Going Viral

Hi, The Investor’s Podcast Network Community!

🔬All eyes are on banks again, with regional banking ETFs, like StateStreet’s (ticker: KRE), down about 5.5% in the past five days.

The feeling is increasing that last month’s banking crisis may not be totally resolved

Causing the most trouble continues to be First Republic Bank, which fell another 30% today. If you haven’t been keeping track, that marks a 95% decline year-to-date, and the bank is looking to sell up to $100 billion in assets as it fights for survival 😬

In contrast, Big Tech seems to be holding up just fine (more on that below), powering the Nasdaq higher today. Meta, aka Facebook, jumped 9% in after-market trading, reporting better than expected earnings and revenue.

—Shawn

Here’s the rundown:

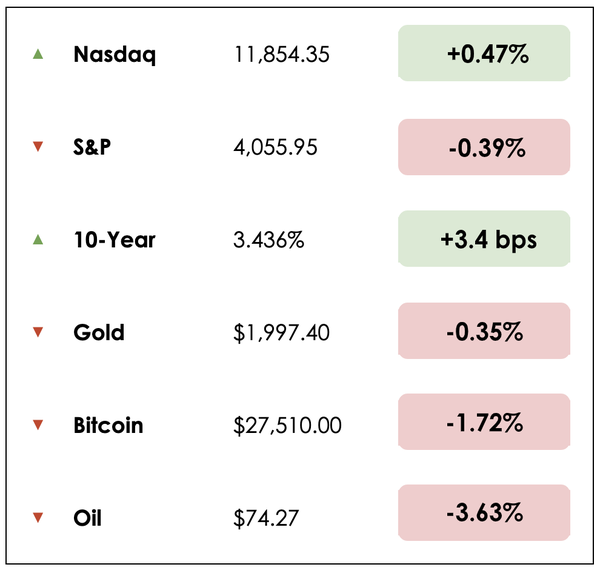

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss in the news:

- Alphabet and Microsoft shrug off investor concerns

- Why investors are betting that the U.S. dollar has further to fall

- Plus, our main story on the science behind “going viral”

All this, and more, in just 5 minutes to read.

Pop quiz: Inspired by our main story, what is the most viewed video of all time?

Read to the end for the answer.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

IN THE NEWS

📈 Alphabet, Microsoft Shrug Off Concerns (NYT)

Thanks to its search engine’s strength, Alphabet, Google’s parent company, has shrugged off this year’s advertising slump.

- The company reported revenue of $69.8 billion in the first three months of 2023, up 3% from a year earlier. Its profits fell 8%, to $15 billion — the fifth consecutive quarterly decline — though Alphabet said it recorded $2.6 billion in charges related to recent layoffs and office space reductions as it tries to become leaner.

Meanwhile, Microsoft’s cloud computing business drove a surprisingly strong quarter despite pressure from the slowing U.S. economy.

- Microsoft’s cloud business — which includes Azure, its cloud computing product, and its Microsoft 365 platform — had $28.5 billion in revenue, up 22% from a year earlier

Why it matters:

Recently, Google has been under pressure from artificial intelligence technology, its sales growth has decelerated, and it’s laying off 12,000 employees to cut costs.

- Its video platform, YouTube, continues to be crimped by the ad slump, and rival Microsoft has gained buzz and users after incorporating an AI chatbot into its search engine, Bing. But the company said travel firms and retailers had spent more to reach customers on the search platform, and AI is only beginning for its search engine.

- CEO Sundar Pichai said they’ve made “good progress” in AI, comparing it to the company’s transition from desktop to mobile computing over a decade ago. “Our investments and breakthroughs in AI over the last decade have positioned us well,” he said. “We’ll continue to incorporate generative AI advances to make search better in a thoughtful and deliberate way.”

For Microsoft, cloud products are “certainly a very important engine for us going forward,” said its director of investor relations.

- CEO Satya Nadella said “AI” or “OpenAI” at least 24 times in his 15-minute introduction on the call with investors. “We have the most powerful AI infrastructure,” Nadella claimed. Its stock jumped nearly 10% Wednesday on the earnings beat and positive outlook on AI.

💰 Investors Bet U.S. Dollar Will Fall Further (FT)

Improving European growth and a potential U.S. recession are expected to pressure the greenback.

- Famed investor Stanley Druckenmiller, who said last year’s dollar rally was the “biggest miss” of his career, is among them. He’s betting against the US dollar as his only high-conviction trade in what he believes is “the most uncertain environment for markets and the global economy in his 45-year career,” reports the Financial Times.

- The U.S. dollar, which rallied strongly last year, has already declined by 10% against a basket of other leading currencies since a November peak. Druckenmiller (and others) believe it has much further to fall.

The reasoning is twofold: The fallout from last month’s banking crisis limits how far the Federal Reserve can raise interest rates, and U.S. investors are hunting overseas for returns.

The How: Differences in real interest rate levels between countries are one of the main factors when pricing currencies. As the Fed hiked at a record rate, the dollar became relatively more attractive. But that comparative attractiveness weakens as other countries catch up to the Fed.

