Fooling JPMorgan

Hi, The Investor’s Podcast Network Community!

Congrats to the Spaniard, Jon Rahm, for an impressive win at the 87th Masters🏌️

If you missed reading corporate earnings reports or hearing our assessment of them, fear not. Earnings season returns on Friday.

It’ll kick off, per usual, with the big banks.

😐 Analysts expect S&P 500 companies to report an almost 7% year-over-year earnings decline. That’s the steepest decline since Covid lockdowns caused a 32% profit contraction in 2020.

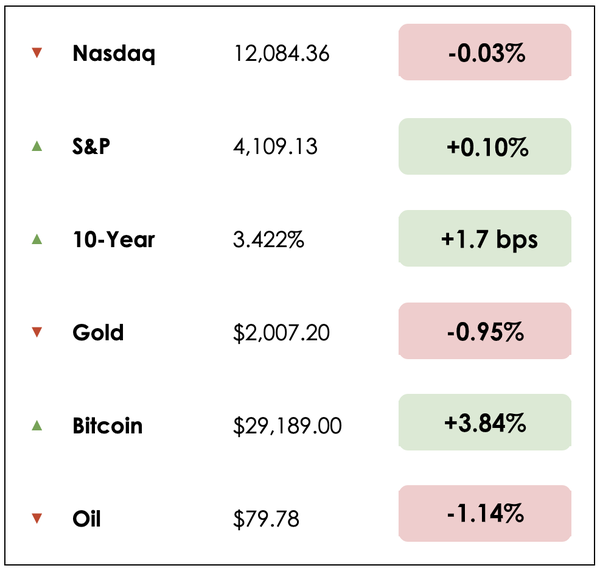

Here’s the market rundown:

MARKETS

*All prices as of market close at 4pm EST

Today, we’ll discuss two items in the news:

- Predictions from the legendary Paul Singer on current markets

- Disgraced tech founders

- Plus, our main story on the economics of Girl Scout cookies

All this, and more, in just 5 minutes to read.

Get smarter about valuing businesses in just a few minutes each week.

Get the weekly email that makes understanding intrinsic value

easy and enjoyable, for free.

Real estate investing, made simple.

17% historical returns*

Minimums as low as $5k.

EquityMultiple helps investors easily diversify beyond stocks and bonds, and build wealth through streamlined CRE investing.

*Past performance doesn’t guarantee future results. Visit equitymultiple.com for full disclosures

IN THE NEWS

💸 Paul Singer’s Latest Prediction (WSJ)

Explained:

Paul Singer, founder of the hedge fund Elliott Management, has a good track record when it comes to crises. Before 2008, he tried to alert investors and public officials about the dangers of subprime mortgages. In 2020, he saw inflation coming.

- In the 15 years since 2008, he’s also warned that the landmark Dodd-Frank Act of 2010, and the expansive monetary policies along the way, were inviting danger.

- “I think that this is an extraordinarily dangerous and confusing period,” he told The WSJ.

“Valuations are still very high,” he says. “There’s a significant chance of recession. We see the possibility of a lengthy period of low returns in financial assets, low returns in real estate, corporate profits, unemployment rates higher than exist now and lots of inflation in the next round.”

His pessimism about the soundness of the dollar isn’t new. He has cautioned that it isn’t wise that the solution to every problem has been to create more money.

Why it matters:

Since 2008, the Fed and other central banks have undertaken “quantitative easing” rounds, creating money to buy government bonds and other assets.

The artificial demand for such assets holds down interest rates, which enables political leaders to spend lavishly and run massive deficits. Singer predicts the Fed will start printing again, resuming the policy of easy money, and inflation will come back “possibly more than the current round.”

- Inflation is abating, and tech stocks moved U.S. equities mostly higher to start 2023. But Singer isn’t counting on it to be the start of another decade of gains like the 2010s. He says: “We think this crisis is a result of over-leverage, overvaluations, bubble securities, bubble asset classes.”

🤦♂️ Another Disgraced Fintech Founder (FT)

Explained:

By now, you might have heard of Charlie Javice, who allegedly fabricated data to induce JPMorgan Chase to buy her start-up for $175 million. The charismatic, upbeat founder charmed a series of investors until her company failed to live up to its promises, and lawsuits and criminal charges followed.

- Frank was designed to help students apply for college financial aid. Founded in 2017 when she was just 24, she drew backing from Apollo’s Marc Rowan and Israeli VC firm Aleph. By 2019, she had landed on Forbes’ 30 under 30 list. But she acknowledged in a 2021 interview that “there were definitely times where I painted a rosier picture than things truly were.”

- JPMorgan Chase and its chief executive Jamie Dimon championed an acquisition, according to court documents. But the $175 million deal has imploded.

Why it matters:

Javice has been sued by JPMorgan and was charged on April 3rd with criminal conspiracy to commit bank, wire, and securities fraud.

- Prosecutors allege Javice represented to JPMorgan that Frank had 4.25 million customers when it had only 300,000.

- Unfortunately, it’s not a new story of misleading or outright lying among startup founders. She joins a long list you don’t want to be on, including Elizabeth Holmes and SBF.

Legal and business experts say that the nature of start-ups, which require founders to seek additional backing, creates a risk of exaggerated claims.

