Is the “Everything Bubble” Popping?

01 August 2022

Hey, The Investor’s Podcast Network Community!

It’s Monday, happy August and welcome back to We Study Markets!

It’s that time of year where everyone starts making nervous comments about how quickly summer is flying by 😅

Stocks closed out a great July performance on Friday, strongly up once again. We credit this to the ‘bad news is good news’ phenomenon, meaning that stocks actually perform better when there’s worse economic data like last month’s GDP report.

This is because when economic data points to a nearing recession, investors begin anticipating a “Fed pivot” sooner than later, where the Federal Reserve counters a recession by cutting interest rates (which is great for equity valuations).

It appears many are expecting a Fed pivot to happen by the middle of next year, but the President of the Federal Reserve Bank of Minneapolis, the famous Neel Kashkari (any readers of Too Big to Fail out there?), says this is far too optimistic.

The central bank still has a long way to go in fighting inflation before considering rate cuts. More on this in our In The News section.

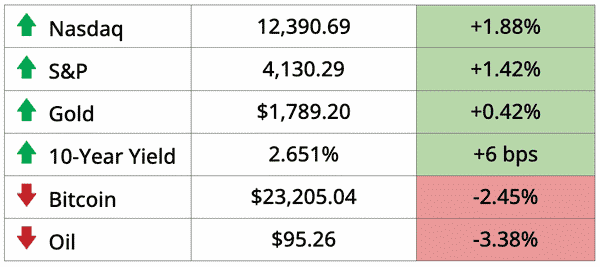

This morning, bonds, Bitcoin, and oil are all weaker👇

**Equities as of 4pm EST on prior day’s close, Bitcoin, bond, and oil prices as of this morning

Today, we’ll discuss Jeremy Grantham’s outlook for markets following the Everything Bubble, mortgage revolts in China, JPMorgan entering the travel business, and a little Guy Spier wisdom.

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

📈 Best Month Since November 2020 for the S&P 500 (NY Times)

Explained:

- 2022 hasn’t had much cause for celebration for investors. Investor’s spirits lifted last month though, as the S&P 500 gained 9.1% in July, while the Nasdaq climbed 12%.

- With inflation at a 40-year high and data showing the U.S. economy shrank for the second quarter in a row, many investors remain cautious about the rally. The Fed raised interest rates another 75 basis points last week, and investors are hoping a slowing economy may encourage the Fed to rethink continued rate hikes.

What to know:

- Stock market rallies are rare in times of Fed tightening, and Jerome Powell and friends hope aggressively raising interest rates will slow the economy and inflation. But, how many rate hikes does he have in his arsenal before seriously hampering economic growth?

- Markets are guessing we’ve hit peak hawkishness, and the Fed will be easing sooner than expected. Or, at least, raise rates at a slower clip than expected. Does this rally have staying power, or has the market prematurely declared victory over inflation?

🏚️ China Home Sales Plunge in July (WSJ)

Explained:

- After a short-lived recovery, widespread mortgage revolts in China over concerns that developers would be unable to finish current projects, led to a 28.6% plunge in home sales in July. The country’s top 100 developers saw their sales drop by $77.6 billion from just one year ago. Following a years-long debt-fueled boom, many property developers in the country find themselves now fending off bankruptcy and protests.

- The revolt began at the end of June, as mortgage holders protested incomplete housing projects by China Evergrande Group, and the trend quickly spread to over 300 incomplete construction projects across the country. These home buyers are, to their credit, no longer interested in paying for homes that are indefinitely paused and uncertain to ever be delivered to them.

What to know:

- Real estate development has been a defining part of China’s economic miracle over the past two decades, in addition to powering much of the world’s total growth. As Chinese leadership became increasingly desperate to match past rates of GDP expansion though, the country’s economy became addicted to a speculative mania stemming from excessive property development.

- China is now famous for sprawling yet entirely empty ghost towns filled with thousands of vacant apartment units. The Chinese Communist Party has reversed course over the past year to try and tame these sorts of misallocations of capital, but the ripple effects are having huge social consequences. Pressure on the government to respond further is rising sharply.

✈️ JPMorgan Enters the Travel Business (WSJ)

Explained:

- For the past 18 months, the nation’s biggest bank has been assembling the pieces to launch a full-service travel company.

- They bought a booking system, a restaurant-review business, and a luxury travel agent. They are also building airport lounges and have hired a team of thousands of travel agents with a website launching soon.

What to know:

- Travel is one of the largest spending categories for banks and credit card issuers, and JPMorgan wants a bigger piece of the pie. Currently, the bank estimates that their customers account for $1 of every $3 spent on leisure travel in the U.S.

- Bank executives said they could capture $15 billion in bookings in 2025 which is five times what JPM does now. That would make it the third largest travel agent in the U.S. Far smaller, though, than the $70 billion that both booking.com and Expedia do in annual bookings.

Tweet about this:

FEATURED SPONSOR

Warren Buffett doesn’t just buy a company’s stock based on its financials. He also looks for great management teams. You need to be like Buffett when investing passively in real estate. Get access to the free 7 Red Flags for Passive Real Estate Investing guide to learn what to look out for in a deal’s management team.

DIVE DEEPER: POPPING THE “EVERYTHING BUBBLE”

Last week, we had the tremendous pleasure of speaking with a very special guest, legendary investor Jeremy Grantham, on our flagship podcast We Study Billionaires.

Grantham is thought of by some as a permabear, that is, someone who frequently predicts turmoil and declines in financial markets, but we’ve found his thinking to be quite prescient.

