Hedge Fund Legend

02 November 2022

Hi, The Investor’s Podcast Network Community!

📈 It’s Fed day, which means we are once again obligated to discuss the central bank’s latest rate hiking endeavors.

It was a bumpy day as investors eagerly awaited Fed Chairman Jerome Powell’s sentiment for indications of what may happen in the future since plans for today’s 0.75% hike were well known in advance.

While the Fed’s statement appeared to caution against being too aggressive in raising rates and sent stocks up, Powell’s follow-up press conference was more mixed and didn’t sit well 🤢

He emphasized that it was far too soon to consider pausing rate hikes altogether, as markets so desperately want, and even suggested that rates may go higher than is currently expected by most investors.

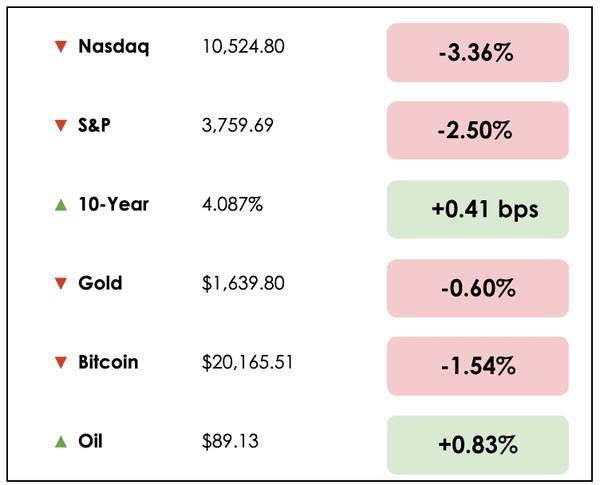

Here’s the market rundown:

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news: The Fed’s fourth massive rate hike in a row and the corresponding fallout for bond prices this year, plus our main story on a hedge fund legend.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

🏦 Fed Delivers Fourth 75 Basis Point Rate Hike (WSJ)

Explained:

- Federal Reserve officials indicated their aggressive campaign to curb inflation could be entering its terminal phase even as they delivered their fourth straight 75 basis-point interest-rate increase.

- While central bankers said that “ongoing increases” will still likely be needed to bring rates to a level that is “sufficiently restrictive to return inflation to 2% over time,” they added language that indicated that “the pace of future increases” in borrowing costs may slow.

Why it matters:

- The policy decision set the target federal funds rate between 3.75% and 4%, the highest since early 2008. As recently as March, that rate was close to zero.

- The U.S. central bank has raised rates at its last six meetings, marking the fastest round of increases since the Paul Volcker years in the 1970s and 1980s.

- The Fed aims to bring down inflation with these rate hikes, yet so far, the actions have slowed activity in housing and some other sectors, but the job market and consumer demand remain strong.

🗡️ A Mark-to-Market Massacre (Bloomberg)

Explained:

- Investors with exposure to corporate bonds may feel nauseous when they review their portfolios this year. Rising interest rates have pushed prices significantly down on high-quality debt.

- A hypothetical portfolio of corporate securities containing thirty bonds in ten major sectors that are all rated investment grade was trading near 100 cents on the dollar in early January.

- This same portfolio is down 34% this year, meaning a $1,000,000 investment in high-quality corporate bonds is now worth only $651,194. That is nearly double how much the S&P 500 has declined in the same time frame.

Why it matters:

- The price declines have come thanks to duration exposure (sensitivity to interest rates) embedded in the debt, with the rise in benchmark rates this year leading to big drops in price.

- The losses are just paper losses (mark-to-market) at this point, and investors who hold the bonds to maturity still collect coupon payments until the bonds pay back in full.

- As one analyst said, “people buy fixed income for a reason, and now you’re running into a situation where your costs are going up, but your fixed income is the same. Hopefully, you won’t need to sell any of your portfolio at such a painful discount to cover those increased costs.”

WHAT ELSE WE’RE INTO

📺 WATCH: The Changing World Order, by Ray Dalio.

👂 LISTEN: Intrinsic value analysis of Dollar General and Apple, by Clay Finck on We Study Billionaires.

📖 READ: Twenty significant mental errors you don’t know you’re making, a Twitter thread by Sahil Bloom.

BROUGHT TO YOU BY

Inflation keeping you up at night?

Sleep well tonight by knowing you invest in one of the best inflation hedges there is — real estate. Learn more at PassiveInvesting.com.

