisdom.

Load up

Buffett’s strategy includes “forcing yourself to load up” rather heavily in an investment. The calculus is that by directing energy and attention to fewer tasks, your odds of success are likely to improve.

To master a skill, an investment strategy, or a portfolio, you must be selective. Sometimes, you have to trim away good ideas to make room for better ones. You have to ignore distractions, market noise, and month-to-month price fluctuations.

Buffett touched on his rule further in 1998, telling MBA students that they shouldn’t just assume they will get 20 great ideas in their lifetime. They might only need “three or five or seven” to get wealthy, he said.

“But what you can’t do is get rich by trying one new idea every day,” Buffett added. He knows the market will always be there and opportunities always resurface.

This uncanny patience has been rewarded over and over.

Fewer decisions

We have thousands of stocks from which to choose, but you only need a few big winners to perform well. Cutting down on the number of decisions you make could enhance your clarity and decision-making ability.

Wall Street benefits from trading activity, which means it usually needs reasons to make many changes to your portfolio. Some investors believe they’ll outperform the market by moving money around from one investment to another, making hundreds of investment decisions annually.

The problem: None of this activity guarantees a return on investment.

Buffett has frequently linked his strategy to baseball Hall of Famer Ted Williams, who wrote The Science of Hitting. Williams argues that to become a great hitter, you have to keep yourself from swinging at bad pitches. You’re looking for the perfect pitch in your wheelhouse.

Buffett took the analogy to investing because you can stand at the plate all day waiting for the right investment opportunities.

“You don’t have to make any decisions,” Buffett once said. “Nothing is forced upon you. They might be wonderful pitches to swing at, but if you don’t know enough, you don’t have to swing.”

Combat choice overload

What does this mean for your investment strategy?

It might mean hardly buying or selling stocks for days, weeks, months, or years. It might mean simply logging out of your investment accounts and enjoying your life without looking at the value of your net worth every week. Or it might mean dollar-cost averaging into your highest-conviction names.

Other investors stick to rigid plans for portfolio size, setting rules such as having no more than 10 or 12 stocks at a time.

Too many positions or choices, the thinking goes, and you can feel overwhelmed. Plus, a focused investor like Buffett would question how an investor could thoroughly know what they own if they have 40 stocks.

It’s never been easier to buy and sell securities with a few clicks on your phone. News alerts, price notifications, and social media exacerbate the tendency to think short term.

By some estimates, the average investor today holds an individual stock for only four months, a far cry from the 1960s, when the average holding period was about eight years.

Charlie Munger says a key to his success is “sit-on-your-ass investing,” another way of saying you’re usually better off buying and holding quality businesses rather than engaging in a low of buying and selling, trying to anticipate market trends.

Dive deeper

Check out The Tao of Warren Buffett to help guide you on wealth, decisions, and life.

Investors, we’d love to hear from you. How much buying and selling do you typically do in a year?

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.