Last year when Grantham spoke to us, he warned of multiple bubbles across financial markets that he called the “everything bubble”, while highlighting that a downturn in speculative tech stocks would be the canary in the coal mine. In the time since, his predictions have proven painfully true, with a harsh sell off in the Nasdaq leading the way.

Both bond and equity markets alike have been beaten down this year, and with a doubling of mortgage rates in just the past few months, it doesn’t seem like long before we see a meaningful pullback in housing prices.

Grantham explains that years of artificially low interest rates, propagated by the Federal Reserve’s interventions and made worse by deteriorating demographics globally (fewer babies being born while populations age), have fueled speculative excesses across nearly all aspects of the economy and financial system.

He describes further that wildly optimistic assumptions about future growth in unprofitable yet innovative companies, particularly those associated with the ‘SPAC boom’ and meme stocks, served as an excellent indication that euphoria had reached its peak.

For example, Grantham was an early investor in QuantumScape, a solid-state lithium-ion battery research lab. Despite the company projecting several years before earning any expected sales, QuantumScape merged with a SPAC and saw its share price rocket, leading to a valuation at one point greater than that of General Motors.

What to Know

In response, U.S. equities in the first half of this year have had just about their sharpest decline in history punctuated recently by a nice rally in July.

Grantham says, “there’s nothing as quick and spectacular as a bear market rally. They had one in late 1929 to early 1930, an absolute doozy of 45% and of course, with historical hindsight they signified very little, but at the time they frightened the pants off bears and they give hope that all is over, all is forgotten and it’s back to the races. I suspect we may very well have a pretty decent bear market rally as we sit. I wouldn’t be surprised if this went on for at least another month.”

Grantham explains that about 80% of the time the market does a good job accurately pricing stocks and other assets.

While 15% of the time, irrational exuberance consumes investors as we saw through much of 2020 and 2021. This can then lead into periods that occur about 5% of the time, where the consensus outlook becomes harshly pessimistic and equities are valued extremely cheaply.

He reminds us that even great companies, like Amazon (AMZN) in the early 2000s, can be brought to their knees by these 5% periods in markets. The stock fell 92% at the time despite consistent sales growth and ultimately following a trajectory to being a defining part of many Americans’ daily life.

So What?

Grantham has not been shy about pointing the blame for the Everything Bubble squarely on the Fed.

Bubbles in financial markets have actually become a tool of their monetary policy he suggests, as the central bank uses low short-term rates and quantitative easing to juice equity and housing market prices which boosts consumer demand in the economy through the wealth effect.

This means that when people see their net worth rising, they’re more inclined to swipe their credit cards which drives economic activity. However, in the years since the 2008 financial crisis, the Fed has become recklessly reliant on this synthetic approach to stimulating growth.

And when the business cycle peaks, marked most recently by a hiking of interest rates in response to surging inflation, the wealth effect has the opposite influence at precisely the wrong time. Just as businesses need consumers to prove resilient the most, crashing asset prices accelerate fears and drive us deeper into a recession.

Grantham was unsurprised that the Fed failed to anticipate how their loose policies would generate inflation saying, “If I’d been asked to bet, would the Fed get inflation wrong when inflation came along? At any time I would’ve said, of course they’ll miss it, they’ll be late, their responses will be pretty ill-judged. The Fed’s record is terrible.”

So it’s safe to say that this famous investor is not optimistic about the current prospects for financial markets, and he’s even less optimistic about how the Fed will navigate these uncertain conditions.

Grantham expects that equities will continue reverting back to the mean in the coming months, or in other words, they’ll keep trending back towards their fair value once this bear market rally subsides. That would mean much more downside ahead 😅

What do you think – is the market stuck in a bear market rally? Or are there truly greener pastures ahead?

Hit reply to this email to let us know.

And if you want to avoid getting stung by overpriced stocks, we recommend using our investing tools over at TIP Finance.

It’ll help you easily calculate a company’s intrinsic value (for free). If you haven’t signed up yet, join the thousands of other investors in our community today, click here to get started.

Tweet about this:

QUOTE OF THE DAY

“The entire pursuit of value investing requires you to see where the crowd is wrong so that you can profit from their misperceptions.”

Guy Spier is the manager of the Aquamarine Fund and author of The Education of a Value Investor. He is well-known for bidding $650,000 with Mohnish Pabrai for a charity lunch with Warren Buffet in 2008.

Guy said his lunch with Buffet turned him into a true value investor. It comes as no surprise then that his largest American holding in the Aquamarine Fund is Berkshire Hathaway (B shares) which comprise 22.50% of the fund according to his latest 13F filing.

- FYI: A 13F filing is a quarterly report institutional fund managers with control over $100 million in assets are required to file with the SEC listing all their equity holdings.

If you’re interested in cloning the super investors of the world, studying their 13F filings is required reading. Or you could just check out TIP Finance to see their portfolio holdings.

Guy is currently searching for value in industries such as cloud computing, SAAS, cybersecurity, luxury goods, credit ratings, elevators, and even stock exchanges.

The quote emphasizes the importance of buying quality businesses when Mr. Market prices stocks below their true value. In such times, moving contrary to the herd can be immensely profitable, and this is the crux of value investing.

Be on the lookout this week, as we’ll be doing a deeper dive into more of Guy’s thoughts and strategies on value investing.

In the meantime, check out William Green’s fantastic interview with Guy on Richer, Wiser, Happier here, and hit reply to this email to let us know your thoughts :)

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12 pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.