Goodbye, Alibaba

17 August 2022

Hi, The Investor’s Podcast Network Community!

Welcome back to We Study Markets!

Today’s set to be a big day in markets, with the minutes from the Fed’s most recent meeting coming out at 2pm EST, alongside new data on the housing market (mortgage applications) and July’s retail sales figures.

This all follows Biden’s signing of the Inflation Reduction Act yesterday which is a $437 billion new spending package.

The bill provides a range of tax credits and energy provisions for electric vehicles, caps on drug prices, a new 1% tax on stock buybacks, and a 15% minimum tax rate for large corporations.

Markets are a bit uneasy this morning after the UK registered its first double-digit rise in inflation in forty years.

On Monday, we wrote about the effect of demographic trends on society and markets, and one reader wrote in saying, “Attractive countries like the US, UK, or Australia will continue to see growth through immigration — they’re great places to be. This isn’t good for those countries losing those immigrants who are developing at the same time and likely slowing their natural birth rates.”

In terms of equity markets, this reader says banks are likely to be far less attractive, while a peaking population will create opportunities in robotics, health care, and automation.

Disagree? Just hit reply to this email to share your thoughts 😉

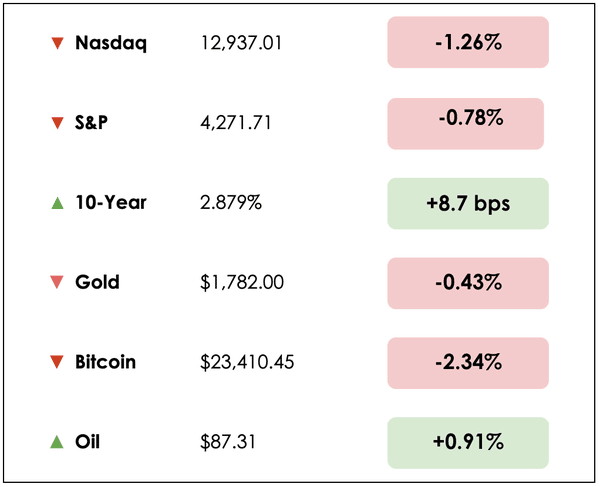

Here’s the market rundown for today:

*All prices as of this morning

Today, we’ll discuss Ray Dalio and Alibaba, the famous investor selling out of his U.S. stocks, Goldman Sach’s research on the commodity supercycle, and July’s retail spending figures.

All this, and more, in just 5 minutes to read.

Let’s do it! ⬇️

Understand the financial markets

in just a few minutes.

Get the daily email that makes understanding the financial markets

easy and enjoyable, for free.

IN THE NEWS

😲 China’s Biggest Bull Dumps Alibaba (Fortune)

Explained:

- Bridgewater Associates founder Ray Dalio, one of the biggest bulls on China, dumped his firm’s entire position in Alibaba amid a fire sale of its holdings in U.S.-listed Chinese stocks. Dalio has historically been a champion of China and its one-party government since he visited the country in 1984.

- Bridgewater sold 7.5 million American depositary shares (ADSs) in Alibaba and its positions in four other Chinese stocks, including JD. com and Didi.

What to know:

- Why Dalio made the change is unclear. He hasn’t completely soured on China, as he kept his positions in tech giants Tencent and Baidu.

- The move comes amid a slowing of the Chinese economy and increased tensions over Nancy Pelosi’s visit to Taiwan. Dalio mentioned last week that he was very concerned about the crisis in the Taiwan Strait and said, “what is happening now between the U.S. and China over Taiwan is following the classic path to war.”

- If tensions continue to escalate, U.S. securities regulators could force Chinese companies to delist from U.S. financial markets so long as they cannot independently verify the quality of their accountants’ audits, affecting up to $1.3 trillion in stocks. We wrote more in-depth on this topic previously here.

