Is China The Next Japan

05 December 2022

Hi, The Investor’s Podcast Network Community!

If you thought you were having a bad Monday, Wall Street might have ya beat 😒

What terrible thing could’ve happened to send stocks tumbling, you ask?

In our topsy-turvy world, strong economic news is actually bad for stocks. The November Institute for Supply Management (ISM) Services index beat consensus expectations and showed that economic activity expanded from October.

This fuels investors’ fears that the Fed will be forced to keep rates elevated for longer to smother demand and return inflation to its 2% annual targets 😅

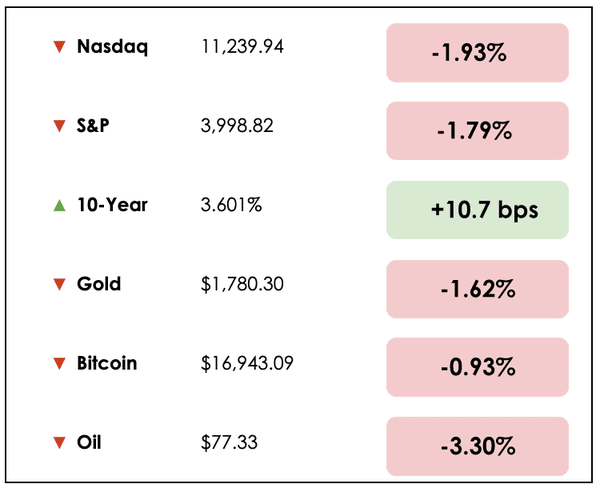

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: Inflation appears to (partially) ease its grip on consumers, and governments warn of $65 trillion in hidden dollar-based debts, plus our main story on why China may be turning into Japan.

All this, and more, in just 5 minutes to read.

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🤞 Inflation Begins To Ease Its Grip — Sort Of (WaPo)

Explained:

- After more than a year of surging inflation, consumers are finally catching a break as supply chain turmoil subsides. Gasoline prices have dropped, chicken wings are on sale, and retailers are broadly marking down their excess inventory.

- At its peak, prices to send a standard 40-foot shipping container from China to the U.S. were over $20,000 in 2021. Today, that figure has fallen 90% to just under $2,000 as the economy slows and people spend less time shopping online.

- While inflation’s pinch is easing, Fed Chairman Jerome Powell recently told an audience, “It will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains too high.”

Why it matters:

- Although price pressure from elevated demand has cooled for merchandise and other goods, spending has shifted towards the services sector.

- Short-staffed restaurants raising prices, for example, are driving inflation in the services sector to rise at more than twice the rate it did last year.

- Even with moderating goods prices and a rapid housing market slowdown, in addition to used car prices falling 15% from their 2021 peak, a survey by the Census Bureau suggests that 15.7% of American households find it “very difficult” to pay for routine expenses.

❓ $65 Trillion In Debt Is “Missing”? (Bloomberg)

Explained:

- Institutions outside the U.S. hold an estimated $65 trillion in “missing” dollar debt off their balance sheet via currency derivatives, prompting policymakers to warn that this cloudy financial picture may make it harder to respond to the next financial crisis.

- Per the Bank for International Settlements (BIS), much of this is short-term borrowing that forms a “huge, missing, and growing” debt that pension funds, among others, owe through foreign-exchange swaps and other derivatives transactions.

Why it matters:

- Like the last global financial crisis, a shortage of dollars can cause panic as firms race to acquire the dollars necessary to pay off dollar-denominated liabilities. Dollar funding became so stressed that central banks were forced to intervene with swap lines to help struggling borrowers.

- One group of researchers concluded, “It’s not even clear how many analysts are aware of the existence of these large off-balance sheet obligations…Thus in times of crisis, policies to restore the smooth flow of short-term dollars in the financial system —for instance, central bank swap lines — are set in a fog.”

- The head of the BIS’s economic and monetary department warned, “There’s a staggering volume of off-balance sheet dollar debt that’s partly hidden, and foreign exchange risk settlement remains stubbornly high.”

BROUGHT TO YOU BY

Enjoy the ups and downs of roller coasters, but not when it comes to your money?

Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

WHAT ELSE WE’RE INTO

📺 WATCH: Key takeaways from Morgan Housel’s personal finance tips, with Weronika Pycek on YouTube

👂 LISTEN: Berkshire Hathaway’s shareholder meeting and intrinsic value, the latest on We Study Billionaires with Clay Finck and Stig Brodersen

THE MAIN STORY: CHINA’S DEMOGRAPHIC CRISIS

Overview

In recent years, paranoia has increased dramatically over whether the U.S. will cede its position as the world’s top economy and military power to China.

