How To Invest Like Li Lu

13 September 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

Hopes for significant inflation relief were squashed by today’s Consumer Price Index report that came in higher than expected.

The Labor Department reported that the pace of U.S. consumer price increases moderated somewhat in August but still remains close to a four-decade high (more on that below).

The CPI report shows that “premature calls for the Federal Reserve to pause or pivot on improvements in the inflation environment should be politely dismissed at this point,” according to Joe Brusuelas, the chief economist at RSM US.

It was a sea of red as investors sold off everything from stocks and bonds to gold, oil, and bitcoin. Fears about a more-aggressive Fed caused stocks to suffer their worst day since 2020.

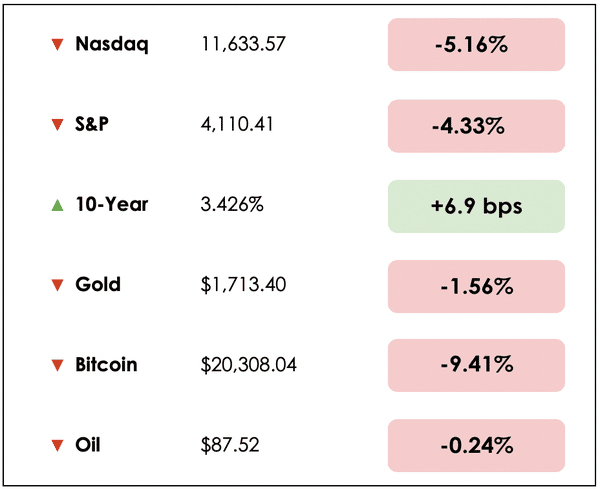

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss takeaways from another troubling inflation number, “debt monsters” and “zombie companies,” a crunch on bitcoin miners, and some investing lessons from a rare Li Lu interview.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

🥵 Another Hot Inflation Report (CNN)

Explained:

- The good news? Inflation cooled for a second straight month, on a year-over-year (YoY) basis. The bad news? It’s still very elevated, and the headline Consumer Price Index (CPI) report came in higher than expected at 8.3% versus the anticipated 8.1%.

- Despite a significant decline in gasoline prices, CPI was unable to cool down in response. Core CPI, which strips out volatile energy and food prices and is watched more closely by the Federal Reserve, rose from 6.2% in July YoY to 6.3% in August.

What to know:

- While most people will talk about the year-over-year price change, that is from August 2021 to August 2022, what perhaps matters more is the sequential change from month to month. In other words, referencing economic data from over a year ago is not particularly relevant to interpreting the current environment.

- On the sequential front, things aren’t any better, though. While the consensus expected a small decline in the inflation rate from July to August, it actually rose by 0.1%.

- Although seemingly small, the direction is what’s significant. It highlights that prices are still increasing in aggregate, even if comparisons to last year show them slightly declining, which is a big challenge to those arguing that inflation has peaked.

👾 Debt Monsters (FT)

Explained:

- For most of the last decade or so following the Great Financial Crisis, extremely low interest rates have allowed a number of otherwise unprofitable “zombie” companies to stay in business. An excess of liquidity and cheap debt enabled these firms to cover up the cracks in their underlying economics.

- Now, though, with inflation surging and interest rates rocketing higher in response, the next shoe to drop will be corporate bankruptcies. There are tons of over-leveraged companies with fragile businesses cringing at the thought of higher interest payments just as the global economy turns down.

What to know:

- In response, the Financial Times has assembled a list of so-called “debt monsters”, whose debts trade at 10 percentage points (1,000 basis points) above government bonds. These excessively high yields on their debts indicate that investors see them as very high bankruptcy risks.

- The list includes 207 companies, and the top is, unsurprisingly, dominated by Chinese property companies that will have to “defy the laws of financial gravity” to survive.

- The list is diverse though, ranging from French supermarkets to Indian miners, Belgian toilet makers, large chicken producers, and meme stocks like AMC (AMC) and Bed Bath and Beyond (BBBY).

⛏️ Challenges Facing Bitcoin Miners (WSJ)

Explained:

- In the highly competitive world of bitcoin mining, which relies on powerful and energy-intensive computers to earn digital asset rewards, the surge in energy costs this year has weighed on operations during a period where bitcoin prices have declined sharply.

- In 2021, with crypto prices surging broadly, it was easy for these companies to raise capital and buy mining machines.

- Now, they’re being pinched from both sides, though, as their mining rewards are worth less, and the cost to earn them is comparatively much higher.

What to know:

- For the large miners, Marathon Digital Holdings Inc. (MARA) and Riot Blockchain Inc (RIOT), their share prices are both down over 55% this year.

- At bitcoin’s price highs last year, it’s estimated that miners earned around $60 million a day, but now, that figure has been reduced to just $19 million.

- For more highly leveraged miners in the space, there’s tremendous pressure to pay down debts by selling off bitcoin holdings and mining equipment — Publicly traded miners alone sold 240,000 bitcoin in May and June. This, in part, forced selling has likely contributed to the large downside seen in bitcoin’s price cycle year-to-date.