👎 Michael Burry Sells U.S. Stocks (Yahoo)

Explained:

- 13F filings have been coming out this week (more on 13Fs below), giving us a peak into the portfolios of top investment managers. One of them from Michael Burry, the famous investor documented in the Big Short for successfully betting against the housing market, has sold all of his U.S. stocks except one, a private prison operator called Geo.

- Warren Buffett added to his positions in Ally Bank though, a classic value play. He also increased his holdings of Apple, which comprises nearly 41% of Berkshire’s stock portfolio.

- In a surprising move, David Tepper of Appaloosa Management added 1.1 million shares to his Kohl’s position.

What to know:

- A 13F provides a snapshot of a funds portfolio as of the end of the second quarter. It doesn’t show any short positions in the portfolios.

- There was a decent amount of tech buying in the second quarter dip, including many funds picking up Amazon, which went from $163 per share at the end of the first quarter to a low of around $102 during the second quarter. To track the investments of legendary investors all in one place, we have a great tool for this over on our website.

🛍️ U.S. Retail Spending Holds Steady In July (WSJ)

Explained:

- As shoppers saved on lower gas prices last month, it appears they made up for it with greater spending elsewhere. Overall retail spending, including online, at restaurants, and in stores, was flat for the month compared to June.

- Removing sales at gas stations and auto sales though, retail spending actually rose 0.7% month-over-month. On Amazon’s Prime day alone (July 12th-13th), consumers spent over $300 million, with much of this going to beauty products, kitchen essentials, and Apple Watches.

What to know:

- Companies like Walmart and Target have highlighted how inflation has changed consumer spending habits and pushed many Americans towards lower-end alternatives for frequently used products. Spending at discount stores, for example, was up 17% year-over-year in July.

- A more complete report on consumer spending that captures spending towards services as well will be released at the end of this month.

FEATURED SPONSOR

Are you worried about inflation? There are few better ways to beat inflation than real estate, but even real estate isn’t all sunshine and rainbows. Learn about the red flags from PassiveInvesting.com.

DIVE DEEPER: IS THE ENERGY AND FOOD CRISIS ALMOST OVER?

Last week, we poured over some research from Goldman Sachs on the matter, so today, we want to discuss the ongoing global crises for energy and food supplies, driven in part by disruptions from the Russian invasion of Ukraine.

Breakdown

Following the war’s first few days, commodity prices globally surged in response to the unprecedented uncertainty stemming from sanctions against one of the largest commodity-producing countries in the world.

As you may know, Europe is hugely dependent on Russian oil and gas, making them particularly vulnerable to rising energy costs amidst their efforts to pressure and sanction Russia.

Because Russia and Ukraine are also among the largest potash producers in the world, which is a necessary ingredient for the fertilizers used in cultivating much of the world’s food supplies, there have been genuine concerns about a dire global food crisis.

And this has been made worse by a perfect storm of poor growing seasons and poor weather conditions in other important areas.

As energy and commodity prices have dramatically cooled in the past few weeks, many investors have rightly questioned whether this means we’ve avoided the worst of these crises.

Supercycle

Goldman Sachs’ head of Commodities, Jeff Currie, has a stern warning for the optimists among us, saying, “In October 2020, we started arguing that we were entering a commodity supercycle similar to what we saw in the 1970s and in the 2000s driven by structural underinvestment.”

Currie has attributed this underinvestment, in part, to the boom-bust nature of these commodity-producer businesses, where large capital investments are made during the boom phase in response to rapid economic growth, which creates a supply glut that crashes prices and spooks investors out of the space for years.

Another factor that he believes will make this cycle particularly painful has been the ESG movement, which has constrained capital inflows into key, yet carbon-heavy industries over the past few years.

Oil companies, metals miners, and others in these spaces have seen the environmental writing on the wall, and broadly not re-invested in new projects.

But this comes at the expense of our intermediate-term production capacity, just at an inflection point in the cycle, as alternative energy sources cannot close the gap in energy supply needs.

Pushing back

Not everyone agrees with Currie’s supercycle view though, which states that prices will be structurally higher for commodities and energy over much of the next decade.

