How To Be a Learning Machine

02 August 2022

Hey, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

It was a ho-hum day in the markets Monday as the first trading day in August closed slightly lower. Despite China’s warnings, Nancy Pelosi intends to go forward with a planned visit to Taiwan which has injected a sense of uneasiness in the markets. Everyone is anxiously watching to see how China responds to what it sees as an almost existential provocation.

Earnings reports are continuing to be released and today Uber (UBER), Airbnb (ABNB), PayPal (PYPL), and Starbucks (SBUX) will make announcements.

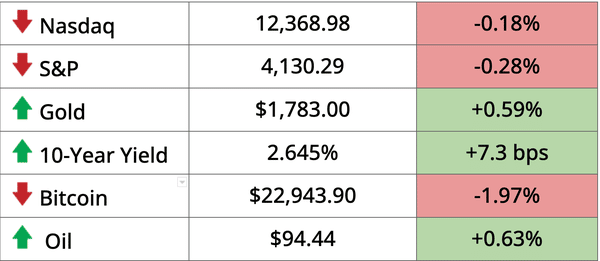

*Equities as of 4pm EST on prior day’s close. Bitcoin, bond, and oil prices as of this morning

Today, we’ll discuss trouble in the Eurozone, Ford’s best month in a decade, deciphering capital gains taxes, and how Ben Franklin can make you a better investor.

All this, and more, in just 5 minutes to read.

IN THE NEWS

🤧 Are Consumer Staples Still a Safe Haven? (WSJ)

Explained:

- During periods of uncertainty, particularly amidst concerns of economic downturns, investors have sought refuge in companies who produce necessary goods like shampoo, razors, toilet paper, toothpaste, etc. But for the two giants in this category, Procter & Gamble (PG) and Colgate-Palmolive (CL), their quarterly guidance delivered Friday has been mixed, just at the time, they should be shining.

- For Procter & Gamble, the impact of a stronger dollar has been considerable since the company earns a chunk of its sales internationally, which means that it has to convert those earnings into dollars at currently unfavorable exchange rates. While sales grew nominally last quarter due to higher prices on goods, real sales volumes declined by 1%. For now, consumers are still willing to stomach higher prices, but company leadership sounded less than confident this trend would continue.

What to know:

- The biggest threat to these stocks is that, as inflation pinches consumer spending further, more shoppers will choose generic alternatives to brands like Gillette and Bounty. With commodity prices soaring over the past 12 months, continued supply chain stress, labor shortages, geopolitical tumult, and a strong dollar, there’s no shortage of headwinds. In his outlook for the company’s new fiscal year starting in July, P&G’s CEO said, “the list of challenges heading into this year is longer than any I can recall.”

- P&G and Colgate are large, established companies with very recognizable brands that most Americans interact with daily, so their insights will continue to highlight the state of the economy and the consumer.

🥴 Italian Bonds Near Eight-Year High Signals Trouble for the Eurozone (FT)

Explained:

- Long-term borrowing costs in Italy are tied to its 2014 highs. The country is seen as one of the most vulnerable to default in Europe as the European Central Bank raises interest rates in lockstep with the Fed.

- While Italy is forced to raise debt with relatively high costs by selling $2 billion of 10-year bonds at a 3.46% yield last month, Germany, in contrast, sees its 10-year bonds (also referred to as Bunds) trading at just 0.94%. This comes after the country’s Prime Minister Mario Draghi resigned last month, soaring food prices, the war in Ukraine, and the end of a decade’s worth of efforts to artificially suppress bond yields on the continent.

What to know:

- Should Italy’s upcoming September 25th elections bring forth a less fiscally disciplined and long-term growth-oriented government, as is feared, then Rome could lose access to approximately $200 billion worth of European Union funding made available via a Covid-19 recovery program.

- For European governments, such discrepancies in bond yields highlight that all is not well in the bloc; right at the time these countries are hoping to show enough strength to endure economic pressure from Russia. Should things continue to worsen for Italy’s financial outlook, this will become an increasingly hot-button issue, with major geopolitical ramifications for the West’s struggle with Russia.

🚚 Ford Notched Its Best Month Since 2009 (CNBC)

Explained:

- Ford Motor (F) had its best month since the Great Recession in July and added 4.4% to the share price on Monday to close at $15.34 per share. The stock climbed 32% for the month. It was the largest monthly gain since its shares surged 127% in April 2009.

- Ford’s stock is still down 26% for the year after being the top growth stock of U.S.-listed automakers last year.

What to know:

- The company’s stock performance was driven by a stream of product-related announcements, including news it has secured battery supplies for its upcoming electric vehicles.

- Ford outperformed GM, Toyota, and Ferrari and returned its quarterly dividend to pre-pandemic levels of 15 cents per share.

Tweet about this:

FEATURED SPONSOR

Enjoy the ups and downs of roller coasters, but not when it comes to your money? Learn how passive real estate investing can give you the enjoyment of a roller coaster ride without all the ups and downs.

DIVE DEEPER: BE A LEARNING MACHINE

“An investment In knowledge pays the best interest.”