With a population of over 1.4 billion compared to the U.S.’s approximately 330 million, it seems this is a question of “when,” not “if.”

Of course, it’s not as simple as just comparing population figures. The age distribution and growth trends matter hugely.

For China, this is where the picture begins to break apart, and the implications for investors globally are significant.

Let’s discuss.

What to know

Howard W. French, a professor at Columbia University’s Graduate School of Journalism and a longtime foreign affairs correspondent, writes, “China’s population dynamics constitute one of the most powerful but regularly underappreciated factors shaping the world today.”

Like many developing countries, China’s rapid ascent was fueled hugely by a so-called “demographic dividend.” Its population structure was defined by a sizable swath of young, working-aged adults rather than older adults nearing retirement and the elderly.

A costly mistake

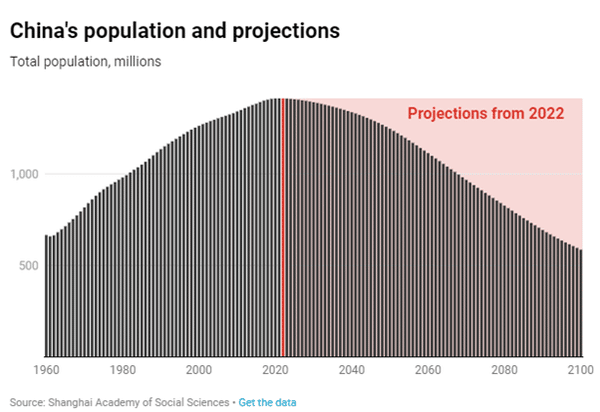

Due partly to its devastating nationwide “one-child” policy from 1980 to 2016 that restricted families to one child each, China’s demography has likely peaked and is in a downward spiral.

This is because such a policy forces birth rates to well below the population replacement level of 2.1 children per woman in aggregate.

The latest projections from the United Nations indicate that by the end of the century, China’s population will be roughly half of its neighbor India’s, despite currently being larger.

The UN also believes that China’s population has already peaked and begun to decline, which comes ten years earlier than its projections in just 2019.

And leaked data reports revealed earlier this year that China’s official demographic statistics might be inaccurate, to the tune of overcounting its population by over 100 million people.

Historical Parallels

China isn’t the first major economic powerhouse to see its fortunes turn due to poor demography. Japan encountered similar issues in the 1990s and has spent the last few decades automating much of its economy in response to labor shortages.

Harvard economist Ezra Vogel predicted that Japan would supplant the United States as the world’s leading economy in 1979, while others maintained the prediction well into the 1990s. Evidently, this didn’t come to pass.

The country’s aging population was too willingly overlooked, and its financial crisis in 1989 created a “Lost Decade.”

For stock investors there, the returns since then have been bleak. Japan’s Nikkei 225 stock market index has yet to return to its 1989 peak.

What it means now

One team of JPMorgan analysts suggested that “the worrisome news is that China has become increasingly similar to Japan in the late 1980s.”

Add to this an authoritarian regime desperate to hold power, a real estate crisis, and unprecedented protests against the Communist Party’s harsh “zero Covid” lockdown policies.

According to JPMorgan, corporate debt in China is now around 160% of GDP, whereas Japan’s peaked at 145%, in addition to household debt levels of 62% of GDP, which exceeds Japan’s 60% figures in 1989.

They also believe China’s aging problem is even worse than Japan’s in the late 1980s while at similar economic development stages.

Takeaways

We’ve expressed concern over investing in China before. Still, the narrative is often that the risks in Chinese equities are worth taking, given the country’s upward trajectory and expected ascension to global dominance.

Professor French concludes, though, that “China will almost certainly not have an economy that towers over that of the current incumbent, the United States.”

We aren’t foolish enough to speculate on the fate of geopolitics.

However, we do believe China’s demographic turmoil raises serious concerns about many overly-optimistic growth projections.

The U.S. faces its own demographic roadblocks and challenges, but the inevitability of China’s rise appears increasingly blurry.

To its advantage, the U.S. has a strong tradition of immigration that lessens its demographic crisis, and its ability to attract immigrants in the future will shape its power struggle with a larger but aging China.

Dive deeper

Check out this analysis from the World Economic Forum exploring the implications of China’s shrinking population.

To hear more, listen to Kyle Bass’s interview on We Study Billionaires

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply message us.