Hole in One

Hi, The Investor’s Podcast Network Community!

🏀 A pair of Air Jordan sneakers, worn by Michael Jordan during the 1998 NBA finals, set a new auction record on Tuesday: They went for $2.2 million, including fees.

Sneaker collectors and Jordan junkies credit ‘The Last Dance’ documentary with igniting MJ-mania. It’s sent recent prices of Jordan game-worn gear to new heights.

It’s all part of the incredible value and lure around Jordan, who played in his final NBA game 20 years ago this week.

🍏 Another milestone: On this day in 1976, Apple released its first computer, the start of an extraordinary era for the tech giant.

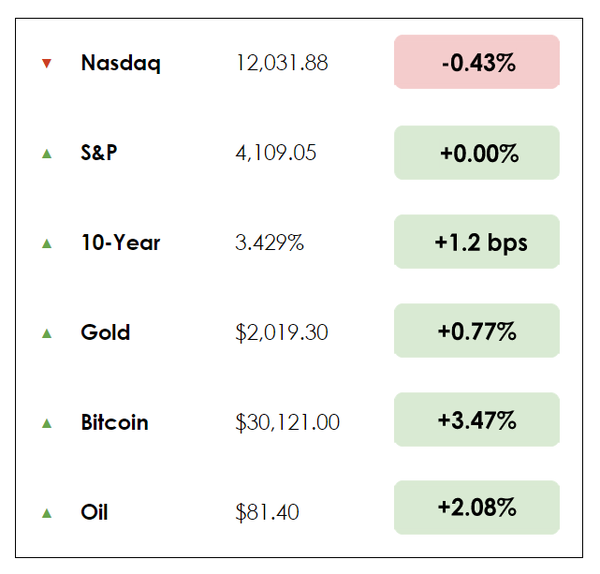

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Buffett’s bargain-hunt in Japan

- Super Mario helps Nintendo level up

- Plus, our main story on the allure of the Masters golf tournament

All this, and more, in just 5 minutes to read.

BROUGHT TO YOU BY:

Real estate investing, made simple.

17% historical returns*

Minimums as low as $5k.

EquityMultiple helps investors easily diversify beyond stocks and bonds, and build wealth through streamlined CRE investing.

*Past performance doesn’t guarantee future results. Visit equitymultiple.com for full disclosures

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

🔎 Buffett Hunts for Bargains in Japan (Bloomberg)

Explained

The Oracle of Omaha has gained around $4.5 billion on several Japanese trading houses since 2020, making his recent statement to Japanese media that he’s open to more investment opportunities in the country less surprising.

- Warren Buffett revealed stakes in Japanese companies worth $6.1 billion in 2020, boosting those holdings with another $2.4 billion in November, and he told Nikkei that he’s since added further to those investments.

The 92-year-old is currently in Japan, meeting with leaders of these commodity-centric conglomerates “just to have a discussion around their businesses and (to) emphasize our support.”

Japan’s trading houses have deep historical roots and date back hundreds of years, supplying the resource-poor nation with everything from energy to food and, more recently, things like home-shopping networks and convenience stores.

- They all roughly follow the same business model: take stakes in natural-resource projects, trade those commodities, and use cash flows to slowly diversify.

Why it matters

Trading houses offer Buffett’s Berkshire Hathaway exposure to a wide swath of the Japanese economy as the company seeks to deploy its massive cash pile into better-returning assets.

- To fund its investments, Berkshire has become one of the largest foreign issuers of yen bonds, preparing another bond sale as soon as this week.

T&D Asset Management’s chief strategist commented that Buffett’s remarks “may encourage foreign investors to invest in Japanese stocks, especially value stocks.”

The moves also highlight Berkshire’s growing exposure to commodities. Berkshire poured over $11 billion into Occidental Petroleum and $20 billion in Chevron in the last year.

🕹️ Super Mario Helps Nintendo Level Up at the Movies (WSJ)

Explained

Moving to a different yet iconic part of the Japanese economy, the beloved gaming company, Nintendo, has found blockbuster success with its Super Mario Bros. movie.

In its first five days, the game-inspired film grossed $377 million globally, making it the largest opening weekend ever for an animated movie, bypassing Disney’s Frozen 2. That sequel later racked up $1.5 billion in box-office revenues.

- The outlook is brighter still since the Mario movie hasn’t opened in its home country of Japan yet. It’ll release later this month.

Why it matters

Jeffries analysts expect the movie to generate around $350 million in operating income for Nintendo, which saw its stock jump 4% this week on the good news.

For Nintendo, a company projected to have earned nearly $4 billion in operating profit in its last fiscal year, what’s really exciting is whether it can seize this opportunity to further monetize its popular video games by bringing them to the big screen.

The company earns most of its revenue from selling Switch video game consoles and console games, with mobile games and royalties accounting for about 3% of its sales. But it hasn’t released a new Switch console in six years.

- Given that many young parents grew up playing its games, Nintendo has an opportunity to reach a large family audience, appealing to both children and adults.