– Benjamin Franklin

Charlie Munger credits assimilating the wisdom of Benjamin Franklin partly to his success. Ben knew a thing or two about the art of investment.

When Franklin passed away in 1790, he left a small gift of $4,000 each to the cities of Philadelphia and Boston. But using his gift came with a caveat: The cities must leave most of the donation invested for 100 years. After that time, 75% could be spent on public works and loans for tradesmen. The remainder was invested for an additional century.

After the first 100 years, a portion of Franklin’s gift was used to fund a museum, a library, and thousands of scholarships for apprentices and medical students.

At the end of the 200 years, the two cities combined still had $6.5 million to spend as they wished. Franklin’s experiment taught an important lesson about how money compounds over time.

Benjamin Franklin was a rare genius adept at business, invention, writing, philosophy, and politics. His writings inspired both intellectual and political freedom while contributing immeasurably to American culture.

From an early age, Franklin was fascinated by reading and learning. One of his favorite books was Plutarch’s Lives, a series of short biographies of famous Greek and Roman leaders. Franklin said, “From a child I was fond of reading, and all the little money that came into my hands was ever laid out in books.” Franklin understood that one of the best investments you can make is an investment in yourself.

Books were a formative influence in his life. He began borrowing books from whoever he could. “Often I sat up in my room reading the greatest part of the night, when the book was borrowed in the evening and to be returned early in the morning, lest it should be missed or wanted.” He began acquiring knowledge early and kept up that pace of learning his entire life, so the knowledge compounded over time.

The Way to Wealth, written in 1757, summarizes Benjamin Franklin’s advice from Poor Richard’s Almanac, published from 1733-1758. It’s a compilation of proverbs woven into a systematic ethical code advocating industry and frugality as a “way to wealth.” His advice is just as relevant today as it was over 270 years ago when first written.

Education should be a work in progress until our final days. The investment you make in yourself will always pay off in the end. The wiser you are, the better decisions you’ll make.

Here are some actions steps:

- Read daily for at least 30 minutes

- Study other successful people you can emulate

- Listen to podcasts and interviews and watch biographies to learn as much as you can about how to get better at what you’re doing

- Find Your Junto. Franklin recognized the importance of establishing a wide, close-knit network of friends. He organized a group of enterprising tradesmen and artisans who, like Franklin, were interested in improving. The club met regularly to debate political issues, discuss philosophy, share self-improvement ideas, and further their careers.

We’ve never lived in a better time to learn. Transferring knowledge anywhere in the world is free and instant. It’s fun to acquire, and it makes your brain work better. It helps you think bigger and beyond your circumstances. It puts your life in perspective by essentially helping you live many lives in one life through other people’s experiences and wisdom.

Mohnish Pabrai summed it up by saying, “Yes, these guys are smart. But there are lots of people who are very smart. It is not about IQ. This is not a game about IQ. This is a game about wisdom. And a game about making less mistakes than others. And if you take the error rate down, then it works out very well.”

Benjamin Franklin was a great writer, inventor, scientist, diplomat, media investor, business strategist, and political theorist. How was he able to achieve mastery across so many different domains?

Constant and never-ending learning.

Hit reply and let us know your thoughts on what you’ve been learning lately that has helped in your financial education. What are you reading? What was the best podcast you’ve listened to lately? Do you have a “mastermind” like Ben’s Junto?

Tweet about this:

WHAT TO KNOW ABOUT TAXES FROM INVESTING

In regular brokerage accounts, you’ll be taxed on capital gains whenever you sell a stock above what you paid for it – your cost basis – and on dividend income paid out to you as a shareholder, which is taxed like regular income typically (even if you have dividends set to be automatically reinvested).

However, retirement accounts are not taxed on capital gains, so if you’re participating in your employer’s 401(k), 403(B), or using an IRA, this is a huge advantage. We have a full investing guide to help explain further.

Understanding Capital Gains

Your broker should make keeping track of capital gains and income taxes quite painless, as they’ll track your cost basis and dividends accrued, in addition to providing the relevant tax forms.

Depending on how long you hold your investment before selling, you’ll be taxed differently on these profits, with the most favorable rates applied to investments held for over a year.

These are called long-term capital gains, and for the vast majority of investors, they’ll be taxed at 15%.

Note, for individuals with incomes up to $40,400, you may face no taxes on long-term capital gains, while extremely high-income earners could pay as much as 20%.

The government disincentivizes short-term trading and speculating by taxing gains on investments held for less than a year as ordinary income which tends to be significantly more costly. In this sense, it literally pays to be a long-term investor 😁

So if you do make large profits, if possible, you may consider waiting one year before selling. And if you lose money investing in a year within a taxable brokerage account, you can use those losses to offset taxes owed on your regular income.

This tax-loss carry forward doesn’t apply for retirement accounts, though, which is all the more reason to invest conservatively with these funds. You also have to actually sell stocks to realize a tax offset; there’s no compensation just for your share prices declining on paper.

Check out the IRS’ resource on capital gains and losses here, or consult a tax professional (nothing here is financial advice).

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you tomorrow!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12 pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.