Inverse Cramer

Hi, The Investor’s Podcast Network Community!

🌱 Let’s start with some positive news: For the first time, renewable sources generated more electricity in the U.S. last year than coal.

In markets, the S&P 500 has had an interesting year — 293 of firms in the index are down, yet it’s up about 4%. The biggest losers include failed banks like SVB and Signature, and pharma companies like Moderna, CVS, Pfizer, and Johnson & Johnson.

Casino and travel stocks, like Wynn Resorts and United Airlines, have led the way, alongside tech stocks, which account for four out of five of the index’s best-performing stocks.

If you like this newsletter, please help support us by forwarding it to a friend or sharing this link in your group chats 😉

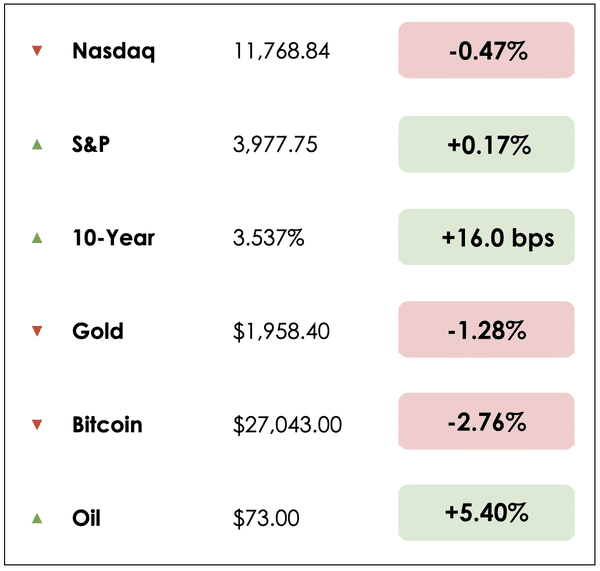

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Chills ripple through start-up funding

- Crocs maintains its pandemic momentum

- Plus, our main story on betting against one very controversial investor

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

In addition to being a good friend, Compounding Quality is one of the fastest-growing accounts on Substack and FinTwit.

He works professionally as an Equity Fund Manager and teaches people about investing for free with his wonderful newsletter.

Learn about Quality Investing from someone who manages roughly $200 million.

IN THE NEWS

🧊 Start-Up Funding Chills (NYT)

Explained:

- Two weeks after Silicon Valley Bank failed, the fallout has hit the start-up market as investors pulled back further.

- One founder of a financial technology startup was aiming for $2.5 million in funding this year but was turned down by 67 investors. Then, in mid-March, his initial investors backed out, too. “I was scratching my head, saying, ‘Why did they just ghost?’” he said. “Then the bank run happened and I was like, ‘Ah, they’re terrified.’”

- After a tough 2022, when the easy money for startups dried up, many hoped things would bounce back in 2023. Not so far, as SVB’s collapse has stoked more anxiety and dread in dealmaking throughout Silicon Valley.

Why it matters:

- The Fed’s campaign to hike interest rates since March 2022 has led to slashed valuations, lowered ambitions, and widespread layoffs. Over the past two weeks, while regulators scrambled to find a buyer for SVB, companies that relied on it for lines of credit have scrambled to secure a new source of funding.

- Note, SVB has found a buyer: U.S. regulators said Monday they would backstop a deal for regional lender First Citizens BancShares (FCNCB) to acquire SVB, sending FCNCB’s stock up over 45%.

- Investors, wary of risk, are choosing to sit on the sidelines. Meanwhile, some young companies are doing what they can to avoid raising new funding, so they do not face lower valuations, onerous terms, and stringent due diligence.

- “People are realizing it’s probably not going to get better,” said Mathias Schilling, an investor at the venture capital firm Headline. “It was a big shock to the system.” He said the bank run that led to SVB’s demise showed how much fear was already in the market. Investors wouldn’t have started such a panic if they weren’t already on edge.

👟 Crocs in Vogue (NYT)

Explained:

- People started buying Crocs in 2020 and haven’t stopped. While other brands that thrived during the pandemic have seen sliding sales, Crocs sales are up nearly 200% since 2019.

- Since January 2020, Crocs’ stock price has soared 167%, partly because the easy slip-on shoes are comfortable for people working at home or puttering around the kitchen or garden. The company’s annual sales have increased 200% in the last three years.

- Last month, after announcing that quarterly sales rose 61 percent, Crocs said it anticipated another record year of growth. Its management team laid out an ambitious business plan that promised more robust profits and revenues when many in the retail industry are trying to temper investor expectations.

Why it matters:

- Crocs continues to lean on influencers, brand partnerships, and digital advertising campaigns. It invests about 7 to 8% of its sales into marketing and will spend more than $200 million on marketing initiatives this year. That includes rolling out more celebrity and big-name partnerships.

- While sales at Peloton, Etsy, and Zoom have dropped since they became pandemic darlings, Crocs is an outlier. Social media deserves credit, as Crocs has built a dedicated customer base with over 6 million Facebook followers and nearly 2 million on Instagram.