After the company’s hit mobile success with “Pokémon Go” failed to materialize as a new revenue driver for Nintendo several years back, investors hope the breakthrough cinema success won’t be a one-off, too.

MORE HEADLINES

🚀 Bitcoin prices climb above $30,000, the highest in 10 months

🛢️ Russian oil & gas revenues plunged 45% in the first quarter

💻 Apple’s Mac shipments drop 40%, PC makers slump

Introduction

When Spaniard Jon Rahm won The Masters on Sunday, he received a $3.24 million check, the largest in the tournament’s history.

But the tournament’s value goes beyond the big prize money.

Every week in April, the best golfers in the world assemble at Augusta National in Georgia. Exclusivity, scarcity, rich history, and tradition have driven up the value of almost all things Masters.

There’s the famed entryway, Magnolia Way, with 61 magnolia trees on each side of the road. There’s the clubhouse built nearly 170 years ago. And there’s the tradition of U.S. presidents flying down to Georgia to play the world-class course.

“A tradition unlike any other,” commentator Jim Nantz has said.

Tradition & legacy

The Masters generates millions in sponsorships, merchandise sales, and TV rights. Forbes estimates the tournament’s net worth is over $2 billion, making it the fourth most valuable brand in sports, behind only the Super Bowl, the Olympics, and the FIFA World Cup.

It’s a special event for sports fans. The tournament is invite-only. It’s held at one of the world’s most exclusive and prestigious golf clubs.

The tournament has been played annually since 1934. It has a rich history of iconic moments, including Jack Nicklaus’ six victories and Tiger Woods’ historic comeback in 2019. The winner receives “The Green Jacket,” every pro golfer’s dream.

The Masters is one of four major tournaments on the pro golf calendar, along with the U.S. Open, the Open Championship, and the PGA Championship. Winning any major tournament is significant and elevates a golfer’s career status (and earnings).

Further, Augusta National is known for its immaculate condition, stunning beauty, and rich greens. Some of its members are among the world’s wealthiest and most influential people, such as Bill Gates, Warren Buffett, multiple CEOs of major corporations, former Secretary of State Condoleezza Rice, and former NFL QB Peyton Manning.

But how the tournament brings in tens of millions each year is less about TV rights and more about ticket sales and merchandise, a non-traditional revenue stream in sports.

Top payouts in 2023

The top five golfers last weekend received the following record payouts:

- $2,700,000

- $1,620,000

- $1,020,000

- $720,000

- $600,000

Revenue breakdown

Estimated revenue for the Masters:

- Merchandise – $70 million

- Badges (tickets) – $40 million

- International TV rights – $25 million

- Concessions – $8 million

- On-course sponsors – $0

- Domestic TV rights – $0

Augusta only has six sponsors — AT&T, Delta, IBM, Mercedes Benz, Rolex, and UPS. Together, they split just four minutes of commercial time per hour of event coverage.

Further, in the TV deals with both ESPN and CBS, per Forbes, the Masters generates no domestic TV revenue because the “agreements with both media partners allow Augusta complete control of the broadcast in exchange for no compensation.” By comparison, golf’s U.S. Open gets nearly $100 million for domestic TV rights.

Merchandise can be purchased only at the event. (Or at a much higher price online via the secondary market.) They do about $70 million in merch sales. That’s $10 million a day, $1 million an hour, $16,000 a minute, and $277 every second.

Because Augusta wants to maintain its image of exclusivity, the Masters is leaving a lot of money on the table. There’s a profound business lesson here that lies in scarcity.

Said Ben Hogan, who won the tournament twice: “If the Masters offered no money at all, I would be here trying just as hard.”

Quirks of Augusta

A few quirks add to the allure. No cell phones are permitted on the grounds.

If you make the once-in-a-lifetime visit to Augusta, it’s going to cost a pretty penny, well into the thousands. But once you’re there, you only need $20 to eat and drink like a king. If you’ve been to an American professional sports event recently, you might have noticed how costly it can be to feed a family of four. Not at Augusta.

The menu’s prices haven’t increased in decades. No sandwich will run you more than $3. Adjusted for inflation, the food has gotten cheaper over time. The inexpensive food prices are part of the draw.

- Egg salad: $1.50

- Georgia Peach Ice Cream Sandwich: $2.50

- White wine: $6

Plus, the course is difficult with its tricky angles, rough areas, tight out-of-bounds areas, water hazards, and strategic location of trees and bunkers. The psychological effect of looming danger exacerbates.

“Every shot is within a fraction of disaster,” said Gary Player, who won three Masters. “That’s what makes it so great.”

The real winner?

Homeowners in Augusta, Georgia.

They can rent out their four- and five-bedroom homes for a weekly rate of $30,000+. It’s simply high demand and not a lot of supply, so the IRS implemented “The Augusta Rule” years ago, enabling homeowners to rent out their home for 14 days per year without requiring them to report the rental income on their tax return.

Dive deeper

Here’s The Athletic’s story on Rahm’s big win Sunday evening.

Enjoy reading this newsletter? Forward it to a friend.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

Enjoy reading this newsletter? Forward it to a friend.