“When seeking to be acquired or go public, a founder has a lot to lose if their failures are discovered,” said David Hess, a professor of management at the University of Michigan. “A natural tendency towards risk-seeking to avoid a loss combined with the founders’ confidence . . .[can] cause them to continue down a path that can cross the line and becomes fraud.”

MORE HEADLINES

🔭 A $1.7 billion, eight-year voyage searching for life on Jupiter begins this week

🚗 When will cars be fully self-driving? It might be longer than you think

🍻 How are bars boosting profits? Answer: trivia night

🏠 Lenders lost $301 for each mortgage they made last year

An annual tradition

Every year from January to April, they amass on American soil, marching door-to-door adorned in green and brown vests.

You’ve seen their booths strategically positioned outside of schools, local businesses, and shopping centers.

Their sales pitch? A child’s enthusiasm and the irresistible appeal of those oh-so-delicious Thin Mints, Samoas, and Tagalongs.

Of course, we’re talking about The Girl Scouts. But you might be surprised to learn about the economics behind this big business.

Big money at stake

These adorable salespeople collectively sell around 200 million boxes of cookies yearly, which works out to almost one box for every adult in the country. Those sales generate more than $800 million in revenue.

To power their operations at scale, The Girl Scouts employ two corporate bakeries: ABC Bakers, part of the conglomerate that owns Wonder Bread, and Little Brownie Bakers, a Keebler subsidiary.

They’re so good at selling that other cookie manufacturers scale back their advertisements during Girl Scout Cookie season. One industry analyst adds, “There’s no upside to marketing against the Girl Scouts.”

Tracking the funds

Where does that money go when you commit $5 for a box of cookies?

Well, about $1.50 goes to the bakeries who pay royalties to the national Girl Scouts organization to license its trademarks.

The remaining $3.50 stays local, divided between the regional council and the troop you purchased from. And those revenues are vital to the local troops, because that’s where most of their annual funding stems — just a few months of cookie sales.

Skilled sellers

The scouts are incentivized with a tiered reward system, so 50 cookie box sales might earn a journal, while 100 earns a stuffed animal. Although the average scout sells roughly 200 boxes per season, others see a bigger opportunity.

Katie Francis, now a 21-year-old at the University of Pennsylvania, sold over 2,000 boxes in her first year, when she was 10. The next year, she sold 7,482 boxes, breaking a state record in pursuit of a college scholarship.

In 2014, she broke the national record with 18,000 boxes sold. But she wasn’t done yet, and by the end of her “career,” she had sold more than 180,000 boxes.

She explains, “Every single year, my mom and I would create a spreadsheet with my goal, and we would break down how many I’d need to sell each week, each day…on an average day after school, I might go to an office building to start with. Then as that peters out, I’ll go to businesses and sell business-to-business. And then maybe after dinner time, I’ll go to restaurants and sell to wait staff.”

Adapting to a new world

Previously, sales were exclusively made door-to-door, but the business has evolved. Booths in areas with high foot traffic have become important; now, technology is a factor.

In 2014, The Girl Scouts began accepting credit cards with mobile card readers. At the same time, the organization started selling cookies online. Scouts could create their own websites, upload promotional videos, and share purchase links directly with friends and family.

And like for other entrepreneurs, the pandemic proved particularly disruptive. Fewer girls were enrolling as scouts, and supply-chain issues and labor shortages created a bottleneck in cookie production.

In some areas, scouts partnered with DoorDash to list their cookie inventories and establish distribution centers at nearby restaurants.

The food delivery app waved its regular fee and even offered same-day delivery for $3.99.

The dark side of the business

But this exposed the dark side of Girl Scout cookie sales. Shortages abound, many troops struggled to source enough cookies to hit their sales targets, yet cookies could still be found on DoorDash.

That’s because parents who could afford to spend thousands of dollars upfront on cookies for their daughters to sell could benefit from partnering with DoorDash, while other families less able to stockpile couldn’t secure the same e-commerce arrangements.

See, at the season’s start, each scout commits to selling a specific number of boxes at their discretion. Their troop pays for the boxes upfront, but the scouts are expected to repay through sales. If they don’t hit their targets, and even worse, if they significantly over-order, things get thorny.

One troop in North Carolina tried suing a mother who refused to pay for hundreds of boxes worth of her daughter’s unsold cookies.

So not all families can afford to set ambitious goals and risk ordering, say, 500 boxes that they might only sell a fraction of.

Firsthand education

Like all businesses, selling Girl Scout Cookies is no exception — it can be tough. Cookie season includes countless challenges, from competition to financial risk, supply-chain obstacles, and technological disruption.

Much goes into putting those delectable cookies before you. The scouts who stick with it earn invaluable insights into capitalism, modern commerce, and the value of teamwork, setting goals, and persistence.

Katie Francis, the prolific salesgirl, mentioned earlier, says: “It’s a really awesome opportunity to build business skills. And girls, as they get older, they can take more charge of their own cookie sales and start to learn how to be a business owner themselves.”

Dive deeper

To learn more about the economics behind everyday things like Girl Scout Cookies, check out this wonderful podcast from Freakonomics Radio.

Enjoy reading this newsletter? Forward it to a friend.

SEE YOU NEXT TIME!

That’s it for today on We Study Markets!

All the best,

![]()

P.S The Investor’s Podcast Network is excited to launch a subreddit devoted to our fans in discussing financial markets, stock picks, questions for our hosts, and much more! Join our subreddit r/TheInvestorsPodcast today!