- The brand has developed a distinctive online voice through emojis and memes, making shoppers feel that its aim is creating a community rather than just getting people to buy more clogs. “My Crocs are part of my self-care,” said one fan.

WHAT ELSE WE’RE INTO

📺 WATCH: The Age of Easy Money, a PBS documentary

👂 LISTEN: Gold through time — understanding its role across monetary regimes

📖 READ: An estimated 68 million Americans have bet on March Madness

THE ETF BETTING AGAINST JIM CRAMER

Niche strategies

Most of us might use exchange-traded funds (ETFs) to invest in, say, the S&P 500 within a retirement fund. But the types of ETFs you can invest in are becoming increasingly specialized.

The man, the myth, the legend

A common bond has formed on “FinTwit” (finance/investing communities on Twitter) in mocking former hedge fund manager, Jim Cramer, a prominent voice on CNBC who hosts the show Mad Money.

Whether you love or hate him, part of the reason it’s easy to make fun of his hilariously wrong and mistimed predictions is simply due to the sheer number of predictions he makes daily on Twitter or TV.

Eric Balchunas, a senior ETF analyst at Bloomberg, says Cramer has a “knack for not just being wrong, but spectacularly wrong on occasion. He’s got a reverse Midas touch.”

Of course, how many of us would look good in hindsight if we tried to make bets daily on what would happen in markets? Most of us know better, but that’s his schtick. And now, there’s an ETF enabling investors to take their taunts one step further by actually betting against the infamous pundit.

So is betting against him a viable investment strategy?

How it works

Matt Tuttle of Tuttle Capital Management, the man behind a new ETF that does exactly this, thinks so. He says it wasn’t easy to get the idea through the Securities and Exchange Commission (SEC), given that it’s a “first-of-its-kind ETF,” but they eventually approved it.

The fund’s full name is the Inverse Cramer Tracker ETF, ticker: SJIM.

The ETF will operate on a long-short basis, taking the opposite side of whatever trade Cramer proposes. Tuttle explains that their work starts at 8:45 am when they monitor his first TV appearances for specific markets bets, and they continue monitoring his tweets throughout the day and then his show Mad Money, which airs after markets close.

Tuttle says they look for instances where Cramer tells audiences to “buy, buy, buy” a stock, to which the ETF would respond by going short the stock “at the next practical moment.”

It’s a massive amount of work, with a team of three people dedicated to tracking Cramer’s bets.

One trick is to discern when Cramer is really expressing a prediction — that decision ultimately falls to Tuttle, who determines whether market commentary from Cramer qualifies as something they should be trading against.

The portfolio aims to hold between 30 and 50 stocks at all times on an equally-weighted basis. When he doubles down on a stock, it stays in the portfolio. If he provides new stock recommendations, they replace the oldest stocks in the portfolio without an updated recommendation.

Does the strategy work?

In a recent television appearance, Cramer went viral for nearly crying when forced to admit that Facebook (aka Meta) had wasted billions on the Metaverse despite espousing enthusiasm for the company for years. The stock had lost hundreds of billions in market value, and sentiment was at its worst.

In 2008, Cramer faced even more backlash for arguing, “Your money is safe in Bear Stearns,” just six days before the investment bank went under.

Since this on-air admission, Meta stock has recovered around 60%. Cramer’s hysterics almost perfectly matched the bottom.

Had the inverse Cramer ETF been operating at the time, it would have performed handsomely. The beauty of the strategy is that it uniquely bets against extremes in crowd thinking.

When a company has done well enough to pop up on Cramer’s radar, his endorsement typically rings in the last bit of positive momentum before a natural pullback occurs.

The same occurs on the downside. Just when Cramer admitted to being wrong about Meta, its losses had become so extreme that the stock was poised to rally on any positive developments, which it did.

Final thoughts

Momentum and sentiment-oriented investing strategies are nothing new, though this is an unconventional approach.

Watching Cramer muse on stock investing has become a full-time job for Tuttle. He says he hasn’t missed an episode of Mad Money in two months. Tuttle jokingly suggests that his biggest worry is the number of brain cells he’s losing from watching.

Tuttle contends that the ETF isn’t a gimmick: It’s tapping into the phenomenon that “most investors are clueless.” Cramer “swings at every pitch,” which requires taking the most mainstream, consensus view on many investments, so the SJIM ETF is a way to profit from the mean reversion of collective euphoria or pessimism.

While financial advisors are unlikely to use the ETF, Tuttle thinks institutions have been betting against Cramer for a while now, using his picks as a proxy for the views held by the everyday investor. SJIM, in his view, could become a valuable portfolio diversifier due to its lack of correlation with common investing approaches.

We probably won’t be investing in it, but the fund illustrates the plethora of niche strategies that have arisen in the past few years. It’ll be fun to watch what happens.

Dive deeper

Listen to Bloomberg’s podcast interview with Tuttle breaking down the inverse Cramer ETF.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.