Economist Gary Shilling says, “If you look at commodities, (using the CRB index as a proxy) it has, corrected for inflation, declined 83% since the mid-1800s…so I think human ingenuity beats shortages any days.”

In other words, Gary believes commodities are historically a poor investment over time.

This is largely because we have continuously devised new technologies to more effectively produce commodities or to simply bypass the need for resources in tight supply.

Others say that we’re experiencing the culmination of both a climate and geopolitical crisis, on top of the lagging effects from a pandemic. It’s a tough spot to be in.

This means that even if the war in Ukraine ended tomorrow, said one expert in the report, we would still face existential issues surrounding food production and our energy transition away from fossil fuels.

Takeaway

The reality is that we are still deeply reliant on fossil fuels, and as the global population swells alongside a burgeoning middle-class in developing countries hoping to consume more, our ability to meet this demand has been called into question in a story that will play out over decades.

And as we remake the global energy system, the transition is sure to not be smooth.

Harvard Professor Meghan O’Sullivan had this to say, “the emerging new energy order will have significant geopolitical implications…the historically close connection between energy and geopolitics is in for a new—and tumultuous—chapter.”

This is not a chapter we’re excited about.

While we’re leaning towards team supercycle, and we don’t expect the current cool down in energy and commodity prices to be lasting, this could change if we hit a harsh recession.

Regardless though, such a decline in demand would only be a temporary pause in facing huge global challenges.

For more on this topic, check out Trey Lockerbie’s recent interview with oil expert Josh Young.

HOW TO USE 13F FILINGS TO MIMIC GREAT INVESTORS

By most estimates, approximately 630,000 companies are now traded publicly worldwide. No individual investor has the time or resources to evaluate such a huge number of potential investments.

One solution is to use the Security and Exchange Commission’s EDGAR database and retrieve the latest 13F filings from the world’s biggest investors.

Using the 13F, you can have a peak into the world’s top investors’ portfolios and know what they are buying and at what price, and when they have exited a position.

What’s a 13F filing?

SEC Form 13F is a quarterly report that is required to be filed by institutional investment managers with at least $100 million in equity assets under management. The report discloses only their U.S. holdings and can provide insights into what the “smart money” is doing.

The report must be filed 45 days after the quarter ends and is just a snapshot of their holdings, but it gives an accurate view of what the top fund managers are buying and selling in the U.S. Short and cash positions are not required to be disclosed though.

So what?

These superinvestors spend millions of dollars on research and are armed with analysts who spend their days analyzing companies.

Using the 13F filings, you can let them do the hard work for you and narrow your potential investment opportunities to a more manageable number. Even greats like Seth Klarman, David Tepper, and Daniel Loeb scrutinize 13F filings.

One of our friends at TIP is Mohnish Pabrai, who also recommends studying the reports and using them to be a shameless cloner.

He has even created his Free Lunch Portfolio, a “set it and forget it portfolio” of 15 great compounding companies. Five of these businesses are shamelessly cloned using the 13F filings, and the 2021 portfolio was up 25% versus 28% for the S&P 500.

Criticisms

One risk for both professional and retail investors is the tendency to borrow investment ideas from others. This can lead to herd behavior resulting in crowded trades and overvalued stocks.

Another frequent criticism is that fund managers are only required to file the report 45 days after the end of the quarter.

Most managers report as late as possible, because they don’t want to tip off rivals about what they are doing. By the time retail investors get their hands on the filings, they are looking at potentially stale information.

Takeaway

Although the above are valid criticisms, we feel studying the 13Fs is a great tool to utilize to narrow down the possibilities of potential investments and cut down your research time.

Fortunately, we aggregate 13F filing data into one place for you using our TIP Finance tool.

It’s free to sign up, and you can easily see the latest holdings of our favorite legend investors 💰

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you tomorrow!

If you enjoyed the newsletter, keep an eye on your inbox for them on weekdays around 12 pm EST, and if you have any feedback or topics you’d like us to discuss, simply respond to this email.