Why it matters:

The dollar entered 2023 coming off an 18-month bull run. Notably, as the dollar soared, U.S. equities fell. Analysts have scaled back their expectations of U.S. interest rate rises, and last week the dollar hit its lowest level in a year against the euro.

Some analysts believe there’s greater potential for rate rises in the eurozone, where economic growth is improving. Further hikes in the U.K. to fend off surging inflation will also continue to put downward pressure on the dollar.

- “The dollar has had a fantastic run but it’s starting to turn,” said Alan Ruskin, chief international strategist at Deutsche Bank. “The pessimism we saw last year about Europe following the start of the Russia-Ukraine war is fading and, at the same time, other currencies have positive stories of their own.”

MORE HEADLINES

✈️ Boeing’s problems and losses mount since the 737 Max was grounded in 2019

🇰🇷 U.S. to send nuclear submarines in new pledge to protect South Korea from North’s threats

🚫 U.K. blocks Microsoft’s bid for Activision, a blow for tech deals

What to know

Why do some companies become enduring household names while others quickly flame out or never become known in the first place? Why do certain social movements change our culture, but others quickly fizzle out?

On an episode of the Hidden Brain podcast, sociologist Damon Centola discusses social contagion and how it influences our world.

Fireworks and fishing nets

Trends gain traction in two main ways, says Centola: either like fireworks or like fishing nets.

The first case is the most intuitive. The fireworks way reflects a social virus, spreading similar to an actual virus like Covid-19. In other words, the transmission stems from what he calls “weak ties” — that is, casual encounters.

It’s extremely easy to spread things in this manner. You sit next to someone at an airport, breathe in their germs, and then you return home and spread the virus to your friends, who spread it to their family and co-workers and so on, forming an exploding fireworks pattern.

Going viral

This is how things go viral online, too.

You send a friend a meme, and they send it to another friend, who sends it in a big group chat. It takes little effort to share a popular TikTok, just like it takes little effort to spread a respiratory virus.

In the digital realm, influencers are the super spreaders, amplifying the reach of everything from trendy clothes to life hacks, memes, and news.

Gone fishing

Not everything spreads so easily, though.

The fishing net pattern of social virality involves “strong ties,” which come at some cost to accept, meaning we’re less likely to initially embrace them without social validation.

As Centola explains, we don’t usually embrace new things, no matter how important or well-intended, the first time we encounter them. This is especially true if they impose costs, whether in taking the extra time to adopt a new habit or changing our mind on an issue, which could hurt our ego.

To share or not to share

Put differently, it probably took more touchpoints for you to start recycling than it would to share, say, a cute dog video, the type of thing that might spread like a firework.

Rather than retweeting a funny tweet without hesitation, Centola has found that for strong-tie ideas, people wait for others to act first. Once your uncle, co-worker, and neighbor have all posted on Facebook about the importance of water conservation, you might do the same.

That makes gaining traction difficult at first, but once a breaking point is hit, it spreads like wildfire.

From the rise of cryptocurrency to the Black Lives Matter protests, these social movements embody a fishing net. Each additional thread (person spreading an idea) reinforces the trend and makes more people comfortable joining the movement.

The snowball effect

You could also compare it to a snowball, compounding slowly until reaching a critical mass.

According to Centola, in 2014, polls showed that most Americans didn’t believe there was a problem with the policing of black communities. But after George Floyd’s death and the BLM protests in 2020, the vast majority of Americans on both sides of the political aisle agreed there was a problem.

As he sees it, this was for one objective reason: the snowball became an avalanche.

But at what point does that happen? How large must a minority set of views grow to drive broader change?

25% rule

Centola believes there’s a “clear cut off at 25%.” Adding, “Pretty much every group below 25% (as a percentage of adoption in a population), had almost no impact on the behavior of the rest of the group. But as soon as the committed minority or activists reached 25%, everyone else in the group changed their behavior.”

That’s why sweeping social changes can seemingly ‘come out of nowhere,’ and other trends never catch on.

After 25% of adoption, Centola finds that movements gain enough traction to support themselves and exponentially grow.

Downsides to social contagion

The 25% rule is a powerful concept.

It enables important issues on the periphery to get pushed to the forefront of society’s attention. Communities on the opposite side of issues “independently move towards each other,” forming a “reconciliation of ideas” that might not have otherwise brought social change.

However, he warns awareness around the 25% rule can be abused, particularly by authoritarian regimes, namely in China.

During protests, instead of flooding social media channels with disinformation, one tactic is to employ agents masquerading as real people into social media communities to distract the conversation and prevent ideas from gaining critical mass.

If chatter about the importance of free speech upticks, these actors will jump into conversations and redirect them toward principles of communist doctrine or upcoming local parades, whatever it takes to inhibit protests from spreading.

He explains, “If you have enough of these people talking to each other, it basically creates (its own) critical mass, where the other people talking about legitimate protest issues or grievances feel like their conversation isn’t relevant anymore.”

He says it’s been “incredibly effective in derailing activists’ efforts on Chinese social media.”

Dive deeper

Listen to the full interview with Damon Centola here and check out his book for even more on how social trends gain traction.

TRIVIA ANSWER

The most viewed video ever, published to YouTube in 2016, is Baby Shark Dance with over 12.7 billion views.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

See you later!