FEATURED SPONSOR

Enjoy the ups and downs of roller coasters, but not when it comes to your money? Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

DIVE DEEPER: LI LU’S INVESTING TENETS

Patrick — I’ve been going down the Li Lu rabbit hole lately. An investing friend had mentioned a documentary called Moving the Mountain, which I had never heard of, but is about the investing legend’s life as a student leader in the 1989 Tiananmen Square protests in Beijing, China.

His early life story is perhaps more fascinating than his rise to become one of the greats in the investing world, and I highly recommend watching it.

For those unfamiliar with Li Lu, he has been called an investing “genius” by Charlie Munger and is also the only fund manager Munger has ever placed his own funds with.

He was the first person to obtain an undergraduate degree, a law degree, and an MBA, all at the same time while studying at Columbia University, in a language that was foreign to him.

While at Columbia, Li Lu saw that a Mr. Buffett would be speaking on investing, and he attended the discussion, thinking a buffet would possibly be served. He was disappointed with the lack of food, but came away hooked on learning more about how to compound money.

By investing the float of his student loans (not something we would recommend), he had accumulated $1 million by the time he graduated with his three degrees. Jeez! I feel like an underachiever!

He currently runs Himalaya Capital Management and has approximately $18 billion under management. It is difficult to find recent returns from Li Lu, but it is reported that he has compounded money at a 30% rate.

Mr. Lu inspired Berkshire Hathaway (BRK.A) to invest in Chinese electric car maker BYD, which has become one of their most successful investments, turning a $232 million stake into approximately $5.6 billion.

After watching Moving the Mountain, I wanted to learn more about Li Lu and his life. I watched this interview with him and Professor Bruce Greenwald of Columbia Business School, where they discuss Lu’s investment strategy and life philosophy. If you want to learn from one of the best minds in value investing, it is well worth the 1.5 hours of your time.

Here are my top takeaways:

- How to handle a stock market crash — In the interview, which took place in 2021, Li Lu said we are “living in unprecedented times” due to the Fed’s liquidity injections, high rates of inflation, and rising interest rates. He stated, “our attitude is a financial crisis will happen all the time.” To survive the expected boom-bust cycles, Mr. Lu said he “looks for businesses which can get through crises and even thrive. If you hold through the ups and downs, your return will roughly equal the business’s return on invested capital.” To be a great investor, you need to have the right temperament, be able to watch your portfolio fall by 40%, and not make irrational, reflexive decisions.

- When to buy stocks — Li Lu has a disciplined value investing approach, as he identifies great businesses he wants to own and happily waits “for the price to come into our strike zone” before buying. This strategy provides for a significant margin of safety and is reminiscent of Warren Buffett’s idea of “waiting for the right pitch.” He also prefers “to buy stocks when they are trading at a discount to intrinsic value” and is happy to buy more if the stock if it goes down further.

- Characteristics of great businesses — What is a great business for Mr. Lu? He says he looks for companies with above-average returns on invested capital. The return on invested capital (ROIC) represents how much a company is earning on its investment. It is calculated by dividing net operating income after tax by invested capital, and it’s a good indicator of profitability and a sustainable business model.

- Competitive advantages — Great businesses don’t need just an above-average ROIC, but they must also have “the ability to fend off competitors,” according to Li Lu. To accomplish this, a company must have “an enduring competitive advantage” and a “long runway of growth.” He says these businesses are really rare, and only a small percentage of companies belong in that category. Finally, he added, “if you’re lucky enough to find a long-term compounder, own them for a long amount of time.”

- Great management — The importance of great management cannot be understated. Mr. Lu wants to see management with a business owner’s mentality and the ability to exercise intellectual honesty in allocating capital to achieve high rates of returns.

- Munger’s friendship — Li Lu said that Charlie Munger is the most influential person in his life and is inspired by his ability to “maintain rational composure and a commonsensical approach to all problems in business and life.” He stressed the importance of having a role model and a mentor from which to learn.

- Generalist vs. specialist — Li Lu says as investors, we should read widely and gather inspiration from many areas as a generalist, but ultimately, we should aim to be a specialist. Ideally, investors should be an expert in the company/industry that they are investing in and know more than others to gain a competitive edge.

- Investing in China — Chinese stocks have been battered, but Li Lu is bullish on the country and says Chinese companies will continue to become an important part of the global economy. According to him, trade propelled the Chinese economy up until ten years ago. It’s now becoming a consumer-driven economy as more Chinese citizens enter the middle-class and have disposable incomes. Chinese consumers spent $6 trillion in the retail market in 2020 versus $5.5 trillion in the U.S. He said, “China is emerging to become the most dynamic, fastest-growing consumer markets in the whole world, and that is likely to continue for many more decades to come. China remains one of the best markets for value investors.”

For more on the complex issues facing China, check out Stig Brodersen’s interview with David Stein at We Study Billionaires.

Li Lu is a fascinating human being and one of our investing heroes. We can’t wait for a biography to be written about his life. Hint, hint: William Green.

Tell us — What do you think of his thoughts on Chinese companies?

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.