THE MAIN STORY: HEDGE FUND LEGEND JULIAN ROBERTSON

Overview

A few months ago, the legendary investor Julian Robertson passed away, and as we spent some time revisiting stories from his life, we decided he may be worth introducing.

Writings from the excellent Frederik Gieschen framed our thinking here.

Who was he?

For two decades, Robertson led one of the highest-profile hedge funds on Wall Street: Tiger Management LLC. During this time, he earned a remarkable 25% average annual return while also training many successful managers in their own right who became known as “Tiger Cubs.”

After serving in the U.S. Navy, Robertson became a director of the brokerage firm Kidder Peabody in 1957 and left over 20 years later to start Tiger with $8 million.

What to know

His approach was simple: Buy inexpensive stocks with solid earnings prospects while betting against extremely expensive shares of stock.

In Tiger’s early days, despite holding a portfolio of nearly 100 positions, it’s said that Robertson could calculate his firm’s performance daily all in his head.

By the late 1990s, he was managing around $22 billion.

Gieschen explains, that, unlike a real tiger, Robertson didn’t hunt alone.

In fact, it was more like a wolf pack, “one of his key strengths was his ability to attract talented analysts and bring out the best in them. In combination with his exceptional network, he created a research engine to constantly source and test ideas for the portfolio.”

His greatest legacy isn’t the success he had personally in investing, but rather, the accomplished careers built today by Tiger Cubs that he fostered.

Struggles

Of course, Robertson’s career wasn’t all smooth sailing; at times, it even felt like the entire world was against him.

In early 2000 during the dotcom boom in tech stocks, Tiger was down almost 40% from 1998, and his assets had shrunk by $15 billion as investors redeemed their holdings and abandoned him.

In an era of so many high-flying tech stocks supposedly destined to change the world, fundamentals-oriented investors were seemingly unequipped to navigate this new digital paradigm.

Robertson, though, rightly called the bubble an unsustainable craze, saying it’s a “Ponzi pyramid destined for collapse.”

He adds, “the only way to generate short-term performance in the current environment is to buy these stocks. That makes the process self-perpetuating until this pyramid eventually collapses under its own excess.”

Closing it down

On March 30th, 2000, Robertson felt defeated and unable to predict when this epic bubble would deflate, so he closed his fund.

Ironically, this date almost perfectly marked the peak in the tech-heavy Nasdaq index.

Despite this, his fund still had an amazing record, racking up an increase of over 259,000% since 1980.

No one at the time had a better record.

And in the end, Robertson was proven right. The bubble collapsed, and fundamental metrics like companies’ earnings (not just projections) began to matter again.

Gieschen poses that, if Robertson had managed to endure the psychological torment associated with seeing your life’s work nearly collapse before your eyes just a little longer, he likely would have bounced back with a triumphant vengeance that added to his astounding returns even more.

Takeaway

Sure, it’s easy to say that he simply lacked the resilience or courage to ride out his bets while the rest of the world mocked his “outdated strategy.” But we can say this only with the benefit of hindsight.

No one could know how long the bubble would run for, and so long as it did, it wasn’t worth the pain for an already massively successful investor to endure in his late 60s.

Gieschen emphasizes that investment returns, especially after Robertson’s track record of success, aren’t the best way to gauge and value the life that he lived.

Instead, we should see his story as a sobering reminder that even in the cutthroat world of professional investing, our relationships with others are what will proceed us, as Robertson will be best remembered for the generation of great investors (Tiger Cubs) that he spawned.

Gieschen continues, “I think the bubble can be viewed as a blessing in disguise…It was the catalyst that allowed him to transition, painfully as it was, to the next stage in his life.”

We ought to consider how we’re building our legacy in our own lives and careers: Are we, metaphorically speaking, allowing ourselves to be defined by our paper investment returns, or are we cultivating meaningful relationships that transcend us?

Dive Deeper

If you enjoyed this analysis, we’d encourage you to sign up for Gieschen’s newsletter, Neckar’s Minds and Markets, where he discusses the overlooked stories and methods of the world’s best investors.

RECOMMENDED READING

Blockware Intelligence is an industry leader in Bitcoin research for both retail and institutional investors.

From their co-authored research report with Riot Blockchain (NASDAQ: RIOT) to their weekly newsletter and podcast, Blockware Intelligence covers all things macro, Bitcoin on-chain and derivatives, and Bitcoin Mining.

Click here to subscribe to their newsletter (for free) today.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 6pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.